Recording owner investments in QuickBooks is essential for accurately tracking the financial contributions made by business owners. This process ensures that the owner's equity is properly reflected in the company's financial records, which is crucial for both internal management and external reporting. Owner investments can come in various forms, including cash contributions, asset purchases, or other financial support to the business. Properly documenting these contributions not only helps maintain accurate books but also supports better financial decision-making.

To record owner investments successfully in QuickBooks, you will need to follow a structured approach. This includes setting up an equity account specifically for owner contributions and then entering the investment transactions accurately. Below is a concise overview of the steps involved in recording these investments effectively.

| Step | Description |

|---|---|

| 1 | Set up an owner's equity account. |

| 2 | Record the owner's investment as a deposit. |

Setting Up an Owner's Equity Account

The first step in recording an owner investment in QuickBooks is to create an owner's equity account. This account will serve as a designated place to track all contributions made by the owner. Here’s how to set it up:

- Open QuickBooks and click on the Settings icon (gear icon) located at the top right corner of the page.

- Select Chart of Accounts from the dropdown menu.

- Click on the New button to create a new account.

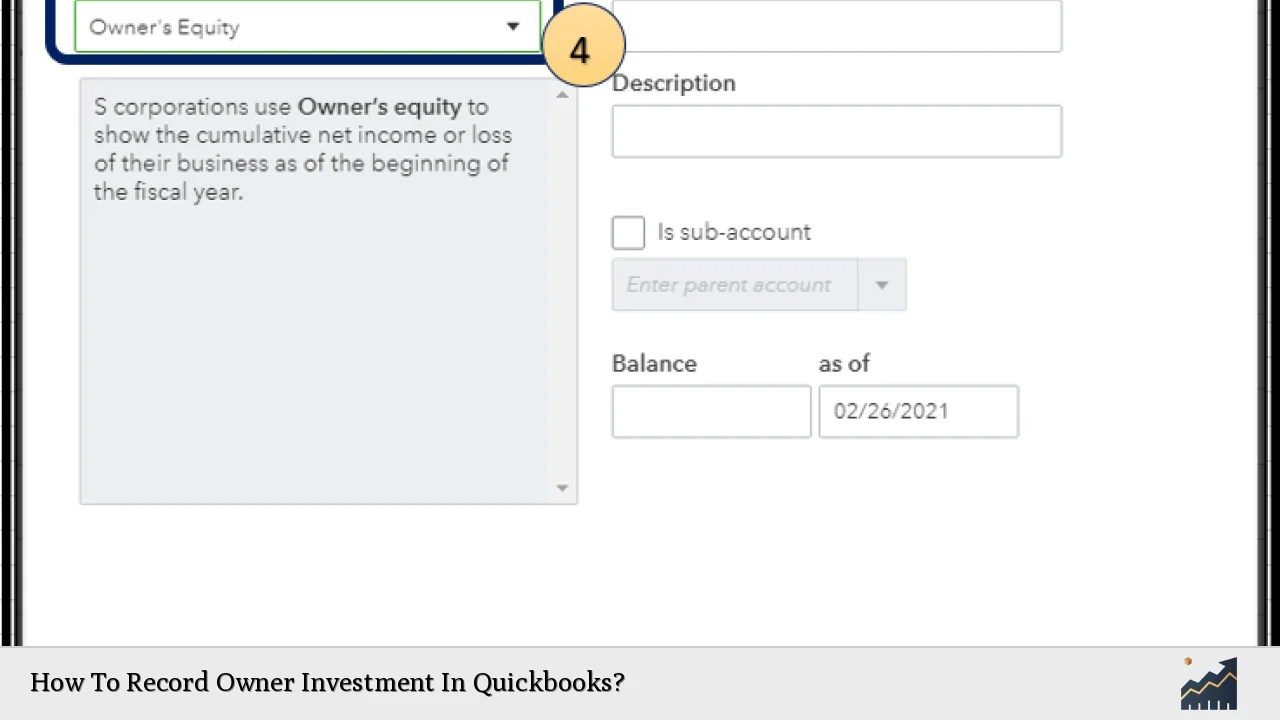

- In the Account Type dropdown menu, select Equity.

