Money transfers have become an integral part of our increasingly interconnected global economy. Whether you're sending funds to family abroad, paying for international goods and services, or managing business transactions, understanding how to execute a money transfer efficiently and securely is crucial. This comprehensive guide will walk you through the process, highlighting key considerations, methods, and best practices to ensure your funds reach their destination safely and cost-effectively.

| Key Concept | Description/Impact |

|---|---|

| Digital Remittances | Projected to grow at a CAGR of 15.6% from 2023 to 2030, reaching USD 60.05 billion by 2030 |

| Global Average Cost | 6.4% to send $200 internationally in 2024, still above the UN's 3% goal |

| Instant Transfers in EU | New regulations aim for euro transfers to arrive within 10 seconds |

| Mobile Transactions | Increasing smartphone penetration driving growth in mobile-based transfers |

Market Analysis and Trends

The money transfer industry is experiencing rapid growth and transformation, driven by technological advancements and changing consumer preferences. In 2024, the global money transfer services market is expected to reach $36.49 billion, growing at a compound annual growth rate (CAGR) of 16.2% from 2023. This growth is primarily fueled by the increasing adoption of digital and instant payment methods.

Digital Remittances on the Rise

Digital remittances are at the forefront of this growth. The market, valued at USD 21.83 billion in 2023, is projected to expand at a CAGR of 15.6%, potentially reaching USD 60.05 billion by 2030. This surge is attributed to the ongoing digital transformation in the financial sector and the increasing penetration of smartphones globally.

Emerging Markets and Mobile Transactions

Regions like the Asia Pacific are witnessing rapid adoption of mobile banking and cashless payments, offering lucrative opportunities for market players. The convenience and accessibility offered by smartphones are making online money transfers more popular, especially in areas with growing smartphone usage.

Regulatory Changes and Instant Transfers

In February 2024, the European Parliament adopted new regulations aimed at ensuring euro money transfers arrive in bank accounts "within ten seconds" throughout the EU. This move towards instant transfers is part of a broader trend to improve the speed and efficiency of financial transactions.

Implementation Strategies

To execute a money transfer successfully, follow these key steps:

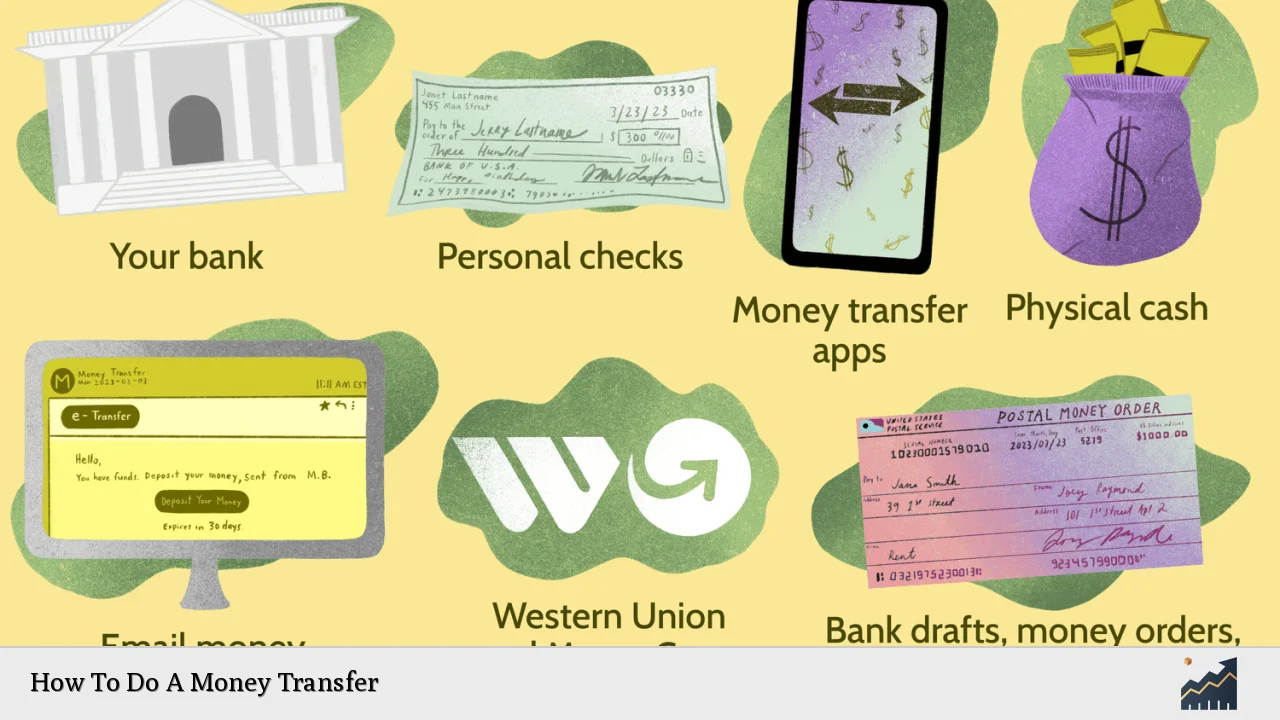

1. Choose the Right Transfer Method

Several options are available for sending money:

- Bank Wire Transfers: Ideal for large amounts ($10,000 or more), delivered within hours or minutes.

