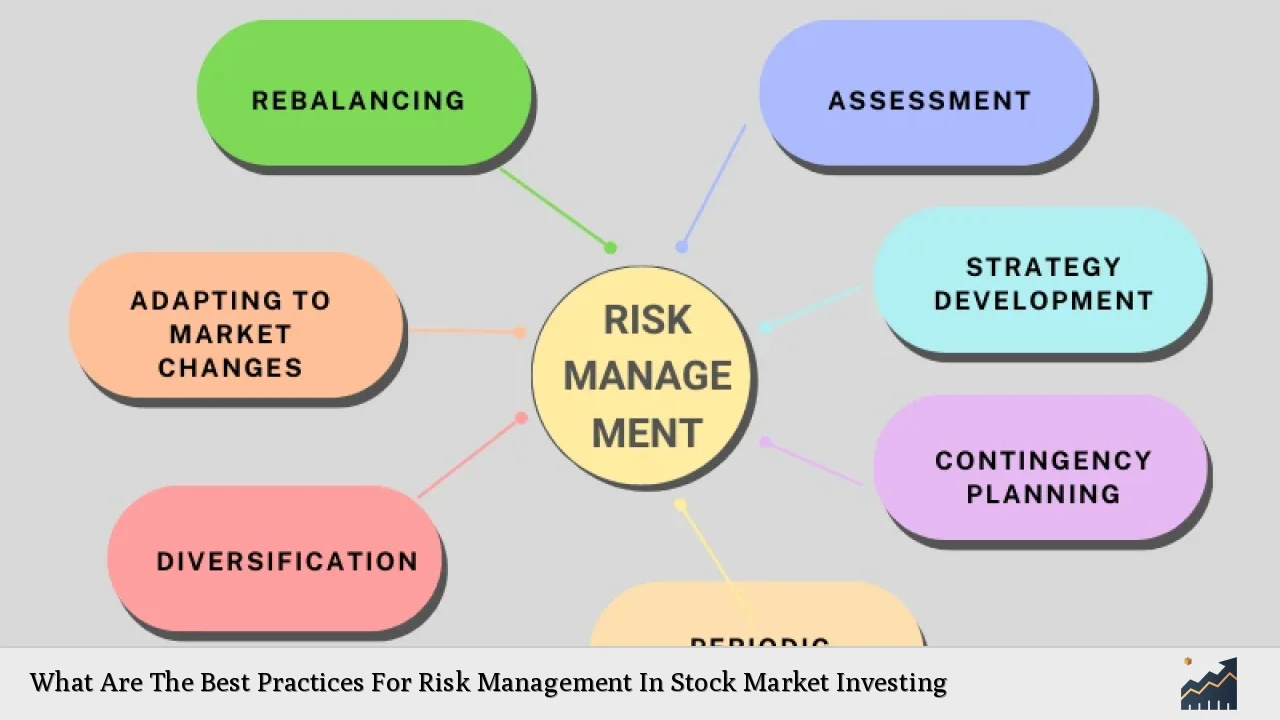

Effective risk management is vital for successful stock market investing. It involves identifying, analyzing, and mitigating risks to protect investments while maximizing potential returns. As market dynamics evolve, understanding best practices in risk management becomes essential for individual investors and finance professionals alike.

| Key Concept | Description/Impact |

|---|---|

| Diversification | Diversification involves spreading investments across various sectors and asset classes to reduce exposure to any single investment's poor performance. This strategy helps mitigate risks associated with market volatility. |

| Position Sizing | Determining the appropriate amount of capital to allocate to each investment is crucial. Position sizing helps limit potential losses and manage overall portfolio risk effectively. |

| Stop-Loss Orders | Implementing stop-loss orders enables investors to set predetermined price levels at which they will exit a position to prevent further losses, thus safeguarding their capital. |

| Risk-Reward Ratio | The risk-reward ratio assesses the potential profit against the potential loss of an investment. A favorable ratio indicates that the potential reward outweighs the risk, guiding investment decisions. |

| Hedging | Hedging involves using financial instruments like options or futures to offset potential losses in investments. This strategy acts as insurance against adverse market movements. |

| Regular Portfolio Rebalancing | Rebalancing involves adjusting the weights of different assets in a portfolio to maintain a desired level of risk and return over time, ensuring alignment with investment goals. |

| Thorough Research and Analysis | Conducting comprehensive research on market trends, economic indicators, and company fundamentals is essential for informed decision-making and effective risk assessment. |

| Understanding Market Conditions | Acknowledging current market conditions, including volatility and macroeconomic factors, is crucial for adapting risk management strategies accordingly. |

| Utilizing Technology and Tools | Employing advanced trading platforms and analytical tools can enhance risk management efforts by providing real-time data and insights into market trends. |

| Continuous Education and Adaptation | Investors should remain informed about evolving market conditions and continuously adapt their strategies to manage risks effectively. |

Market Analysis and Trends

As of December 2024, the U.S. stock market has shown significant resilience, with the S&P 500 index rising approximately 27% since the beginning of the year, reaching new heights above 6,000 points. This growth has been driven by various factors, including advancements in technology, particularly artificial intelligence, and a favorable macroeconomic environment characterized by stable inflation rates and anticipated interest rate cuts by the Federal Reserve.

