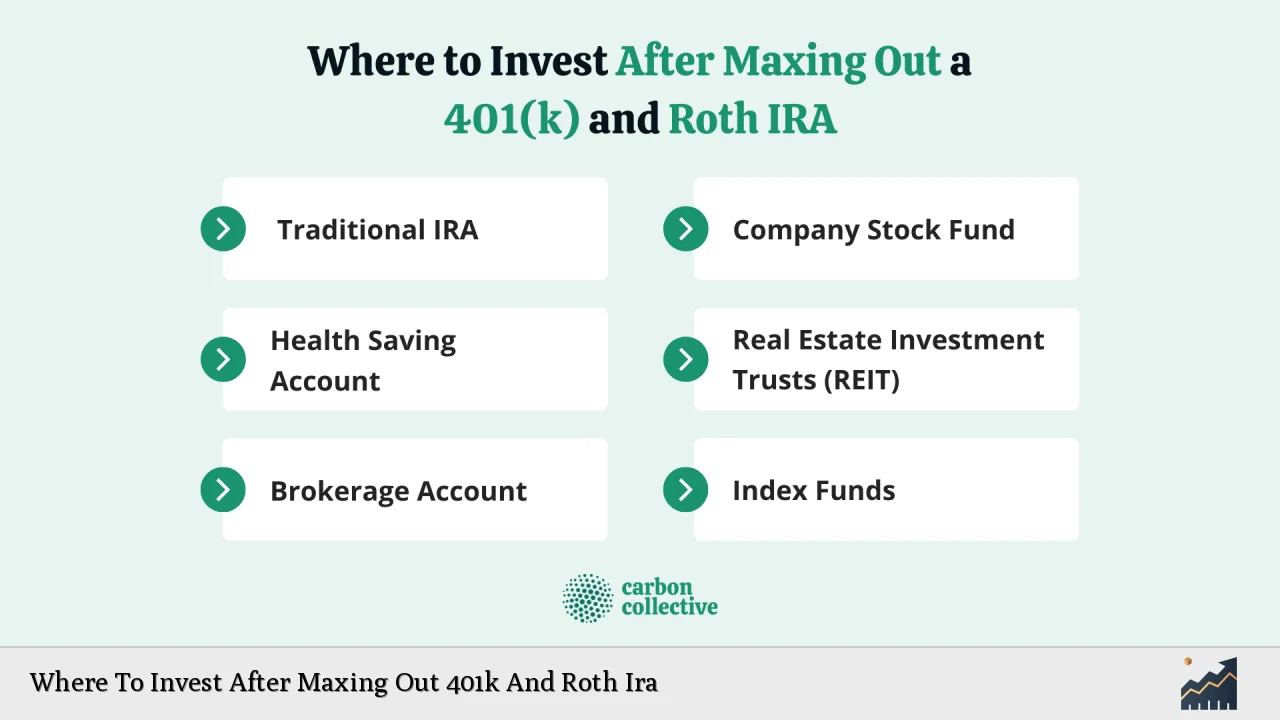

After reaching the contribution limits for your 401(k) and Roth IRA, you may find yourself wondering where to allocate your additional savings. While these retirement accounts offer significant tax advantages, diversifying your investments beyond them is crucial for building long-term wealth. This article explores various investment options available after maxing out these accounts, providing a comprehensive analysis of market trends, implementation strategies, risk considerations, and future outlooks.

| Key Concept | Description/Impact |

|---|---|

| Brokerage Accounts | Taxable investment accounts that offer flexibility with no contribution limits or early withdrawal penalties. |

| Health Savings Accounts (HSAs) | Tax-advantaged accounts for medical expenses that can also serve as an investment vehicle. |

| Real Estate Investments | Direct property investments or real estate investment trusts (REITs) can provide rental income and capital appreciation. |

| Alternative Investments | Investments in private equity, venture capital, or commodities that can offer higher returns but come with increased risk. |

| Fixed Income Securities | Bonds and other fixed-income products provide stability and income, especially in volatile markets. |

| Emergency Fund Enhancements | Boosting your emergency savings can provide financial security and liquidity for unforeseen expenses. |

| Education Savings Accounts | 529 plans or Coverdell accounts help save for education costs with tax benefits. |

| Insurance Products | Permanent life insurance policies can accumulate cash value and provide tax advantages while offering protection. |

Market Analysis and Trends

In 2024, the investment landscape is shaped by several macroeconomic factors, including interest rates, inflation trends, and geopolitical dynamics. The Federal Reserve's anticipated rate cuts are expected to create a favorable environment for equities and fixed income markets.

Current Market Conditions

- Equity Markets: As of mid-2024, global equities reached an all-time high of approximately $78.4 trillion, driven largely by technology stocks related to artificial intelligence (AI). The market's recovery has been robust, with significant capital inflows into sectors poised for growth.

