Investing your Health Savings Account (HSA) money can significantly enhance your financial future, particularly as healthcare costs continue to rise. HSAs are unique in that they provide a triple tax advantage: contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses are also tax-free. This makes HSAs a powerful tool not just for managing current healthcare costs but also for long-term savings and investment.

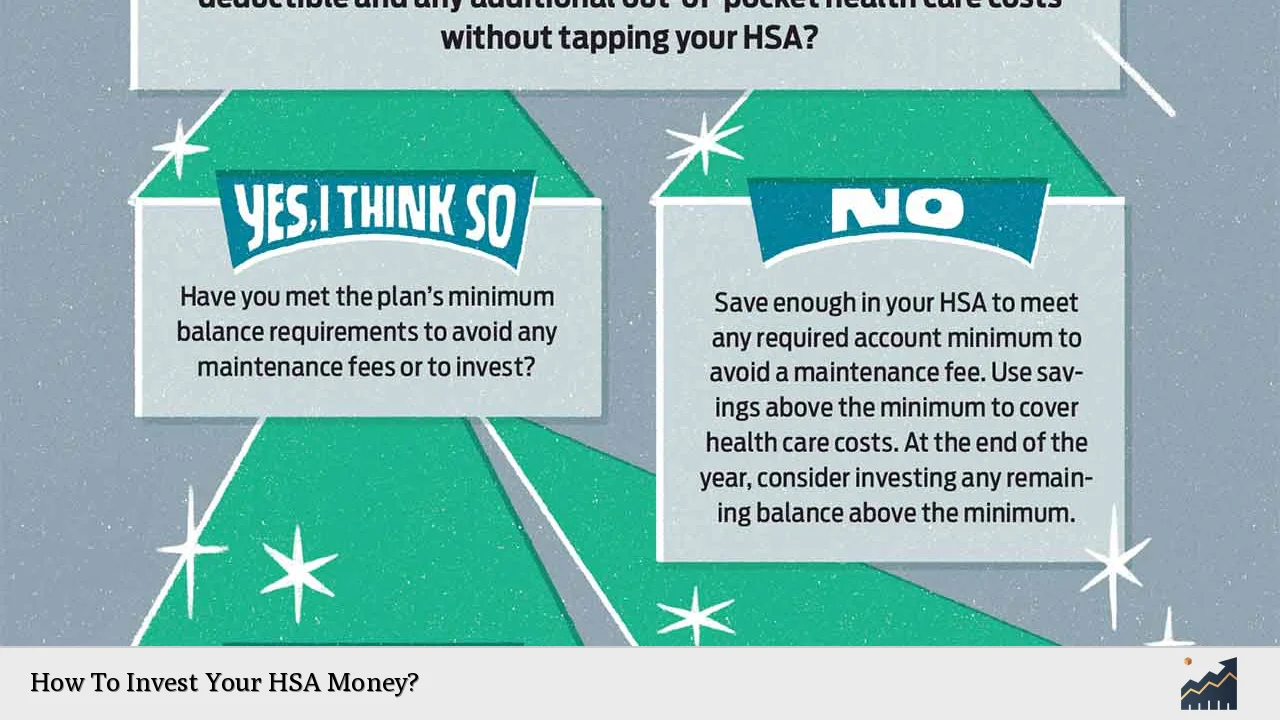

Many individuals overlook the investment potential of their HSAs, often keeping their funds in cash or low-yield accounts. However, once you meet the minimum balance requirement—typically around $2,000—you can start investing your HSA funds in various financial instruments such as stocks, bonds, mutual funds, and more. Understanding how to effectively invest your HSA money can lead to substantial growth over time.

| Feature | Description |

|---|---|

| Tax Benefits | Contributions are tax-deductible; growth is tax-free; withdrawals for medical expenses are tax-free. |

Understanding HSA Investment Options

Before diving into specific investment strategies, it's crucial to understand the types of investments available within an HSA. Depending on your HSA provider, you may have access to a range of options:

- Money Market Funds: These are low-risk investments that provide liquidity and stability. They are suitable for individuals who anticipate needing their funds in the short term.

