Investing extra money is a crucial step towards financial growth and security. Whether you have received a bonus, inherited some money, or simply have surplus funds from your budget, knowing how to invest wisely can help you build wealth over time. Investing is not just about putting your money into stocks or bonds; it encompasses a variety of strategies that can suit different financial goals and risk tolerances.

To effectively invest your extra money, it's essential to understand your financial situation, set clear goals, and choose the right investment vehicles. This process can seem daunting, but with the right approach, you can make informed decisions that align with your long-term objectives.

| Investment Options | Description |

|---|---|

| Stocks | Equity investments in companies that can provide high returns. |

| Bonds | Debt securities issued by governments or corporations with lower risk. |

| Real Estate | Investing in property for rental income or appreciation. |

| ETFs | Exchange-Traded Funds that offer diversification across asset classes. |

Assess Your Financial Situation

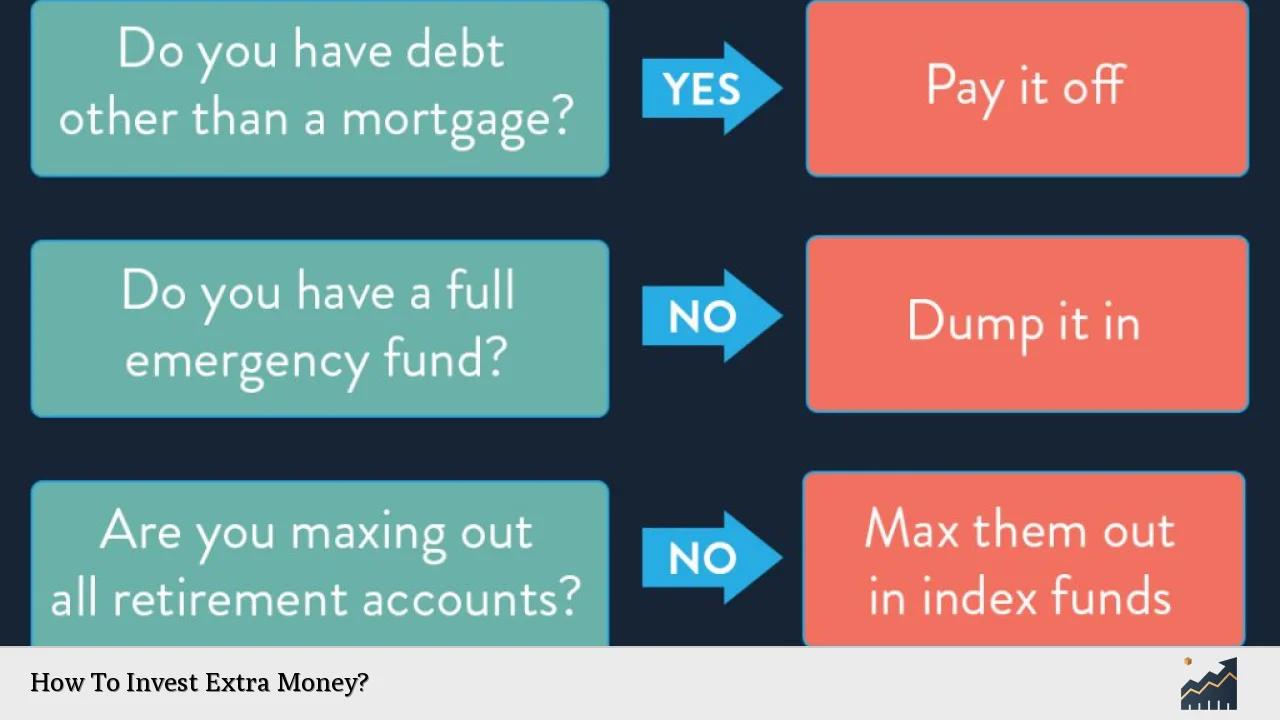

Before investing any extra money, it's vital to assess your current financial situation. This includes understanding your income, expenses, debts, and existing savings. Begin by evaluating the following:

- Emergency Fund: Ensure that you have a sufficient emergency fund covering three to six months of living expenses. This fund acts as a safety net for unforeseen circumstances like job loss or medical emergencies.

- Debt Management: Pay off high-interest debts first. Credit card debt and personal loans can accumulate interest quickly, making it more beneficial to eliminate these before investing.

- Financial Goals: Identify your short-term and long-term financial goals. Are you saving for retirement, a home, or your children's education? Knowing your objectives will guide your investment choices.

By thoroughly understanding your financial landscape, you can make informed decisions about where to allocate your extra money for maximum benefit.

Choose the Right Investment Vehicle

Once you've assessed your financial situation, the next step is to choose the right investment vehicle. Different options cater to various risk tolerances and investment horizons:

- Stocks: Investing in individual stocks can yield high returns but comes with increased risk. Consider diversifying across sectors to mitigate potential losses.

