Investing in Exchange-Traded Funds (ETFs) has become increasingly popular among investors due to their flexibility, low costs, and diversification benefits. ETFs are investment funds that hold a collection of assets, such as stocks, bonds, or commodities, and trade on stock exchanges like individual stocks. This means you can buy and sell shares of an ETF throughout the trading day at market prices. Understanding how to invest in ETFs can help you build a diversified portfolio and achieve your financial goals.

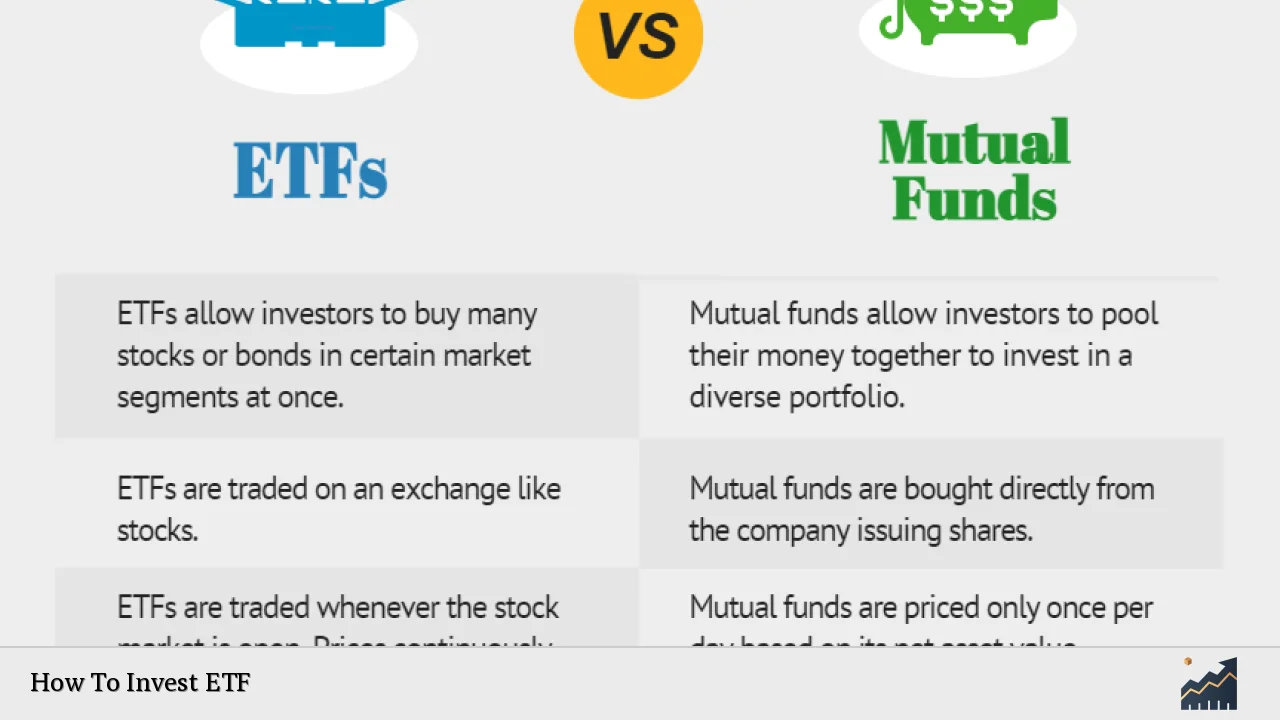

ETFs offer several advantages over traditional mutual funds, including lower fees, tax efficiency, and the ability to trade during market hours. They are designed to track the performance of specific indices or sectors, making them a suitable choice for both novice and experienced investors. In this guide, we will outline the steps to effectively invest in ETFs, from selecting the right ETFs to executing your trades.

| Step | Description |

|---|---|

| 1 | Research and select ETFs that align with your investment goals. |

| 2 | Open a brokerage account to facilitate ETF transactions. |

| 3 | Place your order through the brokerage platform. |

| 4 | Monitor your investments regularly to ensure they meet your objectives. |

Understanding ETFs

ETFs are essentially baskets of securities that allow investors to gain exposure to various asset classes without having to purchase each security individually. They can track indices like the S&P 500 or focus on specific sectors such as technology or healthcare. The primary characteristics of ETFs include:

- Diversification: By investing in an ETF, you gain exposure to a wide range of securities, which helps spread risk.

- Liquidity: ETFs trade on exchanges throughout the day, allowing for quick buying and selling.

- Cost Efficiency: Most ETFs have lower expense ratios compared to mutual funds because they typically follow a passive management strategy.

Investors should be aware that while ETFs offer many benefits, they also come with risks. Market fluctuations can affect the value of an ETF just like individual stocks. Additionally, some ETFs may focus on niche markets or sectors that can be more volatile.