- Stocks and Stock Funds: Investing in individual stocks or stock-based funds can yield higher returns over the long term. However, this comes with increased risk and volatility.

- Bonds and Bond Funds: These tend to be less risky than stocks and provide steady income through interest payments. They can be a good option for conservative investors.

- Mutual Funds and ETFs: These funds pool money from multiple investors to purchase a diversified portfolio of stocks or bonds. They offer diversification and professional management.

- Target Date Funds: These funds automatically adjust their asset allocation based on a specified target date, making them a hands-off investment option suitable for retirement planning.

Understanding these options will help you align your investments with your risk tolerance and financial goals.

Factors to Consider Before Investing

When deciding how to invest your HSA money, several factors should guide your choices:

- Time Horizon: Consider when you expect to need the funds. If you anticipate using your HSA for medical expenses in the near future, it may be wise to keep a portion in cash or low-risk investments.

- Risk Tolerance: Assess how much risk you are willing to take. Younger investors with longer time horizons may opt for more aggressive investments, while those closer to retirement may prefer conservative options.

- Healthcare Needs: Evaluate your potential future medical expenses. If you expect significant healthcare costs soon, maintaining liquidity in your account is essential.

- Investment Goals: Determine whether you are investing primarily for short-term medical expenses or long-term growth. This will influence your investment strategy significantly.

By considering these factors, you can create a tailored investment strategy that meets your needs.

Investment Strategies for Your HSA

There are several strategies you can employ when investing your HSA funds:

- Maximize Contributions: Contribute the maximum allowed each year ($4,150 for individuals and $8,300 for families in 2024). This maximizes the tax benefits associated with HSAs.

- Diversify Investments: Spread your investments across various asset classes (stocks, bonds, mutual funds) to reduce risk. A diversified portfolio can help mitigate losses during market downturns.

- Utilize Target Date Funds: If you're unsure about managing investments yourself, consider target date funds that automatically adjust based on your retirement timeline.

- Consider Robo-Advisors: Many HSA providers offer robo-advisors that automatically manage investments based on your risk tolerance and goals. This can simplify the investment process significantly.

- Self-Directed Investing: If you're comfortable managing your own investments, look for an HSA provider that allows self-directed investing. This gives you more control over where your money goes.

Implementing these strategies can help grow your HSA balance over time while ensuring that you have access to necessary funds when needed.

The Importance of Regular Monitoring

Once you've invested your HSA funds, it's essential to monitor your investments regularly. Market conditions change frequently, and what was once a suitable investment may no longer align with your goals or risk tolerance.

Consider these actions:

- Review Performance: Regularly assess how well your investments are performing relative to benchmarks or expectations. Adjust as necessary if certain assets underperform consistently.

- Rebalance Your Portfolio: As some investments grow faster than others, rebalancing ensures that your asset allocation remains aligned with your original strategy and risk tolerance.

- Stay Informed: Keep up with market trends and economic news that could impact your investments. Knowledge is key to making informed decisions about when to buy or sell assets.

By actively managing your HSA investments, you can better position yourself for long-term success.

FAQs About How To Invest Your HSA Money

- What types of accounts qualify as HSAs?

HSAs must be paired with high-deductible health plans (HDHPs) to qualify. - Can I invest my entire HSA balance?

You can only invest amounts above the minimum balance required by your provider. - Are there penalties for withdrawing from my HSA?

Withdrawals for qualified medical expenses are tax-free; non-qualified withdrawals incur taxes and penalties. - How do I choose the right investments?

Your choice should depend on factors like risk tolerance, time horizon, and healthcare needs. - Is it possible to lose money in an HSA investment?

Yes, like any investment account, there is a risk of loss depending on market conditions.

Investing your HSA money wisely can lead to substantial financial benefits over time. By understanding the available options and considering key factors such as time horizon and risk tolerance, you can create a strategy that aligns with both immediate healthcare needs and long-term financial goals. Regular monitoring and adjustments will further enhance the effectiveness of your investment approach within this unique tax-advantaged account.