Orca, a prominent player in the financial technology sector, places a strong emphasis on user data privacy and protection. As digital transactions and cloud computing become increasingly prevalent, the importance of safeguarding personal information cannot be overstated. Orca's approach to data handling is shaped by regulatory compliance, user consent, and advanced security measures. This article delves into how Orca manages user data, the implications for privacy, and the broader context of data protection in the financial services industry.

| Key Concept | Description/Impact |

|---|---|

| Data Collection | Orca collects personal information such as names, email addresses, and usage patterns to enhance service delivery while ensuring compliance with GDPR and other regulations. |

| User Consent | Users must provide explicit consent for data collection, which is integral to Orca's compliance with privacy laws like GDPR and CCPA. |

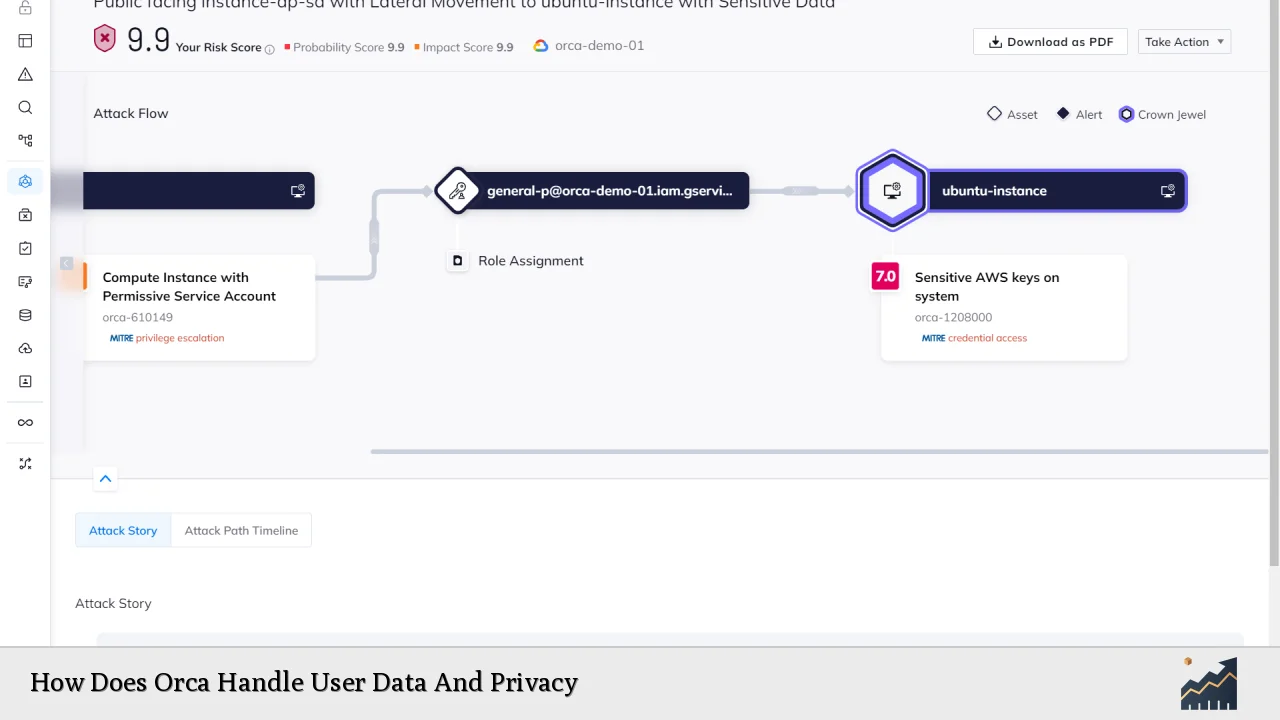

| Data Security Measures | Orca employs advanced security protocols, including encryption and intrusion detection systems, to protect user data from unauthorized access. |

| Transparency | Orca maintains transparency regarding its data practices, allowing users to understand how their information is used and shared. |

| Regulatory Compliance | Orca adheres to various regulations such as GDPR and CCPA, ensuring that user rights are respected and protected. |

| Data Breach Protocols | In the event of a data breach, Orca has established protocols for notification and remediation to protect affected users. |

| User Control | Users have the right to access, modify, or delete their personal information, reinforcing their control over their data. |

| Third-Party Sharing | Orca limits sharing personal data with third parties unless necessary for service provision or legally required. |

Market Analysis and Trends

The financial services sector is experiencing significant transformations due to technological advancements and increasing regulatory scrutiny. As companies like Orca navigate this landscape, they must balance innovation with stringent privacy requirements.

