Layer 1 (L1) blockchains serve as the foundational layer of blockchain technology, providing the infrastructure necessary for decentralized applications (dApps) and smart contracts. Understanding the key performance indicators (KPIs) for these blockchains is crucial for investors and developers alike, as these metrics help gauge the efficiency, security, and overall viability of different blockchain networks. This article delves into the essential KPIs that define L1 blockchains, highlighting their significance in evaluating blockchain performance.

| Key Concept | Description/Impact |

|---|---|

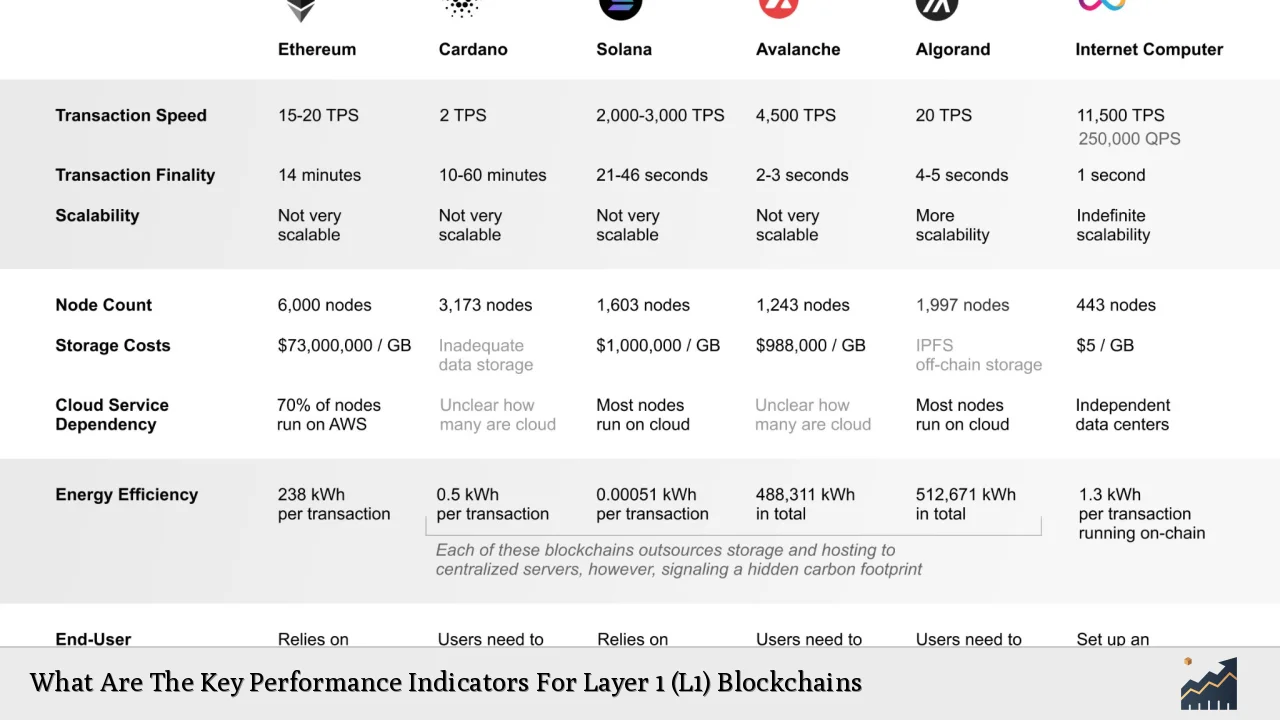

| Transactions Per Second (TPS) | The number of transactions a blockchain can process in one second. Higher TPS indicates better scalability and efficiency. |

| Time to Finality | The duration required for a transaction to be considered irreversible. Shorter times enhance user experience and trust. |

| Network Security | Measured by the robustness of consensus mechanisms and the distribution of nodes. A secure network is less vulnerable to attacks. |

| Total Value Locked (TVL) | The total amount of assets staked or locked in a blockchain's ecosystem, indicating user trust and platform utility. |

| Decentralization Metrics | Assessed by the distribution of nodes across regions and their participation in consensus processes. Greater decentralization enhances security and resilience. |

| Energy Efficiency | Measured by energy consumption per transaction, particularly relevant for Proof-of-Work (PoW) blockchains. Lower energy usage is increasingly important for sustainability. |

| Smart Contract Performance | Includes metrics such as execution speed, gas costs, and complexity of contracts executed on the blockchain. |

| User Adoption Rates | Tracked through active user counts, transaction volumes, and retention rates. Higher adoption signifies a more successful platform. |

| Latency | The delay between transaction initiation and confirmation across the network. Lower latency improves responsiveness. |

| Market Capitalization | The total market value of a blockchain’s native token, reflecting its overall economic standing within the cryptocurrency market. |

Market Analysis and Trends

Layer 1 blockchains have gained significant traction in recent years, particularly as decentralized finance (DeFi) applications continue to proliferate. As of December 2024, the total market capitalization of L1 blockchains exceeded $2.8 trillion, with Bitcoin dominating this space at nearly 70% market share. Ethereum remains a critical player with over $70 billion in total value locked (TVL), showcasing its extensive use in DeFi applications.

