Investing with Vanguard can be a straightforward process, especially for those seeking low-cost investment options and a focus on long-term financial growth. Vanguard is known for its client-owned structure, which means that the funds are owned by the investors themselves rather than outside shareholders. This unique model allows Vanguard to prioritize the interests of its investors, offering a wide range of investment products including mutual funds, exchange-traded funds (ETFs), and retirement accounts.

To begin investing with Vanguard, you need to follow a few essential steps. These include selecting the right type of account, choosing your investment funds, and determining how much money you want to invest. Vanguard provides various account types tailored to different investment goals, such as retirement savings or general investing. Moreover, their extensive selection of funds caters to diverse risk tolerances and investment strategies.

Below is a summary table that outlines key aspects of investing with Vanguard:

| Aspect | Details |

|---|---|

| Ownership Structure | Client-owned, prioritizing investor interests |

| Investment Products | Mutual funds, ETFs, retirement accounts |

| Account Types | Stocks and Shares ISA, Personal Pension, Junior ISA, General Account |

Choosing the Right Account

The first step in investing with Vanguard is to choose the appropriate account for your needs. Vanguard offers several types of accounts:

- Stocks and Shares ISA: A tax-efficient way to invest in stocks and shares.

- Personal Pension: A retirement savings account that provides tax benefits.

- Junior ISA: Designed for saving on behalf of children.

- General Account: A flexible account for various investments without specific tax advantages.

Each account type has its own rules regarding contributions and withdrawals. It is crucial to understand these differences to select the best option that aligns with your financial goals.

When selecting an account, consider factors such as your current financial situation, future goals, and any tax implications associated with each account type. For instance, if you are focused on saving for retirement, a Personal Pension may be more beneficial due to its tax advantages.

Selecting Your Investment Funds

Once you have chosen an account type, the next step is to select the investment funds that suit your investment strategy. Vanguard offers a variety of funds tailored to different risk levels and investment objectives:

- Index Funds: These funds aim to replicate the performance of a specific market index. They are known for their low fees and broad diversification.

- Actively Managed Funds: These funds employ professional managers who actively select investments in an effort to outperform market indices.

- Target-Date Funds: These are designed for investors planning for retirement at a specific date. The asset allocation automatically adjusts as the target date approaches.

When choosing funds, consider your risk tolerance and investment timeline. For example, if you have a higher risk tolerance and a long investment horizon, you might opt for equity-focused index funds. Conversely, if you prefer lower risk, bond funds or balanced funds may be more suitable.

Vanguard also offers tools and resources to help investors assess their risk tolerance and choose appropriate funds based on their financial goals.

Determining Your Investment Amount

After selecting your account type and investment funds, it's time to decide how much money you wish to invest. Vanguard has flexible options for starting investments:

- You can start with a lump sum investment of at least £500.

- Alternatively, you can set up a monthly contribution starting from £100.

It's important to remember that investments can fluctuate in value; thus, you should only invest money that you can afford to leave invested for the long term. Consider establishing an automatic investment plan to make regular contributions easier.

Additionally, if you have existing investments with another provider, you can transfer those assets into your Vanguard account without incurring immediate tax liabilities.

Understanding Fees and Expenses

Investing with Vanguard is often associated with lower fees compared to many other fund providers. However, it's essential to understand the different types of fees that may apply:

- Expense Ratios: This fee is charged annually as a percentage of your total investment in a fund. Lower expense ratios mean more of your money stays invested.

- Transaction Fees: Some transactions may incur fees depending on the fund or account type.

- Advisory Fees: If you choose managed services or advice from Vanguard's advisors, there may be additional fees involved.

Always review the fee structure associated with any fund before investing. Lower costs can significantly impact your overall returns over time.

Monitoring Your Investments

After making your initial investments, it’s crucial to regularly monitor your portfolio's performance. Vanguard provides tools and resources that allow investors to track their investments easily.

Consider the following practices:

- Review your portfolio periodically (e.g., quarterly or annually) to ensure it aligns with your financial goals.

- Rebalance your portfolio as needed if certain investments grow disproportionately compared to others.

- Stay informed about market trends and changes in economic conditions that could affect your investments.

Regular monitoring helps ensure that your investment strategy remains aligned with your objectives and risk tolerance.

