Investing in the stock market can be a daunting task, especially when considering various options available. One such option is the Vanguard Mid-Cap ETF, commonly referred to as VO. This exchange-traded fund (ETF) focuses on mid-cap stocks, which are companies with a market capitalization between $2 billion and $10 billion. These companies often represent a sweet spot in the market, combining growth potential with relative stability compared to small-cap stocks.

VO provides investors with exposure to a diversified portfolio of mid-cap stocks, which historically have outperformed both small-cap and large-cap stocks over long periods. This performance is attributed to their ability to grow faster than larger counterparts while being less volatile than smaller companies. As we delve deeper into whether VO is a good investment, it’s essential to consider its performance metrics, market conditions, and the overall investment strategy.

| Aspect | Details |

|---|---|

| Fund Type | Exchange-Traded Fund (ETF) |

| Focus | Mid-Cap Stocks |

| Expense Ratio | 0.04% |

| Historical Performance | Outperformed small and large caps over time |

Understanding VO's Market Position

Vanguard's VO ETF is designed to track the performance of the CRSP US Mid Cap Index. This index includes a broad range of mid-sized U.S. companies, providing investors with diversified exposure to this segment of the market. Mid-cap stocks are often seen as having a more significant growth potential than large caps while being less risky than small caps.

Investors looking for growth opportunities may find VO particularly appealing due to its focus on mid-cap companies that are often in a position to expand and capture market share. Furthermore, mid-cap stocks can provide better risk-adjusted returns compared to their larger counterparts due to their growth potential combined with less volatility than small caps.

Important info for potential investors is that mid-cap stocks tend to outperform during economic recoveries when companies are looking to expand and innovate. Therefore, if economic indicators suggest a recovery phase, investing in VO could be advantageous.

Performance Metrics

When evaluating an investment like VO, it's crucial to analyze various performance metrics. The price-to-earnings (P/E) ratio is one such metric that helps investors assess if a stock is overvalued or undervalued relative to its earnings. Currently, VO has a P/E ratio of approximately 18.7, which indicates that it is reasonably valued compared to historical averages for mid-cap stocks.

Another important metric is the price-to-book (P/B) ratio, which stands at 2.9 for VO. This ratio provides insight into how much investors are willing to pay for each dollar of net assets owned by the company. A lower P/B ratio may suggest that the stock is undervalued.

Additionally, VO has demonstrated resilience in various market conditions, particularly during downturns. Historical data shows that mid-cap stocks have outperformed both small and large caps during recovery phases following market declines.

Economic Conditions Impacting VO

Economic conditions play a significant role in determining the performance of any investment, including VO. As interest rates fluctuate and economic indicators shift, investor sentiment can change rapidly. Currently, analysts anticipate that interest rate cuts may occur in the near future due to economic uncertainties and inflationary pressures easing.

Such conditions could lead to increased investment in mid-cap stocks as borrowing costs decrease and consumer spending potentially rises. Investors often flock to mid-caps during these periods because they tend to benefit from economic growth while providing more stability than small caps.

Important info: Keeping an eye on macroeconomic indicators such as GDP growth rates, unemployment rates, and consumer confidence can provide valuable insights into when it might be an optimal time to invest in VO.

Risk Considerations

While investing in VO presents many opportunities, it also comes with inherent risks that investors should consider. Market volatility can impact mid-cap stocks significantly more than large caps due to their smaller size and lower liquidity. During market downturns or periods of uncertainty, mid-cap stocks can experience sharper declines.

Moreover, individual companies within the mid-cap space may face unique challenges that can affect their performance. Investors should conduct thorough research on specific holdings within the ETF and stay informed about broader market trends affecting these companies.

