Conflux Network, a high-performance blockchain platform, has emerged as a notable player in the cryptocurrency space, particularly due to its unique Tree-Graph architecture that aims to enhance scalability, security, and decentralization. However, despite its innovative approach and potential, Conflux faces several significant challenges that could impact its growth and adoption in the competitive blockchain landscape. This analysis delves into these challenges, providing insights into the current market dynamics and future outlook for Conflux Network.

| Key Concept | Description/Impact |

|---|---|

| Blockchain Trilemma | The challenge of balancing security, scalability, and decentralization is central to Conflux's development strategy. While it aims to optimize these three aspects, achieving this balance remains a complex task. |

| Regulatory Environment | Conflux operates within the evolving regulatory landscape of China, where compliance with government policies is crucial for its survival and growth. Any adverse regulatory changes could hinder its operations. |

| Market Competition | The blockchain space is highly competitive, with numerous platforms vying for dominance. Conflux must differentiate itself from established players like Ethereum and newer entrants that offer similar functionalities. |

| Technological Adoption | Despite its technical advantages, gaining widespread adoption among developers and businesses remains a challenge. The success of Conflux depends on the ecosystem's growth and the number of decentralized applications (dApps) built on its platform. |

| Market Volatility | The cryptocurrency market is notoriously volatile. Fluctuations in market sentiment can affect investor confidence in Conflux and its native token, CFX, impacting funding and project development. |

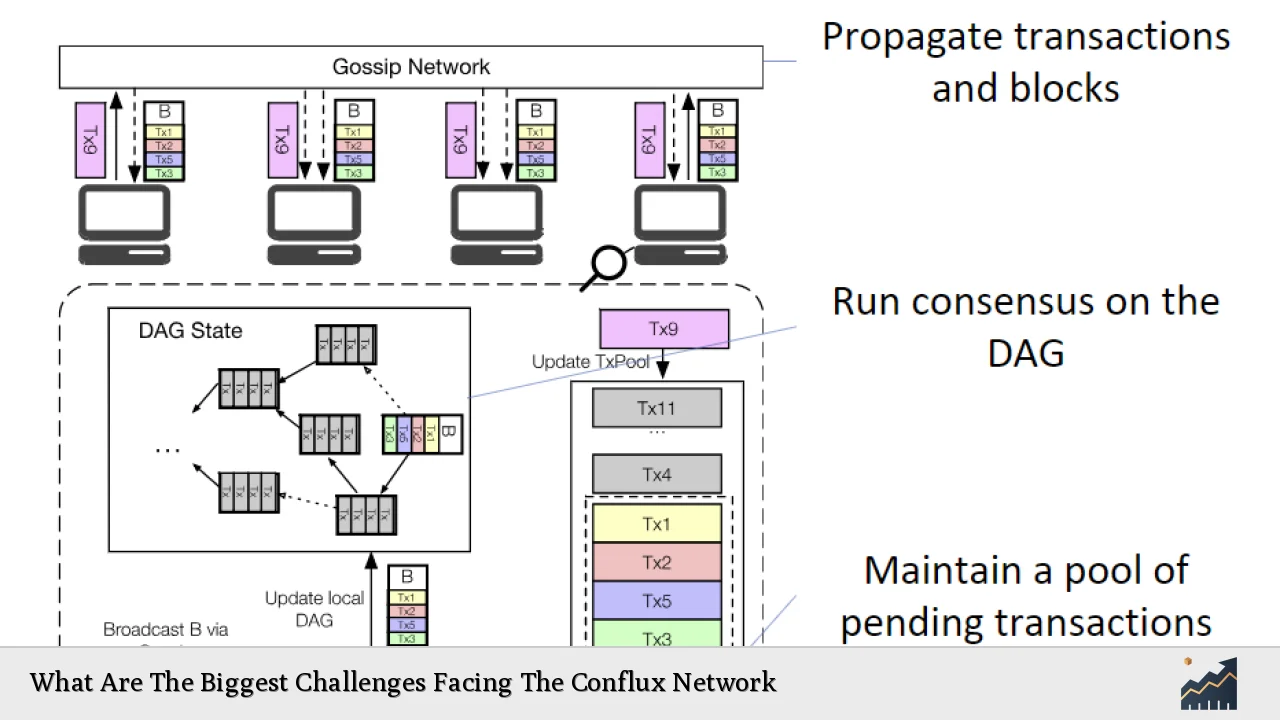

| Scalability Issues | While Conflux's Tree-Graph architecture aims to enhance scalability, it still faces challenges related to transaction speeds and network reliability under heavy loads. |

| User Education | As a relatively new technology, educating potential users about the benefits and functionalities of Conflux is essential for driving adoption. Misunderstandings about blockchain technology can impede user engagement. |

Market Analysis and Trends

The cryptocurrency market has seen significant fluctuations in recent months, driven by macroeconomic factors such as inflation rates, interest rate changes by central banks, and geopolitical tensions. In 2024, the market capitalization of cryptocurrencies is projected to exceed $1 trillion again as investor sentiment begins to recover following a bearish phase.

