Investing in cryptocurrency has become an increasingly popular avenue for individuals looking to diversify their investment portfolios. Cryptocurrencies, digital assets secured by cryptography, offer unique opportunities and risks compared to traditional investments. As the market evolves, understanding how to navigate this landscape is crucial for both new and seasoned investors.

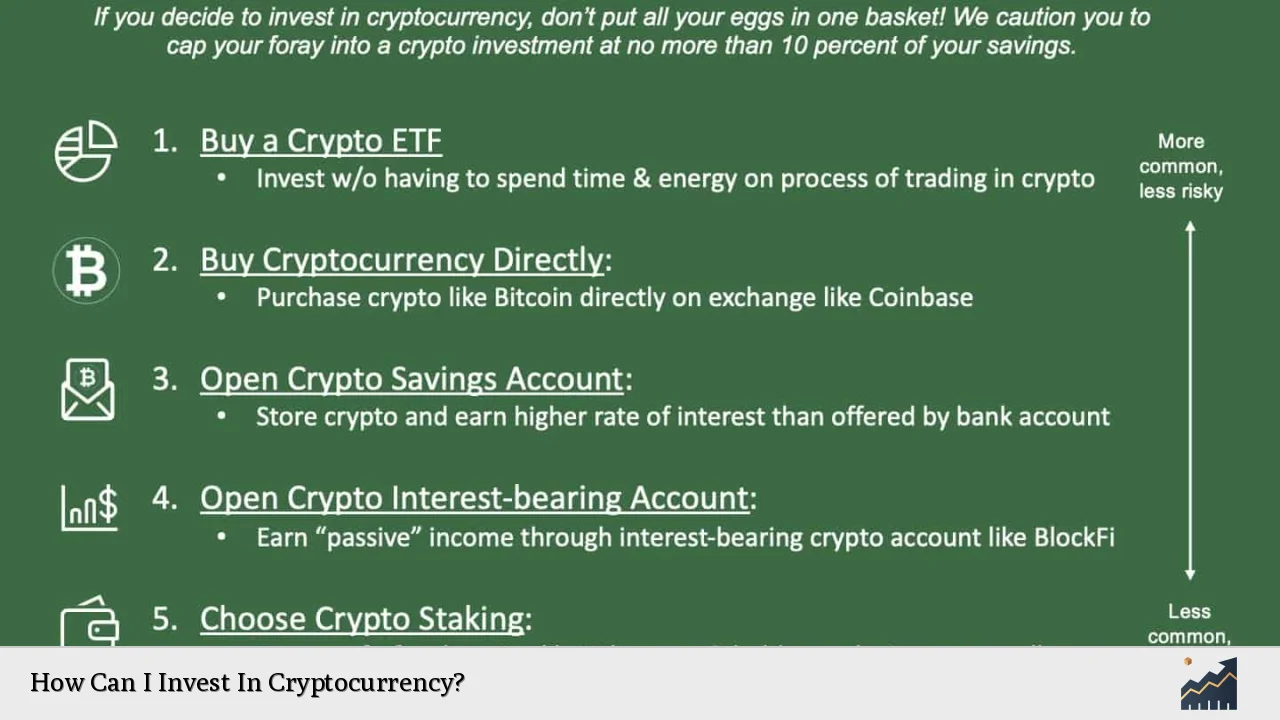

To start investing in cryptocurrency, you need to familiarize yourself with the basic concepts, choose a reliable exchange, and develop a clear strategy. The following guide will provide a comprehensive overview of how to invest in cryptocurrency effectively.

| Step | Description |

|---|---|

| 1 | Choose a cryptocurrency exchange |

| 2 | Decide on the cryptocurrency to invest in |

| 3 | Create a secure wallet |

| 4 | Make your first purchase |

| 5 | Set an investment strategy |

Understanding Cryptocurrency

Cryptocurrency is fundamentally different from traditional currencies. It operates on blockchain technology, which is a decentralized ledger that records all transactions across a network of computers. This technology ensures transparency and security, making it difficult to alter transaction data.

The most well-known cryptocurrency is Bitcoin, but there are thousands of alternatives, known as altcoins. Each cryptocurrency has its unique features and uses, which can affect its value and investment potential. Understanding these differences is essential for making informed investment decisions.

Investing in cryptocurrencies can be highly volatile. Prices can fluctuate dramatically within short periods, influenced by market demand, technological developments, and regulatory news. Therefore, it’s crucial to conduct thorough research before investing.

