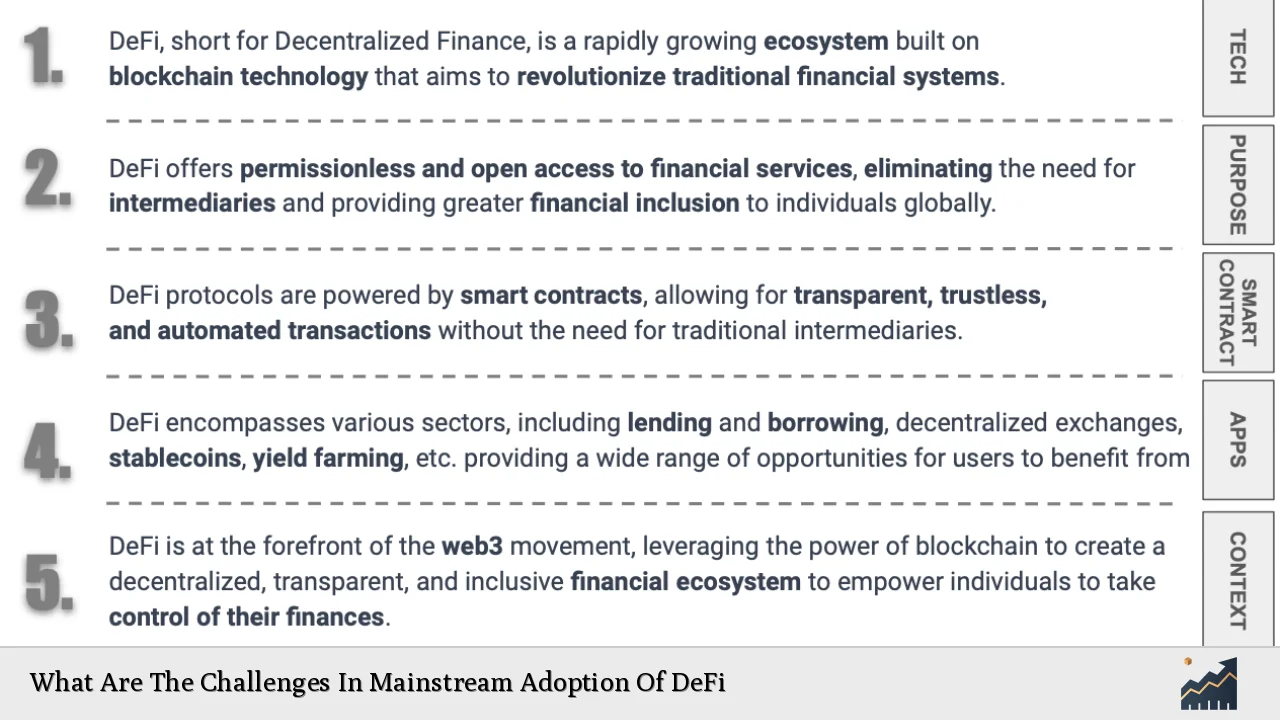

Decentralized Finance (DeFi) represents a transformative shift in the financial landscape, leveraging blockchain technology to eliminate intermediaries and democratize access to financial services. However, despite its potential, DeFi faces significant challenges that hinder its mainstream adoption. These challenges encompass security vulnerabilities, regulatory uncertainties, user experience issues, liquidity problems, and educational barriers. This article delves into these hurdles, providing a comprehensive analysis of the current state of DeFi and its path toward broader acceptance.

| Key Concept | Description/Impact |

|---|---|

| Security Concerns | DeFi platforms are vulnerable to hacks and exploits due to the complexities of smart contracts. The open nature of these systems can lead to significant financial losses, undermining user trust. |

| Regulatory Uncertainty | The lack of clear regulatory frameworks creates hesitance among potential users and investors. This uncertainty complicates compliance for projects operating across different jurisdictions. |

| User Experience Challenges | Many DeFi applications have steep learning curves and complex interfaces, deterring non-technical users from participating in the ecosystem. |

| Liquidity Fragmentation | DeFi suffers from fragmented liquidity across various platforms, making it difficult for users to execute large transactions without impacting market prices. |

| Educational Barriers | A general lack of understanding about DeFi concepts and operations limits user engagement and adoption. |

Market Analysis and Trends

The DeFi market has experienced rapid growth, with the Total Value Locked (TVL) in DeFi protocols reaching approximately $55.95 billion as of January 2024, up from just $9.1 billion in July 2020. This growth reflects a compound annual growth rate (CAGR) of over 10% and indicates a burgeoning interest in decentralized financial solutions. However, despite this growth trajectory, several underlying challenges persist that could impede further adoption.