Utilizing Vanguard's Resources

Vanguard offers numerous resources designed to assist investors throughout their journey:

- Educational Content: Access articles, videos, and webinars covering various investing topics.

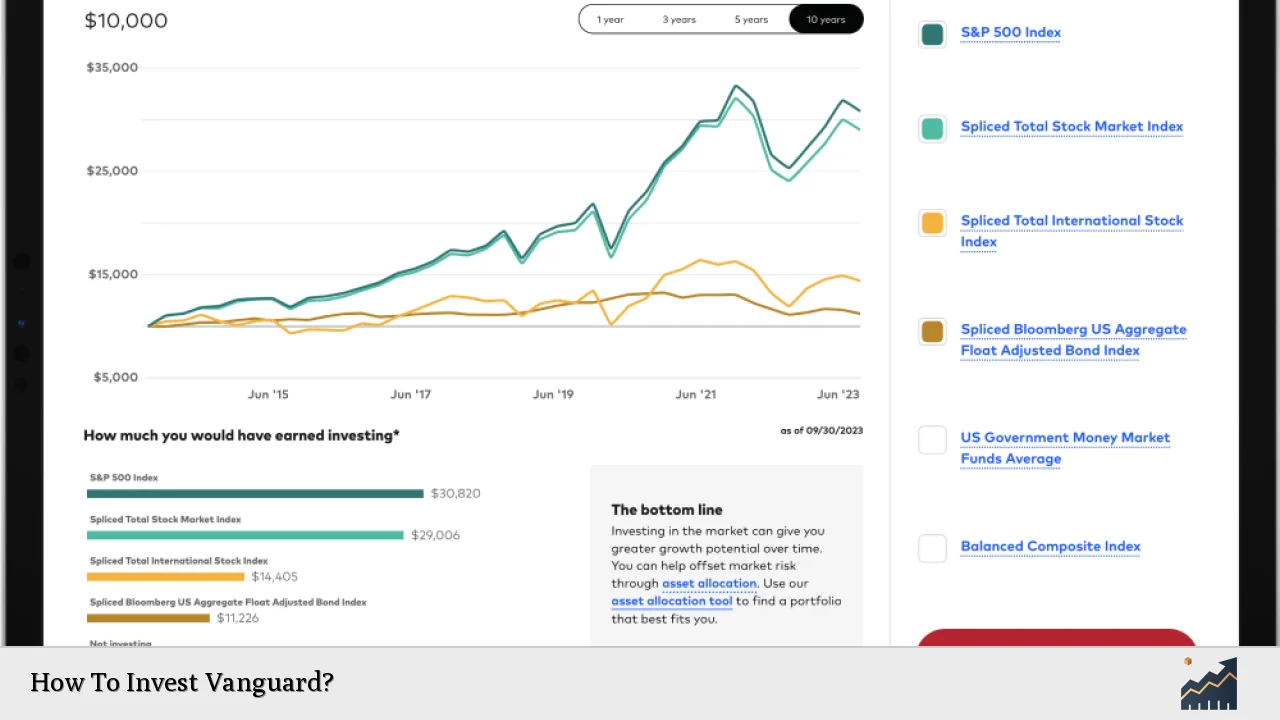

- Investment Tools: Use calculators and planning tools available on their website to help assess potential returns or retirement needs.

- Customer Support: Vanguard provides customer service representatives who can assist with questions regarding accounts or investments.

Leveraging these resources can enhance your understanding of investing and help you make informed decisions.

FAQs About How To Invest Vanguard

- What types of accounts does Vanguard offer?

Vanguard offers Stocks and Shares ISAs, Personal Pensions, Junior ISAs, and General Accounts. - How do I choose which funds to invest in?

Consider your risk tolerance, investment goals, and whether you prefer index or actively managed funds. - What is the minimum amount required to start investing?

You can start investing with a lump sum of £500 or set up monthly contributions from £100. - Are there fees associated with investing at Vanguard?

Yes, there are expense ratios and potential transaction fees; however, they are generally lower than many competitors. - How often should I monitor my investments?

It’s advisable to review your portfolio at least quarterly or annually.

Investing with Vanguard can be an effective way to build wealth over time while benefiting from low costs and high-quality resources. By following these steps—choosing the right account type, selecting suitable funds based on personal goals and risk tolerance, determining how much to invest, understanding fees involved, monitoring investments regularly—you can set yourself up for success in achieving your financial objectives.