Investing your 401(k) early can be a tempting option for those facing immediate financial needs. However, withdrawing from your retirement savings before reaching the age of 59½ comes with significant consequences. Understanding the implications, penalties, and alternative options is crucial for making informed decisions about your financial future.

When you withdraw from your 401(k) early, it is generally subject to a 10% penalty on top of regular income taxes. This means that not only will you lose a portion of your savings to penalties, but you will also face increased tax liabilities. Additionally, removing funds from your retirement account disrupts the compounding growth that these investments are designed to achieve over time.

The following table summarizes key aspects of early 401(k) withdrawals:

| Aspect | Details |

|---|---|

| Age Requirement | Withdrawals before age 59½ incur penalties |

| Penalty Rate | 10% on the withdrawn amount |

| Tax Implications | Ordinary income tax applies to withdrawals |

Understanding Early Withdrawals

An early withdrawal from a 401(k) plan is defined as any distribution taken before the age of 59½. The Internal Revenue Service (IRS) imposes a 10% penalty on these distributions, which is in addition to regular income taxes that apply to the amount withdrawn. This penalty exists to discourage individuals from using their retirement savings for non-retirement expenses.

While it might seem straightforward to access your funds in times of need, it’s important to consider the long-term impact on your retirement savings. Each dollar withdrawn today is one less dollar that can grow and compound over time. For example, if you withdraw $10,000 at age 40, you could potentially lose out on tens of thousands of dollars by retirement age due to lost investment growth.

In certain situations, the IRS allows penalty-free withdrawals under specific circumstances, such as:

- Permanent disability

- Medical expenses exceeding 7.5% of adjusted gross income

- Separation from service at age 55 or older

However, even in these cases, the withdrawn amount is still subject to regular income taxes.

The Impact of Early Withdrawals on Retirement Savings

Withdrawing funds early from your 401(k) not only incurs immediate financial penalties but also has long-lasting effects on your retirement savings. When you take money out of your account, you are effectively reducing the principal amount that can earn returns over time. This loss can significantly hinder your ability to achieve financial security in retirement.

Consider this: If you withdraw $5,000 at age 35 instead of leaving it invested until retirement, you might miss out on an estimated $50,000 or more by the time you reach age 65 due to compounded growth. This scenario highlights the importance of maintaining your retirement savings intact whenever possible.

Additionally, frequent early withdrawals can lead to a cycle of dependency on these funds for short-term needs rather than allowing them to serve their intended purpose: providing financial stability during retirement years.

