Diversification is a crucial strategy in investment management aimed at reducing risk while maximizing returns. The principle of diversification is simple: by spreading investments across various asset classes, sectors, and geographical regions, investors can protect themselves from significant losses that may arise from a downturn in any single investment. This article will provide a comprehensive guide on how to effectively diversify your investment portfolio.

| Key Concept | Description |

|---|---|

| Diversification | Spreading investments across different asset classes to reduce risk. |

Understanding Diversification

Diversification is an investment strategy designed to mitigate risk by allocating investments among various financial instruments, industries, and other categories. The rationale behind this approach is that a portfolio constructed of different kinds of assets will, on average, yield higher returns and pose a lower risk than any individual investment within the portfolio.

Investors can diversify their portfolios by including a mix of stocks, bonds, real estate, and even alternative investments like commodities or cryptocurrencies. Each asset class reacts differently to market conditions, which helps smooth out the overall volatility of the portfolio.

Moreover, diversification can also be achieved through investing in different geographical regions. For instance, if one country's economy is struggling, investments in another country might perform well, thereby balancing the overall performance of the portfolio.

Types of Diversification Strategies

There are several strategies that investors can employ to diversify their portfolios effectively:

- Asset Class Diversification: This involves spreading investments across various asset classes such as stocks, bonds, real estate, and cash. Each asset class behaves differently under various economic conditions.

- Sector Diversification: Within the equity portion of your portfolio, investing in multiple sectors (like technology, healthcare, and consumer goods) protects against sector-specific downturns.

- Geographical Diversification: Investing in international markets can help reduce risks associated with economic downturns in a single country. This includes developed markets as well as emerging markets.

- Investment Vehicle Diversification: Utilizing different investment vehicles such as mutual funds, exchange-traded funds (ETFs), and direct stock purchases can enhance diversification. Mutual funds and ETFs provide built-in diversification by pooling money from many investors to invest in a broad array of securities.

Steps to Achieve Diversification

To effectively diversify your investment portfolio, follow these steps:

1. Set Clear Investment Goals: Determine what you want to achieve with your investments—whether it's long-term growth, short-term income, or capital preservation. Understanding your financial objectives will guide your diversification strategy.

2. Assess Risk Tolerance: Evaluate how much risk you are willing to take. This assessment will influence how you allocate assets among various categories.

