Smart contract platforms represent a transformative shift in how agreements are executed and managed, leveraging blockchain technology to automate processes that traditionally required human intervention. This comparison delves into the fundamental differences between smart contract platforms and traditional computing platforms, highlighting their respective advantages, challenges, and market dynamics.

| Key Concept | Description/Impact |

|---|---|

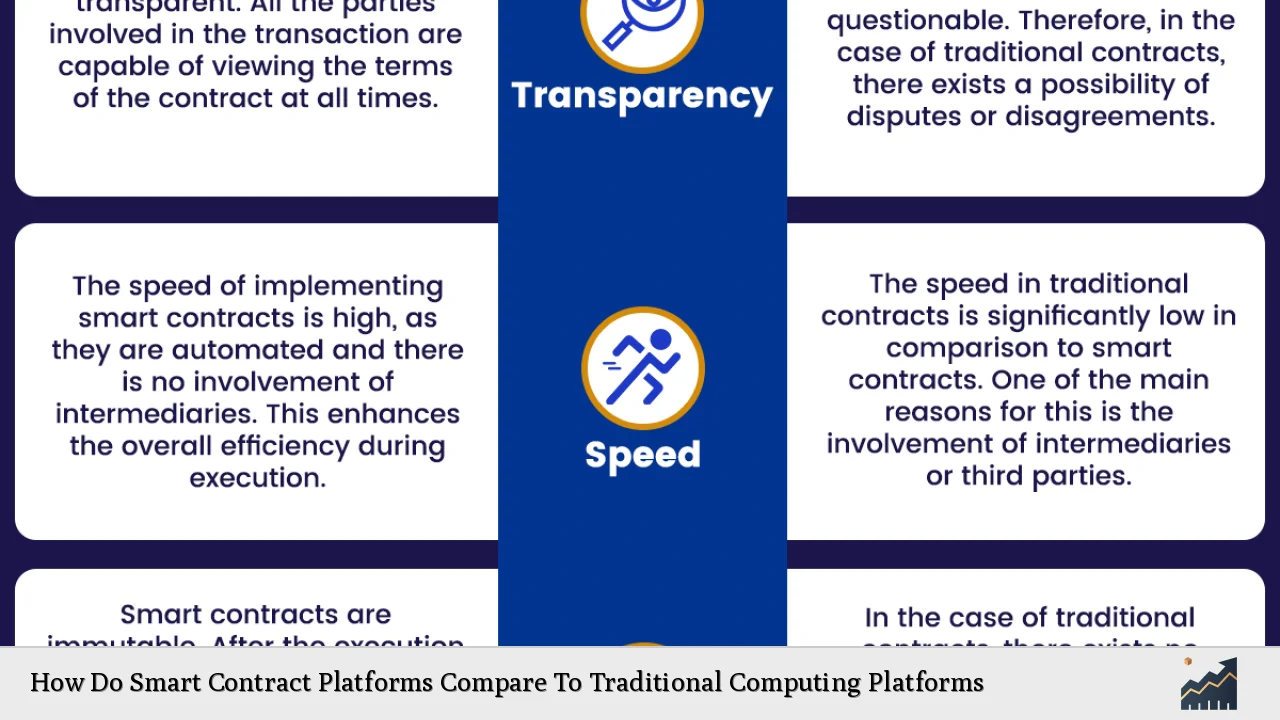

| Automation | Smart contracts automatically execute actions based on predefined conditions, reducing manual labor and speeding up processes. |

| Transparency | Transactions on smart contract platforms are recorded on a public ledger, enhancing visibility and trust among parties. |

| Security | Smart contracts utilize cryptographic techniques to ensure data integrity and prevent tampering, making them more secure than traditional contracts. |

| Cost Efficiency | Elimination of intermediaries in smart contracts can lead to significant cost savings in transaction fees and administrative expenses. |

| Scalability | Some smart contract platforms, like Solana, offer high scalability with the ability to process thousands of transactions per second at low costs. |

| Regulatory Challenges | The legal status of smart contracts is still evolving, posing challenges for widespread adoption and enforcement compared to traditional contracts. |

| Flexibility | While smart contracts can be programmed for complex logic, they lack the adaptability of traditional contracts that can be renegotiated easily. |

| Global Reach | Smart contracts can facilitate cross-border transactions without the need for local legal frameworks, unlike traditional contracts that may face jurisdictional issues. |

Market Analysis and Trends

The market for smart contract platforms is experiencing rapid growth, driven by increased adoption across various industries. According to recent reports, the global smart contract market was valued at approximately USD 1.71 billion in 2023 and is projected to reach USD 12.55 billion by 2032, growing at a CAGR of 24.7% during this period. This growth is fueled by the demand for automation in business processes and the need for secure transaction methods.

