Nvidia has emerged as a powerhouse in the technology sector, particularly known for its advancements in graphics processing units (GPUs) and its strategic investments in various companies. As the demand for artificial intelligence (AI) technologies continues to grow, Nvidia is not only focusing on its core business but also diversifying its portfolio through investments in several smaller AI firms. These investments are crucial for Nvidia as they align with its vision of being at the forefront of AI innovation.

Nvidia’s investment strategy is centered around enhancing its capabilities and expanding its market reach. By investing in companies that complement its technology, Nvidia aims to secure a competitive edge in the rapidly evolving tech landscape. This article will delve into the key companies Nvidia has invested in, the rationale behind these investments, and their potential impact on Nvidia’s future.

| Company | Focus Area |

|---|---|

| SoundHound AI | Voice recognition technology |

| Arm Holdings | Chip design and architecture |

| Recursion Pharmaceuticals | Drug discovery and development |

| Nano-X Imaging | Medical imaging technology |

| TuSimple Holdings | Autonomous trucking solutions |

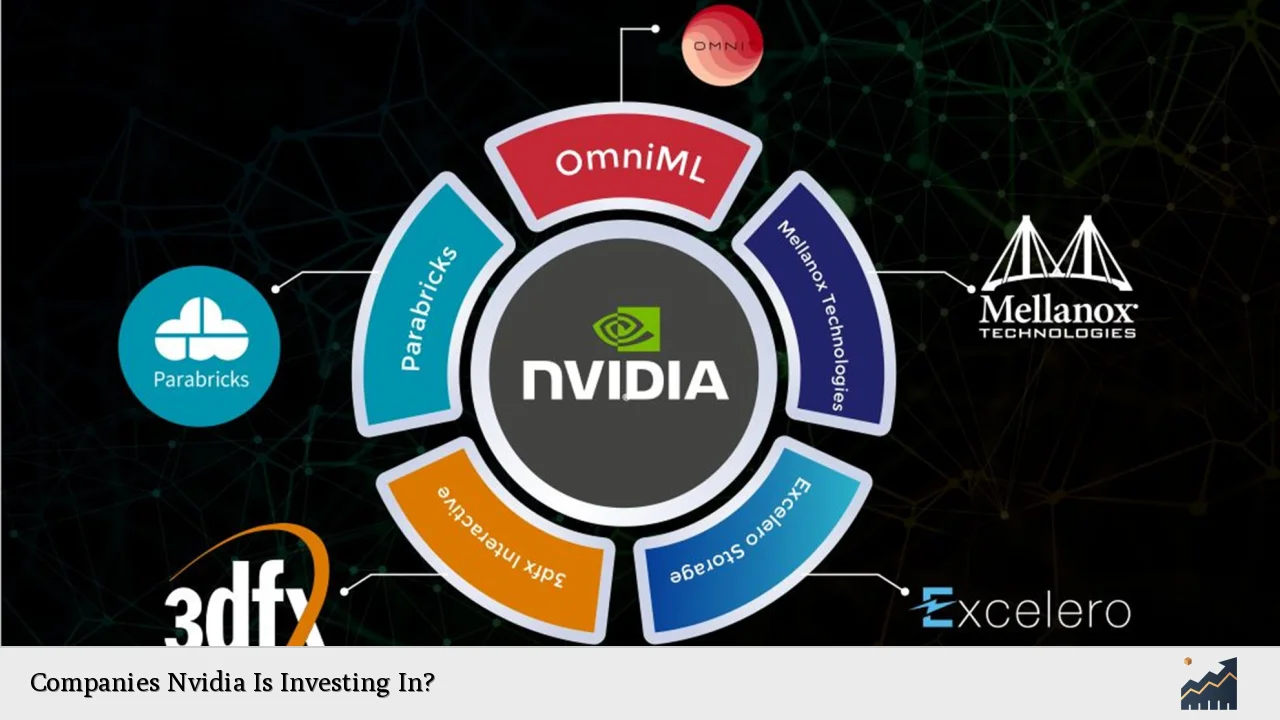

Overview of Nvidia’s Investment Strategy

Nvidia’s investment strategy is heavily focused on companies that are pioneers in AI and related technologies. The company’s approach involves identifying startups and established firms that can leverage Nvidia’s GPU technology to enhance their products and services. By investing in these companies, Nvidia not only secures potential revenue streams but also strengthens its position within the AI ecosystem.

The investments made by Nvidia reflect a broader trend in the tech industry where established companies are increasingly investing in startups to foster innovation and stay ahead of competition. This strategy allows Nvidia to tap into emerging technologies that could redefine industries, from healthcare to transportation.

Nvidia’s commitment to investing in AI-related companies is evident from its significant financial outlay. In 2024 alone, Nvidia reportedly invested $1 billion across various AI ventures, surpassing both Microsoft and Amazon in terms of deal volume. This aggressive investment strategy highlights Nvidia’s intention to maintain its leadership role in the AI space while also supporting the growth of smaller firms that can benefit from its technology.

