Choosing the right investment account for children is a crucial step in fostering financial literacy and preparing them for future financial responsibilities. With various options available, parents can select accounts that align with their financial goals, whether it’s saving for education, retirement, or general wealth building. Understanding the features and benefits of each type of account can help parents make informed decisions that will benefit their children in the long run.

Investment accounts for children can serve multiple purposes. They can help instill good saving habits early on and provide a platform for learning about investing. The earlier you start investing for your child, the more time their money has to grow through the power of compounding. This article will explore different types of investment accounts suitable for children, their advantages, and how to choose the best one based on individual needs.

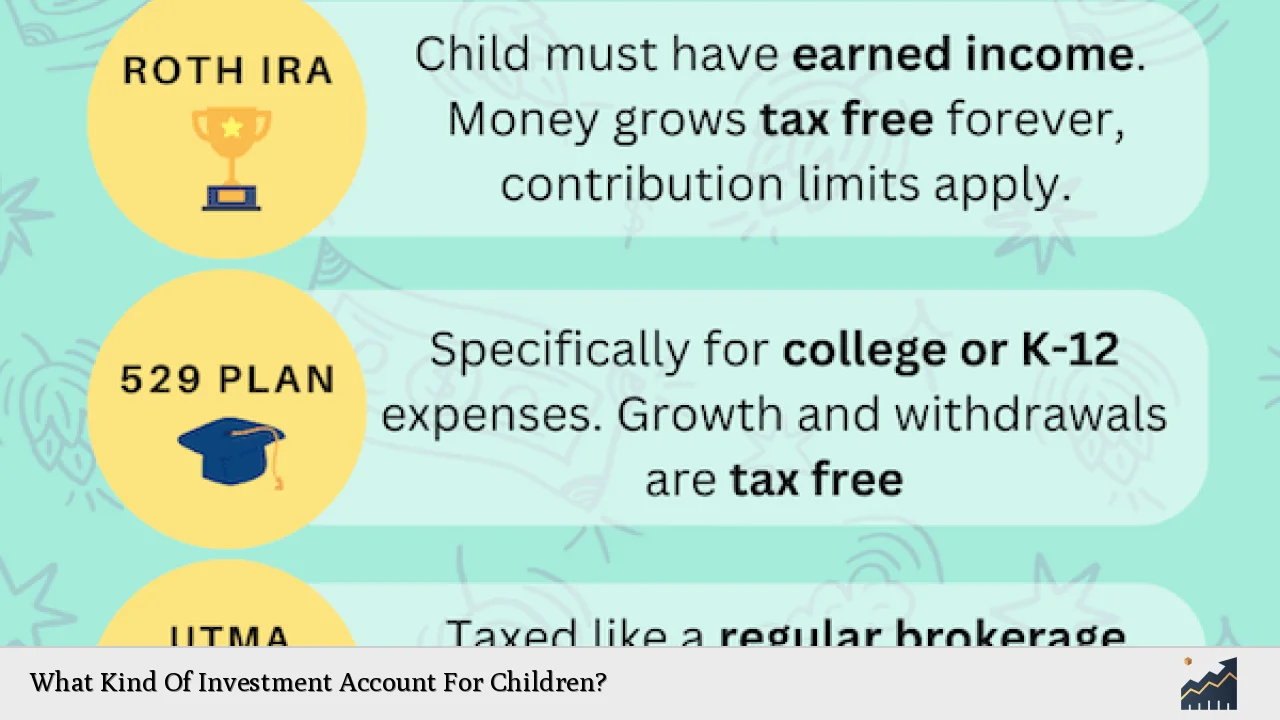

| Type of Account | Key Features |

|---|---|

| 529 College Savings Plan | Tax advantages for education expenses |

| Coverdell ESA | Tax-free growth for education expenses |

| Custodial Accounts (UGMA/UTMA) | Invest in various assets; child gains control at age of majority |

| Roth IRA | Tax-free growth; ideal for retirement savings |

| Junior ISA (UK) | Tax-free savings until age 18; contributions by anyone |

Types of Investment Accounts

There are several types of investment accounts available for children, each with unique features and benefits. Understanding these options is essential for making the right choice.

