The iShares U.S. Technology ETF (IYW) is designed to provide investors with exposure to the performance of the technology sector in the U.S. equity market. Launched in May 2000, this exchange-traded fund (ETF) seeks to track the investment results of the Dow Jones U.S. Technology Index. The fund primarily invests in U.S.-based companies involved in information technology, electronics, and computer software and hardware. With a significant allocation to major tech giants like Microsoft and Apple, IYW aims to capitalize on the growth potential of the technology sector.

Investors are increasingly looking at IYW as a potential addition to their portfolios, particularly given the robust performance of technology stocks in recent years. The ETF has gained attention for its impressive historical returns, low expense ratio, and diversified holdings within the tech sector. As we delve deeper into whether IYW is a good investment, we will explore its performance metrics, risk factors, and overall market outlook.

| Feature | Details |

|---|---|

| Launch Date | May 15, 2000 |

| Expense Ratio | 0.40% |

| Top Holdings | Microsoft, Apple, NVIDIA |

| Net Assets | $16.45 billion |

| Dividend Yield | 0.23% |

Performance Overview

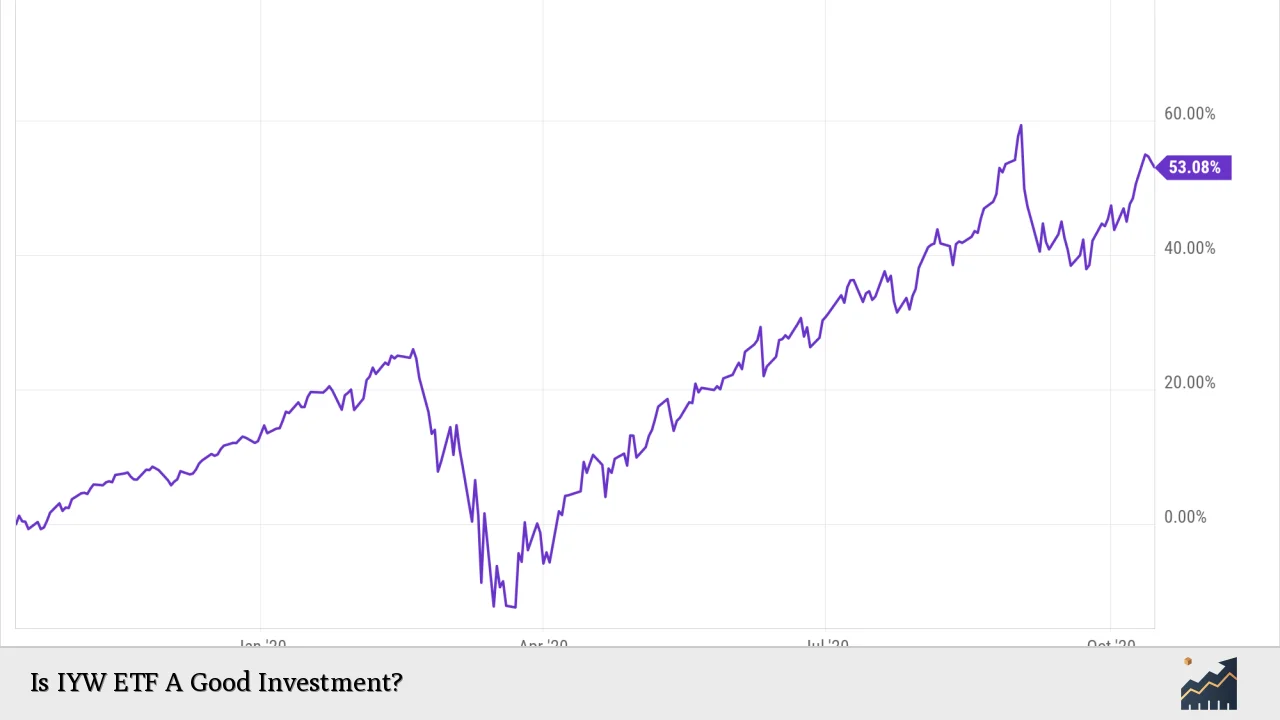

IYW has demonstrated strong performance metrics over various time frames. For instance, it reported a 50% return over the past year, significantly outperforming the S&P 500's 32% return during the same period. This impressive track record can be attributed to the ETF's concentrated holdings in high-growth tech stocks, which have been pivotal in driving market gains.

