3D Systems Corporation, trading under the ticker symbol DDD, is a prominent player in the additive manufacturing and 3D printing industry. The company has faced significant challenges recently, including a substantial decline in stock price and fluctuating revenue streams. This analysis aims to provide insights into whether DDD stock represents a viable investment opportunity.

The current market conditions for 3D Systems are complex. The stock has experienced a year-to-date decline of approximately 64%, largely due to macroeconomic pressures and reduced demand for hardware. Despite these challenges, there are signs of potential recovery driven by advancements in technology and strategic partnerships. Investors need to weigh the risks against the possible rewards before making any investment decisions.

| Metric | Value |

|---|---|

| Current Price | $3.39 |

| Market Cap | $459.75 million |

| 52-Week Range | $1.72 – $5.88 |

| YTD Change | -64% |

Current Financial Performance

3D Systems’ financial performance has been under scrutiny due to its declining revenues and losses reported in recent quarters. In the second quarter of 2024, the company reported revenues of $113.3 million, which represented an 11.7% decrease year-over-year. This decline can be attributed to reduced printer sales, which have been impacted by economic conditions affecting customer budgets and demand.

Despite these setbacks, there are areas of growth within the company, particularly in its materials and services segments. The orthopedic devices market, which is expected to grow at a CAGR of 11.2% through 2032, presents a significant opportunity for 3D Systems as it continues to innovate in additive manufacturing technologies.

