Understanding how much to save is a fundamental aspect of personal finance that influences financial stability and future planning. Individuals often grapple with various factors when determining their savings needs, including interest rates, personal goals, psychological factors, and economic conditions. This article delves into these critical elements, providing insights into current market trends and practical strategies for effective saving.

| Key Concept | Description/Impact |

|---|---|

| Interest Rates | The after-tax real interest rate is crucial as it reflects the actual growth of savings after accounting for inflation and taxes. |

| Psychological Factors | Individuals’ saving behaviors are significantly influenced by their personality traits and immediate gratification tendencies. |

| Financial Goals | Aligning savings goals with personal values enhances motivation and commitment to saving. |

| Economic Conditions | The broader economic environment, including inflation rates and employment levels, affects individuals’ ability to save. |

| Regulatory Frameworks | Understanding regulations like Regulation DD helps consumers make informed decisions about savings accounts and interest rates. |

Market Analysis and Trends

The current landscape of personal savings is marked by fluctuating interest rates and changing consumer behaviors. As of October 2024, the personal savings rate in the United States stands at 4.40%, a slight increase from 4.10% in September but significantly below the long-term average of 8.44%. This decline in savings rates can be attributed to several factors:

- Inflation: Rising prices reduce disposable income, making it challenging for individuals to save.

- Consumer Spending: Increased consumer spending driven by economic recovery post-pandemic has led to a decrease in the savings rate.

- Interest Rates: Although higher interest rates can incentivize saving, they also increase borrowing costs, which may deter some consumers from saving adequately.

