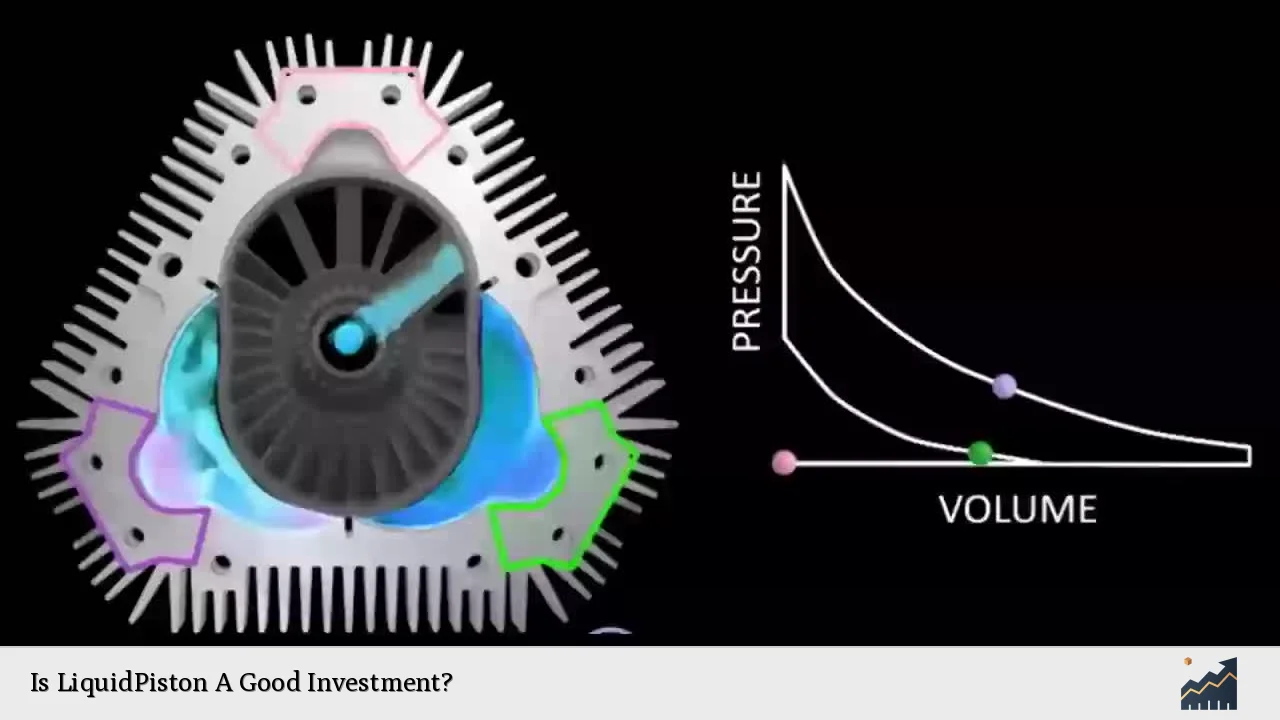

LiquidPiston, Inc. is a technology startup that has garnered attention for its innovative approach to internal combustion engines through its patented High-Efficiency Hybrid Cycle™ (HEHC). Founded in 2003 by Dr. Nikolay Shkolnik and Dr. Alexander Shkolnik, the company aims to disrupt the $400 billion internal combustion engine market with its compact, efficient rotary engines that can utilize various fuels, including hydrogen. With substantial government contracts and a growing investor base, potential investors are keen to understand whether LiquidPiston represents a sound investment opportunity.

| Key Concept | Description/Impact |

|---|---|

| Market Potential | LiquidPiston targets a $400 billion market with applications across various sectors, including military, automotive, and renewable energy. |

| Innovation | The HEHC technology offers up to 10x more power than traditional engines while being more fuel-efficient and versatile. |

| Funding Success | LiquidPiston has raised over $35 million from equity crowdfunding and venture capital, indicating strong investor interest. |

| Government Contracts | The company has secured $30 million in contracts from the U.S. Department of Defense, providing non-dilutive funding and validation of its technology. |

| Risks | Challenges include high capital intensity, competition in the engine market, and potential regulatory hurdles related to emissions and fuel types. |

Market Analysis and Trends

The internal combustion engine market is undergoing significant transformation as companies innovate to meet demands for efficiency and sustainability. LiquidPiston’s HEHC technology is positioned to capitalize on this trend by offering a more compact and efficient engine design that can operate on various fuels.