Key Companies in Nvidia’s Portfolio

SoundHound AI

One of the notable companies that Nvidia has invested in is SoundHound AI, which specializes in voice recognition and natural language processing technologies. This investment aligns with the growing demand for voice-activated services across various applications, including smart devices and automotive systems.

SoundHound has demonstrated strong growth potential due to its innovative approach to voice recognition, making it a valuable addition to Nvidia’s portfolio. The collaboration between SoundHound and Nvidia could lead to enhanced voice interaction capabilities powered by advanced GPU processing.

Arm Holdings

Nvidia’s acquisition of Arm Holdings represents a strategic move aimed at enhancing its chip design capabilities. Arm is well-known for designing energy-efficient processors used widely in mobile devices and other applications. By integrating Arm’s technology with its own GPUs, Nvidia can create more powerful and efficient computing solutions.

This acquisition not only expands Nvidia’s product offerings but also positions it favorably against competitors who rely on Arm’s architecture. The synergies between Nvidia’s GPUs and Arm’s designs could lead to breakthroughs in various sectors, particularly in mobile computing and IoT devices.

Recursion Pharmaceuticals

Recursion Pharmaceuticals focuses on using AI to streamline drug discovery processes. By investing in Recursion, Nvidia aims to leverage its GPU technology to accelerate research and development in pharmaceuticals. This partnership could significantly reduce the time required to bring new drugs to market, addressing critical healthcare needs.

The integration of AI into drug discovery represents a transformative shift in how pharmaceuticals are developed, making this investment strategically important for both companies. As Recursion continues to innovate, it could provide substantial returns for Nvidia while contributing to advancements in healthcare.

Nano-X Imaging

Nano-X Imaging is another company that has caught Nvidia’s attention due to its innovative approach to medical imaging technology. By utilizing AI-driven imaging solutions, Nano-X aims to make medical imaging more accessible and efficient.

Nvidia’s investment can enhance Nano-X’s capabilities by providing access to high-performance computing resources necessary for processing complex imaging data. This collaboration could lead to significant improvements in diagnostic accuracy and patient care.

TuSimple Holdings

TuSimple Holdings specializes in autonomous trucking solutions, representing a critical area of growth within the transportation sector. As demand for automation increases, TuSimple’s focus on developing self-driving trucks aligns well with Nvidia’s vision of advancing AI technologies.

Nvidia’s investment supports TuSimple’s efforts to enhance safety and efficiency in logistics through autonomous vehicles. The partnership leverages Nvidia’s expertise in AI computing power, which is essential for developing reliable self-driving systems.

The Impact of Investments on Nvidia’s Growth

Nvidia’s strategic investments are set to play a crucial role in driving the company’s growth trajectory over the coming years. By aligning itself with innovative firms across various sectors, Nvidia can capitalize on emerging trends while diversifying its revenue streams.

The partnerships formed through these investments not only bolster Nvidia’s technological capabilities but also enhance its reputation as a leader in the AI space. As these companies grow and succeed, they will likely contribute positively to Nvidia’s financial performance through increased sales of GPUs and related technologies.

Additionally, as these startups mature and scale their operations, they may become significant customers of Nvidia’s products, creating a mutually beneficial ecosystem that fosters innovation while driving revenue growth for both parties involved.

Challenges and Considerations

While Nvidia’s investment strategy appears robust, it is not without challenges. The tech landscape is highly competitive, with numerous players vying for dominance in the AI sector. As larger companies like Microsoft and Google develop their own chips, smaller firms may face increased pressure.

Moreover, some of the companies within Nvidia’s portfolio are still considered speculative investments due to their early-stage development or market volatility. Investors must remain vigilant about monitoring these investments’ performance while assessing their risk tolerance.

Despite these challenges, Nvidia’s commitment to innovation and strategic partnerships positions it well for future growth. By continuously adapting its investment strategy based on market trends and technological advancements, Nvidia can maintain its leadership role within the tech industry.

FAQs About Companies Nvidia Is Investing In

- What types of companies does Nvidia invest in?

Nvidia primarily invests in AI-focused companies that complement its GPU technology. - How much did Nvidia invest in 2024?

Nvidia invested approximately $1 billion across various AI ventures. - What is the significance of SoundHound AI?

SoundHound specializes in voice recognition technology, aligning with growing demand for voice-activated services. - Why did Nvidia acquire Arm Holdings?

The acquisition enhances Nvidia’s chip design capabilities and strengthens its competitive position. - What role does TuSimple play in NVIDIA’s strategy?

TuSimple focuses on autonomous trucking solutions, which align with NVIDIA’s vision for advancing AI technologies.

In conclusion, Nvidia’s investments reflect a strategic approach aimed at enhancing its market position within the rapidly evolving tech landscape. By focusing on innovative companies across various sectors such as healthcare, automotive, and telecommunications, Nvidia not only secures potential revenue streams but also reinforces its commitment to driving forward the AI revolution. As these partnerships develop over time, they will likely yield substantial benefits for both Nvidia and the companies it supports.