Investing in Pokémon can be an intriguing yet complex endeavor, primarily because there isn’t a direct way to buy “Pokémon stock” as the franchise itself is not publicly traded. Instead, investors can gain exposure through companies that hold significant stakes in the Pokémon brand, most notably Nintendo. This guide will delve into the various avenues for investing in Pokémon, including stocks, trading cards, and other collectibles, while providing insights into market trends, strategies, and risks.

| Key Concept | Description/Impact |

|---|---|

| Nintendo’s Stake in Pokémon | Nintendo owns 32% of The Pokémon Company, making its stock (NTDOY) a primary avenue for investors seeking exposure to Pokémon. |

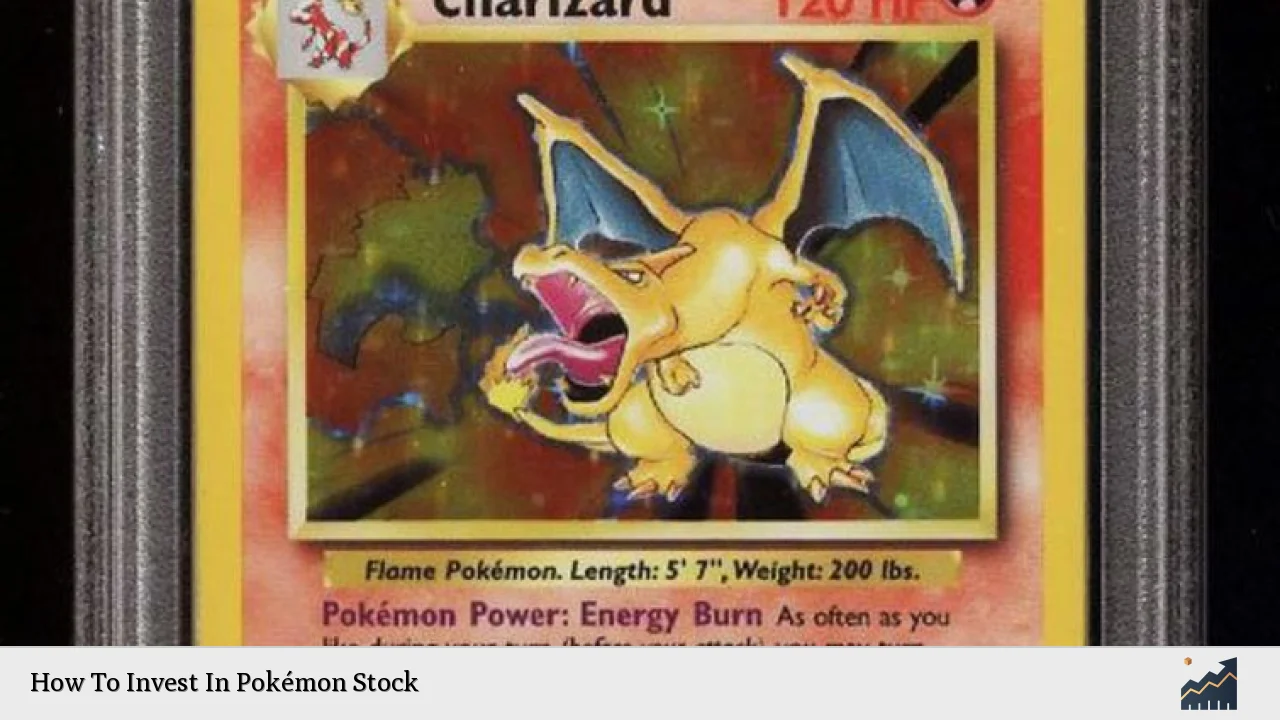

| Pokémon Trading Cards | The trading card market has exploded in popularity, with rare cards fetching high prices and becoming viable investment assets. |

| Market Trends | The trading card market is projected to grow significantly, with Pokémon cards playing a pivotal role in this expansion. |

| Investment Risks | Investing in collectibles like Pokémon cards carries risks such as market volatility and potential for counterfeits. |

| Regulatory Environment | The investment landscape for collectibles is generally less regulated than traditional securities markets. |

| Future Outlook | The demand for Pokémon products continues to rise, suggesting potential growth for investors in this space. |

Market Analysis and Trends

The Pokémon franchise has seen a resurgence over recent years, particularly with the 25th anniversary celebrations and the ongoing popularity of both video games and trading cards. The trading card game (TCG) segment alone has become a significant driver of growth within the broader $21.4 billion trading card industry, which is expected to reach $58.2 billion by 2034 at a compound annual growth rate (CAGR) of 13%.