Conflux Network has positioned itself strategically within this landscape by focusing on partnerships that enhance its visibility and use cases. For instance:

- Partnerships: Collaborations with entities like WSPN aim to integrate stablecoins into the Conflux ecosystem, enhancing liquidity and usability.

- Regulatory Compliance: As China continues to embrace blockchain technology within regulatory frameworks, Conflux's compliance status could attract institutional investments.

Current statistics indicate that Conflux has a market cap of approximately $965 million with a trading volume of around $123 million over 24 hours. The token's price has shown resilience but remains susceptible to broader market trends.

Implementation Strategies

To address these challenges effectively, Conflux Network can adopt several strategic initiatives:

- Strengthening Regulatory Compliance: Engaging with regulators proactively could help mitigate risks associated with sudden policy changes. Building strong relationships with governmental bodies will be crucial.

- Enhancing Developer Engagement: By offering incentives for developers to create dApps on its platform—such as grants or technical support—Conflux can foster a vibrant ecosystem that attracts more users.

- Marketing and Education: Increased efforts in marketing campaigns aimed at educating potential users about the benefits of using Conflux will be essential. This could include webinars, tutorials, and community engagement initiatives.

- Technological Upgrades: Continuous improvement of the Tree-Graph architecture to ensure it can handle increased transaction loads without compromising speed or reliability will be vital for maintaining user satisfaction.

Risk Considerations

Investing in blockchain technologies like Conflux involves inherent risks:

- Regulatory Risks: Changes in regulations can significantly impact operations. Investors should stay informed about potential legal hurdles that may arise.

- Market Risks: The volatility of cryptocurrencies means that investments can fluctuate widely in short periods. This unpredictability can deter potential investors.

- Technological Risks: As with any technology platform, there are risks associated with bugs or vulnerabilities that could be exploited by malicious actors.

- Adoption Risks: If developers do not adopt the platform as anticipated, it could lead to lower than expected growth rates for the network.

Regulatory Aspects

The regulatory environment surrounding cryptocurrencies is evolving rapidly. In China, where Conflux is based, the government has shown interest in blockchain technology but maintains strict control over cryptocurrency transactions.

Conflux must navigate these regulations carefully:

- Compliance Frameworks: Establishing robust compliance frameworks will be crucial for operating within legal parameters while fostering innovation.

- Engagement with Authorities: Active participation in discussions regarding blockchain regulation can help shape favorable policies that support growth.

Future Outlook

Looking ahead, the future of Conflux Network appears cautiously optimistic if it can successfully address its challenges:

- Market Positioning: As one of the few compliant blockchain platforms in China, it holds a unique position that could be leveraged for growth as regulations become clearer.

- Technological Advancements: Continued innovation within its consensus mechanism may attract more users seeking scalable solutions.

- Ecosystem Growth: If successful in fostering a robust ecosystem of dApps and partnerships, Conflux could see significant increases in user engagement and investment.

In summary, while Conflux Network faces substantial challenges ranging from regulatory hurdles to market competition, strategic implementation of solutions focused on compliance, education, and technological enhancement may pave the way for its success in the evolving blockchain landscape.

Frequently Asked Questions About What Are The Biggest Challenges Facing The Conflux Network

- What is the primary challenge facing Conflux Network?

The primary challenge is balancing security, scalability, and decentralization—a concept known as the blockchain trilemma. - How does regulation affect Conflux Network?

Regulations in China are crucial; any adverse changes could significantly impact operations and investor confidence. - What strategies can Conflux use to improve adoption?

Conflux should focus on developer incentives, marketing efforts to educate users about its benefits, and strengthening partnerships. - What are the risks associated with investing in Conflux?

The main risks include regulatory changes, market volatility, technological vulnerabilities, and adoption rates. - How does competition impact Conflux Network?

The competitive landscape requires Conflux to differentiate itself from other blockchains like Ethereum while continually innovating. - What role does technology play in overcoming challenges?

Technological advancements are critical for improving transaction speeds and network reliability under heavy loads. - What is the future outlook for Conflux Network?

If it addresses current challenges effectively through strategic initiatives, it may see significant growth due to its unique positioning in China. - How important is user education for Conflux?

User education is vital for driving adoption; misunderstandings about blockchain can impede engagement.

This comprehensive analysis highlights both the challenges facing the Conflux Network and potential strategies for overcoming them while providing insights into market dynamics that influence its future trajectory.