Key trends influencing this market include:

- Integration with AI: The merging of artificial intelligence with smart contracts is expected to enhance their functionality by enabling more complex decision-making processes.

- Layer-2 Solutions: These solutions aim to improve scalability by processing transactions off the main blockchain, thereby increasing efficiency and reducing costs.

- Increased Regulatory Scrutiny: As smart contracts gain traction, regulatory bodies are beginning to establish frameworks to govern their use, which could impact adoption rates.

- Sector-Specific Applications: Industries such as finance, healthcare, and supply chain management are increasingly utilizing smart contracts for their efficiency and transparency benefits.

Implementation Strategies

For organizations looking to implement smart contract platforms effectively, several strategies can be adopted:

- Pilot Projects: Start with small-scale pilot projects to assess the feasibility and impact of smart contracts within specific business units before full-scale implementation.

- Training and Development: Invest in training employees on blockchain technology and smart contract programming languages like Solidity to build internal expertise.

- Collaboration with Tech Partners: Partner with blockchain technology firms that specialize in smart contract development to leverage their expertise and resources.

- Regulatory Compliance: Stay informed about evolving regulations regarding blockchain technology and ensure that all implementations comply with local laws.

Risk Considerations

While smart contract platforms offer numerous advantages, they also come with inherent risks:

- Security Vulnerabilities: Despite their robust security features, smart contracts can still be susceptible to coding errors or exploits if not properly audited.

- Legal Ambiguities: The legal status of smart contracts remains uncertain in many jurisdictions, which could complicate enforcement or lead to disputes.

- Market Volatility: The cryptocurrency markets can be highly volatile, impacting the value of assets tied to smart contracts.

- Dependence on Technology: Organizations must ensure reliable technological infrastructure since disruptions could hinder contract execution.

Regulatory Aspects

The regulatory landscape surrounding smart contracts is complex and varies significantly across regions. Key considerations include:

- Legal Recognition: Some jurisdictions have begun recognizing smart contracts as legally binding agreements, while others have not yet established clear guidelines.

- Data Privacy Regulations: Compliance with data protection laws such as GDPR is crucial when implementing smart contracts that handle personal data.

- Cross-Border Transactions: Different countries may have varying regulations regarding the use of blockchain technology and cryptocurrencies, impacting international agreements.

Future Outlook

The future of smart contract platforms appears promising as they continue to evolve. Key predictions include:

- Increased Adoption Across Industries: As businesses recognize the benefits of automation and transparency offered by smart contracts, adoption is expected to rise significantly.

- Technological Advancements: Innovations in blockchain technology will likely enhance the capabilities of smart contracts, making them more efficient and user-friendly.

- Greater Regulatory Clarity: As governments develop clearer regulations around blockchain technology, businesses will feel more confident in adopting these solutions.

- Hybrid Models: The combination of traditional contract frameworks with smart contract capabilities may emerge as a popular approach for complex agreements requiring flexibility alongside automation.

Frequently Asked Questions About How Do Smart Contract Platforms Compare To Traditional Computing Platforms

- What are smart contracts?

Smart contracts are self-executing agreements where the terms are directly written into code on a blockchain. They automatically execute actions when predefined conditions are met. - How do smart contracts enhance security?

The decentralized nature of blockchain technology ensures that once a contract is deployed, it cannot be altered or tampered with without consensus from the network participants. - What industries benefit most from smart contracts?

Industries such as finance, healthcare, supply chain management, and real estate are leveraging smart contracts for their efficiency and transparency advantages. - Can traditional contracts coexist with smart contracts?

Yes, businesses can integrate elements of both types of contracts by using smart contracts for specific functions while maintaining traditional legal frameworks for overall governance. - What challenges do organizations face when adopting smart contracts?

Organizations may encounter challenges related to regulatory compliance, security vulnerabilities, and the need for specialized knowledge in blockchain technology. - Are there any cost savings associated with using smart contracts?

The elimination of intermediaries often leads to significant cost savings in transaction fees and administrative overheads when using smart contracts compared to traditional methods. - What is the future outlook for smart contract platforms?

The future looks bright for smart contract platforms as they continue to gain traction across various sectors due to their ability to automate processes efficiently. - How do I get started with implementing a smart contract platform?

Organizations should begin by conducting pilot projects while investing in training staff on blockchain technologies and collaborating with experienced tech partners.

In conclusion, the comparison between smart contract platforms and traditional computing platforms highlights significant differences in automation capabilities, security features, cost efficiency, and regulatory challenges. As organizations increasingly recognize these benefits, the adoption of smart contract technologies is expected to rise dramatically in various sectors.