As the cryptocurrency market continues to evolve, investors are increasingly seeking effective strategies to navigate its complexities. With 2025 on the horizon, understanding the best investment strategies is crucial for maximizing returns while managing risks. This comprehensive guide delves into market analysis and trends, implementation strategies, risk considerations, regulatory aspects, and future outlooks for cryptocurrency investments in 2025.

| Key Concept | Description/Impact |

|---|---|

| Market Maturity | The cryptocurrency market is expected to become more stable and less volatile due to increased institutional adoption and regulatory clarity. |

| Regulatory Frameworks | Anticipated regulations will provide clearer guidelines for cryptocurrency transactions, fostering greater confidence among investors. |

| Technological Advancements | Innovations in blockchain technology, such as Layer-2 solutions and interoperability protocols, will enhance the functionality of cryptocurrencies. |

| Investment Diversification | Diversifying portfolios across various cryptocurrencies can mitigate risks associated with individual asset volatility. |

| Stablecoin Adoption | Increased use of stablecoins is expected, providing a less volatile option for transactions and savings within the crypto ecosystem. |

| Long-term Accumulation Strategies | Investors are likely to adopt dollar-cost averaging and accumulation plans to build positions gradually over time. |

Market Analysis and Trends

The cryptocurrency landscape is undergoing significant transformations that will shape investment strategies in 2025. Key trends include:

- Increased Institutional Adoption: Major financial institutions are integrating cryptocurrencies into their offerings. This trend is expected to continue, with predictions indicating that Bitcoin could reach values between $100,000 and $200,000 by 2025 due to rising demand from institutional investors.

- Regulatory Developments: The anticipated shift in U.S. regulatory policies under a pro-crypto administration may lead to more favorable conditions for cryptocurrency trading and investment. This includes clearer guidelines that could enhance market stability and investor confidence.

- Technological Innovations: Advancements in blockchain technology are paving the way for new applications. For instance, Ethereum’s transition to a proof-of-stake model has made it more efficient and environmentally friendly, likely increasing its adoption rate.

- Stablecoin Growth: With stablecoins expected to double in adoption by 2025, they offer a less volatile alternative for investors looking to engage with cryptocurrencies without exposing themselves to extreme price fluctuations.

Implementation Strategies

To effectively invest in cryptocurrencies in 2025, consider the following strategies:

- Dollar-Cost Averaging (DCA): This strategy involves investing a fixed amount of money at regular intervals regardless of the asset’s price. It helps reduce the impact of volatility by averaging out purchase prices over time.

- Diversification: Spread investments across multiple cryptocurrencies rather than concentrating on a single asset. This approach can help manage risk since different cryptocurrencies may react differently to market conditions.

- Long-Term Holding: Known as “HODLing,” this strategy involves buying cryptocurrencies with strong fundamentals and holding them for an extended period. Assets like Bitcoin and Ethereum are often considered good candidates due to their established market positions.

- Active Trading: For those who prefer a hands-on approach, active trading strategies such as day trading or swing trading can be employed. These require a good understanding of market trends and technical analysis.

- Utilizing Crypto Savings Accounts: Many platforms now offer interest on cryptocurrency holdings. Investors can earn passive income by depositing their assets into these accounts while maintaining exposure to potential price appreciation.

Risk Considerations

Investing in cryptocurrencies carries inherent risks that must be managed effectively:

- Market Volatility: Cryptocurrencies are known for their price volatility. Investors should prepare for significant price swings that can occur within short timeframes.

- Regulatory Risks: Changes in regulations can impact the legality and usability of certain cryptocurrencies. Keeping abreast of regulatory developments is essential for informed decision-making.

- Technological Risks: The rapid pace of technological change means that new innovations can quickly render existing solutions obsolete. Investors should stay informed about emerging technologies that could affect their holdings.

- Security Risks: Cybersecurity remains a critical concern in the crypto space. Utilizing secure wallets (both hot and cold) and practicing good security hygiene can help protect investments from theft or loss.

Regulatory Aspects

The regulatory environment for cryptocurrencies is evolving rapidly:

- U.S. Regulations: With potential changes in leadership and policy direction under a pro-crypto administration, there may be significant shifts toward more favorable regulations that could enhance market legitimacy.

- Global Perspectives: Different countries are approaching cryptocurrency regulation uniquely. Investors should be aware of local regulations affecting their investments, especially if they engage in cross-border transactions.

- Tax Implications: Understanding the tax treatment of cryptocurrency transactions is vital. In many jurisdictions, profits from crypto trading are subject to capital gains tax, which can affect overall returns.

Future Outlook

Looking ahead to 2025, several factors will influence the cryptocurrency market:

- Increased Legitimacy: As more institutional players enter the space and regulations become clearer, cryptocurrencies may gain wider acceptance as legitimate investment assets.

