Fundraising for a GameFi project, which integrates gaming with decentralized finance, requires a nuanced understanding of both the gaming industry and the blockchain ecosystem. The landscape has evolved significantly, with many projects facing challenges in sustainability and investor confidence. This guide aims to provide a comprehensive approach to fundraising for GameFi projects, covering market trends, strategies, risk considerations, regulatory aspects, and future outlook.

| Key Concept | Description/Impact |

|---|---|

| Initial Game Offerings (IGOs) | Emerging fundraising method tailored for gaming projects, allowing developers to raise capital through token sales specifically designed for gamers. |

| Community Engagement | Building a loyal player base is crucial; active communities can drive project visibility and investor interest. |

| Sustainable Tokenomics | A well-structured economic model is essential to maintain the value of in-game currencies and assets. |

| Market Trends | The GameFi market is expected to grow significantly, with projections indicating a compound annual growth rate (CAGR) of 29.5% from 2024 to 2031. |

| Investment Risks | High failure rates in the sector necessitate careful evaluation of potential projects and investment strategies. |

Market Analysis and Trends

The GameFi market has seen dramatic fluctuations over recent years. In 2024, the global GameFi market size is estimated at approximately USD 19.58 billion, with projections indicating it could reach USD 119.62 billion by 2031, growing at a CAGR of 29.5% during this period. This growth is driven by the increasing adoption of play-to-earn models that allow players to earn cryptocurrencies and NFTs through gameplay.

However, the sector faces significant challenges. Reports indicate that around 93% of GameFi projects have failed, often within just four months of launch. This high failure rate highlights the volatility and speculative nature of investments in this space. Despite these setbacks, there remains a strong interest in high-potential projects, evidenced by a 44% increase in fundraising rounds compared to the previous year.

Implementation Strategies

To successfully approach fundraising for a GameFi project, consider the following strategies:

- Develop a Compelling Game Concept: The foundation of any successful GameFi project lies in creating an engaging game that resonates with players. Focus on unique gameplay mechanics and rewarding experiences that encourage player retention.

- Utilize Initial Game Offerings (IGOs): IGOs have emerged as a popular method for raising funds specifically for gaming projects. These offerings allow developers to sell tokens directly to players and investors before the game's launch.

- Engage Your Community: Building an active community around your game can significantly enhance your fundraising efforts. Use social media platforms, forums, and Discord channels to engage potential players and investors. Consider offering exclusive rewards for early supporters.