Steps to Invest in ETFs

Research and Select ETFs

The first step in investing in ETFs is conducting thorough research to identify which funds align with your investment objectives. Consider the following factors:

- Investment Goals: Define what you want to achieve with your investments—whether it’s long-term growth, income generation, or capital preservation.

- Underlying Assets: Look into what assets the ETF holds. For example, some may focus on equities, while others may invest in bonds or commodities.

- Expense Ratios: Compare the expense ratios of different ETFs; lower costs can lead to better long-term returns.

- Performance History: Review past performance data but remember that past performance does not guarantee future results.

Choosing the right ETF requires careful consideration of these factors to ensure it fits within your overall investment strategy.

Open a Brokerage Account

To buy and sell ETFs, you need a brokerage account. Here’s how to get started:

- Choose a Brokerage: Select a reputable brokerage firm that offers a user-friendly platform for trading ETFs. Many brokerages now offer commission-free trading for ETFs.

- Account Setup: Complete the application process by providing personal information and financial details. Some brokerages may require a minimum deposit.

- Link Your Bank Account: Ensure your brokerage account is linked to your bank account for easy fund transfers.

Once your account is set up and funded, you can begin investing in ETFs.

Place Your Order

After selecting your desired ETF, follow these steps to place an order:

- Log In: Access your brokerage account online or through their mobile app.

- Find Your ETF: Use the search function to locate the ETF by its ticker symbol.

- Choose Order Type: Decide whether you want to place a market order (buying at current market price) or a limit order (setting a specific price).

- Specify Quantity: Enter how many shares of the ETF you wish to purchase.

- Review Order: Double-check all details before confirming the transaction.

Once submitted, your order will be executed based on current market conditions.

Monitor Your Investments

After investing in ETFs, it’s essential to monitor their performance regularly. Here are some tips for effective monitoring:

- Track Performance: Keep an eye on how your ETFs are performing relative to their benchmarks and other investments.

- Stay Informed: Follow market news and trends that may impact your investments.

- Rebalance Portfolio: Periodically review your portfolio allocation and make adjustments as needed based on changes in market conditions or personal financial goals.

Regular monitoring helps ensure that your investments remain aligned with your objectives.

Benefits of Investing in ETFs

Investing in ETFs comes with several benefits that make them an attractive option for many investors:

- Low Costs: Compared to mutual funds, most ETFs have lower management fees and no sales loads.

- Tax Efficiency: The structure of ETFs allows for fewer taxable events compared to mutual funds, making them more tax-efficient options.

- Flexibility: Investors can buy or sell shares throughout the trading day at real-time prices.

- Variety of Options: With thousands of ETFs available globally, investors can choose from various asset classes and investment strategies tailored to their needs.

These advantages contribute significantly to why many investors choose ETFs as part of their investment strategy.

Risks Associated with ETF Investing

While there are many benefits to investing in ETFs, it is also crucial to understand the associated risks:

- Market Risk: Like all investments tied to market performance, ETFs can experience price volatility based on market conditions.

- Liquidity Risk: Some niche or less popular ETFs may have lower trading volumes, making it harder to buy or sell shares without affecting the price.

- Tracking Error: An ETF may not perfectly replicate the performance of its underlying index due to various factors such as fees or management decisions.

Being aware of these risks allows investors to make informed decisions when incorporating ETFs into their portfolios.

Choosing the Right ETF

When selecting an ETF for investment, consider these critical factors:

Investment Strategy

Identify what type of investment strategy aligns with your financial goals. Common strategies include:

- Index Tracking: Most common type; aims to replicate performance of a specific index.

- Sector-Specific Funds: Focuses on particular sectors like technology or healthcare for targeted exposure.

Fund Size and Age

Evaluate the size (assets under management) and age of an ETF:

- Larger funds often have better liquidity and lower expense ratios due to economies of scale.

- Older funds tend to have more established track records compared to newer entrants.

Performance Metrics

Review key performance metrics such as historical returns, volatility measures (standard deviation), and Sharpe ratios (risk-adjusted returns) when comparing different ETFs.

By carefully considering these factors during selection, investors can choose appropriate funds that align with their objectives and risk tolerance.

FAQs About How To Invest ETF

- What is an ETF?

An Exchange-Traded Fund (ETF) is an investment fund that holds multiple underlying assets and trades on stock exchanges like individual stocks. - How do I buy an ETF?

You need a brokerage account; once set up, you can search for an ETF by its ticker symbol and place an order through the platform. - What are the benefits of investing in ETFs?

ETFs offer low costs, diversification across multiple assets, tax efficiency, and flexibility in trading. - Are there risks associated with investing in ETFs?

Yes, risks include market volatility, liquidity issues for less popular funds, and tracking errors compared to underlying indices. - How do I choose the right ETF?

Consider factors such as investment goals, underlying assets, expense ratios, fund size and age when selecting an ETF.

Investing in ETFs can be a rewarding venture if approached thoughtfully. By understanding how they work and following these steps diligently—researching options carefully before investing—you can build a diversified portfolio that aligns with your financial aspirations.