Choosing a Cryptocurrency Exchange

The first step in investing is selecting a cryptocurrency exchange. This platform allows you to buy, sell, and trade cryptocurrencies. When choosing an exchange, consider the following factors:

- Reputation: Look for exchanges with positive reviews and a solid track record.

- Security: Ensure the platform has robust security measures in place.

- Fees: Different exchanges have varying fee structures; compare them to find the best deal.

- User Interface: A user-friendly interface can enhance your trading experience.

- Available Cryptocurrencies: Check if the exchange offers the cryptocurrencies you want to invest in.

Popular exchanges include Coinbase, Binance, and Kraken. Each has its strengths and weaknesses, so it’s essential to choose one that aligns with your investment goals.

Selecting Cryptocurrencies to Invest In

After choosing an exchange, the next step is deciding which cryptocurrencies to invest in. Here are some commonly considered options:

- Bitcoin (BTC): The first and most recognized cryptocurrency.

- Ethereum (ETH): Known for its smart contract functionality.

- Litecoin (LTC): Often considered silver to Bitcoin’s gold due to faster transaction times.

- Ripple (XRP): Focuses on facilitating international money transfers.

When selecting cryptocurrencies, consider factors such as market capitalization, historical performance, and future potential. Conducting thorough research on each option will help you make informed decisions.

Creating a Secure Wallet

Once you’ve decided on a cryptocurrency to invest in, you’ll need a secure way to store it. This is where a cryptocurrency wallet comes into play. There are two main types of wallets:

- Hot Wallets: These are connected to the internet and are more convenient for frequent trading but can be more vulnerable to hacks.

- Cold Wallets: These are offline storage options that provide enhanced security against online threats.

Choosing the right wallet depends on your trading habits and security preferences. If you plan on holding your investments long-term, a cold wallet may be more suitable.

Making Your First Purchase

With your exchange account set up and wallet ready, you’re prepared to make your first purchase. Follow these steps:

1. Fund your exchange account using fiat currency (like USD or EUR).

2. Navigate to the trading section of the exchange.

3. Select the cryptocurrency you wish to purchase.

4. Decide how much you want to invest.

5. Place your buy order.

After completing your transaction, transfer your purchased cryptocurrency from the exchange to your wallet for safekeeping.

Setting an Investment Strategy

Having a clear investment strategy is crucial for success in cryptocurrency investing. Here are some strategies you might consider:

- HODLing: This strategy involves buying cryptocurrencies and holding onto them for an extended period regardless of market fluctuations.

- Trading: Active trading involves buying and selling cryptocurrencies based on market trends and price movements.

- Dollar-Cost Averaging (DCA): This strategy entails investing a fixed amount regularly over time, which can reduce the impact of volatility.

Regardless of the strategy you choose, it’s essential to stay informed about market trends and continuously evaluate your investment portfolio.

Risks Involved in Cryptocurrency Investment

Investing in cryptocurrencies comes with inherent risks that every investor should understand:

- Market Volatility: Cryptocurrency prices can change dramatically within short time frames.

- Regulatory Risks: Changes in regulations can impact the legality and value of certain cryptocurrencies.

- Security Risks: Exchanges can be hacked, leading to potential loss of funds.

- Lack of Consumer Protections: Unlike traditional investments, cryptocurrencies often lack regulatory protections.

Being aware of these risks will help you make informed decisions and manage your investments wisely.

Staying Informed

The cryptocurrency market is constantly evolving; staying informed about new developments is critical for successful investing. Follow reputable news sources, join online forums or communities, and engage with other investors to share insights and strategies.

Consider subscribing to newsletters or podcasts focused on cryptocurrency trends for ongoing education about market dynamics.

FAQs About How Can I Invest In Cryptocurrency

- What is the best way to start investing in cryptocurrency?

The best way is to choose a reputable exchange, create an account, select cryptocurrencies to invest in, and set up a secure wallet. - Is investing in cryptocurrency safe?

While there are security measures available, investing in cryptocurrency carries inherent risks due to market volatility and potential hacks. - How much money should I invest in cryptocurrency?

Your investment amount should depend on your financial situation, risk tolerance, and overall investment strategy. - Can I lose all my money investing in cryptocurrency?

Yes, due to high volatility; it is possible to incur significant losses when investing in cryptocurrencies. - What are altcoins?

Altcoins refer to any cryptocurrencies other than Bitcoin; they often have different features or use cases.

By following these guidelines and being aware of both opportunities and risks associated with cryptocurrency investments, you can navigate this exciting financial landscape effectively. Always remember that thorough research and strategic planning are key components of successful investing in this dynamic market.