Investing $25,000 can be a pivotal step toward achieving financial goals, whether they are short-term savings, long-term wealth accumulation, or retirement planning. The key to successful investing lies in understanding the various options available, assessing personal risk tolerance, and aligning investments with financial objectives. This guide offers a comprehensive analysis of how to effectively invest $25,000 by exploring market trends, implementation strategies, risk considerations, regulatory aspects, and future outlooks.

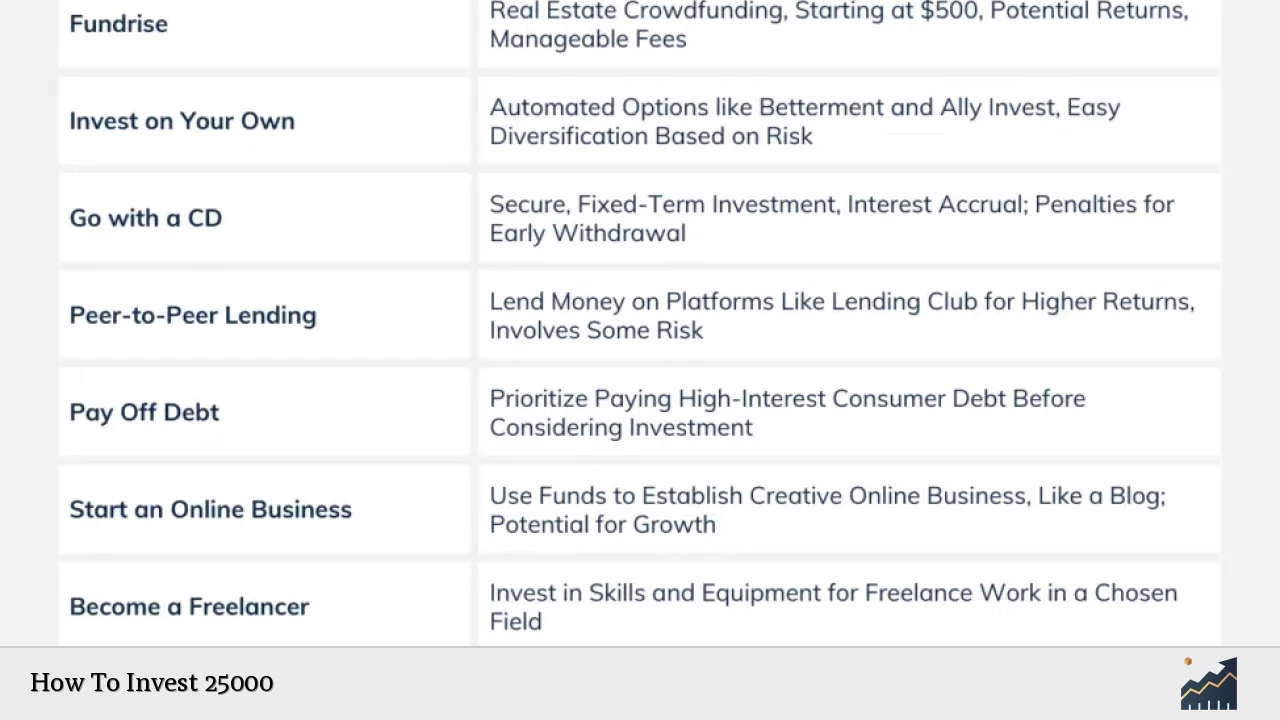

| Key Concept | Description/Impact |

|---|---|

| High-Yield Savings Accounts | Offers low-risk growth with higher interest rates than traditional savings accounts, ideal for emergency funds or short-term goals. |

| Stocks and ETFs | Investing in individual stocks or exchange-traded funds (ETFs) allows for potential high returns but comes with increased risk. |

| Bonds | Fixed-income securities provide stability and regular income; suitable for conservative investors seeking lower volatility. |

| Real Estate Investment Trusts (REITs) | Allows for investment in real estate without direct ownership; offers dividends and capital appreciation potential. |

| Alternative Investments | Includes assets like cryptocurrencies or art; can diversify portfolios but often come with higher risks and less liquidity. |

Market Analysis and Trends

The investment landscape is continuously evolving, influenced by economic indicators, market performance, and investor sentiment. As of 2024, several trends are shaping how individuals approach investing:

- Equity Market Recovery: Global equities reached an all-time high of $78.4 trillion as of June 2024, marking a nearly 10% increase from December 2023. This recovery is largely driven by technology stocks related to artificial intelligence.

