Investing in the S&P 500 is a popular choice for many investors seeking exposure to the U.S. stock market. The S&P 500 index comprises 500 of the largest publicly traded companies in the United States, making it a reliable indicator of the overall health of the U.S. economy. This guide will provide you with a comprehensive understanding of how to invest in the S&P 500, including various investment options, strategies, and important considerations.

| Aspect | Details |

|---|---|

| Index Composition | 500 largest U.S. companies |

| Investment Vehicles | Index funds, ETFs, individual stocks |

Understanding the S&P 500

The S&P 500 index was launched in 1957 and has become one of the most widely followed equity indices in the world. It includes companies from various sectors, such as technology, healthcare, and finance, which provides investors with diversification. The index is weighted by market capitalization, meaning that larger companies have a more significant impact on its performance.

Investing in the S&P 500 allows individuals to gain exposure to a broad range of established companies without needing to buy each stock individually. This approach not only simplifies the investment process but also reduces risk through diversification.

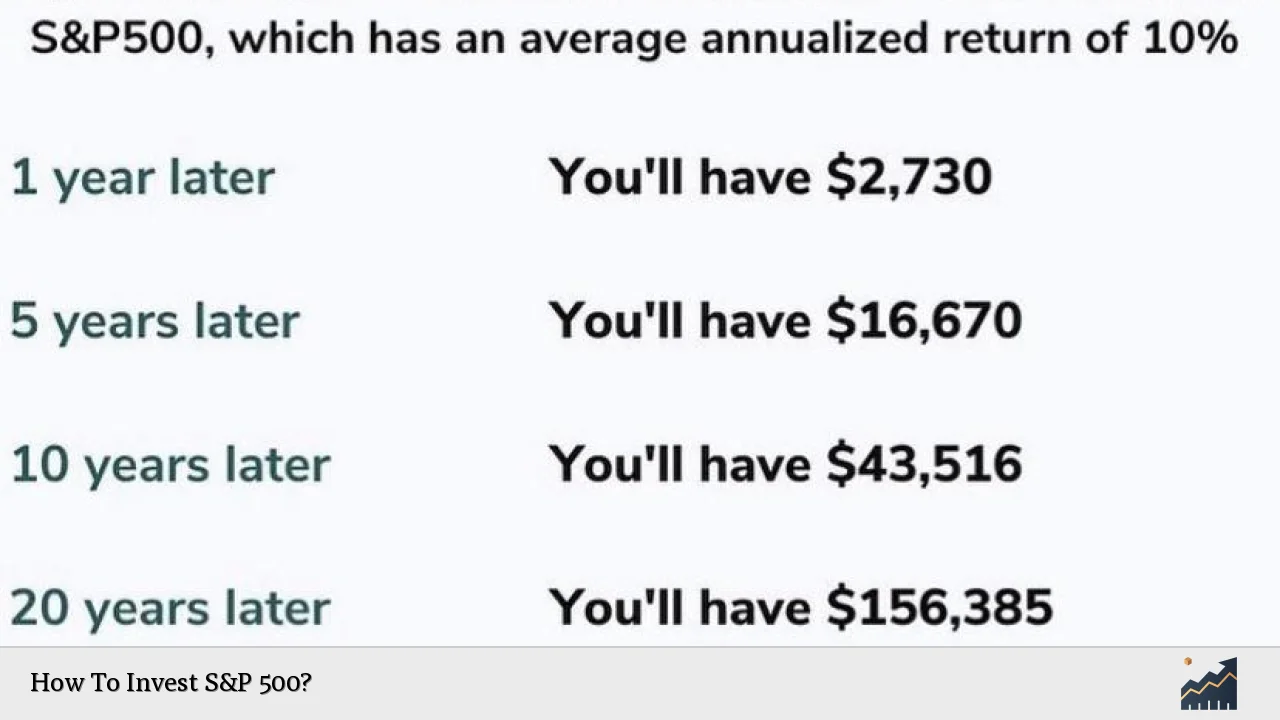

The S&P 500 is often viewed as a benchmark for overall market performance. Historically, it has provided investors with consistent long-term returns, making it an attractive option for both novice and seasoned investors.