- Technological Integration: The integration of blockchain technology into traditional finance systems could lead to innovative financial products that leverage digital assets.

- Potential Market Corrections: While bullish sentiment prevails, history suggests that corrections are inevitable after periods of rapid growth. Investors should be prepared for potential downturns.

- Emerging Opportunities: New projects and technologies will continue to emerge within the crypto ecosystem. Staying informed about these developments can provide early investment opportunities before they gain mainstream traction.

Frequently Asked Questions About What Are The Best Cryptocurrency Investment Strategies For 2025

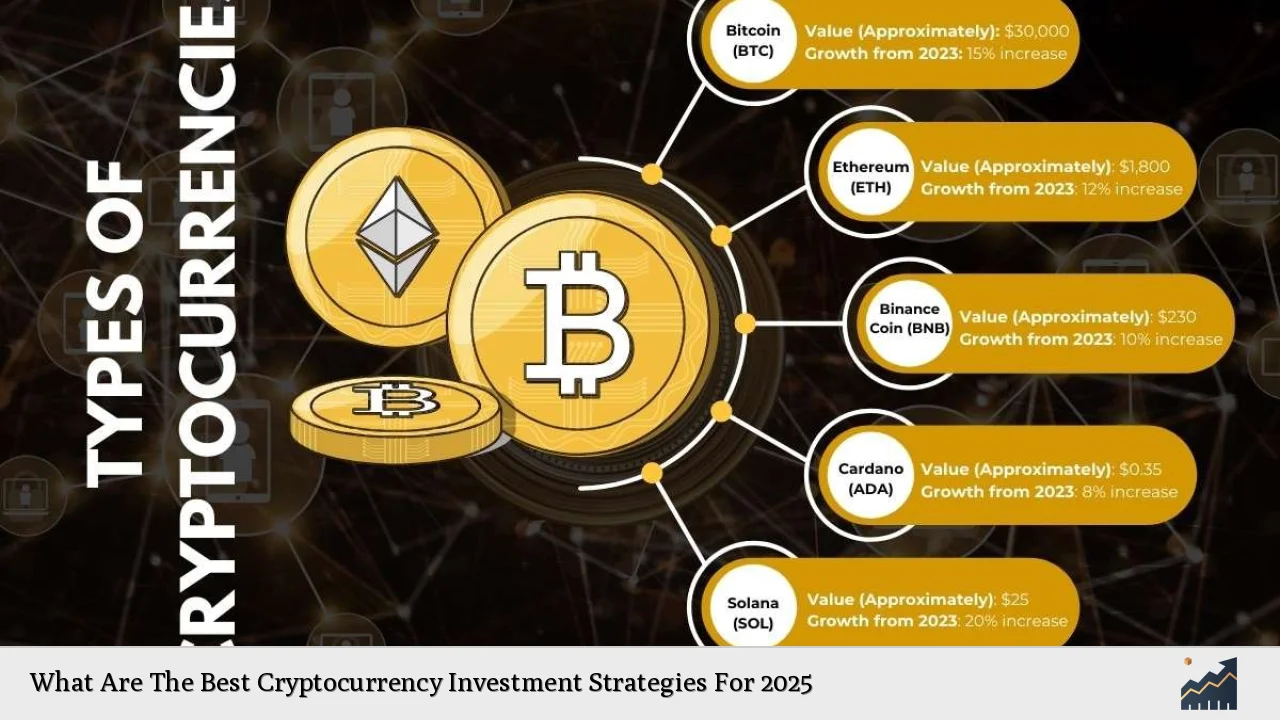

- What are the best cryptocurrencies to invest in for 2025?

Top contenders include Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Cardano (ADA), and XRP due to their strong fundamentals and growth potential. - How can I minimize risks when investing in cryptocurrencies?

Diversifying your portfolio across multiple assets, employing dollar-cost averaging strategies, and staying informed about regulatory changes can help mitigate risks. - Is it too late to invest in cryptocurrencies?

While some assets have seen significant gains already, many experts believe there are still opportunities for growth as adoption increases globally. - What role do regulations play in cryptocurrency investments?

Regulations can significantly impact market stability and investor confidence. Favorable regulations may lead to increased institutional adoption. - How should I choose a cryptocurrency exchange?

Consider factors such as security features, fees, available currencies, user interface, and customer support when selecting an exchange. - What is dollar-cost averaging?

Dollar-cost averaging is an investment strategy where you invest a fixed amount regularly over time regardless of price fluctuations. - Are stablecoins a good investment?

Stablecoins can provide stability during volatile market conditions but typically offer lower returns compared to more volatile assets. - What technological advancements should I watch for?

Keep an eye on developments related to Layer-2 solutions, interoperability protocols, and advancements in decentralized finance (DeFi) applications.

This comprehensive overview provides insights into effective cryptocurrency investment strategies for 2025 while addressing key trends and considerations necessary for informed decision-making.