Investment banking is a complex and highly competitive field that requires a combination of financial expertise, analytical skills, and strong interpersonal abilities. To succeed in investment banking, one must understand the industry's core functions, develop essential skills, and follow a strategic career path. This comprehensive guide will walk you through the key steps to enter and excel in the world of investment banking.

| Key Aspects | Description |

|---|---|

| Core Functions | M&A Advisory, Capital Raising |

| Essential Skills | Financial Modeling, Valuation, Communication |

| Career Path | Analyst, Associate, Vice President, Managing Director |

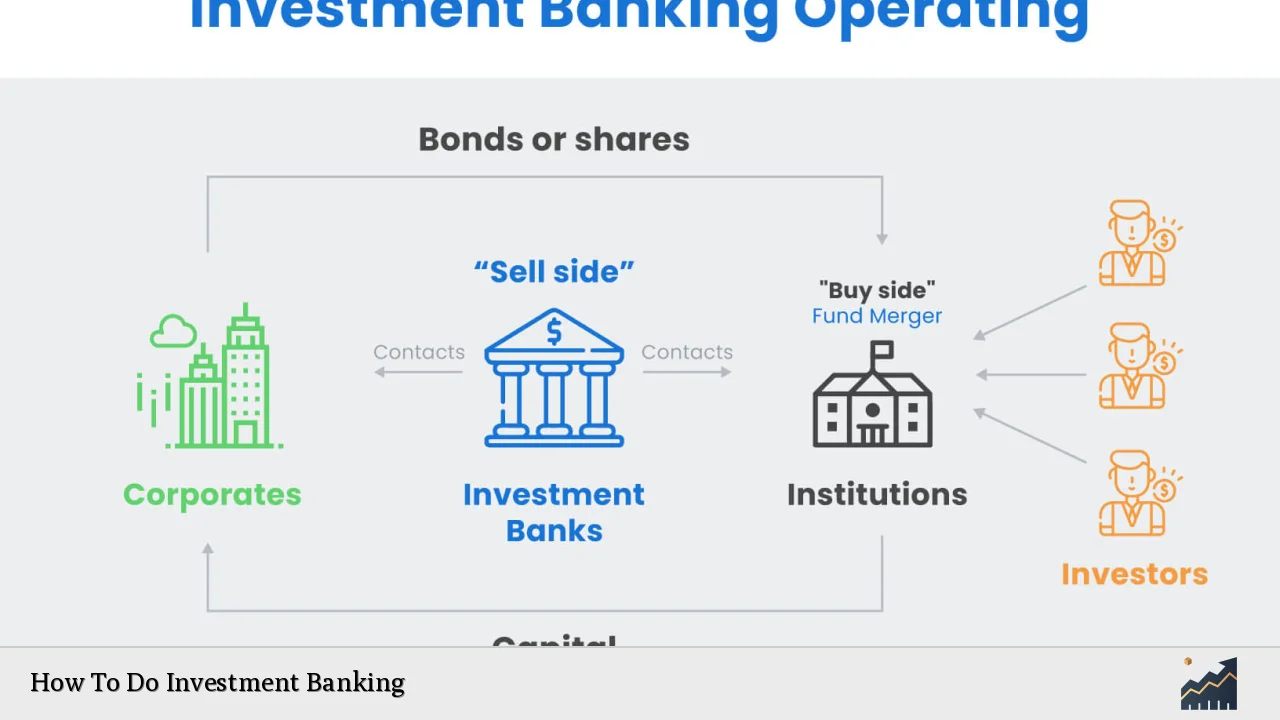

Investment banking plays a crucial role in the financial world by providing advisory services to corporations, institutions, and governments. The primary functions of investment banks include mergers and acquisitions (M&A) advisory and capital raising through debt and equity offerings. To succeed in this field, aspiring investment bankers must develop a strong foundation in finance, economics, and accounting, as well as hone their analytical and communication skills.

Understanding Investment Banking Functions

Investment banking revolves around two core functions: M&A advisory and capital raising. In M&A advisory, investment bankers help clients evaluate potential mergers, acquisitions, or divestitures. They conduct financial analysis, perform valuation, and negotiate deal terms. Capital raising involves helping clients raise funds through various means, such as initial public offerings (IPOs), bond issuances, or private placements.

To excel in these functions, investment bankers must possess a deep understanding of financial markets, industry trends, and valuation methodologies. They must be able to analyze complex financial statements, create detailed financial models, and present their findings effectively to clients and colleagues.

