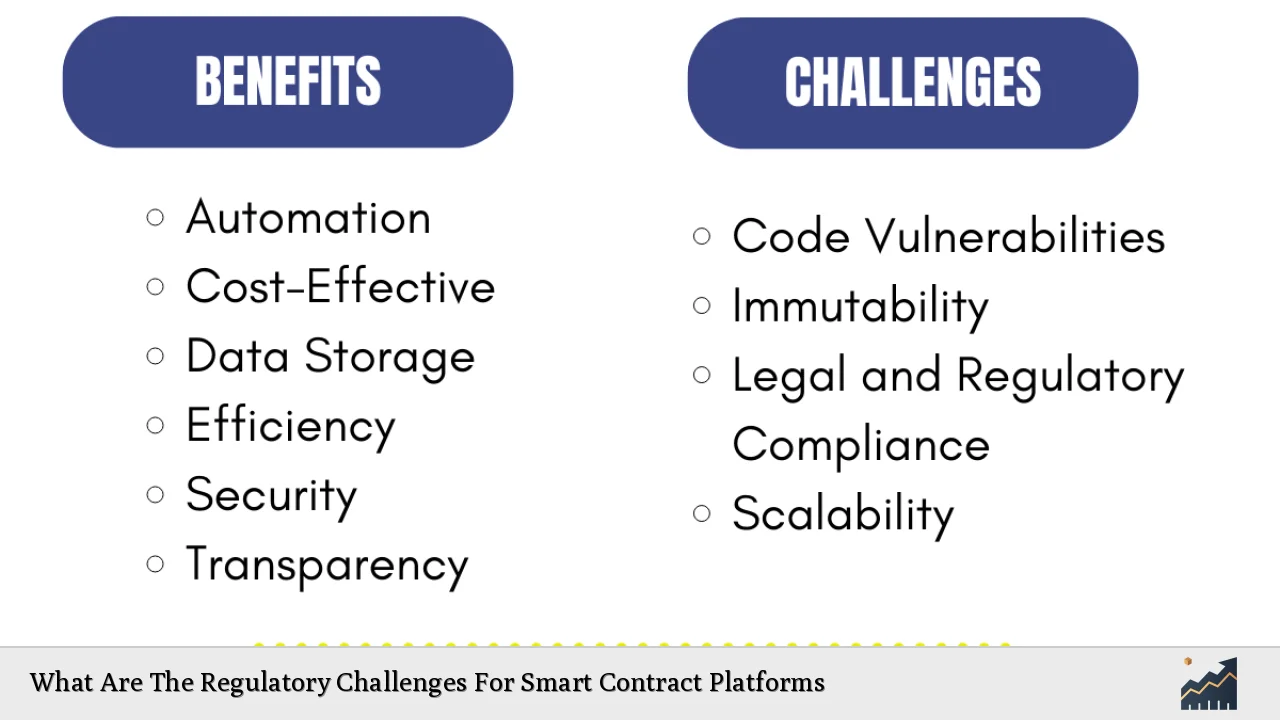

Smart contracts are self-executing agreements where the terms are directly written into code, operating on blockchain technology. They promise to automate and streamline processes across various industries, particularly in finance, supply chain management, and legal services. However, the rapid adoption of smart contracts brings significant regulatory challenges that need to be addressed to ensure their effective implementation and compliance with existing legal frameworks. This article explores these challenges in detail, providing insights into the current market landscape, implementation strategies, risk considerations, regulatory aspects, and future outlook for smart contract platforms.

| Key Concept | Description/Impact |

|---|---|

| Lack of Standardization | The absence of uniform standards for smart contracts leads to interoperability issues and complicates compliance across different jurisdictions. |

| Regulatory Uncertainty | Varying legal recognition of smart contracts across jurisdictions creates uncertainty about their enforceability and compliance requirements. |

| Data Privacy Concerns | Smart contracts operate on transparent ledgers, raising concerns about sensitive data exposure and compliance with data protection regulations. |

| Dispute Resolution Mechanisms | The automated nature of smart contracts complicates traditional dispute resolution methods, necessitating new approaches like oracles or escape hatches. |

| Cross-Border Jurisdictional Issues | The decentralized nature of blockchain complicates legal enforcement across different jurisdictions with varying laws and regulations. |

| Integration with Existing Regulations | Smart contracts must comply with various regulations such as AML and KYC, which require continuous updates to reflect changing laws. |

| Security Risks | Smart contracts are vulnerable to coding errors and cyberattacks, necessitating robust security measures to protect against exploits. |

Market Analysis and Trends

The global market for smart contracts is experiencing rapid growth. According to industry reports, the smart contract market was valued at approximately $1.83 billion in 2023 and is projected to reach $7.78 billion by 2030, growing at a compound annual growth rate (CAGR) of 23% from 2024 to 2030. This growth is driven by increasing adoption in sectors such as banking, financial services, insurance (BFSI), supply chain management, and legal affairs.