Current Market Statistics

- The U.S. internal combustion engine market is projected to reach approximately $84.2 billion by 2024, growing at an annual rate of 4.7%.

- LiquidPiston’s addressable market includes sectors like drones, portable generators, and automotive applications, with potential expansion into electric vehicles as hybrid technologies gain traction.

Competitive Landscape

While LiquidPiston’s technology is groundbreaking, it faces competition from established players in the automotive and aerospace industries. Companies are increasingly investing in electric and hybrid solutions, which could impact demand for traditional combustion engines.

Implementation Strategies

Investors considering LiquidPiston should evaluate several key strategies for maximizing their investment:

- Diversification: Given the broad applications of LiquidPiston’s technology—from military to consumer markets—investing in a diversified portfolio that includes other innovative tech firms may mitigate risks associated with market fluctuations.

- Long-Term Perspective: As with many startups in emerging technologies, a long-term investment horizon may be necessary to realize substantial returns as the company scales operations and captures market share.

- Monitoring Developments: Keeping abreast of LiquidPiston’s contract wins, technological advancements, and regulatory changes will be crucial for assessing the ongoing viability of the investment.

Risk Considerations

Investing in LiquidPiston carries inherent risks that potential investors must consider:

- High Capital Requirements: The development of advanced engine technologies requires significant capital for research, development, and production scaling. Investors should be aware that ongoing funding rounds may dilute existing shares.

- Market Competition: The automotive industry is highly competitive with established players who have more resources for innovation and marketing. LiquidPiston must continuously demonstrate its technological advantages to gain traction.

- Regulatory Challenges: As environmental regulations tighten globally, LiquidPiston’s ability to adapt its technology to meet these standards will be critical. This includes transitioning towards greener fuel options amidst shifting consumer preferences.

Regulatory Aspects

LiquidPiston operates within a framework of regulatory oversight that influences its business operations:

- SEC Regulations: As a company raising funds through equity crowdfunding under Regulation A+, LiquidPiston must comply with SEC reporting requirements that ensure transparency for investors.

- Environmental Regulations: The company’s focus on hybrid technologies aligns with increasing regulatory pressure on reducing emissions from traditional combustion engines. Adapting to these regulations will be essential for long-term viability.

Future Outlook

The future outlook for LiquidPiston appears promising but contingent on several factors:

- Technological Advancements: Continued innovation in engine design will be crucial for maintaining competitive advantages against both traditional engine manufacturers and emerging electric vehicle technologies.

- Market Expansion: The company’s ability to penetrate new markets—such as consumer electronics or renewable energy applications—could significantly enhance growth prospects.

- Strategic Partnerships: Collaborations with established companies in automotive or aerospace sectors could provide valuable resources and accelerate product development timelines.

Conclusion

In summary, LiquidPiston presents an intriguing investment opportunity characterized by innovative technology and substantial market potential. However, potential investors should carefully weigh the associated risks against their investment strategies. Conducting thorough due diligence and staying informed about industry trends will be essential for making informed decisions regarding this unique startup.

Frequently Asked Questions About Is LiquidPiston A Good Investment?

- What is LiquidPiston’s core technology?

LiquidPiston’s core technology is the High-Efficiency Hybrid Cycle (HEHC), which allows its engines to achieve higher efficiency and power output compared to traditional internal combustion engines. - What markets does LiquidPiston target?

LiquidPiston targets multiple markets including military applications (drones), portable power generation, automotive sectors, and potentially consumer electronics. - How much funding has LiquidPiston raised?

LiquidPiston has raised over $35 million through equity crowdfunding and venture capital investments. - What are the main risks associated with investing in LiquidPiston?

The main risks include high capital requirements for R&D, intense competition from established players, and regulatory challenges regarding emissions standards. - What is the company’s current revenue status?

LiquidPiston reported annual revenue growth of 22% year-over-year, reaching approximately $8.17 million recently. - How does LiquidPiston’s technology compare to traditional engines?

LiquidPiston’s HEHC technology can produce up to 10 times more power than traditional diesel engines while being more compact and capable of using various fuels. - Is investing in startups like LiquidPiston risky?

Yes, investing in startups involves significant risk due to factors such as market volatility, competition, and operational challenges; therefore, careful consideration is advised. - What should investors monitor when considering an investment in LiquidPiston?

Investors should monitor contract wins, technological advancements, funding rounds, market trends in the automotive sector, and regulatory changes affecting the industry.