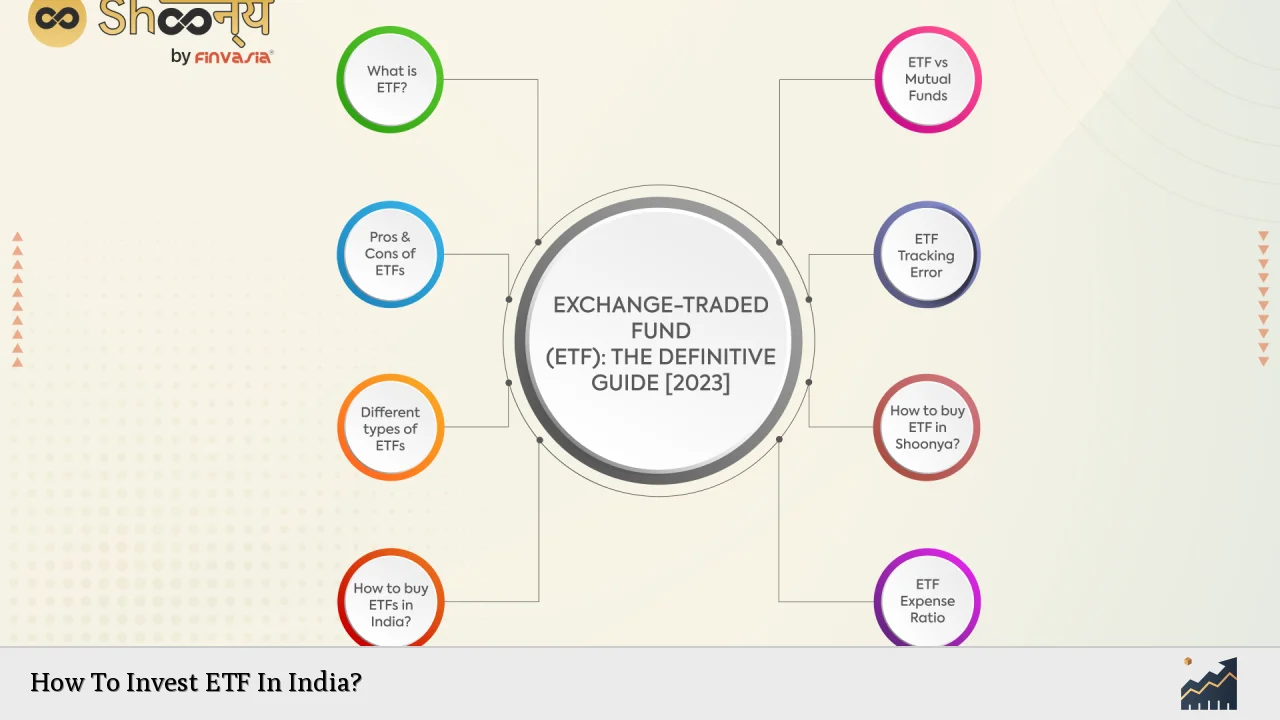

Investing in Exchange-Traded Funds (ETFs) has become increasingly popular in India, providing investors with a flexible and cost-effective way to gain exposure to various asset classes. ETFs combine the features of mutual funds and stocks, allowing investors to buy and sell shares on the stock exchange throughout the trading day. This guide will walk you through the essential steps to invest in ETFs in India, the types of ETFs available, and key considerations for making informed investment decisions.

ETFs are investment funds that hold a diversified portfolio of assets such as stocks, bonds, or commodities and are traded on stock exchanges like individual stocks. They offer several advantages, including lower expense ratios compared to actively managed funds, tax efficiency, and the ability to trade throughout the day at market prices. As more investors recognize these benefits, the ETF market in India continues to grow.

To start investing in ETFs, you will need to follow a few essential steps. First, you must open a Demat account and a trading account with a registered brokerage firm. Once your accounts are set up, you can research different ETFs based on your investment goals and risk tolerance. After selecting an ETF, you can place buy orders through your brokerage platform.

| Step | Description |

|---|---|

| Open Accounts | Create a Demat and trading account with a brokerage firm. |

| Research ETFs | Identify suitable ETFs based on your investment objectives. |

| Place Orders | Use your trading platform to buy selected ETFs. |

Understanding ETFs

ETFs are designed to track the performance of specific indices or sectors, offering investors exposure to a wide range of assets without needing to buy individual stocks or bonds. They are typically passively managed, meaning they aim to replicate the performance of an underlying index rather than actively selecting securities.

There are various types of ETFs available in India:

- Equity ETFs: These funds invest primarily in stocks and track indices like the Nifty 50 or Sensex. They provide exposure to large-cap companies and can be an excellent choice for long-term growth.

- Bond ETFs: These invest in fixed-income securities such as government or corporate bonds. They offer lower risk compared to equity ETFs and provide regular income streams.

- Commodity ETFs: These funds invest in physical commodities like gold or silver. They can serve as a hedge against inflation and diversify your portfolio.