Current Market Statistics

- Market Size (2023): $1.83 billion

- Projected Market Size (2030): $7.78 billion

- CAGR (2024-2030): 23%

- Key Sectors: BFSI (34% market share), Supply Chain Management (highest CAGR expected)

The BFSI sector is particularly poised for growth due to the need for automation in processes such as loan origination and insurance claims. The integration of AI with smart contracts is also anticipated to enhance their functionality and compliance capabilities.

Implementation Strategies

To effectively implement smart contracts while navigating regulatory challenges, organizations should consider the following strategies:

- Develop Standardized Protocols: Creating uniform standards for smart contract development can facilitate interoperability and compliance across different platforms.

- Engage with Regulatory Bodies: Collaborating with regulators can help companies understand compliance requirements better and influence the development of supportive regulatory frameworks.

- Utilize Regulatory Sandboxes: These controlled environments allow businesses to test their smart contract solutions under regulatory oversight without facing immediate penalties for non-compliance.

- Incorporate Compliance Mechanisms: Smart contracts should embed necessary compliance checks such as AML and KYC requirements within their code.

Risk Considerations

Implementing smart contracts involves several risks that organizations must manage:

- Security Vulnerabilities: Smart contracts can be susceptible to coding errors or cyberattacks. Historical incidents like The DAO hack highlight the importance of rigorous security audits.

- Legal Risks: The lack of clear legal frameworks can lead to disputes over enforceability. Companies must ensure their smart contracts align with traditional contract law principles.

- Regulatory Compliance Risks: Non-compliance with evolving regulations can result in significant fines or penalties. Continuous monitoring of regulatory changes is essential.

Regulatory Aspects

The regulatory landscape for smart contracts varies significantly across jurisdictions:

- Legal Recognition: Some regions have enacted laws recognizing smart contracts (e.g., Arizona), while others remain ambiguous about their legal status.

- Compliance Requirements: Smart contracts must adhere to existing regulations such as GDPR for data protection, which complicates their design due to the immutable nature of blockchain technology.

- Cross-Border Challenges: The global nature of blockchain complicates jurisdictional enforcement, requiring innovative solutions for cross-border legal agreements.

Future Outlook

As the adoption of smart contracts continues to grow, several trends are likely to shape their future:

- Increased Regulation: Expect more jurisdictions to develop comprehensive regulatory frameworks addressing the unique characteristics of smart contracts.

- Technological Integration: The integration of AI will enhance the capabilities of smart contracts, enabling real-time compliance monitoring and adaptive contract terms.

- Standardization Efforts: Initiatives aimed at developing standardized templates for smart contracts will likely gain traction, simplifying compliance processes.

- Focus on Security Enhancements: With rising cyber threats, there will be a heightened emphasis on security audits and best practices in smart contract development.

Frequently Asked Questions About Regulatory Challenges For Smart Contract Platforms

- What are smart contracts?

Smart contracts are self-executing agreements where the terms are written into code on a blockchain. - Why is regulatory compliance important for smart contracts?

Compliance ensures that smart contracts are legally enforceable and protects parties from potential legal disputes. - What challenges do businesses face when implementing smart contracts?

Lack of standardization, regulatory uncertainty, data privacy concerns, and security risks pose significant challenges. - How can organizations ensure their smart contracts comply with regulations?

By embedding compliance mechanisms within the contract code and staying updated on regulatory changes. - What role do regulatory sandboxes play in smart contract development?

They provide a controlled environment for testing new technologies under regulatory supervision without immediate penalties. - How does jurisdiction impact the enforceability of smart contracts?

The decentralized nature of blockchain can complicate enforcement across different jurisdictions with varying laws. - What future trends should we expect in the regulation of smart contracts?

Increased regulation, technological integration (like AI), standardization efforts, and enhanced security measures are anticipated. - What are the security risks associated with smart contracts?

Coding errors and cyber vulnerabilities can lead to significant financial losses if not properly managed.

In conclusion, while smart contract platforms offer transformative potential across various industries by automating processes and enhancing efficiency, they face considerable regulatory challenges that must be navigated carefully. Addressing these challenges through standardization, collaboration with regulators, and robust security practices will be crucial for maximizing the benefits of this innovative technology while ensuring compliance within a complex legal landscape.