- Bonds: Bonds are generally safer investments than stocks and provide fixed interest payments. They are ideal for conservative investors looking for stability.

- Real Estate: Real estate investments can generate passive income and appreciate over time. You can invest directly by purchasing property or indirectly through Real Estate Investment Trusts (REITs).

- ETFs and Mutual Funds: These funds allow for diversification by pooling money from multiple investors to buy a range of assets. They are suitable for those who prefer a hands-off approach.

Choosing the right investment vehicle depends on your risk tolerance, investment goals, and time horizon.

Diversify Your Investments

Diversification is a crucial strategy in investing. It involves spreading your investments across various asset classes to reduce risk. By not putting all your eggs in one basket, you can protect yourself against market volatility.

- Asset Allocation: Determine the percentage of your portfolio to allocate to stocks, bonds, real estate, and other assets based on your risk tolerance and investment goals.

- Sector Diversification: Within stocks, consider investing in different sectors such as technology, healthcare, and consumer goods to further spread risk.

- Geographic Diversification: Investing in international markets can also provide exposure to different economic conditions and growth opportunities.

A well-diversified portfolio can help stabilize returns over time and reduce the impact of poor performance from any single investment.

Utilize Tax-Advantaged Accounts

Maximizing contributions to tax-advantaged accounts is an effective way to invest extra money while minimizing tax liabilities:

- 401(k) Plans: If available through your employer, contribute as much as possible to your 401(k), especially if they offer matching contributions. This is essentially free money that boosts your retirement savings.

- IRAs: Individual Retirement Accounts (IRAs) allow you to save for retirement with tax benefits. Consider traditional IRAs for tax-deferred growth or Roth IRAs for tax-free withdrawals in retirement.

- Health Savings Accounts (HSAs): If eligible, HSAs provide tax advantages for medical expenses while allowing funds to grow over time.

Using these accounts not only helps you save on taxes but also encourages disciplined saving for long-term goals.

Explore Passive Income Opportunities

Investing in passive income opportunities can generate additional cash flow without requiring constant effort:

- Dividend Stocks: These stocks pay regular dividends, providing a steady income stream while allowing capital appreciation.

- Real Estate Investments: Rental properties or REITs can generate monthly income while potentially increasing in value over time.

- Peer-to-Peer Lending: Platforms that facilitate lending between individuals allow you to earn interest on loans made to borrowers.

Passive income investments require initial research and capital but can lead to significant returns over time with minimal ongoing involvement.

Start a Side Hustle

If you're looking for ways to increase your income further before investing extra money, consider starting a side hustle:

- Freelancing: Use skills such as writing, graphic design, or programming to take on freelance projects during your free time.

- E-commerce: Sell products online through platforms like Etsy or Amazon. This could be handmade crafts or dropshipping items without holding inventory.

- Consulting Services: If you have expertise in a particular field, offering consulting services can be lucrative while allowing flexibility in hours worked.

The additional income generated from a side hustle can be directly funneled into investments or savings goals.

Monitor Your Investments Regularly

Investing is not a set-it-and-forget-it endeavor; it requires regular monitoring:

- Review Performance: Periodically assess how each investment is performing against benchmarks and expectations. Adjust allocations if necessary based on performance trends.

- Rebalance Portfolio: As certain investments grow faster than others, rebalancing ensures that your portfolio maintains its intended asset allocation over time.

- Stay Informed: Keep up with market trends and economic news that could impact your investments. Knowledge is key to making informed decisions about buying or selling assets.

Regularly monitoring your investments helps ensure they align with changing financial goals and market conditions.

Invest in Financial Education

Investing in yourself through financial education is one of the best ways to ensure successful investing:

- Courses and Workshops: Participate in courses focused on investing strategies or personal finance management to enhance your knowledge base.

- Books and Podcasts: Read books by reputable authors on investing principles or listen to finance-related podcasts for insights into market trends and strategies.

- Financial Advisors: Consider consulting with a financial advisor who can provide personalized advice tailored to your unique financial situation.

The more knowledgeable you become about investing principles and market dynamics, the better equipped you'll be to make informed decisions regarding your extra money.

FAQs About How To Invest Extra Money

- What should I do before investing extra money?

Assess your financial situation including debts, savings, and emergency funds. - How do I choose where to invest my extra cash?

Select investments based on risk tolerance, time horizon, and financial goals. - Is diversification really necessary?

Yes, diversification helps reduce risk by spreading investments across various asset classes. - What are tax-advantaged accounts?

These are accounts like 401(k)s and IRAs that offer tax benefits for retirement savings. - How often should I review my investments?

Regularly monitor performance at least once every six months or after significant market changes.