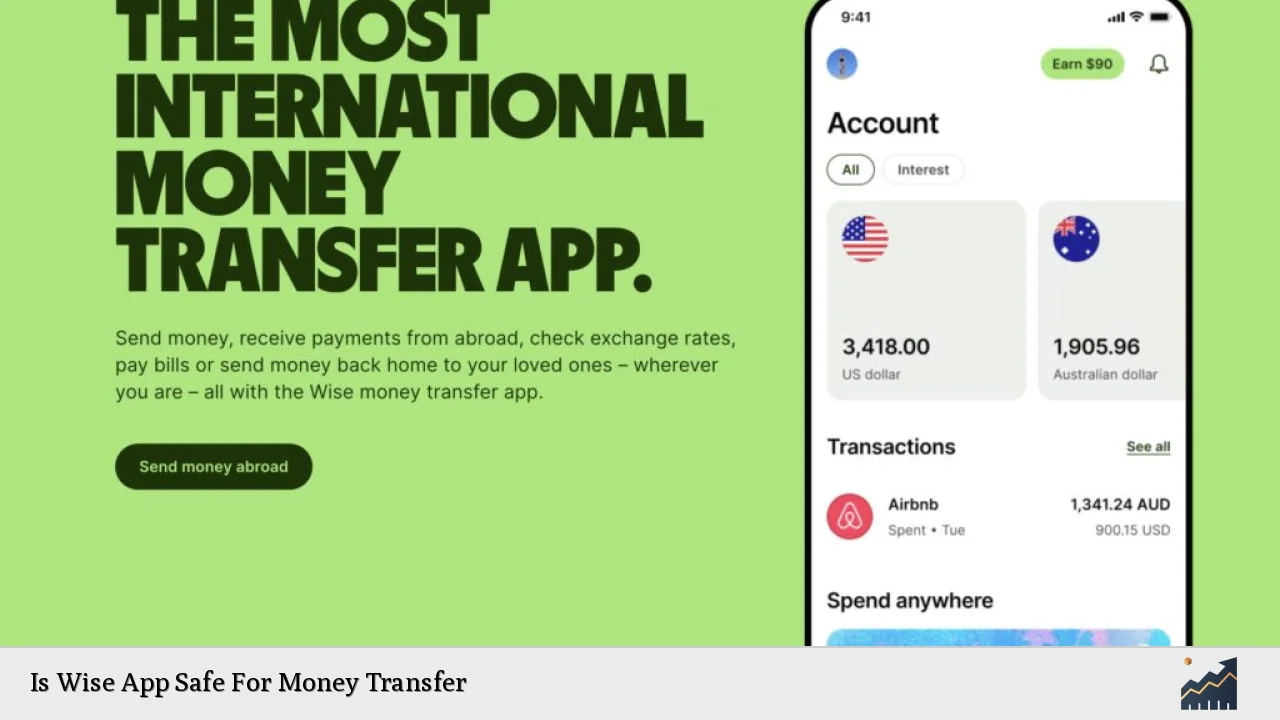

Wise, formerly known as TransferWise, has established itself as a prominent player in the international money transfer market. With over 16 million users and a monthly transaction volume exceeding $10 billion, the platform has garnered significant trust among individuals and businesses alike. However, as with any financial service, potential users often question the safety and security of their funds when using Wise for money transfers. This article delves into the safety features of Wise, market trends, implementation strategies, risk considerations, regulatory aspects, and future outlook.

| Key Concept | Description/Impact |

|---|---|

| Regulatory Compliance | Wise is regulated by multiple authorities globally, including FinCEN in the US and the FCA in the UK, ensuring adherence to strict financial regulations. |

| Security Measures | Wise employs bank-grade security protocols including two-factor authentication (2FA) and HTTPS encryption to protect user data and transactions. |

| Customer Trust | With a Trustpilot rating of 4.5/5 from over 160,000 reviews, Wise demonstrates high customer satisfaction and reliability. |

| Market Growth | The money transfer app market is projected to grow from $20.15 billion in 2024 to $65.38 billion by 2031, indicating increasing reliance on digital transfer services. |

| Fraud Prevention | Wise has an in-house fraud detection team that monitors transactions for suspicious activity, temporarily freezing accounts if necessary to prevent fraud. |

| Customer Support | Wise provides responsive customer service to address issues such as account freezes or transaction inquiries, although some users may prefer more immediate phone support. |

Market Analysis and Trends

The global money transfer app market is experiencing robust growth driven by several factors:

- Increased Smartphone Penetration: The rise in smartphone usage has made digital payments more accessible, particularly among millennials who prefer mobile solutions over traditional banking.

