Acorns is a financial technology platform that specializes in micro-investing and automated savings. It allows users to invest small amounts of money, often by rounding up purchases made with linked debit or credit cards to the nearest dollar. This spare change is then automatically invested into diversified portfolios, primarily composed of exchange-traded funds (ETFs). Acorns aims to make investing accessible, especially for those who may feel intimidated by traditional investment methods.

The platform is designed for individuals who want to start investing without needing substantial upfront capital or extensive financial knowledge. Users can begin their investment journey with as little as $5, making it a popular choice among millennials and beginner investors. Acorns also offers additional services such as retirement accounts and banking features, further enhancing its appeal as an all-in-one financial solution.

| Feature | Description |

|---|---|

| Micro-Investing | |

| Portfolio Diversification | Invest in ETFs for reduced risk and better returns. |

How Acorns Works

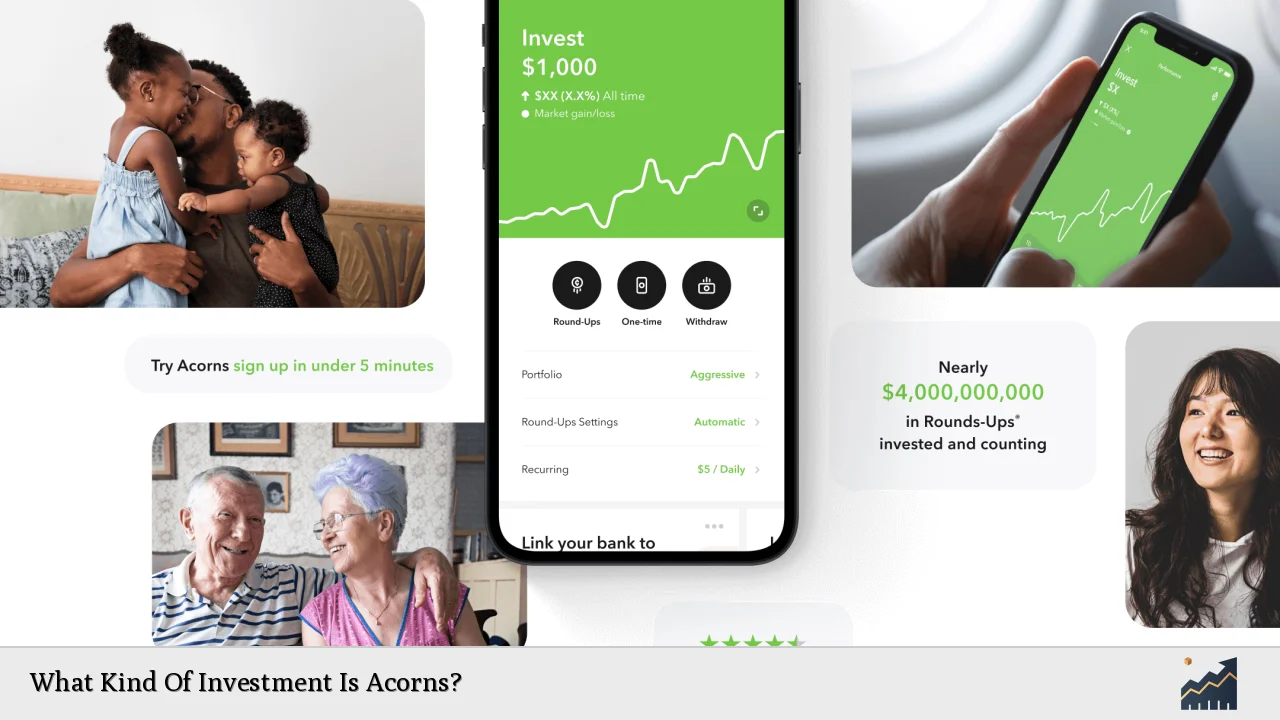

Acorns operates primarily through its Round-Ups feature, which links to users' bank accounts and credit cards. When a user makes a purchase, Acorns rounds up the total to the nearest dollar and invests the difference. For example, if you buy a coffee for $2.75, Acorns will round it up to $3.00 and invest the $0.25. This process allows users to accumulate investments passively over time without requiring significant effort or planning.