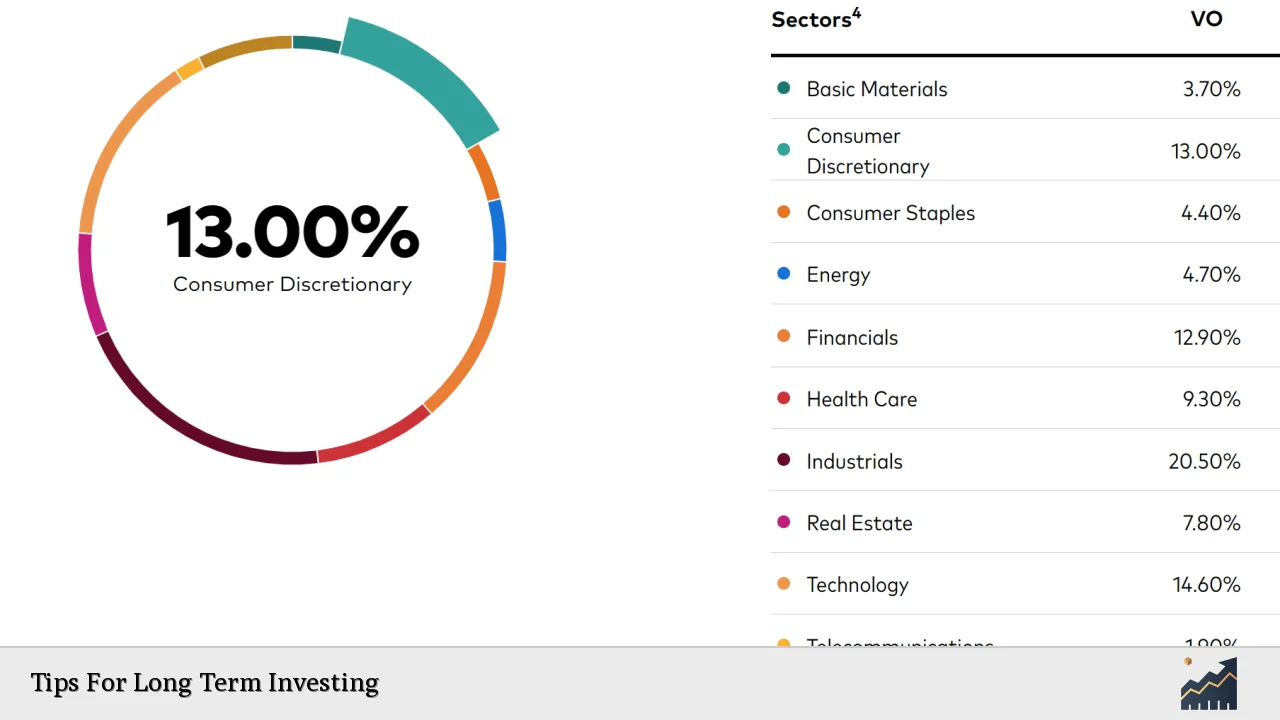

Important info: Diversification within the ETF helps mitigate some risks associated with individual stock performance; however, understanding sector allocations can further enhance risk management strategies.

Investment Strategy with VO

Investing in VO should align with your overall financial goals and risk tolerance. For those seeking growth through exposure to U.S. equities without taking on excessive risk associated with small caps, VO represents an attractive option.

A well-rounded investment strategy might include:

- Allocating a portion of your portfolio to VO for exposure to mid-cap growth.

- Diversifying further by including large-cap ETFs like VOO or small-cap ETFs like VB.

- Considering dollar-cost averaging as a method for investing consistently over time regardless of market conditions.

This strategic approach allows investors not only to capitalize on potential growth opportunities but also manage risk effectively across different market segments.

Analyst Opinions

Many financial analysts view VO favorably based on its historical performance and current valuation metrics. Analysts have set an average price target for VO around $310, indicating potential upside from its current trading levels.

The consensus among analysts suggests that VO is positioned well for future growth due to favorable economic conditions and its inherent characteristics as a mid-cap fund. With a moderate buy rating from numerous analysts, it appears that there is strong confidence in the fund's ability to deliver returns over the next year.

Important info: Always consider consulting financial professionals or conducting personal research before making investment decisions based on analyst ratings alone.

FAQs About Vo

- What type of fund is VO?

VO is an exchange-traded fund (ETF) focusing on mid-cap U.S. stocks. - What are the key benefits of investing in VO?

VO offers diversification across mid-sized companies with growth potential while mitigating some risks associated with smaller firms. - How does VO perform compared to other ETFs?

Historically, mid-caps like those in VO have outperformed both small-caps and large-caps over long periods. - What should I consider before investing in VO?

Consider your risk tolerance, investment horizon, and how this ETF fits into your overall portfolio strategy. - Is now a good time to invest in VO?

Market conditions suggest potential growth opportunities; however, individual circumstances should guide investment timing.

In conclusion, whether or not VO is a good investment depends largely on individual financial goals and market conditions at any given time. With its focus on mid-cap stocks offering strong growth potential and diversification benefits, it certainly merits consideration for those looking for exposure beyond large-cap equities. As always, thorough research and alignment with personal financial objectives are essential steps before making any investment decision.