Over longer periods, IYW has continued to show resilience and growth potential. For example:

- 1-Year Return: Approximately 36%

- 3-Year Annualized Return: About 12.5%

- 5-Year Annualized Return: Roughly 23.9%

- 10-Year Annualized Return: An impressive 20.2%

These figures indicate that IYW has consistently outperformed not only its benchmark index but also many other sector-focused ETFs.

Risk Factors

While IYW presents a compelling investment opportunity, it is essential for investors to consider the associated risks. The ETF is heavily concentrated in a few top holdings, with Microsoft and Apple making up over one-third of its assets. This concentration can lead to increased volatility; if these companies face challenges, it could significantly impact IYW's performance.

Additionally, the technology sector is subject to rapid changes due to innovation cycles and economic conditions. Factors such as regulatory changes, competition from emerging technologies, and shifts in consumer preferences can affect the profitability of tech companies.

IYW has a beta of approximately 1.16, indicating that it is slightly more volatile than the broader market. Investors should be prepared for price fluctuations and potential downturns during market corrections.

Market Outlook

Looking ahead, analysts remain optimistic about IYW's prospects for continued growth in 2024 and beyond. The technology sector is expected to benefit from several macroeconomic trends:

- Earnings Growth: Many tech companies are projected to sustain double-digit revenue and earnings growth driven by advancements in cloud computing, artificial intelligence (AI), and other innovative technologies.

- Economic Stability: A favorable economic environment with potential interest rate cuts could further bolster investor sentiment toward tech stocks.

- Market Trends: As seen in recent years, major tech firms have consistently driven market gains, suggesting that investments in this sector may continue to yield positive returns.

The consensus among analysts is that IYW remains well-positioned to capitalize on these trends due to its strong portfolio of leading tech companies.

Comparison with Other ETFs

When evaluating whether IYW is a good investment choice, it's helpful to compare it with other technology-focused ETFs such as Invesco QQQ Trust (QQQ) and Vanguard Information Technology ETF (VGT). Below is a summary comparison:

| ETF | Expense Ratio |

|---|---|

| IYW | 0.40% |

| QQQ | 0.20% |

| VGT | 0.10% |

While IYW's expense ratio is higher than its competitors', its historical performance justifies this cost for many investors seeking exposure to high-growth technology stocks.

Investment Strategy

Investing in IYW can be part of a broader strategy for those looking to gain exposure specifically within the technology sector without having to pick individual stocks. By investing in this ETF, investors can achieve diversification across various tech sub-sectors such as software services, semiconductors, and hardware equipment.

Investors should consider their risk tolerance and investment goals when deciding whether to include IYW in their portfolios. Long-term investors may find that IYW aligns well with their objectives due to its historical performance and growth potential.

Dividends

IYW offers a modest dividend yield of approximately 0.23%, which may appeal to income-seeking investors despite being lower than some other sectors or funds. This yield reflects the income generated from dividends paid by the underlying holdings within the ETF.

While dividends are not the primary focus for many investors in growth-oriented sectors like technology, they can provide some level of income during periods of market volatility.

Conclusion

In conclusion, whether IYW is a good investment largely depends on individual investor circumstances and market outlooks. Its strong historical performance combined with a solid portfolio of leading technology companies makes it an attractive option for those seeking exposure to this dynamic sector.

However, potential investors should remain aware of the risks associated with high concentration and sector volatility. Overall, for those with a long-term investment horizon who believe in the continued growth of technology companies, IYW presents a compelling opportunity worth considering.

FAQs About IYW ETF

- What is IYW ETF?

IYW ETF tracks the Dow Jones U.S. Technology Index and invests primarily in U.S.-based technology companies. - How has IYW performed historically?

IYW has shown impressive returns over various periods, including about 50% over the past year. - What are the main risks associated with investing in IYW?

The primary risks include high concentration in top holdings and volatility inherent within the tech sector. - Is IYW suitable for long-term investment?

Yes, many analysts view IYW as a solid long-term investment due to its strong fundamentals. - What is the expense ratio of IYW?

The expense ratio for IYW is 0.40%, which is higher than some comparable ETFs.