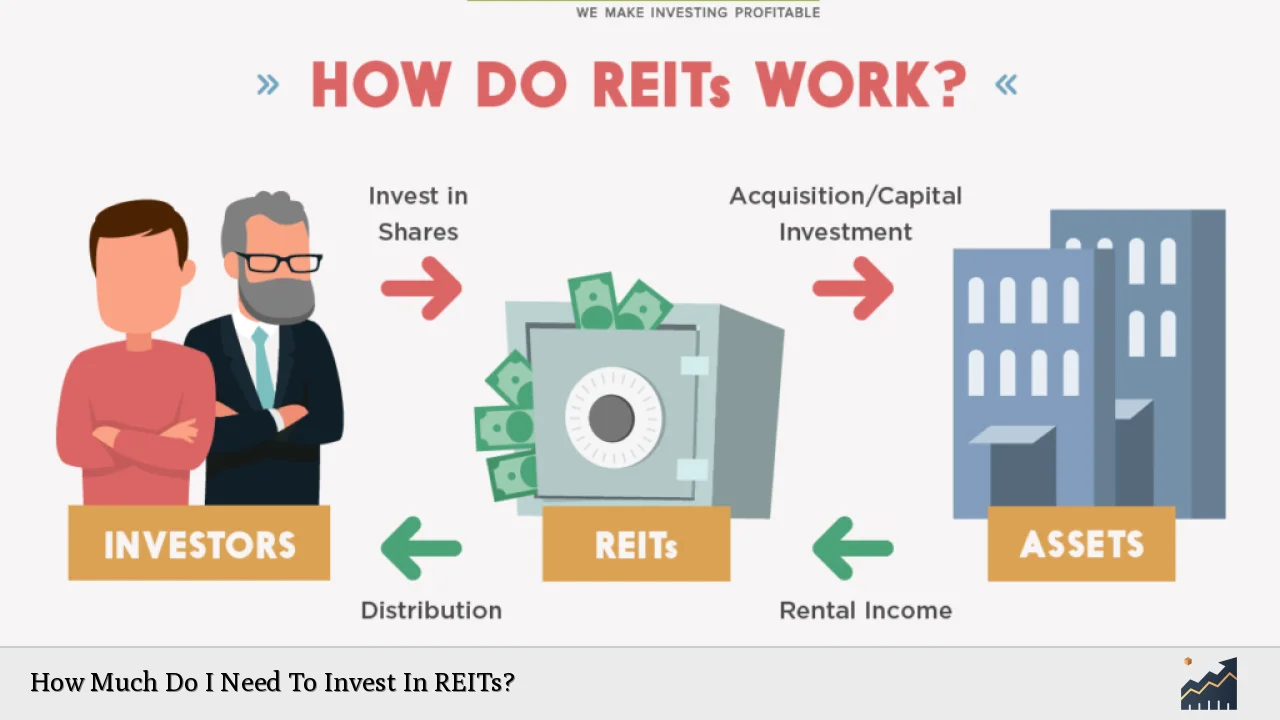

Investing in Real Estate Investment Trusts (REITs) can be a lucrative opportunity for individuals looking to diversify their portfolios and earn regular income. REITs allow investors to pool their money to invest in large-scale, income-producing real estate without the need to buy properties directly. This investment vehicle has become increasingly popular due to its potential for high returns and the ability to generate passive income through dividends. However, determining how much you need to invest in REITs can depend on several factors, including the type of REIT, your financial goals, and your risk tolerance.

The amount you should invest in REITs varies significantly based on whether you choose public, private, or non-traded REITs. Publicly traded REITs are accessible via stock exchanges and typically have lower minimum investment requirements, making them suitable for new investors. In contrast, private REITs often require substantial initial investments and are available primarily to accredited investors. Understanding these distinctions is crucial for making informed investment decisions.

| Type of REIT | Minimum Investment |

|---|---|

| Publicly Traded REITs | Cost of one share + fees |

| Private REITs | $1,000 – $50,000 |

| Non-Traded REITs | $1,000 – $2,500 |

Understanding Different Types of REITs

REITs can be classified into three main categories: publicly traded, private, and non-traded. Each type has unique characteristics that influence the investment amount required.

Publicly traded REITs are listed on stock exchanges and are the most accessible for individual investors. You can start investing with as little as the price of a single share plus any brokerage fees. This makes them an attractive option for those new to real estate investing or those with limited capital. For example, some public REITs like Realty Income may have minimum investments starting around $1,500 when purchasing through direct stock purchase programs.