M&A Advisory

M&A advisory services are a cornerstone of investment banking. Bankers in this area help clients identify potential acquisition targets or buyers, conduct due diligence, and structure deals. Key responsibilities include:

- Performing company valuations using various methods (e.g., DCF, comparable company analysis)

- Analyzing synergies and potential cost savings in merger scenarios

- Preparing pitch books and presentations for client meetings

- Negotiating deal terms and managing the transaction process

Capital Raising

Capital raising is another critical function of investment banking. Bankers help clients access the capital markets to fund their operations, expansion plans, or acquisitions. This involves:

- Determining the optimal capital structure for clients

- Preparing offering memorandums and other marketing materials

- Conducting roadshows to attract potential investors

- Managing the underwriting process for securities offerings

Developing Essential Skills

To succeed in investment banking, you must develop a range of technical and soft skills. These skills are crucial for performing day-to-day tasks and advancing your career.

Technical Skills

- Financial modeling: Create complex financial models to analyze company performance, project future cash flows, and evaluate potential deals.

- Valuation: Master various valuation techniques, including discounted cash flow (DCF), comparable company analysis, and precedent transactions.

- Accounting knowledge: Understand financial statements and key accounting principles to analyze company financials accurately.

- Excel proficiency: Develop advanced Excel skills for efficient data analysis and financial modeling.

- PowerPoint expertise: Create compelling presentations and pitch books to communicate ideas effectively.

Soft Skills

- Communication: Articulate complex financial concepts clearly to both technical and non-technical audiences.

- Attention to detail: Maintain accuracy in financial analysis and deal documentation.

- Time management: Handle multiple projects and tight deadlines efficiently.

- Teamwork: Collaborate effectively with colleagues, clients, and other professionals.

- Networking: Build and maintain relationships with industry professionals and potential clients.

Building Your Career Path

Entering the investment banking industry typically follows a structured career path. Understanding this progression can help you plan your career and set realistic goals.

Entry-Level Positions

Most investment banking careers begin at the analyst level. Analysts are typically recent graduates who join the bank for a two to three-year program. Key responsibilities include:

- Conducting financial analysis and creating financial models

- Preparing pitch books and client presentations

- Performing industry and company research

- Supporting senior bankers in deal execution

Mid-Level Positions

After completing the analyst program, many bankers progress to the associate level. Associates often have MBA degrees or several years of relevant experience. Their responsibilities include:

- Managing analysts and overseeing their work

- Taking a more active role in client interactions

- Leading financial modeling and valuation efforts

- Contributing to deal structuring and negotiation

Senior Positions

As bankers gain more experience and prove their abilities, they can advance to vice president and eventually managing director roles. These senior positions focus on:

- Building and maintaining client relationships

- Generating new business opportunities

- Providing strategic advice to clients

- Managing deal teams and overseeing transaction execution

Gaining Relevant Experience

To break into investment banking, it's crucial to gain relevant experience early in your career. Consider the following strategies:

- Internships: Secure internships at investment banks, preferably during your sophomore or junior year of college.

- Finance-related roles: Work in corporate finance, private equity, or other financial services to build transferable skills.

- Networking: Attend industry events, join professional organizations, and connect with alumni in the field.

- Financial certifications: Pursue certifications like the CFA (Chartered Financial Analyst) to demonstrate your commitment and expertise.

Mastering the Recruitment Process

Investment banking recruitment is highly competitive. To stand out, focus on:

- Resume optimization: Highlight relevant skills, experiences, and achievements.

- Interview preparation: Practice technical questions, behavioral interviews, and case studies.

- Networking: Leverage your connections to secure informational interviews and referrals.

- Industry knowledge: Stay updated on market trends, recent deals, and industry news.

Continuous Learning and Development

The finance industry is constantly evolving, making continuous learning essential for long-term success in investment banking. Stay ahead by:

- Reading industry publications: Follow financial news sources like the Wall Street Journal and Financial Times.

- Attending conferences: Participate in industry events to learn about new trends and network with professionals.

- Pursuing advanced education: Consider an MBA or other relevant graduate degrees to enhance your skills and knowledge.

- Developing new skills: Stay updated on emerging technologies and analytical tools used in the industry.

FAQs About How To Do Investment Banking

- What qualifications do I need to become an investment banker?

A bachelor's degree in finance, economics, or a related field is typically required, with many top firms preferring candidates with MBA degrees. - How long does it take to become a managing director in investment banking?

It usually takes 10-15 years of experience to reach the managing director level, depending on individual performance and firm structure. - What are the typical working hours in investment banking?

Investment bankers often work long hours, typically 80-100 hours per week, especially during active deal periods. - How much can I expect to earn as an entry-level investment banking analyst?

Entry-level analysts at top firms can expect total compensation (base salary plus bonus) ranging from $100,000 to $150,000 per year. - What exit opportunities are available for investment bankers?

Common exit opportunities include private equity, hedge funds, corporate development, and strategy consulting roles.