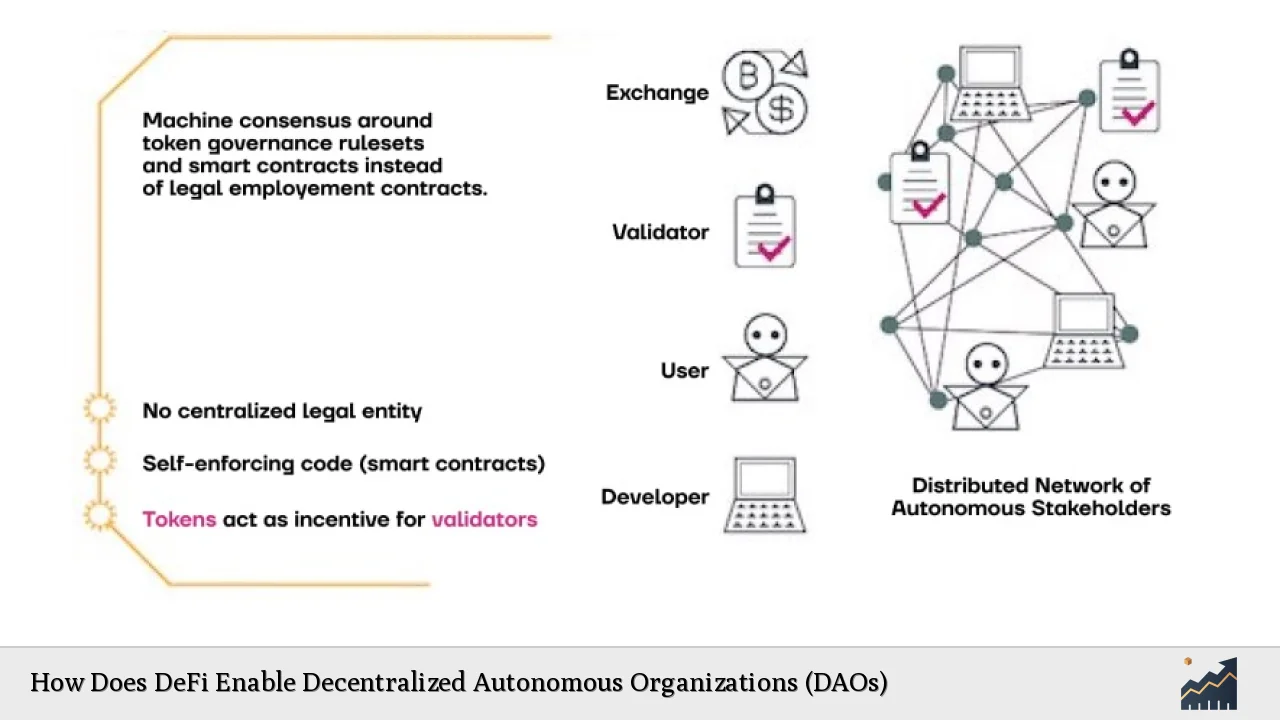

Decentralized Finance (DeFi) has revolutionized the financial landscape by leveraging blockchain technology to create open, transparent, and permissionless financial systems. One of the most innovative aspects of DeFi is its ability to enable Decentralized Autonomous Organizations (DAOs), which represent a new paradigm in organizational structure and governance. DAOs are blockchain-based entities that operate without centralized control, instead relying on smart contracts and community governance to make decisions and manage resources.

| Key Concept | Description/Impact |

|---|---|

| Smart Contracts | Self-executing code that automates DAO operations and enforces rules |

| Governance Tokens | Digital assets that grant voting rights and decision-making power in DAOs |

| Decentralized Governance | Community-driven decision-making process without central authority |

| Transparency | All transactions and decisions are recorded on the blockchain for public viewing |

| Composability | Ability to integrate with other DeFi protocols and services seamlessly |

Market Analysis and Trends

The DeFi and DAO ecosystem has experienced explosive growth in recent years. As of January 2024, the total value locked (TVL) in DeFi protocols reached $55.95 billion, showcasing a significant increase from $9.1 billion in July 2020. This growth reflects the increasing adoption of decentralized financial services and the rising popularity of DAOs as a governance model.

DAOs are gaining momentum across various sectors, with finance being at the forefront. Notable examples include MakerDAO and Uniswap DAO, which have become pivotal in the DeFi landscape. MakerDAO, for instance, has seen nearly 40% of its total supply of DAI stablecoin backed by real-world assets (RWA) collaterals as of June 2024, indicating a growing integration with traditional finance.

The global blockchain market, which underpins DeFi and DAOs, is projected to reach $67.4 billion by 2026, growing at a CAGR of 68.4% from 2021 to 2026. This rapid expansion is fueled by increased venture capital funding and greater adoption of blockchain technology in payments, banking, and cybersecurity solutions.