- Cross-Border Transactions: As globalization continues to expand, individuals and businesses increasingly require efficient methods for sending money across borders. Wise's competitive exchange rates and low fees make it an attractive option.

- Regulatory Environment: Compliance with financial regulations is critical for maintaining user trust. Wise's adherence to regulations across various jurisdictions enhances its credibility as a safe transfer option.

- User Experience: The intuitive design of money transfer apps like Wise simplifies the process of sending money internationally, catering to users' needs for convenience and speed.

Recent statistics indicate that Wise saw a 29% year-over-year increase in active customers in Q4 of FY2024, highlighting its growing popularity and user base expansion. Additionally, the company reported a revenue increase of 24%, driven by increased usage of its features beyond basic transfers.

Implementation Strategies

To maximize the benefits of using Wise for money transfers, users should consider the following strategies:

- Utilize Multi-Currency Accounts: Opening a Wise account allows users to hold multiple currencies simultaneously. This feature can help mitigate exchange rate fluctuations when transferring funds internationally.

- Leverage Real-Time Exchange Rates: Wise offers mid-market exchange rates without hidden fees. Users should monitor these rates to optimize their transfers.

- Plan Transfers Ahead of Time: For larger amounts or specific deadlines, planning transfers can help avoid potential delays caused by verification processes or compliance checks.

- Stay Informed About Regulatory Changes: Users should keep abreast of any changes in regulations that might affect their ability to send or receive funds through Wise.

Risk Considerations

While Wise provides a secure platform for money transfers, users should be aware of potential risks:

- Account Freezes: Due to regulatory compliance measures, accounts may be temporarily frozen if unusual activity is detected. This is generally a protective measure but can be inconvenient for users needing immediate access to funds.

- Fraud Risks: As with any online service, there is always a risk of scams or phishing attempts. Users must verify recipient details before completing transactions.

- Regulatory Scrutiny: Recent reports have highlighted regulatory challenges faced by Wise regarding anti-money laundering practices. While the company is actively addressing these issues, they underscore the importance of compliance in maintaining operational integrity.

Regulatory Aspects

Wise operates under stringent regulatory frameworks across various jurisdictions:

- Licensing: The company holds licenses from numerous financial authorities worldwide, including FinCEN in the US and FCA in the UK. This ensures compliance with local laws governing money transfer services.

- Anti-Money Laundering (AML) Compliance: Wise has been subject to scrutiny regarding its AML practices but has implemented remediation plans to address identified gaps. This commitment to compliance helps safeguard user funds and maintain trust.

- Data Protection Regulations: Wise adheres to data protection laws such as GDPR in Europe, ensuring that user information is handled securely and transparently.

Future Outlook

The future for Wise appears promising given current market trends:

- Continued Growth: The global money transfer app market is expected to grow significantly due to increasing demand for digital payment solutions. Wise's innovative features position it well within this expanding market.

- Enhanced Features: As Wise continues to develop its platform, users can expect new functionalities that enhance usability and security. Recent expansions into new markets indicate a strategic focus on growth.

- Increased Competition: While Wise currently enjoys a strong position in the market, competition from other fintech companies could intensify. Maintaining user trust through robust security measures will be crucial for sustaining its customer base.

Frequently Asked Questions About Is Wise App Safe For Money Transfer

- Is my money safe with Wise?

Yes, Wise employs bank-grade security measures including two-factor authentication and encryption to protect your funds. - How does Wise handle large transfers?

Wise can process large transfers up to $1 million per transaction while ensuring compliance with regulatory requirements. - What happens if my account gets frozen?

If your account is frozen due to suspicious activity, you will be notified by Wise's customer service team who will guide you through the verification process. - Are there any hidden fees with Wise?

No, Wise is transparent about its fees and uses mid-market exchange rates without hidden costs. - How does Wise compare to traditional banks?

Wise typically offers lower fees and better exchange rates compared to traditional banks for international transfers. - Can I trust customer reviews about Wise?

The majority of customer reviews are positive; however, it's essential to consider both positive and negative feedback when evaluating any service. - What security measures does Wise implement?

Wise uses two-factor authentication (2FA), encryption protocols, and has an internal fraud detection team monitoring transactions. - Is Wise regulated?

Yes, Wise is regulated by multiple financial authorities globally which helps ensure compliance with safety standards.

In summary, the Wise app provides a secure environment for international money transfers backed by strong regulatory compliance and advanced security measures. While there are inherent risks associated with any financial service, proactive measures taken by Wise enhance user safety significantly. As digital payment solutions continue to evolve, staying informed about best practices will empower users to make safe financial decisions while leveraging modern technology for their monetary needs.