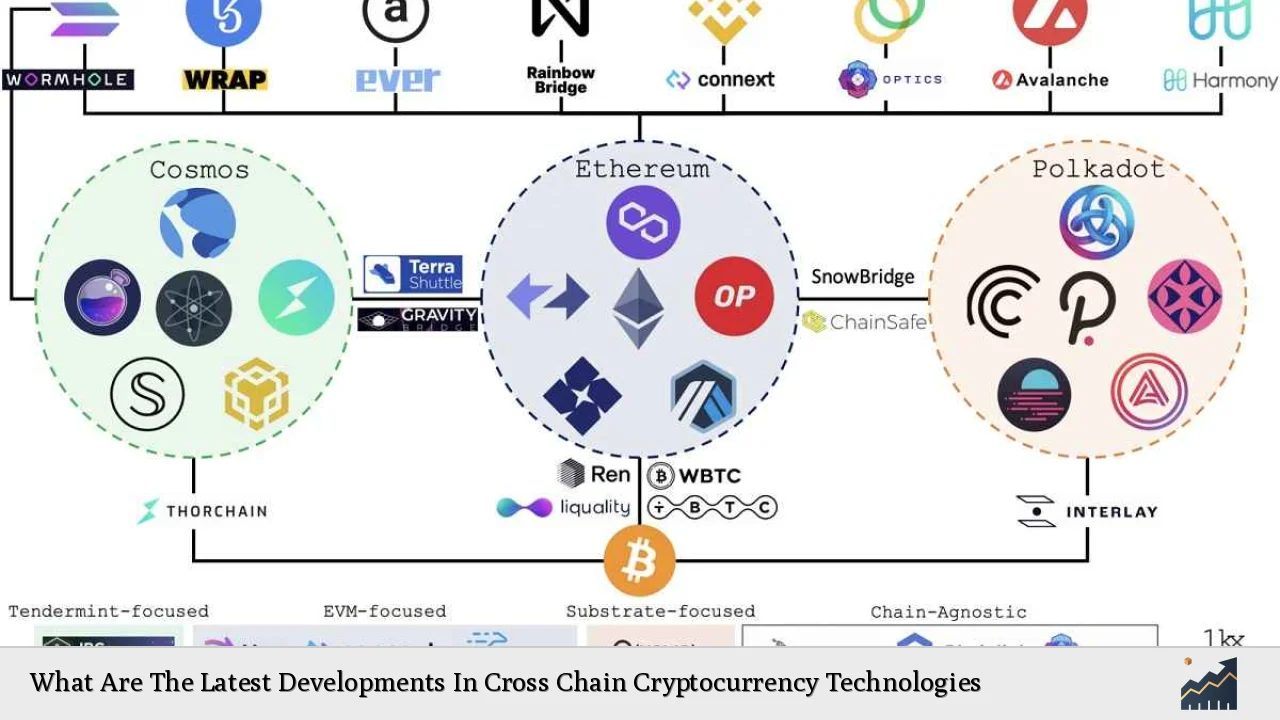

Cross-chain cryptocurrency technologies have emerged as a pivotal development in the blockchain ecosystem, addressing the growing need for interoperability among diverse blockchain networks. As the number of independent blockchains increases, so does the challenge of facilitating seamless interactions and transactions across these platforms. Recent advancements in cross-chain technologies aim to enhance liquidity, reduce transaction costs, and improve user experience, making them essential for the growth of decentralized finance (DeFi) and other blockchain applications.

| Key Concept | Description/Impact |

|---|---|

| Cross-Chain Bridges | Technologies that enable the transfer of assets and data between different blockchain networks, enhancing liquidity and user accessibility. |

| ERC-7683 Standard | A new standard developed by Across and Uniswap Labs aimed at improving cross-chain interactions for decentralized applications (dApps). |

| LayerZero Protocol | An omnichain bridging solution that facilitates communication between multiple blockchains, allowing for efficient dApp development. |

| Inter-Blockchain Communication (IBC) | A protocol used by the Cosmos Network to enable asset transfers and data sharing across compatible blockchains. |

| Market Growth | The blockchain interoperability market is projected to grow at a CAGR of 25.6% from 2024 to 2031 due to increasing demand for cross-chain solutions. |

Market Analysis and Trends

The market for cross-chain technologies is rapidly evolving. As of 2024, the global blockchain interoperability market is valued at approximately $0.7 billion and is expected to expand significantly, with projections indicating a compound annual growth rate (CAGR) of 25.6% through 2031. This growth is driven by the increasing demand for seamless cross-chain transactions and the rise of decentralized finance (DeFi) applications.

Current Market Landscape

- Total Value Locked (TVL) in DeFi: Currently estimated at $42 billion, with a significant portion locked in Ethereum-based projects.

