Investing on Fidelity can be a straightforward process for both beginners and experienced investors. Fidelity Investments offers a wide range of investment options, tools, and resources to help you achieve your financial goals. Whether you're looking to save for retirement, grow your wealth, or generate income, Fidelity provides a platform to meet your investment needs.

To get started with investing on Fidelity, you'll need to follow a few key steps. First, you'll need to choose and open an account that aligns with your investment objectives. Then, you'll fund your account, select your investments, and begin trading. Fidelity offers various account types, including individual brokerage accounts, retirement accounts like IRAs, and specialized accounts for education savings.

| Account Type | Best For |

|---|---|

| Individual Brokerage | General investing and trading |

| Traditional IRA | Tax-deferred retirement savings |

| Roth IRA | Tax-free retirement withdrawals |

| 529 Plan | Education savings |

Let's dive into the step-by-step process of how to invest on Fidelity, covering everything from account setup to choosing investments and managing your portfolio.

Opening a Fidelity Account

The first step in investing with Fidelity is opening an account. Fidelity offers various account types to suit different investment goals and needs. To open an account, visit the Fidelity website or use their mobile app.

To begin the account opening process:

- Go to Fidelity.com and click on "Open an Account"

- Choose the type of account you want to open (e.g., individual brokerage, IRA)

- Provide personal information, including your name, address, and Social Security number

- Set up your login credentials

- Review and accept the account agreements

When selecting an account type, consider your investment goals. For general investing and trading, an individual brokerage account is suitable. If you're saving for retirement, consider a Traditional IRA or Roth IRA. For education savings, a 529 plan might be appropriate.

It's important to note that some accounts, like IRAs, have contribution limits and eligibility requirements. Make sure to review these details before opening an account. Fidelity doesn't charge fees for opening or maintaining most account types, which is a significant advantage for investors.

Funding Your Fidelity Account

Once your account is open, the next step is to fund it. Fidelity offers several options for adding money to your account:

- Electronic funds transfer (EFT) from your bank account

- Wire transfer

- Check deposit (via mobile app or mail)

- Transfer of assets from another brokerage

The easiest and most common method is linking your bank account for electronic transfers. To set this up:

- Log into your Fidelity account

- Go to "Accounts & Trade" and select "Transfers"

- Choose "Link a new bank" and follow the prompts

You can set up one-time transfers or recurring deposits to automate your investment strategy. Recurring deposits can be particularly useful for implementing a dollar-cost averaging approach, which involves investing a fixed amount at regular intervals.

It's important to consider your investment goals and risk tolerance when deciding how much to fund your account with initially. Start with an amount you're comfortable with and can afford to invest without impacting your daily financial needs.

Choosing Your Investments

With your account funded, it's time to choose your investments. Fidelity offers a wide range of investment options, including:

- Individual stocks

- Mutual funds

- Exchange-traded funds (ETFs)

- Bonds

- Options

- Certificates of Deposit (CDs)

For beginners, mutual funds and ETFs can be excellent starting points as they offer diversification and professional management. Fidelity offers many of its own funds with no minimum investment requirements, making it easy to start investing with any amount.

To research and select investments:

- Use Fidelity's research tools and screeners

- Review fund performance, expenses, and holdings

- Consider your risk tolerance and investment timeline

- Look for funds that align with your investment strategy

Fidelity provides several tools to help you choose investments:

- Stock Screener: Filter stocks based on various criteria

- ETF Screener: Compare ETFs and find ones that match your goals

- Mutual Fund Evaluator: Search and compare mutual funds

For those who prefer a hands-off approach, Fidelity offers robo-advisor services through Fidelity Go®. This service creates and manages a diversified portfolio based on your goals and risk tolerance.