Current Market Statistics

- Total Value Locked (TVL): $55.95 billion (January 2024)

- Market Size Projection: Expected to reach $46.61 billion by 2024 and grow to $78.47 billion by 2029.

- User Base: Over 85 million blockchain wallet users globally as of January 2024.

These statistics underscore the potential for DeFi but also highlight the need for addressing existing barriers to facilitate wider adoption.

Implementation Strategies

To overcome the challenges faced by DeFi, several strategies can be employed:

- Enhancing Security Protocols: Implementing robust security measures such as regular audits and insurance mechanisms can help build trust among users.

- Developing User-Friendly Interfaces: Simplifying the user experience through intuitive designs can attract a broader audience beyond tech-savvy individuals.

- Creating Clear Regulatory Frameworks: Engaging with regulators to establish clear guidelines can reduce uncertainty and promote institutional involvement.

- Improving Liquidity Solutions: Developing deeper liquidity pools and cross-platform integrations can enhance transaction efficiency and attract larger trades.

Risk Considerations

Investors must be aware of various risks associated with DeFi:

- Market Volatility: The cryptocurrency market is known for its volatility, which can significantly affect DeFi protocols.

- Smart Contract Vulnerabilities: Bugs or exploits in smart contracts can lead to substantial financial losses.

- Regulatory Risks: Changes in regulatory landscapes can impact the operational viability of DeFi projects.

Mitigating these risks requires comprehensive risk management strategies that include diversification, thorough research, and possibly seeking professional advice.

Regulatory Aspects

The regulatory landscape surrounding DeFi is complex and varies significantly across jurisdictions:

- Global Variability: Countries like Switzerland and Singapore have embraced clearer regulatory frameworks for crypto assets, while others remain cautious or restrictive.

- Compliance Challenges: The decentralized nature of DeFi complicates compliance with existing financial regulations such as Know Your Customer (KYC) and Anti-Money Laundering (AML) laws.

Establishing a balance between fostering innovation and ensuring consumer protection is crucial for the sustainable growth of DeFi.

Future Outlook

The future of DeFi hinges on its ability to address existing challenges effectively:

- Technological Innovations: Advances in blockchain technology, such as Layer 2 solutions, promise to enhance scalability and reduce transaction costs.

- Increased Institutional Participation: As regulatory clarity improves, institutional investors may begin to engage more actively with DeFi platforms.

- Growing User Awareness: Educational initiatives aimed at demystifying DeFi concepts could increase user participation.

Overall, while the path to mainstream adoption is fraught with challenges, ongoing developments in technology, regulation, and user education could pave the way for a more integrated financial ecosystem.

Frequently Asked Questions About Challenges In Mainstream Adoption Of DeFi

- What are the main security concerns in DeFi?

DeFi platforms are prone to hacks due to vulnerabilities in smart contracts. These security issues can lead to significant financial losses for users. - How does regulatory uncertainty affect DeFi?

The lack of clear regulations creates hesitance among users and investors, complicating compliance for projects operating across different jurisdictions. - Why is user experience important for DeFi?

A user-friendly interface is essential for attracting non-technical users who may find current platforms too complex or intimidating. - What is liquidity fragmentation?

Liquidity fragmentation refers to the distribution of liquidity across multiple platforms in DeFi, which makes executing large transactions challenging without affecting market prices. - How can educational initiatives help with DeFi adoption?

Educating potential users about how DeFi works can reduce misconceptions and encourage participation from a broader audience. - What role do institutional investors play in DeFi?

Institutional investors can bring significant capital into the DeFi space but require robust security measures and regulatory clarity before fully engaging. - What are some strategies to mitigate risks in DeFi?

Diversification, thorough research on protocols before investing, and using insurance products where available can help mitigate risks associated with DeFi investments. - How does market volatility impact DeFi?

The inherent volatility of cryptocurrencies affects the stability of DeFi protocols, influencing user confidence and investment levels.

In conclusion, while Decentralized Finance holds immense promise for reshaping financial services globally, overcoming its current challenges will be critical for achieving widespread acceptance. By addressing security concerns, enhancing user experience, clarifying regulatory frameworks, improving liquidity solutions, and increasing educational efforts, the path toward mainstream adoption can be significantly advanced.