Implementation Strategies

Implementing a DAO within the DeFi ecosystem involves several key strategies:

1. Smart Contract Development

The foundation of any DAO is its smart contracts. These self-executing pieces of code define the rules and operations of the organization. Developers must ensure that smart contracts are secure, efficient, and flexible enough to accommodate future upgrades.

2. Governance Token Distribution

DAOs typically issue governance tokens to represent voting power and ownership within the organization. The distribution strategy is crucial for ensuring a fair and decentralized power structure. Common methods include token sales, airdrops, and liquidity mining programs.

3. Voting Mechanisms

Implementing robust voting systems is essential for DAO governance. This may include on-chain voting, off-chain signaling, and delegation mechanisms to allow for efficient decision-making while maintaining decentralization.

4. Treasury Management

DAOs often manage significant financial resources. Implementing multi-signature wallets, time-locks, and other security measures is crucial for protecting the organization's assets.

5. Community Engagement

Fostering an active and engaged community is vital for the success of a DAO. This involves creating forums for discussion, hosting regular governance calls, and providing educational resources for members.

Risk Considerations

While DAOs offer numerous benefits, they also come with unique risks that must be carefully managed:

Smart Contract Vulnerabilities: Bugs or exploits in smart contract code can lead to significant financial losses. Regular audits and formal verification processes are essential.

Governance Attacks: Malicious actors may attempt to manipulate voting processes or accumulate large amounts of governance tokens to influence decisions.

Regulatory Uncertainty: The legal status of DAOs remains unclear in many jurisdictions, potentially exposing participants to regulatory risks.

Market Volatility: The value of governance tokens and managed assets can be highly volatile, affecting the DAO's financial stability.

Scalability Issues: As DAOs grow, they may face challenges in maintaining efficient decision-making processes and community engagement.

Regulatory Aspects

The regulatory landscape for DAOs is still evolving, with different jurisdictions taking varied approaches:

United States: The SEC has shown interest in DAOs, considering some as potential securities. The Wyoming DAO LLC law provides a legal framework for DAOs, offering some regulatory clarity.

European Union: The Markets in Crypto-Assets (MiCA) regulation, set to be fully implemented by 2024, may impact how DAOs operate within the EU.

Global Considerations: DAOs operate globally, which can create complex legal and tax implications for participants across different jurisdictions.

As the regulatory landscape develops, DAOs must prioritize compliance and work towards establishing clear legal frameworks to ensure long-term viability.

Future Outlook

The future of DAOs in DeFi looks promising, with several trends shaping their evolution:

Interoperability: DAOs are likely to become more interconnected, allowing for cross-DAO collaboration and resource sharing.

Real-World Asset Integration: As seen with MakerDAO's RWA collaterals, DAOs are increasingly bridging the gap between DeFi and traditional finance.

Improved Governance Models: Innovations in voting mechanisms and delegation systems will enhance DAO efficiency and participation.

Institutional Adoption: Traditional financial institutions are showing interest in DAOs, potentially leading to hybrid models that combine decentralized governance with institutional backing.

Scalability Solutions: Layer 2 solutions and other scalability improvements will enable DAOs to operate more efficiently on blockchain networks.

As DeFi continues to mature, DAOs are poised to play an increasingly important role in shaping the future of finance. By enabling truly decentralized decision-making and resource allocation, DAOs represent a paradigm shift in how organizations can operate in the digital age.

Frequently Asked Questions About How DeFi Enables Decentralized Autonomous Organizations (DAOs)

- What is the relationship between DeFi and DAOs?

DeFi provides the technological infrastructure and financial protocols that enable DAOs to operate. DAOs often govern DeFi protocols, manage treasury funds, and make decisions about protocol upgrades and parameter changes. - How do governance tokens work in DAOs?

Governance tokens represent voting power within a DAO. Token holders can vote on proposals, delegate their voting rights to others, and sometimes earn rewards for participating in governance. - Are DAOs legal entities?

The legal status of DAOs varies by jurisdiction. Some places, like Wyoming in the US, have created specific legal frameworks for DAOs, while in many other areas, their legal status remains ambiguous. - How do DAOs manage their treasury?

DAOs typically use multi-signature wallets and smart contracts to manage their treasury. Decisions on fund allocation are made through community voting processes. - Can anyone participate in a DAO?

Most DAOs are open for anyone to participate by acquiring governance tokens. However, some DAOs may have specific requirements or restrictions for membership. - What are the main challenges facing DAOs in DeFi?

Key challenges include scalability, regulatory uncertainty, security risks, and maintaining effective governance as the organization grows. - How do DAOs contribute to financial inclusion?

DAOs can promote financial inclusion by providing open access to financial services and decision-making processes, regardless of geographical location or traditional financial status.