Investing in an annuity can be a strategic move for securing a steady income stream during retirement. However, determining the right amount to invest in an annuity is not a straightforward decision. It involves understanding various factors such as the type of annuity, your financial goals, and the minimum investment requirements set by different providers. This article will guide you through the essential considerations and help you decide how much you need to invest in an annuity.

| Type of Annuity | Typical Minimum Investment |

|---|---|

| Fixed Annuities | $1,000 – $50,000+ |

| Variable Annuities | $5,000 – $25,000+ |

| Indexed Annuities | $5,000 – $25,000 |

| Immediate Annuities | $50,000 – $100,000+ |

Understanding Annuities

Annuities are financial contracts between an individual and an insurance company that provide a series of payments in exchange for an initial investment. They are primarily used as a means to secure a reliable income during retirement. The investment can be made as a lump sum or through a series of payments over time.

The two main phases of an annuity are the accumulation phase, where the invested money grows, and the payout phase, where the annuitant receives regular payments. The type of annuity chosen—fixed, variable, indexed, or immediate—will significantly influence both the minimum investment required and the potential payouts.

Types of Annuities

- Fixed Annuities: These offer guaranteed returns and fixed periodic payments. They typically have lower minimum investment requirements compared to other types.

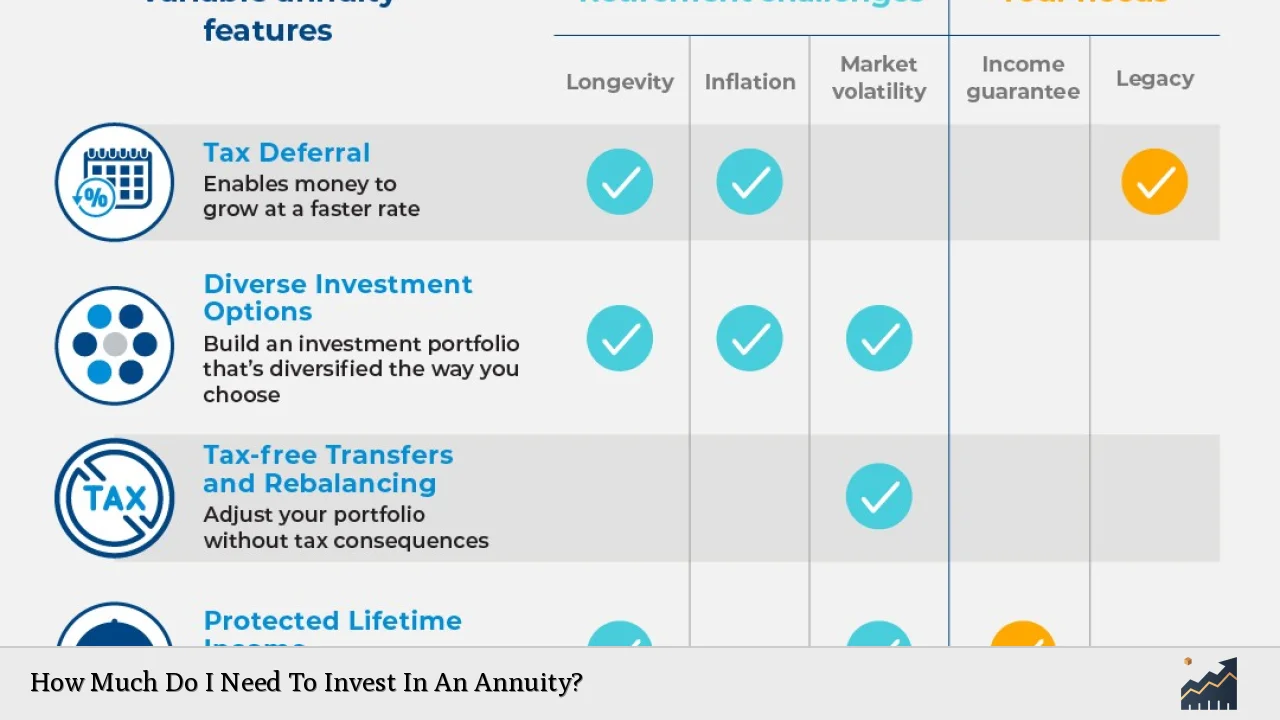

- Variable Annuities: With these, returns depend on the performance of underlying investments. They generally require a higher initial investment.