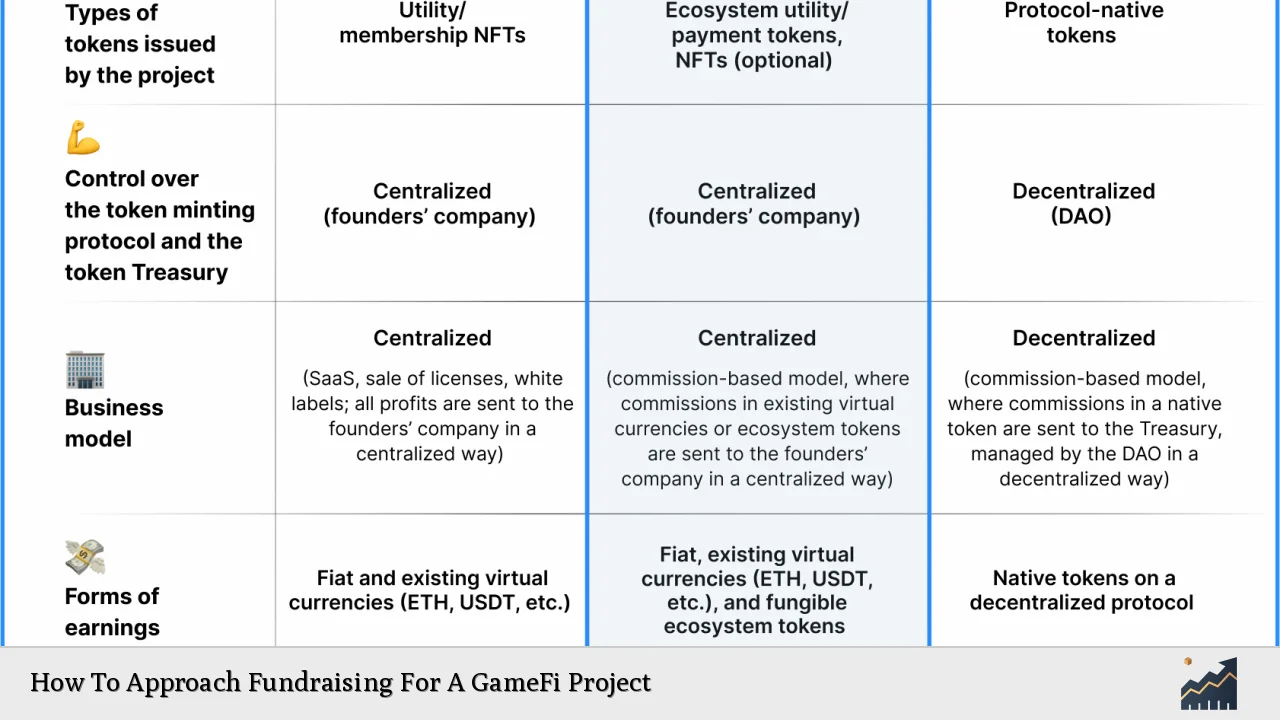

- Implement Sustainable Tokenomics: Design your game's economic model to ensure that in-game currencies maintain their value over time. This may include dual-token systems where one token is used for governance and another for transactions within the game.

- Create a Clear Roadmap: Present a detailed roadmap outlining key milestones and future developments. Transparency about your project's direction can build trust with investors.

Risk Considerations

Investing in GameFi projects carries inherent risks due to the high failure rates observed in the sector:

- Market Volatility: The prices of tokens associated with failed projects often drop dramatically—averaging a decline of 95% from all-time highs.

- Investor Sentiment: Many investors are becoming more cautious due to past failures, leading them to adopt a more selective approach when considering new investments.

- Regulatory Risks: As the GameFi sector grows, so does scrutiny from regulatory bodies. Projects must ensure compliance with local laws regarding cryptocurrency transactions and gaming regulations.

Regulatory Aspects

Navigating regulatory requirements is crucial for any GameFi project:

- Licensing Requirements: Depending on your project's structure, you may need specific licenses related to cryptocurrency transactions or gaming operations. Engaging legal experts can help clarify these needs.

- Anti-Money Laundering (AML) Compliance: Projects that involve fiat currencies must implement AML procedures to prevent illicit activities. This includes Know Your Customer (KYC) processes for participants involved in financial transactions.

- Due Diligence Processes: Regulatory bodies may require thorough due diligence checks before approving fundraising activities. This ensures that all participants are verified and compliant with legal standards.

Future Outlook

The future of fundraising in the GameFi sector appears cautiously optimistic despite current challenges:

- Continued Growth Potential: The overall market is expected to grow robustly as more players engage with blockchain-based games. The increasing acceptance of cryptocurrencies as legitimate payment methods will likely drive participation further.

- Selective Investment Strategies: Investors are likely to focus on projects demonstrating strong fundamentals and community engagement rather than speculative ventures.

- Technological Advancements: Innovations in blockchain technology could lead to new opportunities within the GameFi space, enhancing user experiences and expanding potential revenue streams.

Frequently Asked Questions About How To Approach Fundraising For A GameFi Project

- What are Initial Game Offerings (IGOs)?

IGOs are fundraising events specifically designed for gaming projects where tokens are sold directly to players before the game's launch. - How can I build community engagement?

Create social media channels, host AMAs (Ask Me Anything), and offer exclusive rewards to early supporters. - What are sustainable tokenomics?

Sustainable tokenomics refers to designing an economic model that maintains the value of in-game currencies over time through careful management of supply and demand. - What are the main risks associated with investing in GameFi?

The main risks include market volatility, high failure rates of projects, and regulatory compliance issues. - How important is regulatory compliance?

Regulatory compliance is crucial as it ensures your project operates legally and avoids potential legal issues down the line. - What should be included in a project roadmap?

A roadmap should outline key milestones, future developments, and timelines for feature releases or updates. - How can I ensure my project stands out?

Focus on unique gameplay experiences, strong community engagement, and transparent communication about your project's vision. - What trends should I watch in the GameFi market?

Watch for trends related to technological advancements in blockchain gaming, shifts in investor sentiment, and changes in regulatory landscapes.

In conclusion, approaching fundraising for a GameFi project requires a strategic blend of innovative game design, community engagement, sound financial planning, and adherence to regulatory frameworks. By understanding current market dynamics and implementing effective strategies, developers can enhance their chances of success in this rapidly evolving sector.