In addition to Round-Ups, users can set up recurring investments on a daily, weekly, or monthly basis. This feature encourages consistent saving habits and helps build a more substantial investment portfolio over time. Users can also customize their investment strategies based on their financial goals and risk tolerance, selecting from various portfolios designed by financial experts.

Acorns provides five core portfolios that vary in risk levels, allowing users to choose one that aligns with their investment objectives. These portfolios are constructed from a mix of stock and bond ETFs, which provide diversification and potential growth opportunities.

Investment Options Available

Acorns offers several investment options tailored to different user needs:

- Acorns Invest: The primary micro-investing feature that allows users to invest spare change through Round-Ups.

- Acorns Later: A retirement account option that enables users to save for retirement with tax advantages.

- Acorns Early: Designed for parents wanting to invest for their children's future education or other expenses.

- Acorns Banking: Offers checking accounts with features like early payday options and high-interest savings.

These options make Acorns suitable not only for casual investors but also for those looking to secure their financial futures through retirement savings or education funds.

Target Audience of Acorns

Acorns primarily targets younger demographics, particularly millennials and Gen Z individuals who are tech-savvy and seek convenient ways to start investing. The platform appeals to those who may not have extensive financial knowledge or experience but are eager to learn about investing and saving.

Key characteristics of Acorns' target audience include:

- Young Professionals: Individuals starting their careers who want to build wealth gradually.

- Beginner Investors: Those new to investing who appreciate the simplicity and automation provided by the app.

- Goal-Oriented Individuals: Users focused on achieving specific financial milestones like saving for a home or retirement.

By catering to these groups, Acorns has positioned itself as an accessible entry point into the world of investing.

Benefits of Using Acorns

Using Acorns comes with several benefits that make it an attractive option for many individuals:

- Ease of Use: The app is user-friendly and requires minimal setup, allowing users to start investing quickly.

- Automated Investing: By automating the investment process through Round-Ups and recurring contributions, users can invest without actively managing their portfolios.

- Low Minimum Investment: Users can start with just $5, making it accessible for those who may not have large sums of money to invest initially.

- Educational Resources: Acorns provides educational content within the app, helping users understand investing concepts as they grow their portfolios.

These benefits contribute to a seamless experience that encourages more people to engage with their finances positively.

Fees Associated with Acorns

While Acorns offers many advantages, it's essential to be aware of the associated fees:

- Monthly Subscription Fees: Acorns charges between $3 and $9 per month, depending on the services selected. This fee structure can be significant relative to smaller account balances.

- ETF Expense Ratios: The ETFs within portfolios charge underlying expense ratios that can vary based on the funds chosen. These fees are generally lower than those associated with actively managed funds.

Understanding these fees is crucial for users as they can impact overall returns, especially for smaller investments.

Comparing Acorns with Other Investment Platforms

When considering investment platforms, it's helpful to compare features and services offered by competitors. Below is a comparison between Acorns and two popular alternatives:

| Feature | Acorns | Robinhood |

|---|---|---|

| Investment Type | Micro-investing via Round-Ups | Stock trading & ETFs |

| Minimum Investment | $5 | $0 |

| Fees | $3-$9/month | $0 commissions |

| Target Audience | Beginner investors | Active traders |

This comparison highlights how each platform caters to different types of investors. While Acorns focuses on micro-investing and automated savings, Robinhood appeals more to active traders looking for commission-free stock trading.

FAQs About What Kind Of Investment Is Acorns

- What is micro-investing?

Micro-investing allows individuals to invest small amounts of money regularly, making investing accessible without large capital. - How does Acorns make money?

Acorns generates revenue through subscription fees charged monthly based on the services used. - Can I use Acorns for retirement savings?

Yes, Acorns offers retirement accounts through its Acorns Later service. - Is my money safe with Acorns?

Your investments are SIPC-insured up to $500,000, providing a level of security for your funds. - How do I withdraw my money from Acorns?

You can withdraw your funds at any time through the app by transferring them back into your linked bank account.

In conclusion, Acorns represents an innovative approach to investing that simplifies the process for beginners while promoting healthy financial habits. By leveraging micro-investing techniques and offering various financial products, it empowers individuals from all backgrounds to start building wealth effortlessly.