Alternatives to Early Withdrawals

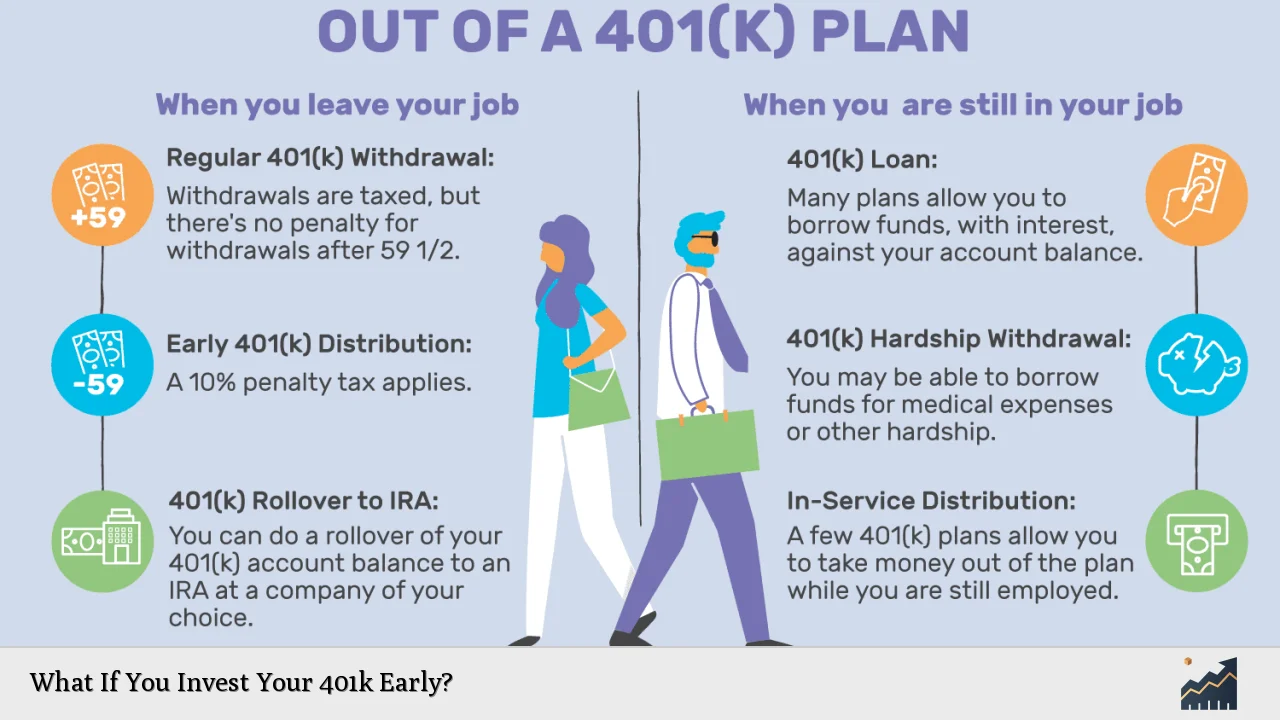

Before resorting to an early withdrawal from your 401(k), it’s essential to explore other options that might be available. Here are some alternatives:

- 401(k) Loans: Many plans allow participants to borrow against their balance without incurring penalties or taxes as long as the loan is repaid within a specified timeframe. However, if you leave your job before repaying the loan, it may be treated as a distribution and subject to taxes and penalties.

- Hardship Withdrawals: If you face immediate financial needs due to specific circumstances such as medical expenses or tuition payments, some plans allow for hardship withdrawals. While these may avoid the penalty under certain conditions, they still incur regular income taxes.

- Emergency Fund: Building an emergency fund can provide a safety net for unexpected expenses without needing to tap into retirement accounts.

- Personal Loans: Consider taking out a personal loan if you need cash quickly. While this option may involve interest payments, it typically doesn’t carry the same penalties as withdrawing from a retirement account.

Exploring these alternatives can help preserve your retirement savings while addressing immediate financial needs.

Tax Implications of Early Withdrawals

When withdrawing funds early from a traditional 401(k), it’s crucial to understand the tax implications involved. The IRS mandates that any amount withdrawn is considered taxable income and will be taxed at your current income tax rate. In addition, the 10% penalty applies unless you meet specific exceptions outlined earlier.

For example, if you withdraw $10,000 and fall into a 25% tax bracket, you’ll owe $2,500 in federal taxes plus an additional $1,000 penalty for early withdrawal. This means you’ll only receive $6,500 after taxes and penalties are deducted from your initial withdrawal.

It’s essential to factor in these costs when considering whether an early withdrawal is necessary or advisable.

Risks Associated with Early Withdrawals

Taking an early withdrawal from your 401(k) carries several risks beyond just immediate financial penalties:

- Loss of Future Growth: By withdrawing funds now, you’re sacrificing potential future growth that could significantly enhance your retirement savings.

- Increased Tax Burden: Early withdrawals increase your taxable income for the year, which could push you into a higher tax bracket and result in additional taxes owed.

- Impact on Retirement Goals: Regularly tapping into your retirement savings can derail long-term financial goals and leave you unprepared for retirement when the time comes.

Given these risks, it’s generally advisable to consider other options before withdrawing funds from your 401(k).

FAQs About What If You Invest Your 401k Early

- What happens if I withdraw my 401(k) before age 59½?

You will incur a 10% penalty and owe regular income taxes on the amount withdrawn. - Are there exceptions to the early withdrawal penalty?

Yes, exceptions include permanent disability and certain medical expenses. - Can I take a loan from my 401(k)?

Many plans allow loans against your balance without penalties if repaid on time. - What are hardship withdrawals?

Hardship withdrawals are allowed under specific circumstances but still incur regular income taxes. - How does an early withdrawal affect my future retirement savings?

An early withdrawal reduces both your principal balance and potential future growth through compounding.

In conclusion, while withdrawing from your 401(k) early may seem like a viable option during financial emergencies, it’s critical to weigh the consequences carefully. The combination of penalties and lost growth potential can have lasting effects on your financial future. Always consider alternatives first and consult with a financial advisor if you’re unsure about the best course of action regarding your retirement savings.