- Online Transfer Services: Platforms like PayPal, Wise, or Remitly offer competitive rates for international transfers.

- Money Transfer Operators: Companies like Western Union or MoneyGram provide both online and in-person services.

- Mobile Apps: Increasingly popular for quick, low-cost transfers, especially for smaller amounts.

2. Gather Necessary Information

Before initiating a transfer, ensure you have:

- Recipient's full name

- Recipient's bank account number or IBAN

- Recipient's bank's name and address

- SWIFT/BIC code of the recipient's bank

- Purpose of the transfer (for compliance reasons)

3. Compare Costs and Exchange Rates

Transfer fees and exchange rates can significantly impact the amount received. Use comparison tools to find the most cost-effective option for your specific transfer.

4. Initiate the Transfer

- Log into your chosen platform or visit your bank

- Enter the recipient's details

- Specify the amount and currency

- Review the transaction details, including fees and exchange rate

- Confirm and send the transfer

5. Track and Confirm

Most services provide a tracking number or confirmation. Use this to monitor the transfer's progress and ensure it reaches the recipient.

Risk Considerations

While money transfers have become increasingly secure, certain risks remain:

Fraud and Scams

Be wary of unsolicited requests for money transfers. Verify the recipient's identity and the purpose of the transfer, especially for large amounts or unfamiliar recipients.

Exchange Rate Fluctuations

For international transfers, be aware that exchange rates can fluctuate between the time you initiate the transfer and when it's completed, potentially affecting the final amount received.

Transfer Delays

While many transfers are now instant or same-day, factors like time zones, bank holidays, or compliance checks can cause delays. Plan accordingly, especially for time-sensitive transfers.

Security Breaches

Use reputable services with strong security measures. Enable two-factor authentication when available and avoid using public Wi-Fi for financial transactions.

Regulatory Aspects

Money transfers are subject to various regulations aimed at preventing money laundering and terrorist financing:

Know Your Customer (KYC)

Financial institutions are required to verify the identity of their clients. Be prepared to provide identification documents when setting up accounts or making large transfers.

Anti-Money Laundering (AML) Compliance

Transfers may be subject to additional scrutiny, especially for large amounts or transfers to certain countries. Be prepared to provide information on the source of funds and purpose of the transfer.

Reporting Requirements

In many countries, transfers above certain thresholds must be reported to regulatory authorities. For example, in the U.S., international transfers of $10,000 or more must be reported to the Financial Crimes Enforcement Network (FinCEN).

Future Outlook

The money transfer industry is poised for continued innovation and growth:

Blockchain and Cryptocurrency Integration

Blockchain technology and cryptocurrencies are expected to play an increasing role in international money transfers, potentially offering faster and cheaper alternatives to traditional methods.

Artificial Intelligence and Automation

AI is being leveraged to improve fraud detection, automate compliance checks, and provide personalized user experiences in money transfer services.

Open Banking Initiatives

Open banking regulations are enabling fintech companies to access banking infrastructure, potentially leading to more innovative and competitive money transfer solutions.

Focus on Financial Inclusion

There's a growing emphasis on providing money transfer services to underbanked populations, particularly in emerging markets, which could drive further growth in mobile and digital transfer solutions.

As the money transfer landscape continues to evolve, staying informed about new technologies, regulatory changes, and market trends will be crucial for both individual users and businesses engaged in international transactions. By understanding the various methods available and following best practices for security and cost-effectiveness, you can ensure that your money transfers are executed smoothly and efficiently in this dynamic financial environment.

Frequently Asked Questions About How To Do A Money Transfer

- What's the fastest way to transfer money internationally?

For speed, wire transfers or digital services like Wise or PayPal often offer the quickest options, with some transfers completed within minutes. However, the fastest method can vary depending on the countries involved and the amount being sent. - How can I avoid high fees when transferring money abroad?

Compare different providers, as fees can vary significantly. Online transfer services often offer lower fees than traditional banks. Also, consider the exchange rate offered, as some providers make money on the spread rather than explicit fees. - Are there limits on how much money I can transfer?

Yes, limits can vary by provider and method. Banks may have higher limits for wire transfers, while online services often have daily or monthly caps. For large transfers, you may need to provide additional documentation or use multiple transactions. - How long does an international money transfer typically take?

Transfer times can range from instant to 5+ business days. Factors affecting speed include the countries involved, the transfer method, and whether intermediary banks are used. Digital transfers are often faster than traditional bank transfers. - Is it safe to use online money transfer services?

Reputable online transfer services use encryption and other security measures to protect your information and funds. However, it's crucial to use strong passwords, enable two-factor authentication, and be wary of phishing scams. - What information do I need to make an international transfer?

Typically, you'll need the recipient's full name, bank account number or IBAN, their bank's name and address, and the bank's SWIFT/BIC code. Some countries may require additional information, so check with your provider. - Can I cancel a money transfer after it's been sent?

It depends on the transfer method and how quickly you act. Many providers allow cancellations if the transfer hasn't been picked up or deposited. Contact your provider immediately if you need to cancel a transfer.