The current landscape highlights several key trends:

- Sustainability Focus: There is a growing emphasis on environmental, social, and governance (ESG) factors among investors. Companies that prioritize sustainable practices are likely to attract more investment.

- Technological Advancements: Innovations in sectors such as fintech, healthcare technology, and renewable energy are reshaping investment opportunities.

- Emerging Markets: Investors are increasingly looking towards emerging markets for growth potential as developed markets face saturation.

- Market Volatility: While recent trends show positive growth, investors must remain vigilant about potential volatility due to geopolitical tensions and economic uncertainties.

Implementation Strategies

To effectively manage risks in stock market investing, consider implementing the following strategies:

- Diversification: Spread investments across various asset classes (stocks, bonds, commodities) and sectors to minimize exposure to any single economic event.

- Position Sizing: Allocate a specific percentage of your total capital to each investment based on your risk tolerance. A common guideline is not risking more than 1-2% of your total capital on a single trade.

- Stop-Loss Orders: Set stop-loss orders at strategic levels (e.g., 5-10% below purchase price) to automatically sell shares if they decline beyond a certain point.

- Risk-Reward Assessment: Before entering a trade, analyze the potential upside versus downside. A favorable risk-reward ratio (e.g., 1:3) suggests that potential gains significantly outweigh risks.

- Hedging Techniques: Use options or futures contracts to hedge against adverse movements in your primary investments. For example, buying put options can protect against declines in stock prices.

Risk Considerations

Investors should be aware of various risks that can affect their portfolios:

- Market Risk: The risk of losses due to fluctuations in market prices. Diversification can help mitigate this risk but cannot eliminate it entirely.

- Credit Risk: The possibility that a borrower will default on their obligations. This is particularly relevant for bond investors.

- Liquidity Risk: The risk of being unable to buy or sell investments quickly without affecting their price significantly. Investing in less liquid assets can increase this risk.

- Operational Risk: Risks arising from failures in internal processes or systems. This includes technology failures or fraud.

- Regulatory Risk: Changes in laws or regulations can impact specific industries or companies significantly. Staying informed about regulatory changes is crucial for managing this risk.

Regulatory Aspects

Understanding regulatory requirements is essential for effective risk management:

- Compliance with SEC Regulations: Investors must adhere to guidelines set by regulatory bodies like the Securities and Exchange Commission (SEC), which oversees securities markets in the U.S.

- Reporting Requirements: Publicly traded companies must disclose financial information regularly. Investors should utilize this information for informed decision-making.

- Investment Advisers Act of 1940: This act governs how investment advisers operate. Understanding these regulations can help investors choose reputable advisers if needed.

Future Outlook

Looking ahead into 2025 and beyond, several factors will shape stock market investing:

- Continued Technological Integration: As technology evolves, investors will need to adapt their strategies accordingly. Embracing digital tools for analysis and trading will be crucial.

- Focus on Sustainable Investments: The trend toward sustainability will likely continue as consumers demand more socially responsible practices from companies.

- Geopolitical Influences: Global events will continue to impact markets. Investors should remain aware of geopolitical tensions that could lead to market volatility.

- Interest Rate Environment: With expectations of further interest rate cuts from central banks globally, borrowing costs may decrease, potentially fueling further investment in equities.

Frequently Asked Questions About What Are The Best Practices For Risk Management In Stock Market Investing

- What is diversification?

Diversification is the practice of spreading investments across different asset classes or sectors to reduce overall portfolio risk. - How do stop-loss orders work?

A stop-loss order automatically sells a security when it reaches a certain price level set by the investor, helping limit potential losses. - What is a good risk-reward ratio?

A good risk-reward ratio typically ranges from 1:2 to 1:3, meaning that for every dollar at risk, there is a potential reward of two or three dollars. - Why is research important in investing?

Thorough research helps investors make informed decisions based on market trends, company fundamentals, and economic indicators. - What are hedging strategies?

Hedging strategies involve using financial instruments like options or futures contracts to offset potential losses in an investment portfolio. - How often should I rebalance my portfolio?

The frequency of rebalancing depends on individual goals but generally ranges from quarterly to annually based on market conditions. - What risks should I consider when investing?

The main risks include market risk, credit risk, liquidity risk, operational risk, and regulatory risk. - How can I stay updated on regulatory changes?

Investors should follow financial news outlets, subscribe to updates from regulatory bodies like the SEC, and consult with financial advisers when necessary.

In summary, effective risk management in stock market investing requires a multifaceted approach that encompasses diversification, thorough research, appropriate use of stop-loss orders, understanding market conditions, and ongoing education. By implementing these best practices while staying informed about current trends and regulations, investors can better navigate the complexities of the stock market while safeguarding their investments.