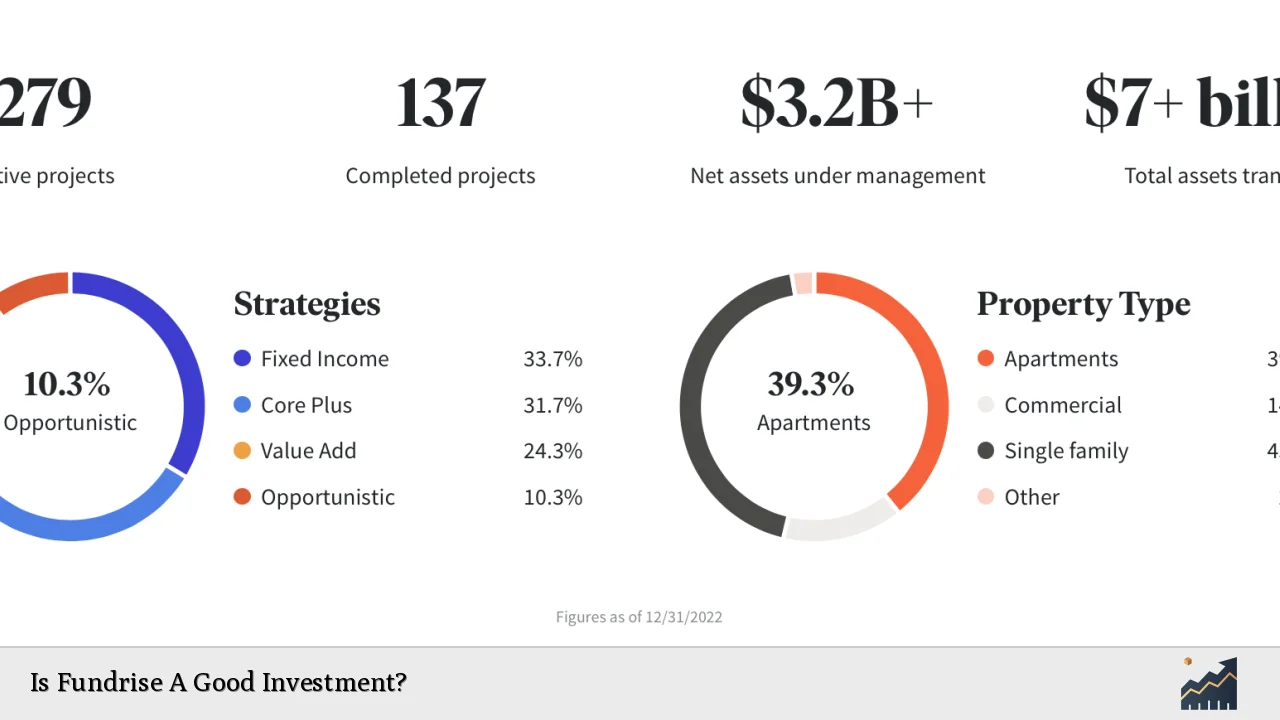

Fundrise has emerged as a prominent player in the realm of real estate investment, offering a platform that allows both accredited and non-accredited investors to participate in real estate crowdfunding. By enabling individuals to invest in private real estate projects through eREITs (electronic Real Estate Investment Trusts) and eFunds, Fundrise democratizes access to real estate investments that were once reserved for institutional investors. This article will explore whether Fundrise is a good investment by examining its features, benefits, drawbacks, and overall suitability for different types of investors.

| Feature | Description |

|---|---|

| Investment Type | Real estate crowdfunding through eREITs and eFunds |

| Minimum Investment | $10 for basic plans |

| Fees | 0.85% annual management fee |

| Investment Horizon | 3-5 years recommended |

Understanding Fundrise

Fundrise operates by pooling funds from multiple investors to finance various real estate projects. This model allows investors to gain exposure to real estate without needing substantial capital to purchase properties outright. The platform offers several investment plans tailored to different financial goals, including income generation and long-term growth.

Investors can choose from portfolios such as the Supplemental Income Plan, which focuses on generating regular dividends, or the Long-Term Growth Plan, aimed at capital appreciation over time. The flexibility of these options makes Fundrise appealing to a broad audience, including those new to investing.