529 College Savings Plans

A 529 College Savings Plan is designed specifically for education savings. Contributions to these plans are not tax-deductible, but earnings grow tax-free. Withdrawals used for qualified education expenses are also tax-free. This account is ideal if your primary goal is to save for your child’s college education.

Coverdell Education Savings Accounts (ESAs)

Coverdell ESAs allow parents to contribute up to $2,000 per year per child. The funds can be used for a wide range of educational expenses, including elementary and secondary school costs, making it more versatile than a 529 plan. Like the 529 plan, earnings grow tax-free, and withdrawals used for qualified expenses are also tax-free.

Custodial Accounts (UGMA/UTMA)

Custodial Accounts, governed by the Uniform Gifts to Minors Act (UGMA) or the Uniform Transfers to Minors Act (UTMA), allow parents to invest on behalf of their children until they reach the age of majority (usually 18 or 21, depending on state laws). These accounts can hold various assets like stocks, bonds, and mutual funds. Once the child reaches adulthood, they gain full control over the account.

Roth IRA

A Roth IRA is a retirement account that allows contributions after taxes have been paid. The key advantage is that earnings grow tax-free, and withdrawals during retirement are also tax-free. While this account is primarily aimed at retirement savings, it can be an excellent option if your child has earned income from a job.

Junior ISA (UK)

For those in the UK, a Junior ISA allows parents to save up to £9,000 per year tax-free until the child turns 18. Anyone can contribute to this account, making it a flexible option for family members who wish to help save for a child’s future.

Choosing the Right Account

When selecting an investment account for your child, consider several factors that will influence your decision.

Age of Your Child

The age of your child plays a significant role in determining which investment account is most suitable. Younger children may benefit from custodial accounts or education-specific plans like 529s or Coverdell ESAs. In contrast, older teens with earned income might be better suited for a Roth IRA.

Financial Goals

Define your long-term financial goals. If you aim to save specifically for college expenses, a 529 plan or Coverdell ESA would be appropriate choices. For general wealth accumulation or retirement savings, custodial accounts or Roth IRAs may be more suitable.

Risk Tolerance

Understanding both your risk tolerance and that of your child is vital when choosing investments within these accounts. Younger children can afford to take more risks due to their longer investment horizon; thus, aggressive investment strategies may be appropriate.

Tax Considerations

Different accounts come with varying tax implications. For example, while contributions to a Roth IRA are made with after-tax dollars, earnings grow tax-free. In contrast, custodial accounts may subject earnings to taxation based on the child’s income level.

Contribution Limits

Be aware of contribution limits associated with each account type. For instance, Coverdell ESAs have annual contribution limits of $2,000, while 529 plans often allow higher annual contributions depending on state regulations.

Tips for Maximizing Investment Accounts

To ensure that you make the most out of your chosen investment account for your child:

- Start Early: The earlier you begin investing, the more time your money has to grow through compounding.

- Diversify Investments: A diversified portfolio can spread risk and potentially increase returns.

- Make Regular Contributions: Consistent contributions can significantly impact overall growth over time.

- Educate Your Child: Use this opportunity to teach your child about investing and financial literacy.

FAQs About Investment Accounts For Children

- What types of investment accounts are best for kids?

The best types include 529 plans for education savings, custodial accounts for general investing, and Roth IRAs if they have earned income. - Can I open an investment account in my child’s name?

Yes, parents can open custodial accounts or other types of accounts in their child’s name. - What is a custodial account?

A custodial account is an investment account managed by an adult on behalf of a minor until they reach adulthood. - Are there tax benefits associated with children’s investment accounts?

Yes, many children’s investment accounts offer tax advantages like tax-free growth or withdrawals when used for qualified expenses. - How much can I contribute annually?

This depends on the type of account; for example, Coverdell ESAs allow up to $2,000 per year.

By understanding these various investment options and strategies tailored specifically for children’s financial futures, parents can empower their children with valuable skills and resources that will benefit them throughout their lives. Investing early not only helps secure their financial future but also instills lifelong habits that promote financial responsibility and independence.