The decision to pursue a career in investment banking is often driven by a combination of personal ambition, the desire for professional growth, and the appeal of working in a dynamic and challenging environment. Investment banking offers a unique opportunity to engage with high-profile financial transactions, develop critical analytical skills, and build a robust professional network. As the industry continues to evolve, understanding the motivations behind choosing this path becomes essential for aspiring bankers and recruiters alike.

| Key Concept | Description/Impact |

|---|---|

| Skill Development | Investment banking provides rigorous training in financial modeling, valuation techniques, and analytical skills, essential for career advancement in finance. |

| Career Opportunities | The investment banking sector serves as a launchpad for various lucrative exit opportunities in private equity, hedge funds, and corporate finance. |

| Networking | Working alongside talented professionals fosters relationships that can lead to future collaborations and career advancements. |

| Dynamic Environment | The fast-paced nature of investment banking ensures that no two days are alike, appealing to those who thrive on challenge and variety. |

| Financial Rewards | Investment banking roles often come with competitive salaries and bonuses, reflecting the demanding nature of the work. |

| Exposure to High-Profile Transactions | Investment bankers frequently work on significant mergers and acquisitions (M&A), gaining insights into major corporate strategies. |

| Global Perspective | The international scope of investment banking allows professionals to engage with diverse markets and cultures. |

Market Analysis and Trends

The investment banking industry is currently experiencing significant growth, driven by various factors including economic recovery, increasing mergers and acquisitions (M&A), and a resurgence in capital markets activity. According to recent projections, the investment banking market size is expected to grow from $131.25 billion in 2023 to $142.16 billion in 2024, reflecting a compound annual growth rate (CAGR) of 8.3%.

Current Market Dynamics

- M&A Activity: The first half of 2024 has seen a notable increase in M&A deals, with expectations for continued activity as economic conditions stabilize. Major banks are poised for a 30% rise in advisory and underwriting revenues due to this uptick.

- Job Growth: The U.S. Bureau of Labor Statistics projects a 7% growth rate for investment banking jobs from 2022 to 2032, indicating robust demand for skilled professionals.

- Technological Integration: Investment banks are increasingly leveraging technology for data analytics and operational efficiency. This trend is reshaping recruitment strategies as firms seek candidates with strong technical skills.

Implementation Strategies

To successfully navigate a career in investment banking, candidates should adopt several key strategies:

- Education and Skill Acquisition: Pursuing relevant degrees (e.g., finance, economics) and obtaining certifications (e.g., CFA) can enhance employability.

- Internships: Gaining practical experience through internships at reputable financial institutions provides invaluable insights into the industry.

- Networking: Building connections within the industry can open doors to job opportunities and mentorship.

- Continuous Learning: Staying updated on market trends, regulatory changes, and technological advancements is crucial for long-term success.

Risk Considerations

Investment banking is not without its risks. Professionals must be aware of:

- Market Volatility: Fluctuations in market conditions can impact deal flow and profitability.

- Regulatory Compliance: Adhering to stringent regulations is essential to avoid legal repercussions. Investment banks face ongoing scrutiny from regulatory bodies.

- Operational Risks: Internal failures or human errors can lead to significant financial losses. Effective risk management frameworks are necessary to mitigate these risks.

Regulatory Aspects

The regulatory landscape for investment banks is evolving, particularly in response to global economic changes. Key considerations include:

- Capital Requirements: Investment banks must comply with capital adequacy standards set by regulatory authorities like the SEC.

- Cross-Border Regulations: As firms operate globally, understanding different jurisdictions’ regulations is critical for compliance.

- Emerging Regulations: New regulations concerning digital assets and sustainable finance are gaining traction, requiring banks to adapt their practices accordingly.

Future Outlook

Looking ahead, the investment banking sector is expected to continue its upward trajectory:

- Sustained Growth: Projections indicate that the market could reach $194.05 billion by 2028, driven by ongoing M&A activity and increased demand for advisory services.

- Technological Advancements: The integration of AI and machine learning will likely enhance efficiency in deal-making processes.

- Focus on Sustainability: As ESG principles gain prominence, investment banks will need to incorporate sustainable practices into their operations.

Frequently Asked Questions About Why Do You Want To Work In Investment Banking

- What skills are essential for success in investment banking?