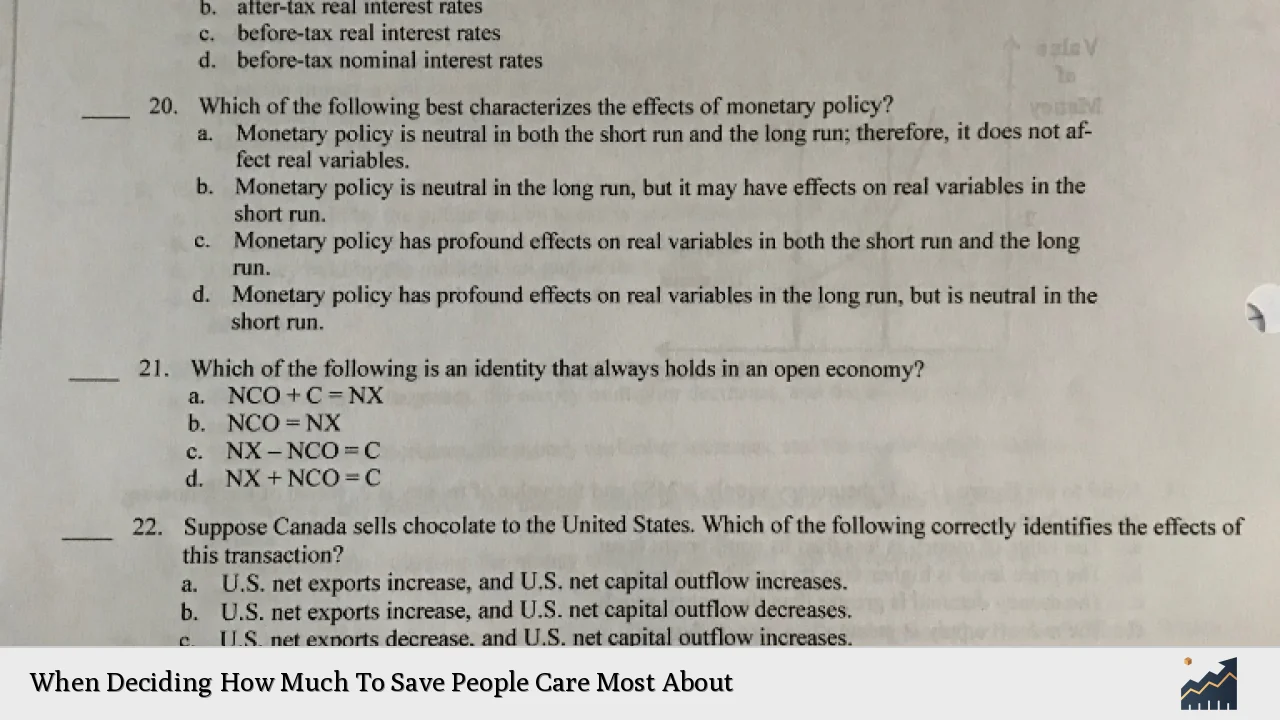

Recent studies indicate that individuals prioritize the after-tax real interest rate when deciding how much to save. This metric is essential as it represents the true benefit derived from savings after accounting for inflation and taxes.

Implementation Strategies

To effectively decide how much to save, individuals should consider implementing the following strategies:

- Automate Savings: Setting up automatic transfers from checking to savings accounts can help build savings effortlessly.

- Set Clear Goals: Establishing specific, measurable financial goals can enhance motivation. For instance, saving for a vacation or emergency fund can provide tangible targets.

- Utilize High-Yield Accounts: Exploring high-yield savings accounts or certificates of deposit (CDs) can maximize returns on saved funds.

- Diversify Investments: For those with longer-term goals, diversifying investments into low-risk options such as bonds or mutual funds can provide better returns while managing risk.

Risk Considerations

Understanding risk is vital when deciding how much to save. Key considerations include:

- Market Volatility: Short-term investments may be subject to market fluctuations; therefore, individuals should avoid high-risk investments if they need access to funds within a short period.

- Personal Risk Tolerance: Each individual’s comfort level with risk varies; assessing this can guide investment choices that align with their financial goals.

- Emergency Funds: Maintaining an emergency fund covering three to six months of expenses is crucial for financial security and mitigating unforeseen risks.

Regulatory Aspects

Regulatory frameworks play a significant role in shaping saving behaviors. For instance:

- Regulation DD mandates that financial institutions disclose interest rates and fees associated with deposit accounts, empowering consumers to make informed decisions.

- Consumer Protection Laws ensure that individuals are aware of their rights regarding financial products, which can influence their saving strategies.

Understanding these regulations can help individuals navigate their options more effectively and choose accounts that offer the best terms for their savings goals.

Future Outlook

Looking ahead, several trends are likely to shape how individuals approach saving:

- Increased Financial Literacy: As awareness around personal finance grows, more individuals will likely prioritize saving as a key component of financial health.

- Technological Advancements: Fintech solutions that simplify budgeting and saving will continue to gain traction, making it easier for consumers to manage their finances.

- Behavioral Economics Insights: Understanding psychological factors influencing saving behavior will lead to more effective strategies tailored to individual needs.

As economic conditions evolve, staying informed about market trends and adjusting strategies accordingly will be essential for effective saving.

Frequently Asked Questions About When Deciding How Much To Save People Care Most About

- What is the most important factor when deciding how much to save?

The after-tax real interest rate is often considered the most important factor as it reflects the actual growth potential of savings. - How do psychological factors influence saving behavior?

Psychological traits such as impulsivity and future orientation significantly impact an individual’s ability to save effectively. - What role do financial goals play in saving?

Aligning savings goals with personal values enhances motivation and commitment, making it easier to save consistently. - How can I improve my savings rate?

Automating transfers to savings accounts, setting clear financial goals, and utilizing high-yield accounts are effective strategies. - What are the risks associated with saving?

Market volatility, personal risk tolerance, and inadequate emergency funds are key risks that need consideration when planning savings. - How does Regulation DD affect my savings?

This regulation requires banks to disclose important information about fees and interest rates on deposit accounts, helping consumers make informed choices. - What is the current trend in personal savings rates?

The personal savings rate in the U.S. has recently increased slightly but remains below historical averages due to high consumer spending and inflation pressures. - Why is it important to have an emergency fund?

An emergency fund provides financial security against unexpected expenses or income loss, allowing individuals to maintain stability without derailing their long-term savings goals.

By addressing these aspects comprehensively, individuals can better navigate their saving decisions and enhance their overall financial health.