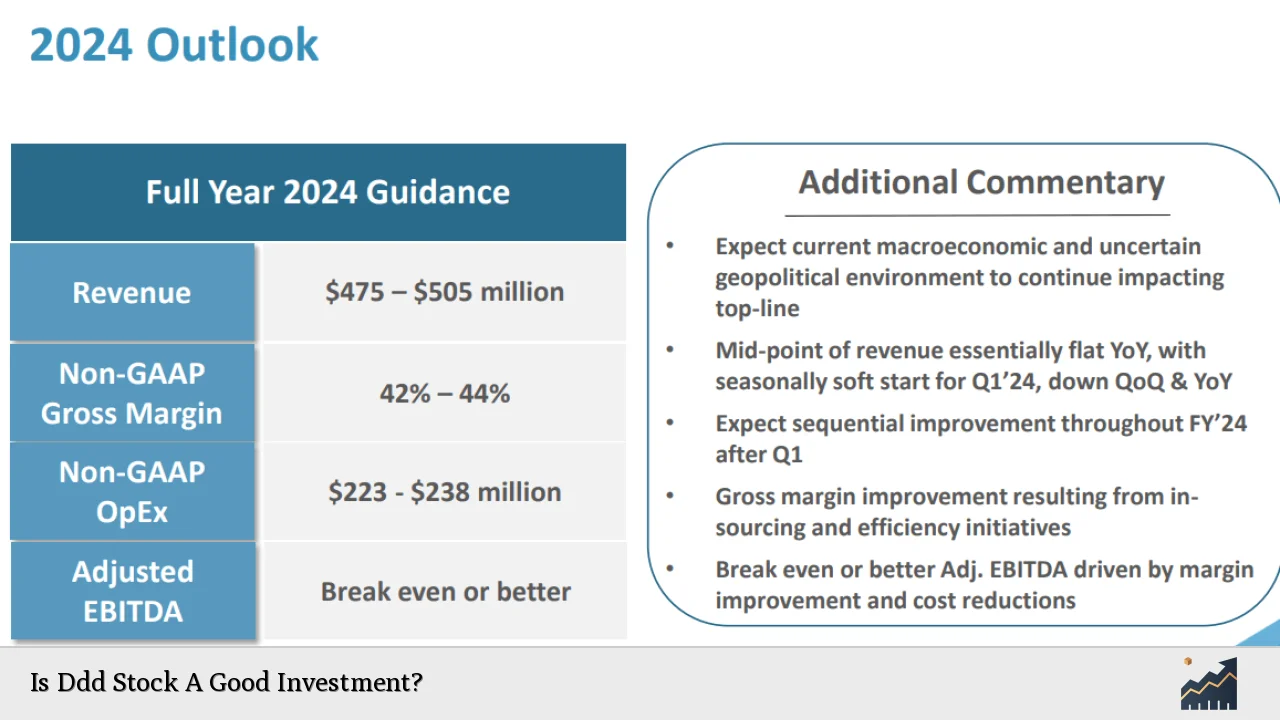

Investors should be aware that while the company’s revenue projections for 2024 indicate a potential decline, with estimates ranging between $450 million and $460 million, there is still optimism regarding its future growth trajectory.

Analyst Ratings and Price Targets

When evaluating DDD stock as an investment, it is essential to consider analyst ratings and price targets. Currently, analysts have provided mixed recommendations for 3D Systems:

- Hold: The consensus rating among analysts is a “Hold,” indicating that investors should maintain their current positions without making new purchases.

- Price Target: The average price target for DDD is approximately $3.94, suggesting a potential upside of about 20% from its current trading price.

Analysts have set a range for DDD’s price targets from a low of $2.00 to a high of $5.75. This variability reflects differing opinions on the company’s recovery potential amidst ongoing economic challenges.

| Price Target Type | Value |

|---|---|

| Average Price Target | $3.94 |

| Highest Price Target | $5.75 |

| Lowest Price Target | $2.00 |

Competitive Landscape

The competitive landscape for 3D Systems is characterized by rapid technological advancements and increasing competition from other companies in the additive manufacturing sector. Major competitors include Stratasys and HP, both of which have made significant strides in developing innovative printing technologies.

3D Systems has responded to this competitive pressure by focusing on enhancing its product offerings and expanding its market reach through strategic partnerships. For instance, collaborations with companies like Precision Resource aim to improve manufacturing capabilities and efficiency.

However, investors should recognize that competition remains fierce, and any delays in product development or market entry could further impact DDD’s market share and profitability.

Risks Associated with Investing in DDD

Investing in DDD stock carries several risks that potential investors must consider:

- Market Volatility: The stock has shown high volatility, with significant fluctuations in price over short periods.

- Economic Conditions: Ongoing economic challenges such as inflation can adversely affect consumer spending and demand for 3D printing products.

- Operational Challenges: The company has faced operational difficulties leading to revenue declines, which could continue if not addressed effectively.

Given these risks, it is crucial for investors to conduct thorough due diligence before committing capital to DDD stock.

Future Outlook

Looking ahead, the future outlook for DDD hinges on several factors:

- Technological Advancements: Continued innovation in additive manufacturing technology could enhance product offerings and attract new customers.

- Market Demand: Recovery in customer demand as economic conditions stabilize may lead to improved sales figures.

- Strategic Partnerships: Collaborations with other firms can bolster operational capabilities and expand market presence.

While there are positive indicators suggesting potential growth, investors should remain cautious given the current economic climate and competitive pressures facing the company.

Conclusion

In conclusion, whether DDD stock represents a good investment depends on individual risk tolerance and investment strategy. With its current low price point potentially offering upside based on analyst projections, some investors may view it as an opportunity for long-term growth.

However, the risks associated with investing in this volatile stock cannot be overlooked. It is advisable for investors to stay informed about market conditions and company performance while considering diversification strategies to mitigate risk exposure.

FAQs About Ddd Stock

- Is DDD stock currently undervalued?

Some analysts suggest that DDD may be undervalued based on its price targets compared to current trading prices. - What are the main risks of investing in DDD?

The main risks include market volatility, economic conditions affecting demand, and operational challenges. - What is the consensus rating for DDD stock?

The consensus rating among analysts is “Hold,” indicating that investors should maintain their current positions. - How much upside potential does DDD have?

The average price target suggests an upside potential of approximately 20% from its current price. - What factors will influence DDD’s future performance?

Technological advancements, market demand recovery, and strategic partnerships will significantly influence future performance.