Key Market Indicators

- Card Sales: In fiscal year 2023-2024, The Pokémon Company reported sales of approximately 11.9 billion cards, marking a substantial increase from previous years.

- Rare Card Values: Certain rare cards have achieved staggering auction prices; for example, a first edition Charizard card sold for $420,000 in 2022. This trend highlights the potential for significant returns on investment.

- Digital Integration: The rise of digital platforms for trading card games has further expanded the market’s reach and accessibility.

Demographic Shifts

The demographic appeal of Pokémon spans multiple generations. Millennials and Gen Z are particularly engaged with nostalgia-driven products like trading cards. This cross-generational interest is fueling both demand and investment opportunities in the collectibles market.

Implementation Strategies

Investors looking to capitalize on the Pokémon phenomenon can consider several strategies:

Stock Investment

- Invest in Nintendo (NTDOY): Since Nintendo holds a significant stake in The Pokémon Company, purchasing shares of Nintendo provides indirect exposure to the Pokémon brand.

- Brokerage Account: To invest in NTDOY, investors need to set up an account with a brokerage that allows over-the-counter (OTC) trading.

Trading Cards

- Research and Education: Understanding card grading (e.g., PSA or BGS), rarity, and market trends is crucial before investing in trading cards.

- Diversification: Just like traditional investing, diversifying your card portfolio across different sets and rarities can mitigate risks.

- Graded Cards: Focus on acquiring graded cards as they tend to have higher resale values and offer protection against counterfeits.

Collectibles Market

- Sealed Products: Investing in sealed booster boxes or elite trainer boxes can be lucrative as these products often appreciate over time.

- Secondary Market Engagement: Participate actively in online marketplaces where high-value cards are bought and sold.

Risk Considerations

Investing in Pokémon-related assets comes with inherent risks:

- Market Volatility: The collectibles market can experience rapid price fluctuations influenced by trends, releases, and economic conditions.

- Counterfeits: The prevalence of counterfeit cards necessitates careful vetting and reliance on professional grading services.

- Liquidity Challenges: While some assets may appreciate significantly, selling them at desired prices can be challenging due to market demand fluctuations.

Regulatory Aspects

The regulatory landscape for investing in collectibles is less stringent compared to traditional securities:

- Securities Regulations: Unlike stocks or bonds that are heavily regulated by bodies like the SEC, collectibles like Pokémon cards are generally viewed as personal property rather than securities.

- Tax Implications: Investors should be aware of potential capital gains taxes when selling collectibles at a profit.

Future Outlook

The future of investing in Pokémon appears promising due to several factors:

- Continued Popularity: The franchise’s enduring appeal ensures ongoing demand for both new products and vintage collectibles.

- Market Expansion: As more demographics engage with Pokémon products—especially through digital platforms—the overall market size is expected to grow.

- Investment Legitimacy: Increasing recognition of trading cards as legitimate investment assets may attract more institutional interest into this space.

Frequently Asked Questions About How To Invest In Pokémon Stock

- Can I buy stock directly in The Pokémon Company?

No, The Pokémon Company is privately held; however, you can invest indirectly through Nintendo. - What is the best way to invest in Pokémon trading cards?

Focus on graded cards from popular sets and diversify your collection while staying informed about market trends. - Are there risks associated with investing in Pokémon?

Yes, risks include market volatility, counterfeit products, and liquidity challenges. - How do I determine the value of my Pokémon cards?

Card value is influenced by rarity, condition (graded vs. ungraded), and current market demand. - Is investing in sealed products worthwhile?

Yes, sealed products often appreciate over time; however, thorough research is necessary before purchasing. - What should I know about grading services?

Grading services evaluate card condition which significantly affects resale value; it’s advisable to use reputable companies like PSA or BGS. - How often do new sets release?

The Pokémon Company regularly releases new sets throughout the year; staying updated on release schedules can help inform investment decisions. - What other companies are involved with Pokémon besides Nintendo?

The other major stakeholders are Creatures Inc. and Game Freak Inc., which also contribute to the development of Pokémon products.

In conclusion, while there is no direct way to invest in “Pokémon stock,” individuals interested in this unique asset class can explore various avenues such as investing in Nintendo shares or engaging actively within the thriving trading card market. With careful research and strategic planning, investors can navigate this exciting landscape successfully.