The performance landscape is highly competitive, with various blockchains like Solana, Cardano, and Avalanche emerging as formidable alternatives to Ethereum. Each blockchain emphasizes different aspects such as transaction speed, scalability, or energy efficiency:

- Solana: Known for its high TPS capabilities (up to 65,000 TPS), making it suitable for transaction-heavy applications like gaming.

- Cardano: Prioritizes security and sustainability but has lower TPS compared to Solana.

- Avalanche: Offers rapid finality times while maintaining a focus on decentralization.

Understanding these trends helps investors identify which L1 solutions may offer better long-term growth potential based on their unique strengths.

Implementation Strategies

Investors looking to leverage L1 blockchains should consider several strategies:

- Diversification: Investing across multiple L1 platforms can mitigate risks associated with individual blockchain performance.

- Focus on Use Cases: Identifying L1s with strong use cases—such as those supporting DeFi or NFTs—can lead to higher returns.

- Monitoring KPIs: Regularly tracking key performance indicators such as TPS, TVL, and user adoption can provide insights into which platforms are gaining traction.

- Participating in Governance: Engaging in governance mechanisms on platforms like Ethereum or Cardano can provide additional benefits through staking rewards or voting rights.

Risk Considerations

Investing in Layer 1 blockchains comes with inherent risks:

- Market Volatility: The cryptocurrency market is known for its price fluctuations; investors should be prepared for potential losses.

- Regulatory Risks: Changes in regulations can impact blockchain operations significantly. Investors must stay informed about legal developments.

- Technological Risks: Bugs or vulnerabilities in smart contracts can lead to financial losses; thorough audits are essential.

- Competition: The rapid evolution of technology means that new competitors could emerge quickly, potentially displacing established players.

Regulatory Aspects

The regulatory landscape surrounding Layer 1 blockchains is evolving. In many jurisdictions, regulators are beginning to scrutinize cryptocurrencies more closely:

- Compliance Requirements: Projects must ensure they comply with local laws regarding securities and anti-money laundering (AML).

- Tax Implications: Investors should be aware of how cryptocurrency transactions are taxed in their respective countries.

- Data Privacy Regulations: With increasing focus on data protection laws like GDPR in Europe, L1 projects must navigate compliance carefully.

Understanding these regulatory aspects is crucial for both investors and developers working within the blockchain space.

Future Outlook

The future of Layer 1 blockchains appears promising as they continue to innovate and adapt to market demands:

- Scalability Solutions: Many L1s are exploring sharding and other scaling solutions to enhance transaction throughput without sacrificing security.

- Interoperability: Projects focusing on cross-chain compatibility may gain an edge as demand for interconnected ecosystems grows.

- Sustainability Initiatives: With increasing scrutiny on environmental impacts, many PoW networks are transitioning to PoS or developing eco-friendly alternatives.

Investors should keep an eye on these trends as they could significantly influence the performance and adoption rates of various L1 blockchains.

Frequently Asked Questions About Key Performance Indicators For Layer 1 Blockchains

- What is TPS in Layer 1 blockchains?

TPS stands for Transactions Per Second; it measures how many transactions a blockchain can process within one second. - Why is Time to Finality important?

Time to Finality indicates how quickly a transaction is confirmed as irreversible, impacting user trust and experience. - How do I measure a blockchain's security?

Security can be assessed through consensus mechanism robustness, node distribution, and historical attack records. - What does Total Value Locked (TVL) signify?

TVL represents the total assets staked within a blockchain ecosystem, indicating its utility and user trust. - What are Decentralization Metrics?

These metrics assess how distributed a network's nodes are across different regions and their participation levels in consensus processes. - How does energy efficiency affect Layer 1 blockchains?

Energy efficiency is crucial for sustainability; lower energy consumption per transaction is increasingly favored by investors and regulators alike. - What role do Smart Contracts play?

Smart contracts automate processes within dApps; their performance affects overall blockchain efficiency. - Why should I monitor User Adoption Rates?

User adoption rates reflect the platform's popularity and potential growth; higher rates often correlate with increased value.

This comprehensive analysis highlights the essential KPIs that define Layer 1 blockchains' effectiveness. By understanding these metrics, investors can make informed decisions about where to allocate their resources within this rapidly evolving landscape.