Key skills include financial modeling, analytical thinking, proficiency in Excel, strong communication abilities, and a solid understanding of corporate finance. - How important is networking in investment banking?

Networking is crucial as it helps build relationships that can lead to job opportunities and collaborations throughout your career. - What are common exit opportunities after working in investment banking?

Common exit opportunities include roles in private equity, hedge funds, corporate finance positions, venture capital firms, or starting one’s own business. - What challenges do investment bankers face?

The main challenges include long working hours, high-pressure environments, market volatility, and stringent regulatory requirements. - Is prior experience necessary for entry-level positions?

No formal experience is typically required; however, internships or relevant coursework can significantly enhance your application. - How does one prepare for an investment banking interview?

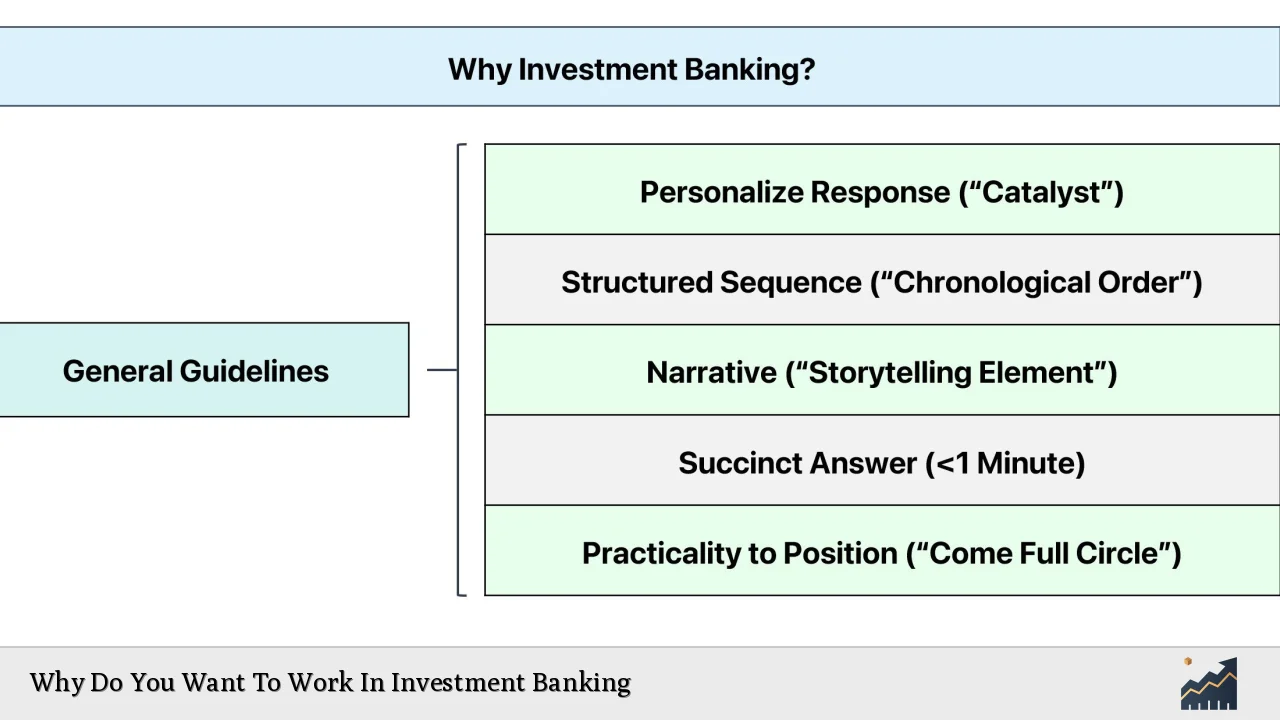

Candidates should familiarize themselves with technical concepts related to finance and practice behavioral interview questions that highlight their motivations and skills. - What role does technology play in modern investment banking?

Technology enhances efficiency through automation of processes such as data analysis and financial modeling while also enabling better risk management practices. - What is the typical career progression in investment banking?

The typical progression starts from analyst roles moving up to associate positions before advancing to vice president (VP), director, and eventually managing director levels.

In conclusion, pursuing a career in investment banking offers numerous benefits including skill development, lucrative compensation packages, exposure to high-profile transactions, and extensive networking opportunities. However, aspirants must be prepared for the challenges that accompany this demanding field while staying abreast of market trends and regulatory changes.