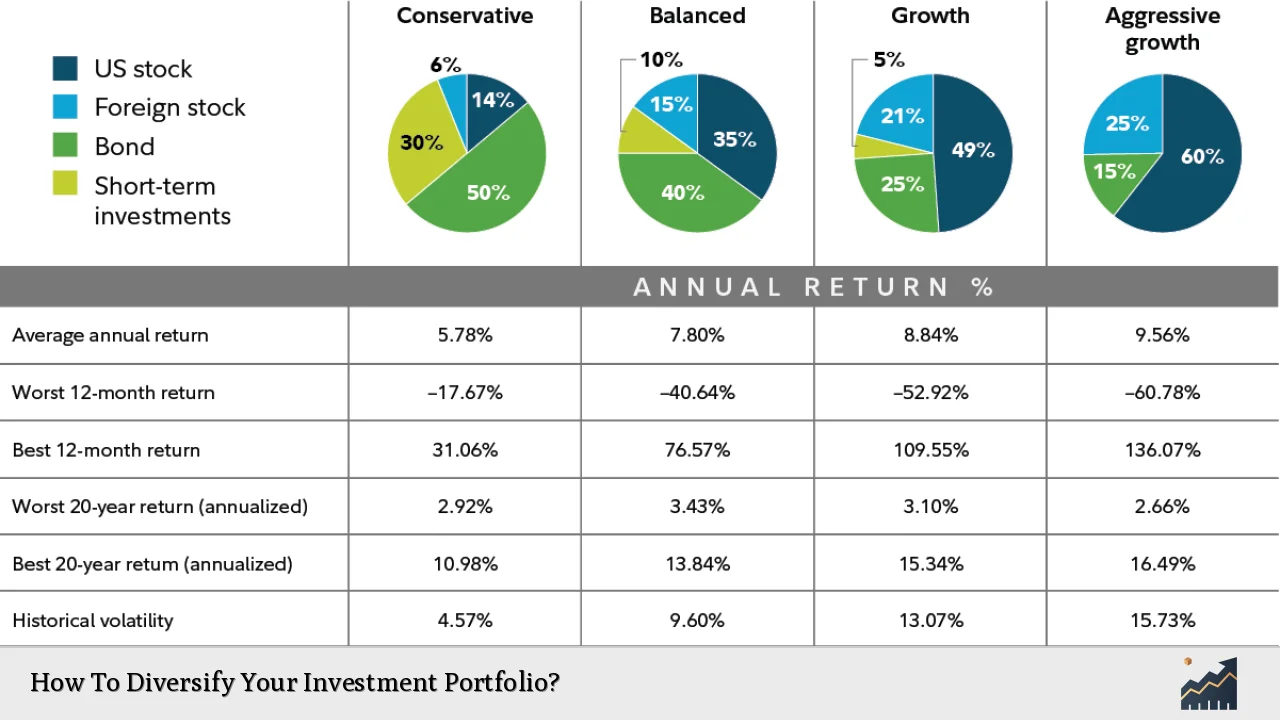

3. Allocate Assets Across Classes: Create a balanced mix of asset classes based on your goals and risk tolerance. A common approach is the 60/40 rule—60% in stocks and 40% in bonds—but this should be tailored to individual preferences.

4. Diversify Within Asset Classes: Ensure that within each asset class, you have a variety of investments. For example, within stocks, invest in different sectors and company sizes (large-cap vs. small-cap).

5. Include Geographic Diversity: Invest not just domestically but also internationally to tap into global growth opportunities and mitigate risks associated with local economies.

6. Rebalance Periodically: Over time, certain investments may grow faster than others, skewing your original asset allocation. Regularly review and adjust your portfolio to maintain your desired level of diversification.

The Importance of Regular Rebalancing

Rebalancing is an essential part of maintaining a diversified portfolio. As market conditions change, some assets may perform better than others, leading to an imbalance in your original allocation strategy.

For example, if your stock investments perform exceptionally well over a year while bonds lag behind, you might find yourself with a higher percentage of stocks than intended—thereby increasing your overall risk exposure. By rebalancing periodically—typically once or twice a year—you can realign your portfolio with your original investment strategy.

Utilizing Different Investment Vehicles

Different types of investment vehicles can enhance diversification:

- Mutual Funds: These funds pool capital from multiple investors to purchase a diverse range of securities. They are ideal for those who prefer a hands-off approach.

- ETFs (Exchange-Traded Funds): Similar to mutual funds but traded on exchanges like stocks; they often have lower fees and provide flexibility in trading.

- Direct Equities: For those who want more control over their investments; buying stocks directly allows for targeted exposure to specific companies or sectors.

- Real Estate Investment Trusts (REITs): These allow investors to invest in real estate without having to buy property directly, providing exposure to real estate markets.

The Role of Alternative Investments

Including alternative investments in your portfolio can further enhance diversification:

- Commodities: Investing in physical goods like gold or oil can act as a hedge against inflation and provide returns that are uncorrelated with traditional stock and bond markets.

- Cryptocurrencies: While highly volatile, cryptocurrencies can offer significant growth potential and serve as an alternative asset class for those willing to accept higher risk levels.

- Private Equity: Investing in private companies or venture capital funds can provide access to high-growth opportunities not available through public markets.

Monitoring Costs and Liquidity

Cost management is often overlooked but crucial for maintaining an efficient diversified portfolio. High transaction fees or management costs can erode returns over time.

Additionally, ensure that your portfolio includes both liquid assets (like stocks) for quick access to cash when needed and illiquid assets (like real estate) that may provide higher returns over longer periods but are harder to sell quickly.

FAQs About How To Diversify Your Investment Portfolio

- What is the main purpose of diversifying my investment portfolio?

The main purpose is to reduce risk while maximizing potential returns by spreading investments across various asset classes. - How often should I rebalance my diversified portfolio?

It’s generally advisable to rebalance at least once or twice a year. - Can I be over-diversified?

Yes, over-diversification can lead to diminished returns as it may dilute the potential gains from high-performing assets. - What types of assets should I include for effective diversification?

You should include stocks, bonds, real estate, commodities, and possibly alternative investments like cryptocurrencies. - Is it necessary to invest internationally for diversification?

While not strictly necessary, international investments can help mitigate risks associated with domestic market downturns.

Diversifying your investment portfolio is not just about mixing different types of assets; it’s about creating a balanced approach that aligns with your financial goals and risk tolerance while adapting to changing market conditions. By following these strategies and regularly reviewing your investments, you can build a resilient portfolio that stands the test of time.