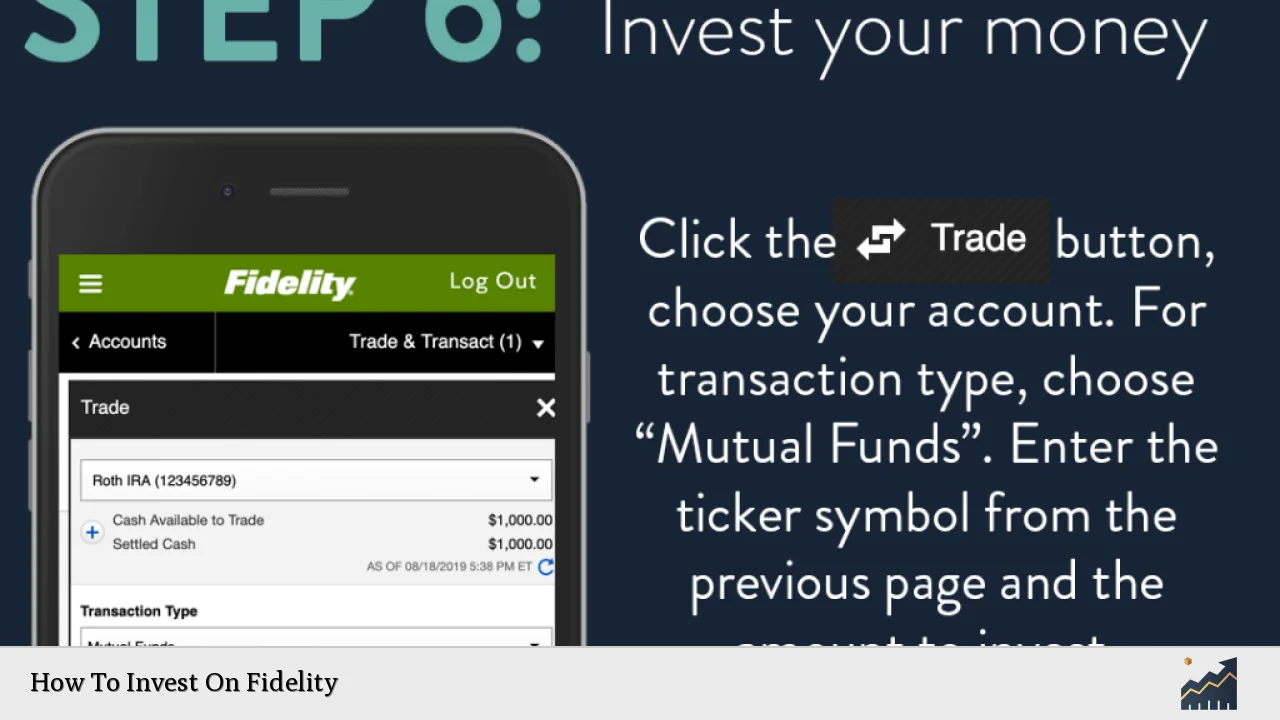

Placing Trades on Fidelity

Once you've selected your investments, it's time to place trades. Fidelity's platform makes it easy to buy and sell securities:

- Log into your account

- Go to "Accounts & Trade" and select "Trade"

- Choose the account you want to trade in

- Enter the symbol of the security you want to trade

- Specify the action (buy or sell) and the quantity

- Review and submit your order

When placing trades, pay attention to the order types available:

- Market Order: Buys or sells at the current market price

- Limit Order: Sets a maximum price for buying or minimum price for selling

- Stop Order: Triggers a market order when a specified price is reached

For mutual funds, you'll typically enter a dollar amount rather than a number of shares. ETFs and stocks are usually traded by specifying the number of shares.

Fidelity offers commission-free trading for stocks, ETFs, and options, which can help keep your investment costs low. However, be aware that some mutual funds may have transaction fees or load charges.

Managing Your Fidelity Portfolio

After making your initial investments, it's crucial to manage and monitor your portfolio regularly. Fidelity provides several tools to help you track and adjust your investments:

- Portfolio Summary: Gives an overview of your holdings and performance

- Analysis Tools: Help you assess your asset allocation and diversification

- Alerts: Set up notifications for price changes or news about your investments

Regularly review your portfolio to ensure it remains aligned with your investment goals and risk tolerance. Consider rebalancing your portfolio periodically to maintain your desired asset allocation.

Fidelity also offers educational resources to help you improve your investing knowledge:

- Webinars and online courses

- Market analysis and commentary

- Retirement planning tools

Take advantage of these resources to make informed decisions about your investments and stay up-to-date with market trends.

FAQs About How To Invest On Fidelity

- What's the minimum amount needed to start investing on Fidelity?

There's no minimum to open most Fidelity accounts, and many Fidelity funds have no minimum investment requirement. - Does Fidelity charge fees for trading stocks and ETFs?

Fidelity offers commission-free online trading for stocks, ETFs, and options for U.S. securities. - Can I automatically reinvest dividends on Fidelity?

Yes, Fidelity offers dividend reinvestment for eligible securities at no additional cost. - How do I set up automatic investments on Fidelity?

You can set up automatic investments through Fidelity's Automatic Investments feature in your account settings. - What types of retirement accounts does Fidelity offer?

Fidelity offers Traditional IRAs, Roth IRAs, SEP IRAs, SIMPLE IRAs, and rollover IRAs for individuals.