- Interest Rates and Bonds: With central banks starting to lower interest rates, bond markets are experiencing renewed interest. High-yield bonds have seen significant activity, with a 73% increase in issuance from H1 2023 to H1 2024.

- Real Estate Dynamics: The real estate market is showing signs of recovery post-pandemic, with values increasing to $6.7 trillion as of June 2024. However, it remains below pre-pandemic levels.

- Alternative Investments Growth: There is a growing interest in alternative investments such as cryptocurrencies and collectibles. These assets can offer high returns but come with increased volatility and risk.

Implementation Strategies

When considering how to invest $25,000, it is crucial to develop a strategy that aligns with your financial goals and risk tolerance. Here are some effective strategies:

- Diversification: Spread your investments across various asset classes (stocks, bonds, real estate) to mitigate risk. A balanced portfolio might include:

- 40% in stocks or ETFs

- 30% in bonds

- 20% in REITs

- 10% in alternative investments

- Dollar-Cost Averaging: Invest a fixed amount regularly (e.g., monthly) rather than all at once. This strategy reduces the impact of market volatility.

- Use of Tax-Advantaged Accounts: Consider utilizing accounts like IRAs or HSAs for tax benefits while investing. For example, contributions to a Roth IRA grow tax-free.

- Focus on Index Funds: For those new to investing or looking for lower fees, index funds provide exposure to the broader market without the need for extensive research.

Risk Considerations

Investing inherently involves risks that must be managed effectively:

- Market Risk: The possibility that stock prices will fluctuate due to economic factors. Diversifying your portfolio can help mitigate this risk.

- Interest Rate Risk: Changes in interest rates can affect bond prices inversely; rising rates typically lead to falling bond prices.

- Liquidity Risk: Some investments may not be easily sold without incurring losses (e.g., real estate). Ensure that part of your portfolio remains liquid.

- Regulatory Risks: Changes in laws or regulations can impact investment performance. Staying informed about regulatory changes is essential.

Regulatory Aspects

Understanding the regulatory landscape is crucial for compliance and informed investing:

- SEC Regulations: The Securities and Exchange Commission (SEC) oversees securities markets and protects investors against fraud. Familiarize yourself with SEC guidelines when investing in stocks or mutual funds.

- Tax Implications: Be aware of capital gains taxes on profits from selling investments. Utilizing tax-efficient strategies can enhance returns.

- Investment Advisers: If uncertain about investment choices, consider consulting a registered investment adviser who can provide personalized guidance based on your financial situation.

Future Outlook

Looking ahead, several factors will influence investment strategies:

- Technological Advancements: Innovations such as AI-driven investment platforms are changing how investors manage portfolios. These tools can provide personalized insights based on spending habits and market trends.

- Sustainability Trends: There is an increasing focus on sustainable investing as investors seek opportunities that align with environmental and social governance (ESG) criteria.

- Economic Indicators: Keep an eye on inflation rates, employment data, and GDP growth as these factors will influence market conditions and investment opportunities.

Frequently Asked Questions About How To Invest 25000

- What is the safest way to invest $25,000?

The safest way is typically through high-yield savings accounts or certificates of deposit (CDs), which offer guaranteed returns with minimal risk. - Can I invest $25,000 in real estate?

Yes, you can invest indirectly through Real Estate Investment Trusts (REITs) or consider purchasing rental properties if you have additional capital for down payments. - Should I pay off debt before investing?

Yes, paying off high-interest debt can provide a guaranteed return equivalent to the interest rate of the debt. - What percentage of my investment should go into stocks?

This depends on your risk tolerance; generally, younger investors might allocate 60%-80% of their portfolio to stocks for growth potential. - Is it wise to invest in cryptocurrencies?

Cryptocurrencies can offer high returns but come with significant volatility; only invest what you can afford to lose. - How do I start investing if I'm new?

Consider starting with index funds or ETFs through a brokerage account; these options provide diversification with lower fees. - What role do financial advisors play?

Financial advisors help tailor investment strategies based on individual goals and risk tolerance while providing ongoing support. - How often should I review my investment portfolio?

You should review your portfolio at least annually or after significant life changes or market events.

Investing $25,000 wisely requires careful planning and consideration of various factors including market trends, personal financial goals, and risk tolerance. By diversifying investments across asset classes and staying informed about market conditions and regulatory changes, you can optimize your chances for long-term financial success.