The platform’s user-friendly interface simplifies the investment process, allowing individuals to view potential projects and their expected returns easily. This accessibility is crucial for attracting a younger demographic that prefers online investment solutions.

Pros of Investing in Fundrise

Investing in Fundrise comes with several advantages:

- Low Minimum Investment: With a minimum investment of just $10, Fundrise allows individuals with limited capital to enter the real estate market.

- Diversification: Fundrise offers a range of investment options across different types of properties and geographical locations, helping investors diversify their portfolios beyond traditional stocks and bonds.

- Passive Income: Investors can earn passive income through quarterly dividends generated by the underlying properties in the eREITs and eFunds.

- Accessibility: The platform is open to both accredited and non-accredited investors, making it easier for everyday individuals to participate in real estate investing.

- Transparent Reporting: Fundrise provides detailed reports on the performance of investments, allowing investors to track their progress over time.

These benefits make Fundrise an attractive option for those looking to diversify their investment strategies and gain exposure to real estate without significant upfront costs.

Cons of Investing in Fundrise

Despite its advantages, there are notable drawbacks associated with investing in Fundrise:

- Illiquidity: Investments in Fundrise are generally illiquid, meaning that funds cannot be easily accessed or sold before a specified period (typically three to five years). This lack of liquidity can be problematic for investors who may need quick access to their funds.

- Early Redemption Penalties: If investors choose to withdraw their money before the recommended holding period, they may incur penalties that reduce their returns.

- Variable Returns: While Fundrise markets itself as a way to achieve higher returns than traditional investments, actual returns can vary significantly based on market conditions and property performance. Historical average returns have been around 4.81%, which may not meet everyone’s expectations.

- Limited Control: Investors do not have direct control over individual projects; instead, they must trust Fundrise’s management decisions regarding where funds are allocated.

- Fees: Although the fees are relatively low compared to traditional real estate investments, they still exist and can impact overall returns. The annual management fee is set at 0.85%.

These cons should be carefully considered by potential investors, particularly those who prioritize liquidity or have short-term financial needs.

Who Should Consider Fundrise?

Fundrise is best suited for long-term investors who are comfortable with market fluctuations and can afford to leave their money invested for several years. Ideal candidates include:

- New Investors: Individuals new to investing who want an easy way into real estate without needing extensive knowledge or capital.

- Diversification Seekers: Investors looking to diversify their portfolios beyond stocks and bonds while gaining exposure to real estate.

- Passive Income Seekers: Those interested in generating passive income through dividends from real estate investments.

However, it may not be suitable for:

- Short-Term Investors: Those who require quick access to their funds or have short-term financial goals should look elsewhere due to the illiquid nature of the investments.

- Risk-Averse Individuals: Investors who are uncomfortable with potential losses or market volatility may find better options in more stable investment vehicles.

Performance Expectations

When evaluating whether Fundrise is a good investment, it’s essential to consider performance expectations. Historical data indicates that investors can expect average annual returns around 4.81%. While this figure is competitive compared to traditional bond funds, it may not meet the expectations of those used to higher returns from stock market investments.

Additionally, it’s crucial for potential investors to understand that past performance does not guarantee future results. Economic downturns can impact property values and rental income, leading to lower-than-expected returns during challenging times.

Investors should also consider that while Fundrise has paid out millions in dividends since its inception, these payments may not be consistent year-to-year and can fluctuate based on market conditions.

Conclusion

In summary, whether Fundrise is a good investment largely depends on individual financial goals and risk tolerance. For those seeking low-cost access to real estate investments with a long-term outlook, Fundrise offers an appealing platform with various options. However, potential investors must weigh the benefits against the drawbacks of illiquidity and variable returns.

Before committing funds, it’s advisable for individuals to conduct thorough research into their investment choices and consider how these align with their overall financial strategy. As with any investment decision, consulting with a financial advisor can provide personalized insights tailored to individual circumstances.

FAQs About Fundrise

- What types of investments does Fundrise offer?

Fundrise offers eREITs and eFunds focused on real estate projects. - Is there a minimum investment required?

The minimum investment for basic plans is $10. - Can I withdraw my money at any time?

You can withdraw your money but may incur penalties if done before the holding period. - What are the fees associated with investing in Fundrise?

Fundrise charges an annual management fee of 0.85%. - What is the expected return on investment?

The average annual return historically has been around 4.81%.