Private REITs require a more substantial initial investment, typically ranging from $1,000 to $50,000. These investments are not available on public exchanges and usually cater to accredited investors—those with a net worth exceeding $1 million or an annual income of $200,000 (or $300,000 if married). Because they are less liquid and not subject to the same regulatory scrutiny as public REITs, they carry different risks.

Non-traded REITs fall somewhere in between. While they are not listed on stock exchanges, they must register with the SEC and adhere to certain regulations. The minimum investment for non-traded REITs generally ranges from $1,000 to $2,500, making them more accessible than private options but still requiring a higher initial outlay than publicly traded REITs.

Factors Influencing Your Investment Amount

Several factors should influence how much you decide to invest in REITs:

- Investment Goals: Determine what you want to achieve with your investment. Are you looking for regular income through dividends or long-term capital appreciation? Your goals will dictate how much you should allocate to this asset class.

- Risk Tolerance: Assess your comfort level with risk. Publicly traded REITs tend to be less risky due to their liquidity and regulatory oversight compared to private or non-traded options. If you have a low-risk tolerance, starting with publicly traded REITs may be wise.

- Portfolio Diversification: Consider how much of your overall portfolio you want to allocate to real estate. Financial advisors often recommend that real estate investments should comprise about 5% to 15% of your total portfolio depending on your financial situation and market conditions.

- Market Conditions: Stay informed about current market trends in real estate. Economic conditions can affect property values and rental income potential, influencing your decision on how much to invest.

Strategies for Investing in REITs

To maximize your investment in REITs effectively, consider the following strategies:

- Start Small: If you’re new to investing in real estate through REITs, begin with a modest amount that fits within your budget. This allows you to learn about the market dynamics without exposing yourself to significant risk.

- Diversify Your Investments: Spread your investments across different types of REITs—such as residential, commercial, industrial, and healthcare—to mitigate risks associated with any single sector’s downturn.

- Invest Regularly: Consider dollar-cost averaging by investing a fixed amount regularly over time. This strategy helps reduce the impact of market volatility and allows you to accumulate shares at varying prices.

- Monitor Performance: Keep track of your investments’ performance regularly. Evaluate factors such as dividend yields, occupancy rates of properties owned by the REIT, and overall market conditions that might affect returns.

Potential Returns from Investing in REITs

Investors often choose REITs for their potential high returns compared to traditional stocks or bonds. The bulk of returns from REIT investments typically comes from dividends rather than capital appreciation. Most publicly traded REITs distribute at least 90% of their taxable income as dividends due to tax regulations governing these entities.

The average dividend yield for publicly traded REITs tends to range between 4% and 10%, depending on the sector and specific trust performance. For instance:

| REIT Sector | Average Dividend Yield |

|---|---|

| Residential | 4% – 6% |

| Retail | 5% – 8% |

| Healthcare | 6% – 10% |

While these yields can be attractive, it’s essential also to consider the risks involved with investing in specific sectors that may be more volatile than others.

Risks Associated with Investing in REITs

Like any investment vehicle, investing in REITs carries inherent risks that potential investors should understand:

- Market Risk: The value of publicly traded REIT shares can fluctuate based on market conditions similar to stocks. Economic downturns can lead to decreased property values or rental income.

- Interest Rate Risk: Rising interest rates can negatively impact borrowing costs for REITs and may lead to lower property values as investors seek higher yields elsewhere.

- Sector-Specific Risks: Different types of properties face unique challenges; for example, retail properties may suffer from e-commerce competition while healthcare facilities may be affected by regulatory changes.

- Liquidity Risk: Private and non-traded REITs may have limited liquidity since they are not easily bought or sold like publicly traded options.

Understanding these risks is crucial before committing significant capital into any type of REIT investment.

FAQs About How Much Do I Need To Invest In REITs

- What is the minimum investment for publicly traded REITs?

The minimum investment is typically just the price of one share plus any brokerage fees. - How much do I need for private REIT investments?

Private REIT investments usually require a minimum of $1,000 up to $50,000. - Are non-traded REITs a good option?

Non-traded REITs can be good options due to their regulatory oversight but require a minimum investment between $1,000 and $2,500. - What percentage of my portfolio should be in REITs?

A common recommendation is allocating about 5% to 15% of your portfolio towards real estate investments. - What are the risks associated with investing in REITs?

The main risks include market risk, interest rate risk, sector-specific risks, and liquidity risk.

Investing in Real Estate Investment Trusts can offer significant benefits but requires careful consideration regarding how much capital you wish to commit based on your financial goals and risk tolerance. By understanding the different types of REITs available and employing effective strategies for investment management, you can position yourself for potential success in this asset class.