Investment refers to the allocation of resources, typically money, with the expectation of generating income or profit over time. This practice is fundamental to both individual wealth accumulation and broader economic growth. Investors engage in various types of investments, each with distinct characteristics, risk levels, and potential returns. Understanding what constitutes an investment is crucial for anyone looking to build a financial portfolio or secure their financial future.

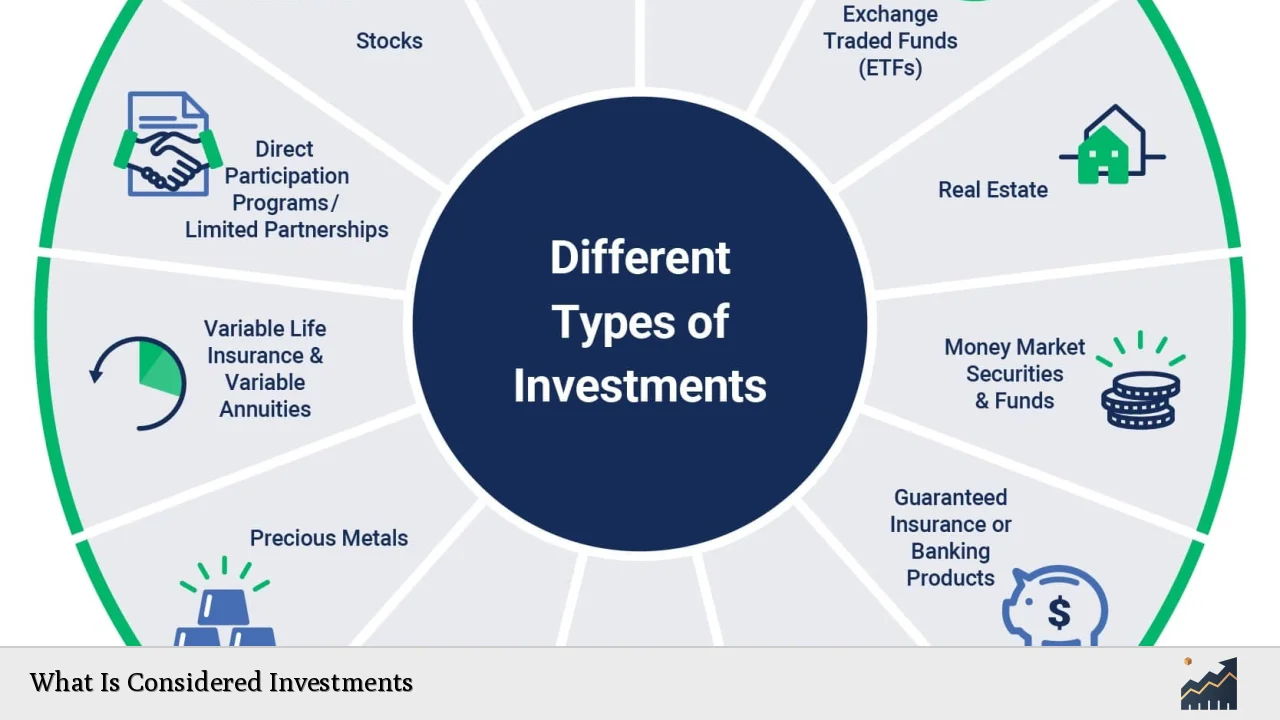

Investments can be classified into several categories based on their nature and purpose. Common types include stocks, bonds, real estate, mutual funds, and alternative investments. Each category serves different investment goals, such as capital appreciation, income generation, or risk management.

When considering investments, it is essential to evaluate factors such as risk tolerance, investment horizon, and financial goals. A well-diversified portfolio typically includes a mix of asset types to balance risk and return effectively.

| Type of Investment | Description |

|---|---|

| Stocks | Equity ownership in a company, offering potential capital gains and dividends. |

| Bonds | Debt securities issued by governments or corporations, providing fixed interest payments. |

| Real Estate | Property investments that can generate rental income and appreciate in value. |

| Mutual Funds | Pooled investment vehicles managed by professionals, offering diversification. |

| Alternative Investments | Non-traditional assets like hedge funds or private equity that may offer higher returns. |

Types of Investments

Investments can be categorized into three primary types: equity, fixed income, and cash equivalents. Each type has unique features and serves different purposes in an investment strategy.

