Mergers and Acquisitions (M&A) investment banking represents a crucial segment of the financial services industry, providing advisory services to companies involved in the buying, selling, and merging of businesses. This specialized field not only facilitates transactions but also plays a vital role in shaping corporate strategy and market dynamics. Understanding why M&A investment banking is significant involves exploring its market trends, implementation strategies, risk considerations, regulatory aspects, and future outlook.

| Key Concept | Description/Impact |

|---|---|

| Market Demand | The demand for M&A advisory services has surged due to favorable economic conditions and increased corporate activity. |

| Revenue Growth | Investment banks are projected to see a 30% rise in advisory revenues in 2024, driven by a robust M&A environment. |

| Strategic Importance | M&A is often a key growth strategy for companies looking to enhance market share or enter new markets. |

| Regulatory Environment | Investment banks navigate complex regulations to ensure compliance during M&A transactions. |

| Technological Integration | The adoption of advanced technologies like AI and data analytics is transforming M&A processes, enhancing efficiency and decision-making. |

Market Analysis and Trends

The landscape of M&A investment banking is continuously evolving. Recent data indicates that the global investment banking market is projected to grow from $131.25 billion in 2023 to $142.16 billion in 2024, with a compound annual growth rate (CAGR) of 8.3%. This growth is attributed to several factors:

- Economic Recovery: Following a period of economic uncertainty, businesses are increasingly looking to mergers and acquisitions as a means of growth. The anticipated interest rate cuts by the Federal Reserve are expected to further stimulate M&A activity as companies seek to capitalize on lower borrowing costs.

- Private Equity Activity: A significant amount of capital is held by private equity firms, which are actively seeking acquisition targets. As many firms approach the end of their investment cycles, they are more likely to divest assets, creating opportunities for strategic buyers.

- Sector-Specific Trends: Certain sectors, such as technology and healthcare, are experiencing heightened M&A activity due to rapid innovation and consolidation pressures. For instance, technology firms are increasingly acquiring startups to bolster their capabilities in areas like artificial intelligence and cloud computing.

Implementation Strategies

Successful M&A transactions require careful planning and execution. Key strategies include:

- Due Diligence: Conducting thorough due diligence is essential for identifying potential risks associated with an acquisition. This involves analyzing financial statements, legal contracts, and operational performance metrics.

- Valuation Techniques: Investment bankers use various valuation methods—such as discounted cash flow analysis (DCF), comparable company analysis (comps), and precedent transactions—to determine the fair value of target companies.

- Negotiation Skills: Effective negotiation can significantly impact the terms of a deal. Investment bankers must balance the interests of both buyers and sellers while striving for a favorable outcome for their clients.

- Post-Merger Integration: After a deal closes, integrating the two organizations is critical for realizing synergies. This includes aligning corporate cultures, systems, and operational processes.

Risk Considerations

M&A transactions inherently carry risks that must be managed effectively:

- Market Risk: Fluctuations in market conditions can affect deal valuations and financing options. Investment banks must stay attuned to macroeconomic indicators that could impact transaction success.

- Regulatory Risk: Compliance with antitrust laws and other regulatory requirements is paramount. Failure to address these issues can lead to delays or even cancellations of deals.

- Operational Risk: Post-merger integration challenges can arise if there are cultural mismatches or operational inefficiencies between merging entities. Investment banks often assist with change management strategies to mitigate these risks.

Regulatory Aspects

The regulatory environment surrounding M&A transactions has become increasingly complex:

- Antitrust Regulations: Regulatory bodies like the Federal Trade Commission (FTC) scrutinize mergers that may reduce competition within industries. Investment banks play a crucial role in ensuring that their clients meet these requirements by conducting antitrust analyses.

- Disclosure Requirements: Companies involved in M&A must adhere to strict disclosure norms set by regulatory authorities such as the Securities and Exchange Commission (SEC). This includes providing accurate financial information and material facts regarding the transaction.

- International Regulations: For cross-border transactions, understanding foreign regulations is essential. Different jurisdictions may impose varying requirements that could affect deal structuring and execution.

Future Outlook

Looking ahead, several trends are expected to shape the future of M&A investment banking:

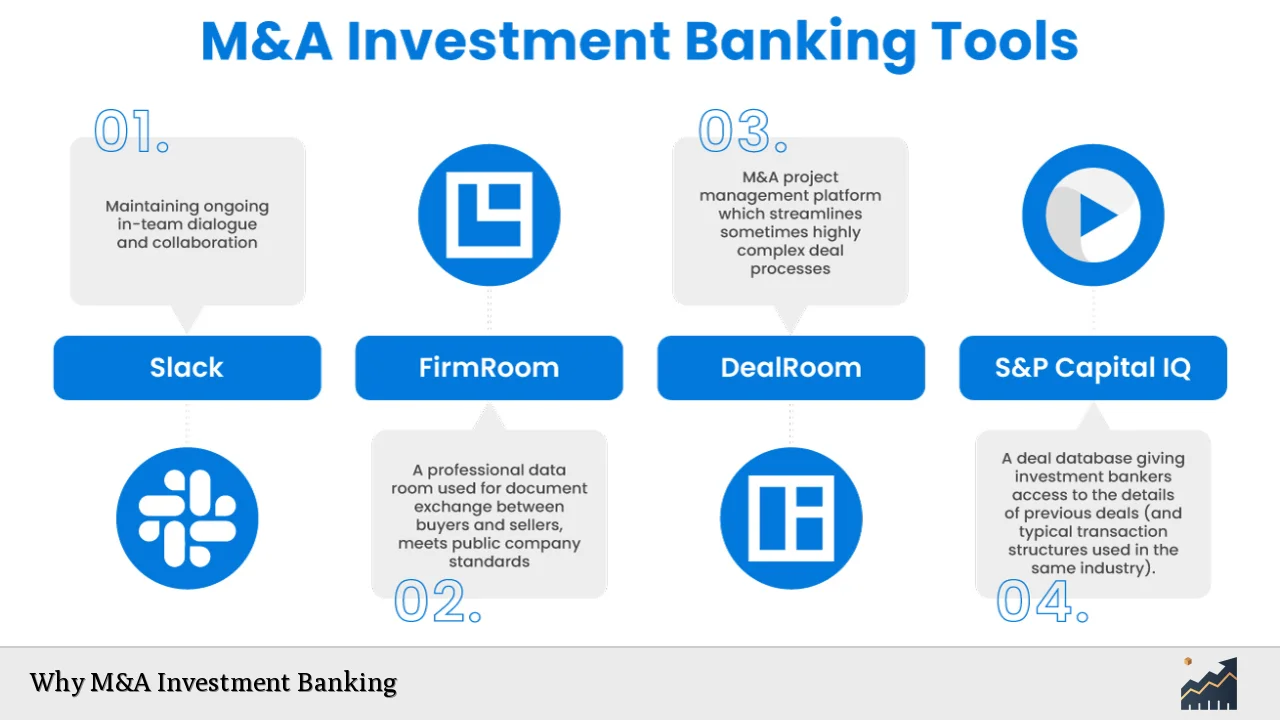

- Increased Use of Technology: The integration of technology into M&A processes will continue to grow. Investment banks are adopting tools such as artificial intelligence for predictive analytics and data management systems for enhanced due diligence processes.

- Focus on ESG Factors: Environmental, Social, and Governance (ESG) considerations are becoming integral to investment decisions. Companies are increasingly seeking acquisitions that align with sustainable practices and ethical governance.

- Globalization of Markets: As markets become more interconnected, cross-border M&A activity is likely to rise. Investment banks will need to navigate diverse regulatory environments while identifying global opportunities for their clients.

Frequently Asked Questions About Why M&A Investment Banking

- What is the primary role of an investment bank in an M&A transaction?

Investment banks serve as intermediaries that advise companies on mergers and acquisitions by providing valuation services, conducting due diligence, negotiating terms, and facilitating the overall transaction process. - How do investment banks determine the value of a company?

Investment banks utilize various valuation methods including discounted cash flow analysis (DCF), comparable company analysis (comps), and precedent transactions to arrive at an accurate valuation. - What are some common challenges faced during post-merger integration?

Common challenges include aligning corporate cultures, integrating IT systems, managing employee expectations, and realizing expected synergies between merging organizations. - How do regulatory bodies impact M&A transactions?

Regulatory bodies enforce antitrust laws and other regulations that can affect whether a merger or acquisition proceeds; compliance with these regulations is critical for successful transactions. - What trends are currently influencing M&A activity?

Current trends include increased private equity involvement, technological advancements in deal processes, heightened focus on ESG factors, and favorable economic conditions supporting corporate growth through acquisitions. - Why is due diligence important in M&A?

Due diligence helps identify potential risks associated with an acquisition by thoroughly examining financial records, legal obligations, operational capabilities, and market conditions before finalizing a deal. - What skills are essential for success in M&A investment banking?

Essential skills include strong analytical abilities for valuation assessments, negotiation skills for deal-making discussions, project management capabilities for overseeing complex transactions, and knowledge of regulatory compliance. - How does technology influence modern M&A processes?

Technology enhances efficiency through tools like AI for data analysis during due diligence phases; it also streamlines communication between parties involved in transactions.

Investment banking’s role in mergers and acquisitions continues to evolve amidst changing market dynamics. By understanding these elements—market trends, strategic implementation approaches, risk management practices, regulatory frameworks, and future directions—investors can better navigate this complex landscape.