- Cross-Chain Bridge Volume: Circle’s Cross-Chain Transfer Protocol (CCTP) has become a leading bridge by volume due to its integration with major platforms like Solana and MetaMask.

- Emerging Technologies: Projects like LayerZero and the ERC-7683 standard are gaining traction as they simplify cross-chain interactions while enhancing security and efficiency.

Key Players

Several key players are shaping the cross-chain landscape:

- Cosmos Network: Utilizing its IBC protocol, it connects over 50 blockchains, promoting efficient asset transfers.

- Polkadot: Known for its sharded architecture that facilitates communication between multiple chains through its relay chain.

- Wanchain: Focuses on enabling seamless asset transfers across various blockchains, including Bitcoin and Ethereum.

Implementation Strategies

To effectively leverage cross-chain technologies, developers and investors should consider several strategies:

Building Cross-Chain dApps

- Utilize Established Protocols: Leverage existing protocols like IBC or LayerZero to ensure compatibility across different blockchains.

- Focus on User Experience: Simplifying the user interface can help mitigate the complexities associated with cross-chain transactions.

Enhancing Security Measures

Security remains a critical concern in cross-chain operations. Implementing robust security protocols such as multi-signature wallets and continuous auditing can help mitigate risks associated with vulnerabilities in smart contracts.

Collaborating with Other Projects

Strategic partnerships with other blockchain projects can enhance interoperability. For example, integrating with liquidity pools across multiple chains can improve asset availability and transaction speeds.

Risk Considerations

While cross-chain technologies present numerous opportunities, they also come with inherent risks:

Security Vulnerabilities

Cross-chain bridges have been targets for hacks, as evidenced by incidents like the Wormhole exploit. Ensuring robust security measures is crucial to protect assets during transfers.

Regulatory Challenges

Navigating varying regulations across jurisdictions can complicate cross-chain operations. Compliance with local laws is essential to avoid legal repercussions.

Technical Complexities

The lack of standardized protocols can lead to integration challenges between different blockchains. Developers must ensure their solutions are adaptable to various consensus mechanisms and architectures.

Regulatory Aspects

As cross-chain technologies evolve, regulatory scrutiny is increasing:

Compliance Requirements

Regulatory bodies are beginning to establish guidelines for cross-chain operations. Adhering to these regulations will be crucial for projects wishing to operate globally.

Jurisdictional Challenges

Cross-border transactions may involve multiple regulatory frameworks, complicating compliance efforts. Projects must be aware of these complexities when designing their systems.

Future Outlook

The future of cross-chain technologies appears promising:

Continued Market Growth

With a projected CAGR of 25.6%, the demand for cross-chain solutions is expected to rise significantly as DeFi continues to expand.

Technological Innovations

Emerging technologies such as zero-knowledge proofs and layer-2 solutions are likely to enhance the scalability and privacy of cross-chain transactions, further driving adoption.

Increased Adoption Across Sectors

As industries increasingly recognize the benefits of blockchain technology, cross-chain solutions will play a pivotal role in facilitating seamless interactions across diverse applications—from finance to supply chain management.

Frequently Asked Questions About What Are The Latest Developments In Cross Chain Cryptocurrency Technologies

- What is cross-chain technology?

Cross-chain technology refers to methods that allow different blockchain networks to communicate and share data or assets seamlessly. - Why is interoperability important in blockchain?

Interoperability allows for greater liquidity, enhanced user experience, and broader access to decentralized applications across multiple blockchains. - What are some examples of cross-chain protocols?

Examples include LayerZero, Cosmos’ Inter-Blockchain Communication (IBC), Polkadot’s relay chain architecture, and ERC-7683 from Across and Uniswap Labs. - What risks are associated with cross-chain transactions?

Risks include security vulnerabilities in bridges, regulatory compliance challenges, and technical complexities related to integrating different consensus mechanisms. - How is the market for blockchain interoperability expected to grow?

The market is projected to grow at a CAGR of 25.6% from 2024 to 2031 due to increasing demand for seamless asset transfers across various blockchain networks. - What role do decentralized finance (DeFi) applications play in cross-chain technology?

DeFi applications benefit from cross-chain technology by enabling users to access a wider range of financial services across multiple blockchain ecosystems. - How can developers ensure security in cross-chain applications?

Developers can implement multi-signature wallets, conduct regular audits, and utilize established security protocols when building cross-chain solutions. - What future developments can we expect in cross-chain technology?

Future developments may include advancements in layer-2 scaling solutions, enhanced privacy measures through zero-knowledge proofs, and broader adoption across various sectors.

In conclusion, the advancements in cross-chain cryptocurrency technologies represent a significant leap toward creating a more interconnected blockchain ecosystem. As these technologies continue to evolve, they will play an essential role in driving innovation within decentralized finance and beyond. Investors should remain informed about these developments as they navigate this dynamic landscape.