Recent statistics indicate that 63% of consumers globally believe companies lack transparency regarding their data use, leading many to terminate relationships with brands over privacy concerns. This sentiment underscores the necessity for companies to adopt robust data protection measures.

Moreover, with the rise of Open Finance, where customer data is shared among various financial institutions, the need for secure data handling practices is more critical than ever. The Financial Data Access (FiDA) Regulation in the EU aims to enhance consumer control over their financial data while ensuring compliance with existing privacy laws like GDPR.

Implementation Strategies

To effectively manage user data and privacy, Orca employs several key strategies:

- User Education: Orca provides clear information about its data collection practices through comprehensive privacy policies. This transparency helps build trust with users.

- Consent Management: Users are required to give explicit consent before any personal data is collected. This practice not only complies with legal standards but also empowers users.

- Data Minimization: Orca adopts a principle of collecting only the necessary information required for service functionality. This approach reduces potential risks associated with excessive data storage.

- Advanced Security Technologies: Utilizing encryption, firewalls, and intrusion detection systems ensures that user data is safeguarded against unauthorized access.

- Regular Audits: Conducting regular audits of data handling practices helps identify vulnerabilities and ensure compliance with evolving regulations.

Risk Considerations

While Orca implements strong security measures, several risks persist in the realm of user data management:

- Data Breaches: Despite robust security protocols, no system is entirely immune to breaches. The financial sector is particularly vulnerable due to the sensitive nature of the data handled.

- Regulatory Changes: The landscape of data privacy regulations is continuously evolving. Companies must remain agile to comply with new laws or amendments that could impact their operations.

- User Trust: Maintaining consumer trust is paramount. Any perceived lapse in privacy can lead to reputational damage and loss of clientele.

- Third-Party Risks: Sharing user data with third-party vendors introduces additional risks. Orca must ensure that these partners adhere to similar privacy standards.

Regulatory Aspects

Orca's operations are heavily influenced by various regulatory frameworks designed to protect consumer rights:

- General Data Protection Regulation (GDPR): This EU regulation mandates strict guidelines on personal data collection and processing. Orca complies by ensuring users can access their information and request modifications or deletions.

- California Consumer Privacy Act (CCPA): Similar to GDPR but specific to California residents, CCPA provides consumers with rights regarding their personal information. Orca's policies reflect these requirements by offering opt-out options for users.

- Financial Data Access (FiDA) Regulation: This emerging regulation aims to enhance consumer rights in financial services by facilitating secure access and sharing of financial data among institutions.

Future Outlook

As we look ahead, several trends are likely to shape how companies like Orca handle user data:

- Increased Regulatory Scrutiny: Governments are expected to implement stricter regulations on data privacy, compelling organizations to enhance their compliance frameworks.

- Adoption of Privacy-Preserving Technologies: Innovations such as differential privacy and homomorphic encryption will gain traction as organizations seek ways to analyze data without compromising individual privacy.

- Consumer Empowerment: There will be a growing demand for tools that allow consumers greater control over their personal information. Companies will need to adapt by providing more transparent practices and user-friendly options for managing consent.

- Focus on Cybersecurity Resilience: As cyber threats evolve, organizations will prioritize building robust cybersecurity frameworks that not only protect against breaches but also ensure rapid response capabilities in case of incidents.

Frequently Asked Questions About How Does Orca Handle User Data And Privacy

- What types of personal information does Orca collect?

Orca collects various types of personal information including names, email addresses, usage patterns, and device identifiers necessary for service provision. - How does Orca ensure compliance with GDPR?

Orca ensures compliance by obtaining explicit user consent before collecting personal information and providing users access to their data rights. - What security measures does Orca implement?

Orca employs encryption, intrusion detection systems, and regular audits as part of its comprehensive security strategy. - Can users delete their personal information from Orca?

Yes, users have the right to request deletion of their personal information at any time. - Does Orca share my personal information with third parties?

No, Orca limits sharing personal information with third parties unless necessary for service provision or legally mandated. - What happens if there’s a data breach?

If a breach occurs, Orca has protocols in place for immediate notification and remediation efforts. - How does Orca handle cookies?

Orca uses cookies for functionality but ensures compliance with global regulations regarding cookie usage and provides options for users to manage their preferences. - What steps can I take if I have concerns about my privacy?

If you have concerns about your privacy or how your information is handled, you can contact Orca directly through their support channels for clarification or action.

In conclusion, as digital finance continues to evolve rapidly, companies like Orca must remain vigilant in protecting user data while navigating complex regulatory landscapes. By prioritizing transparency, security measures, and user empowerment, they can foster trust and loyalty among consumers in an increasingly skeptical market.