- Indexed Annuities: These link returns to a specific market index while providing some downside protection. Their minimum investments usually fall between those of fixed and variable annuities.

- Immediate Annuities: These begin paying out almost immediately after purchase and require a significant upfront investment.

Understanding these types will help you determine which aligns best with your financial needs and goals.

Minimum Investment Requirements

When considering how much to invest in an annuity, it’s crucial to know that each type has different minimum investment thresholds.

- Fixed Annuities: You might find options starting as low as $1,000, but many providers set their minimums between $5,000 and $50,000.

- Variable Annuities: Typically require an initial investment ranging from $5,000 to $25,000 or more due to their inherent risk and potential for higher returns.

- Indexed Annuities: Generally have minimums similar to variable annuities, often starting at around $5,000.

- Immediate Annuities: Require larger investments, usually between $50,000 and $100,000, since they provide immediate income streams.

These figures can vary significantly among different insurance companies and products. Therefore, it is important to shop around and compare offerings.

Factors Influencing Your Investment Decision

Determining how much to invest in an annuity should be based on several personal financial factors:

- Retirement Goals: Consider your desired lifestyle during retirement. Calculate how much income you will need monthly or annually to maintain that lifestyle.

- Current Financial Situation: Assess your savings, other income sources (like Social Security or pensions), and any outstanding debts. This will give you a clearer picture of how much you can afford to allocate toward an annuity.

- Investment Horizon: The time until you retire will affect your risk tolerance and investment strategy. If retirement is many years away, you might prefer growth-oriented investments rather than locking up funds in an annuity.

- Liquidity Needs: Understand that investing in an annuity locks up your money for a specified period. If you anticipate needing access to these funds sooner rather than later, consider this when deciding on your investment amount.

- Risk Tolerance: Your comfort level with market fluctuations should influence your choice between fixed and variable products. Fixed annuities provide stability but may offer lower returns compared to variable options that come with greater risk.

Evaluating Payout Potential

The amount you invest directly affects the payout you can expect from an annuity. Generally speaking:

- A larger initial investment leads to higher monthly payouts.

- Conversely, investing only the minimum required will yield lower monthly payments than if you were to invest more substantial sums.

For example:

- If you invest $25,000 in an immediate annuity at age 67, your monthly payout may be around $125, depending on interest rates and life expectancy calculations.

- Increasing that investment to $100,000 could potentially raise your monthly payout significantly—sometimes even doubling it.

This relationship emphasizes the importance of considering not just the minimum required investment but also how much you realistically need for retirement income.

Diversifying Your Portfolio

While annuities can be a valuable part of your retirement strategy, experts recommend limiting your total allocation to them:

- Aim for no more than 5% to 10% of your overall retirement savings in annuities.

This approach helps mitigate risks associated with locking up funds in illiquid investments while still benefiting from guaranteed income streams during retirement.

Consider using other financial instruments alongside annuities:

- Stocks

- Bonds

- Mutual funds

- Real estate

A diversified portfolio can help ensure that you have multiple sources of income during retirement while managing risks effectively.

Consulting with Professionals

Given the complexities involved in choosing the right amount to invest in an annuity:

- It is advisable to consult with a financial advisor who specializes in retirement planning.

- They can help assess your unique financial situation and goals while guiding you through various product offerings available in the market.

A professional can also assist in calculating potential payouts based on different investment amounts and help identify which type of annuity aligns best with your objectives.

FAQs About How Much To Invest In An Annuity

- What is the typical minimum investment required for an annuity?

Minimum investments for annuities vary widely; fixed annuities can start at $1,000 while others may require much higher amounts. - How do I determine how much I should invest in an annuity?

Your decision should consider factors like retirement goals, current financial situation, liquidity needs, and risk tolerance. - Can I increase my investment after purchasing an annuity?

Some types allow additional contributions while others do not; check specific contract terms. - What happens if I withdraw money from my annuity early?

Early withdrawals may incur penalties or surrender charges depending on your contract’s terms. - Are there tax implications when investing in an annuity?

Annuities grow tax-deferred until withdrawal; however, distributions may be subject to ordinary income tax.

Deciding how much to invest in an annuity is a critical step toward ensuring financial security during retirement. By understanding the various types of annuities available and considering personal financial circumstances alongside professional advice, individuals can make informed decisions that align with their long-term goals.