- Fixed Income: With rising interest rates stabilizing and potentially decreasing in 2024, bond markets are becoming more attractive. Investment-grade corporate debt issuance saw a notable increase of 14.2% year-on-year in the first half of 2024.

- Real Estate: The real estate market has shown signs of recovery post-pandemic, with values rising to $6.7 trillion as of June 2024. However, it remains below pre-pandemic levels.

Emerging Trends

- Sustainable Investing: There is a growing emphasis on Environmental, Social, and Governance (ESG) factors in investment decisions. Investors are increasingly seeking opportunities that align with their values while also providing competitive returns.

- Technological Integration: The rise of AI and fintech solutions is transforming how investors analyze data and make decisions. Robo-advisors are gaining popularity due to their ability to provide low-cost investment management tailored to individual risk profiles.

Implementation Strategies

Once you've maxed out your 401(k) and Roth IRA contributions, consider the following strategies to effectively allocate your funds:

1. Open a Brokerage Account

A brokerage account allows you to invest in stocks, bonds, ETFs, and mutual funds without the restrictions of retirement accounts. This option provides:

- Flexibility: No contribution limits or penalties for withdrawals.

- Tax Efficiency: Long-term capital gains tax rates can be more favorable than ordinary income tax rates.

2. Invest in Health Savings Accounts (HSAs)

If eligible for a high-deductible health plan (HDHP), consider maximizing contributions to an HSA:

- Triple Tax Advantage: Contributions are tax-deductible, grow tax-deferred, and withdrawals for qualified medical expenses are tax-free.

3. Real Estate Investments

Investing in real estate can diversify your portfolio and provide passive income:

- Direct Ownership: Purchase rental properties to generate cash flow.

- REITs: Invest in real estate investment trusts for liquidity without the need for direct property management.

4. Explore Alternative Investments

Consider diversifying into alternative assets such as private equity or commodities:

- Higher Returns Potential: These investments often have higher risk but can yield substantial returns if managed well.

5. Increase Fixed Income Holdings

Adding bonds or fixed-income securities can stabilize your portfolio:

- Income Generation: Bonds provide regular interest payments while preserving capital.

Risk Considerations

Investing beyond retirement accounts introduces various risks that need careful management:

- Market Volatility: Stocks can fluctuate significantly; diversification across asset classes can mitigate this risk.

- Liquidity Risk: Real estate and alternative investments may not be easily liquidated in times of need.

- Interest Rate Risk: Rising rates can negatively impact bond prices; consider laddering bonds to manage this risk effectively.

Regulatory Aspects

Understanding the regulatory environment is crucial when investing outside retirement accounts:

- Tax Implications: Be aware of capital gains taxes on brokerage account earnings and ensure compliance with IRS regulations regarding HSAs and other tax-advantaged accounts.

- Investment Restrictions: Some alternative investments may have restrictions based on accredited investor status or minimum investment thresholds.

Future Outlook

The investment landscape is likely to evolve significantly over the next few years:

- Interest Rates: Continued rate cuts could spur equity market growth while making fixed-income investments more attractive.

- Technological Advancements: The integration of AI into investing will likely enhance decision-making processes and create new investment opportunities.

- Sustainability Focus: ESG investing will continue gaining traction as investors seek responsible investment options that align with their values.

Frequently Asked Questions About Where To Invest After Maxing Out 401k And Roth Ira

- What should I do first after maxing out my 401(k) and Roth IRA?

Consider opening a brokerage account for flexible investing options without contribution limits. - Are HSAs worth it if I have maxed out my retirement accounts?

Yes, HSAs offer unique tax advantages that can complement your retirement savings strategy. - Can I invest in real estate with limited funds?

Yes, consider REITs or crowdfunding platforms that allow smaller investments in real estate projects. - What are the risks associated with alternative investments?

They typically involve higher risk due to lower liquidity and market volatility; thorough research is essential. - How does investing in bonds fit into my strategy?

Bonds provide stability and regular income; they can balance the volatility of stock investments. - What role does diversification play after maxing out retirement accounts?

Diversification helps spread risk across various asset classes, reducing potential losses from any single investment. - Should I consult a financial advisor after maxing out my accounts?

Yes, a financial advisor can help tailor an investment strategy based on your financial goals and risk tolerance. - How often should I review my investment strategy?

Regular reviews—at least annually—are recommended to adjust your portfolio based on market conditions and personal goals.

In conclusion, after maxing out your 401(k) and Roth IRA contributions, there are numerous avenues available for further investing. By understanding market trends, implementing diverse strategies, considering risks carefully, adhering to regulatory requirements, and keeping an eye on future developments, you can optimize your investment portfolio for long-term growth.