- From the Detail Type dropdown menu, choose either Owner's Equity or Partner's Equity, depending on your business structure.

- Name your account appropriately, such as "Owner's Investment" or "Equity Contribution."

- Finally, click on Save and Close to complete the setup.

This new account will allow you to monitor all owner contributions effectively. It is crucial to name this account clearly so that it is easily identifiable in your financial reports.

Recording Owner Investments

Once you have set up the owner's equity account, you can proceed to record any investments made by the owner. This process can be done through a bank deposit if your bank account is linked to QuickBooks. Follow these steps:

- Navigate to the Home Page and click on New.

- Select Bank Deposit from the options provided.

- Choose the relevant bank account where the funds are being deposited from the dropdown menu.

- Enter the date of the deposit in the designated field.

- In the Received From section, enter the name of the owner or partner who made the contribution.

- In the Account field, select the owner's equity account you created earlier.

- Specify the payment method used for this deposit (e.g., cash, check).

- Enter the amount of money being invested by the owner in the Amount field.

- Once all information has been entered correctly, click on Save and Close to finalize this transaction.

By following these steps, you ensure that your financial records accurately reflect any investments made by owners, providing clarity in your accounting practices.

Alternative Methods for Recording Contributions

In some cases, owners may not directly deposit funds into a business bank account but instead pay for business expenses out of their personal accounts. To record these types of transactions, you can use an expense form:

- Click on New, then select Expense from the options available.

- Fill out who was paid for this expense and enter the date of payment.

- Choose a payment method that reflects how this expense was paid (e.g., cash or credit card).

- Describe what was purchased and enter the total amount spent.

- Add another line item where you categorize this transaction as an "Owner's Investment" using a negative amount equal to what was spent. This action balances out your expense without affecting your cash flow directly.

This method allows you to track personal contributions made toward business expenses while ensuring that your accounting records remain accurate and transparent.

Importance of Accurate Record-Keeping

Maintaining precise records of owner investments is crucial for several reasons:

- It provides a clear picture of each owner's stake in the business, which is essential for understanding equity distribution among partners or shareholders.

- Accurate documentation helps in preparing financial statements that reflect true business performance and health.

- It aids in compliance with tax regulations by clearly delineating personal contributions from business income or expenses.

By keeping detailed records of all owner investments, businesses can ensure they are well-prepared for audits and can provide stakeholders with reliable financial information when needed.

Monitoring Owner Equity Over Time

After recording owner investments, it's important to regularly monitor these accounts. QuickBooks allows users to generate reports that provide insights into equity changes over time. You can view your owner's equity account balance by:

- Navigating to Reports from your QuickBooks dashboard.

- Selecting Balance Sheet under standard reports.

This report will display all assets, liabilities, and equity accounts, including your newly created owner's equity account. Regularly reviewing this report helps ensure that all transactions are recorded correctly and provides valuable insights into how much capital has been invested over time.

FAQs About How To Record Owner Investment In Quickbooks

- What is an owner's investment?

An owner's investment refers to personal funds contributed by a business owner into their company. - Why do I need an owner's equity account?

An owner's equity account tracks all contributions made by owners, ensuring accurate financial reporting. - Can I record multiple owner investments?

Yes, you can record multiple investments by creating separate entries under your owner's equity account. - What if I pay business expenses from my personal funds?

You can record these payments as expenses and categorize them as owner investments in QuickBooks. - How often should I review my owner's equity?

You should review your owner's equity regularly to ensure accurate tracking and reporting of all contributions.

By following these guidelines for recording owner investments in QuickBooks, you can maintain accurate financial records that reflect true ownership stakes within your business. This practice not only supports better management decisions but also enhances transparency with stakeholders regarding capital contributions.