Ways to Invest in the S&P 500

There are several methods to invest in the S&P 500, each with its advantages and considerations:

- S&P 500 Index Funds: These are mutual funds designed to replicate the performance of the S&P 500 index. They invest in all or a representative sample of the stocks within the index, providing instant diversification.

- Exchange-Traded Funds (ETFs): ETFs like SPDR S&P 500 ETF Trust (SPY) track the index and can be traded like stocks on an exchange. They offer flexibility and generally lower fees compared to mutual funds.

- Individual Stocks: Investors can choose to buy shares of specific companies within the S&P 500. This method requires more research and carries higher risk due to lack of diversification.

Each option has its own set of fees, tax implications, and risk levels that investors should consider before making a decision.

Steps to Invest in the S&P 500

Investing in the S&P 500 can be broken down into clear steps:

1. Open a Brokerage Account: Choose a reputable brokerage that offers access to S&P 500 funds or ETFs. Look for platforms with low fees and user-friendly interfaces.

2. Determine Your Investment Amount: Assess your financial situation to decide how much you can invest. It’s often recommended to start small and increase your investment over time.

3. Choose Your Investment Vehicle: Decide whether you want to invest in an index fund, ETF, or individual stocks based on your investment goals and risk tolerance.

4. Place Your Order: Once your account is funded, you can place an order for your chosen investment vehicle through your brokerage platform.

5. Monitor Your Investment: Regularly review your investment performance and make adjustments as needed based on market conditions or changes in your financial goals.

Investment Strategies for the S&P 500

Implementing effective investment strategies can enhance your returns when investing in the S&P 500:

- Dollar-Cost Averaging: This strategy involves investing a fixed amount regularly regardless of market conditions. It helps mitigate the impact of volatility by averaging out purchase prices over time.

- Buy and Hold: This long-term strategy focuses on purchasing shares and holding them through market fluctuations, capitalizing on overall market growth over time.

- Reinvesting Dividends: Many S&P 500 funds pay dividends that can be reinvested to purchase additional shares, compounding returns over time.

These strategies can help investors achieve their financial goals while managing risk effectively.

Risks Associated with Investing in the S&P 500

While investing in the S&P 500 offers many benefits, it also comes with certain risks:

- Market Volatility: The stock market can be unpredictable, leading to fluctuations in investment value. Investors should be prepared for potential downturns.

- Concentration Risk: The index is heavily weighted towards large-cap companies, meaning that poor performance by these firms can significantly impact overall returns.

- Economic Factors: Changes in economic conditions, interest rates, or government regulations can affect market performance and investor sentiment.

Understanding these risks is crucial for making informed investment decisions and developing appropriate risk management strategies.

Tax Considerations When Investing

When investing in the S&P 500 through funds or ETFs, it's essential to consider tax implications:

- Capital Gains Tax: Profits from selling investments may be subject to capital gains tax. Long-term investments (held for over one year) typically incur lower tax rates than short-term gains.

- Dividend Taxation: Dividends received from investments are generally taxable as income in the year they are received.

Consulting with a tax professional can help you navigate these considerations effectively and optimize your investment strategy for tax efficiency.

FAQs About How To Invest S&P 500

- What is an S&P 500 index fund?

An S&P 500 index fund is a mutual fund designed to replicate the performance of the S&P 500 index by investing in its constituent stocks. - How do I choose between an ETF and an index fund?

ETFs offer flexibility as they trade like stocks throughout the day, while index funds are typically purchased at end-of-day prices. - Can I invest directly in the S&P 500?

No, you cannot invest directly in the S&P 500; instead, you must invest through funds or ETFs that track its performance. - What are some popular ETFs tracking the S&P 500?

Popular ETFs include SPDR S&P 500 ETF Trust (SPY) and Vanguard S&P 500 ETF (VOO). - Is investing in the S&P 500 suitable for beginners?

Yes, investing in the S&P 500 through index funds or ETFs is often recommended for beginners due to its simplicity and diversification.

By following these guidelines and understanding both opportunities and risks associated with investing in the S&P 500, you can make informed decisions that align with your financial goals. Whether you're looking for long-term growth or a simple way to participate in U.S. equity markets, investing in this benchmark index offers a compelling option for many investors.