- Sector and Thematic ETFs: These focus on specific sectors (like technology or healthcare) or themes (like ESG investing), allowing investors to capitalize on trends within particular industries.

- International ETFs: These provide exposure to foreign markets, enabling Indian investors to diversify their portfolios globally.

Each type of ETF has its unique characteristics and risk profiles. Therefore, it's crucial to assess your financial goals before choosing an ETF that aligns with your investment strategy.

Steps To Invest In ETFs

Investing in ETFs involves several straightforward steps:

1. Open a Demat Account: A Demat account is essential for holding the shares of your ETF investments electronically. You can open one through various brokerage firms that offer online trading services.

2. Choose a Brokerage Firm: Select a brokerage that provides access to Indian stock exchanges where ETFs are listed. Look for platforms that offer user-friendly interfaces, low fees, and reliable customer support.

3. Research Available ETFs: Analyze different ETFs based on factors such as expense ratios, historical performance, liquidity, and tracking error. Consider how each ETF fits into your overall investment strategy.

4. Fund Your Trading Account: Deposit money into your trading account through bank transfers or other accepted methods so that you have sufficient funds available for purchasing ETFs.

5. Place Buy Orders: Use your brokerage platform to search for the desired ETF using its ticker symbol. Enter the number of units you wish to purchase and confirm your order during market hours.

6. Monitor Your Investments: After buying ETFs, regularly review their performance against your investment goals. This will help you make informed decisions about holding or selling your investments as needed.

7. Understand Tax Implications: Be aware of the tax treatment for capital gains from ETF investments in India. Short-term capital gains (for holdings less than one year) are taxed at 15%, while long-term gains (for holdings over one year) are exempt up to ₹1 lakh; gains above this limit are taxed at 10%.

Key Considerations Before Investing

Before diving into ETF investments, consider these critical factors:

- Investment Goals: Clearly define what you want to achieve with your investments—whether it's capital growth, income generation, or diversification.

- Risk Tolerance: Assess how much risk you are willing to take based on your financial situation and investment horizon. Different types of ETFs carry varying levels of risk.

- Expense Ratios: Look for ETFs with low expense ratios since high fees can eat into your returns over time. Compare similar funds before making a decision.

- Trading Volume: Higher trading volumes generally indicate better liquidity, making it easier to buy or sell shares without affecting the price significantly.

- Performance History: While past performance is not indicative of future results, it can provide insights into how well an ETF has tracked its benchmark index over time.

Popular ETFs In India

Here are some of the most popular ETFs in India that investors often consider:

| ETF Name | 1-Year Return |

|---|---|

| Nippon India ETF Nifty BeES | 12.43% |

| HDFC Sensex ETF | 12.05% |

| SBI ETF Sensex | 11.73% |

| Motilal Oswal NASDAQ 100 ETF | 10.94% |

| ICICI Prudential Nifty Next 50 ETF | 10.58% |

These ETFs have shown solid performance over the past year and provide exposure to major indices in India.

Advantages Of Investing In ETFs

Investing in ETFs offers several benefits:

- Diversification: By investing in an ETF, you gain exposure to multiple securities within a single fund, reducing individual stock risk.

- Cost Efficiency: Generally lower expense ratios compared to mutual funds make them more cost-effective for long-term investors.

- Liquidity: As they trade on exchanges like stocks, you can buy or sell shares throughout the trading day at real-time prices.

- Transparency: Most ETFs disclose their holdings daily, allowing investors to know exactly what assets they own at any given time.

- Tax Efficiency: Capital gains taxes may be deferred until you sell your shares, providing better tax management compared to traditional mutual funds.

Disadvantages Of Investing In ETFs

While there are many advantages, there are also some drawbacks:

- Market Risk: Like all investments tied to the stock market, ETFs can be subject to volatility and market fluctuations.

- Liquidity Issues: Some lesser-known or niche ETFs may have low trading volumes, making it challenging to enter or exit positions without impacting prices significantly.

- Tracking Error: An ETF may not perfectly track its underlying index due to management fees and other factors affecting performance.

FAQs About How To Invest ETF In India

- What is an ETF?

An Exchange-Traded Fund (ETF) is an investment fund traded on stock exchanges that holds assets like stocks or bonds. - How do I buy an ETF?

You need a Demat account and a trading account; then search for the desired ETF on your brokerage platform. - Are there different types of ETFs?

Yes, there are equity ETFs, bond ETFs, commodity ETFs, sector-specific ETFs, and international ETFs. - What are the tax implications for investing in ETFs?

Short-term capital gains are taxed at 15%, while long-term gains above ₹1 lakh are taxed at 10%. - Can I sell my ETF easily?

Yes, you can sell your ETF shares anytime during market hours just like individual stocks.

In conclusion, investing in ETFs provides a practical approach for both novice and experienced investors looking for diversified exposure with lower costs. By understanding how they work and following the outlined steps for investing in them within India’s financial landscape, you can effectively enhance your investment portfolio while managing risks efficiently.