- Equity Investments: This category includes stocks and shares in companies. When you purchase equity, you become a part-owner of the company and can benefit from its growth through capital appreciation and dividends. Stocks are considered higher-risk investments due to market volatility but can yield substantial returns over time.

- Fixed Income Investments: These involve lending money to an entity (government or corporation) in exchange for periodic interest payments plus the return of the principal at maturity. Bonds are the most common fixed-income instruments. They are generally considered safer than stocks but offer lower potential returns.

- Cash Equivalents: These are short-term investments that are easily convertible to cash with minimal risk. Examples include savings accounts, money market accounts, and certificates of deposit (CDs). While they provide liquidity and safety, their returns are typically lower than other investment types.

Factors Influencing Investment Choices

Several factors influence an investor's choice of investment products. Understanding these factors can help investors make informed decisions that align with their financial goals.

- Risk Tolerance: An investor's willingness to accept risk plays a significant role in determining their investment choices. Those with high-risk tolerance may prefer stocks or alternative investments that offer greater potential returns but come with higher volatility.

- Investment Horizon: The length of time an investor plans to hold an investment affects their choices. Long-term investors may opt for equities or real estate for capital growth, while short-term investors might focus on cash equivalents or bonds for stability.

- Financial Goals: Individual financial objectives drive investment decisions. For example, someone saving for retirement may prioritize growth-oriented investments like stocks, while another person seeking immediate income might favor bonds or dividend-paying stocks.

- Market Conditions: Economic factors such as interest rates, inflation, and market trends can influence investment choices. Investors often adjust their portfolios based on current market conditions to optimize returns.

Investment Products

Investment products encompass a wide range of financial instruments designed to meet various investor needs. Understanding these products is essential for effective portfolio management.

- Stocks: Represent ownership in a company; they can provide dividends and capital appreciation.

- Bonds: Debt instruments that pay interest over time; they are generally less risky than stocks.

- Mutual Funds: Pooled investments managed by professionals; they allow investors to diversify without needing extensive knowledge about individual securities.

- Exchange-Traded Funds (ETFs): Similar to mutual funds but traded on stock exchanges; they offer flexibility and lower fees.

- Real Estate Investment Trusts (REITs): Companies that own or finance income-producing real estate; they provide exposure to real estate without direct ownership.

The Importance of Diversification

Diversification is a critical strategy in investing that involves spreading investments across various asset classes to reduce risk. By diversifying a portfolio, investors can mitigate the impact of poor performance in any single investment.

A well-diversified portfolio typically includes:

- A mix of asset classes (stocks, bonds, real estate)

- Investments across different sectors (technology, healthcare, consumer goods)

- Geographic diversification (domestic and international markets)

This approach helps balance potential losses from one area with gains from another, ultimately leading to more stable overall performance.

Common Investment Strategies

Investors employ various strategies based on their goals, risk tolerance, and market conditions. Some common strategies include:

- Buy and Hold: This long-term strategy involves purchasing securities and holding them for an extended period regardless of market fluctuations.

- Value Investing: Investors look for undervalued stocks that have strong fundamentals but are trading below their intrinsic value.

- Growth Investing: This strategy focuses on companies expected to grow at an above-average rate compared to others in the industry.

- Income Investing: Investors seek assets that generate regular income through dividends or interest payments.

Risks Associated with Investing

All investments carry some level of risk. Understanding these risks is essential for making informed decisions:

- Market Risk: The possibility that an investment's value will decline due to market fluctuations.

- Credit Risk: The risk that a bond issuer will default on its payment obligations.

- Liquidity Risk: The risk associated with not being able to sell an investment quickly without incurring significant losses.

- Inflation Risk: The possibility that rising inflation will erode the purchasing power of returns from an investment.

Investors should assess their risk tolerance before making decisions and consider strategies to mitigate these risks effectively.

FAQs About Investments

- What is the definition of an investment?

An investment is the allocation of resources with the expectation of generating income or profit over time. - What are the main types of investments?

The main types include equity (stocks), fixed income (bonds), and cash equivalents. - Why is diversification important?

Diversification reduces risk by spreading investments across various asset classes. - What are common investment strategies?

Common strategies include buy and hold, value investing, growth investing, and income investing. - What risks should investors consider?

Investors should be aware of market risk, credit risk, liquidity risk, and inflation risk.

In conclusion, understanding what constitutes an investment is fundamental for individuals looking to build wealth and secure their financial future. By exploring different types of investments, recognizing influencing factors, employing effective strategies, and acknowledging associated risks, investors can make informed decisions tailored to their unique financial goals.