Investment banking is a dynamic and multifaceted sector that attracts individuals for various reasons, from the allure of high financial rewards to the intellectual challenges presented by complex financial transactions. This field serves as a critical intermediary in the capital markets, facilitating mergers and acquisitions (M&A), underwriting new debt and equity securities, and providing advisory services for corporate finance decisions. Understanding the motivations behind pursuing a career in investment banking can provide valuable insights into the industry’s appeal and its evolving landscape.

| Key Concept | Description/Impact |

|---|---|

| High Earning Potential | Investment banking is known for its lucrative compensation packages, often including base salaries, bonuses, and stock options. Entry-level analysts can earn between $80,000 to $100,000 annually, with potential total compensation exceeding $150,000 after bonuses. |

| Intellectual Challenge | The complexity of financial transactions offers a steep learning curve. Analysts engage in rigorous financial modeling, valuation techniques, and strategic analysis, which enhances their analytical skills and business acumen. |

| Career Advancement Opportunities | Investment banking provides a clear career progression path. Success as an analyst can lead to promotions to associate and beyond, with increased responsibilities and compensation at each level. |

| Networking and Relationship Building | Professionals in investment banking work closely with clients from various industries, allowing them to build a robust professional network that can be invaluable throughout their careers. |

| Diverse Work Environment | The fast-paced nature of investment banking fosters a diverse environment where professionals collaborate on high-stakes projects across multiple sectors. |

Market Analysis and Trends

The investment banking sector is currently experiencing significant growth driven by several key factors:

- Economic Recovery: Following the disruptions caused by the COVID-19 pandemic, global economies are rebounding. The World Bank forecasts a global GDP growth of 2.7% in 2024, which is expected to bolster corporate investments and M&A activities.

- M&A Activity: Major investment banks are anticipating a 30% rise in advisory and underwriting revenues in 2024 due to increased M&A activity. This surge is attributed to pent-up demand from private equity firms looking to capitalize on favorable market conditions.

- Technological Advancements: The integration of artificial intelligence (AI) and data analytics is transforming how investment banks operate. Firms leveraging these technologies can enhance decision-making processes and improve client service outcomes.

- Sustainable Finance: There is a growing emphasis on environmental, social, and governance (ESG) criteria within investment strategies. Investment banks are increasingly incorporating sustainable finance into their offerings to meet investor demand for socially responsible investments.

Implementation Strategies

To succeed in investment banking, aspiring professionals should consider the following strategies:

- Education and Skills Development: A strong foundation in finance, economics, or related fields is essential. Pursuing internships during college can provide practical experience that enhances employability.

- Networking: Building relationships with professionals already in the industry can offer insights into the job market and potential opportunities. Attending industry conferences or joining finance-related clubs can facilitate these connections.

- Continuous Learning: The financial landscape is constantly evolving. Keeping abreast of market trends, regulatory changes, and technological advancements through ongoing education—such as certifications or advanced degrees—can provide a competitive edge.

- Adaptability: As the industry shifts towards digital solutions and sustainable practices, being open to change and willing to learn new technologies will be crucial for long-term success.

Risk Considerations

Investment banking involves inherent risks that professionals must navigate:

- Market Volatility: Economic downturns can significantly impact deal flow and revenue generation. Investment bankers must be adept at managing risk during uncertain times.

- Regulatory Compliance: The financial sector is heavily regulated. Staying informed about compliance requirements is essential to avoid legal repercussions that can arise from non-compliance.

- Reputation Management: The nature of investment banking requires maintaining a strong reputation among clients and within the industry. Missteps or ethical breaches can have lasting consequences on career trajectories.

Regulatory Aspects

Investment banks operate under strict regulatory frameworks designed to protect investors and maintain market integrity:

- Securities Exchange Commission (SEC): In the U.S., the SEC regulates securities transactions to ensure transparency and fairness in the markets.

- Basel III: This international regulatory framework sets standards for bank capital adequacy, stress testing, and market liquidity risk management.

- Dodd-Frank Act: Enacted after the 2008 financial crisis, this legislation aims to reduce risks in the financial system by increasing transparency in derivatives markets and imposing stricter capital requirements on banks.

Understanding these regulations is vital for investment bankers as they navigate complex transactions while ensuring compliance with legal standards.

Future Outlook

The future of investment banking appears promising yet challenging:

- Growth Projections: The global investment banking market is projected to grow from $131.25 billion in 2023 to $142.16 billion in 2024, reflecting an 8.3% compound annual growth rate (CAGR). By 2028, it could reach $194.05 billion.

- Technological Integration: As digital transformation continues, firms that successfully adopt AI-driven solutions will likely outperform competitors who lag behind.

- Focus on Private Capital Markets: With traditional funding sources becoming more competitive, there is an increasing shift towards private equity and alternative financing options.

- Geopolitical Factors: Ongoing geopolitical tensions may influence market dynamics; however, economic recovery trends suggest resilience within the sector.

Frequently Asked Questions About Why Are You Interested In Investment Banking

- What skills are essential for success in investment banking?

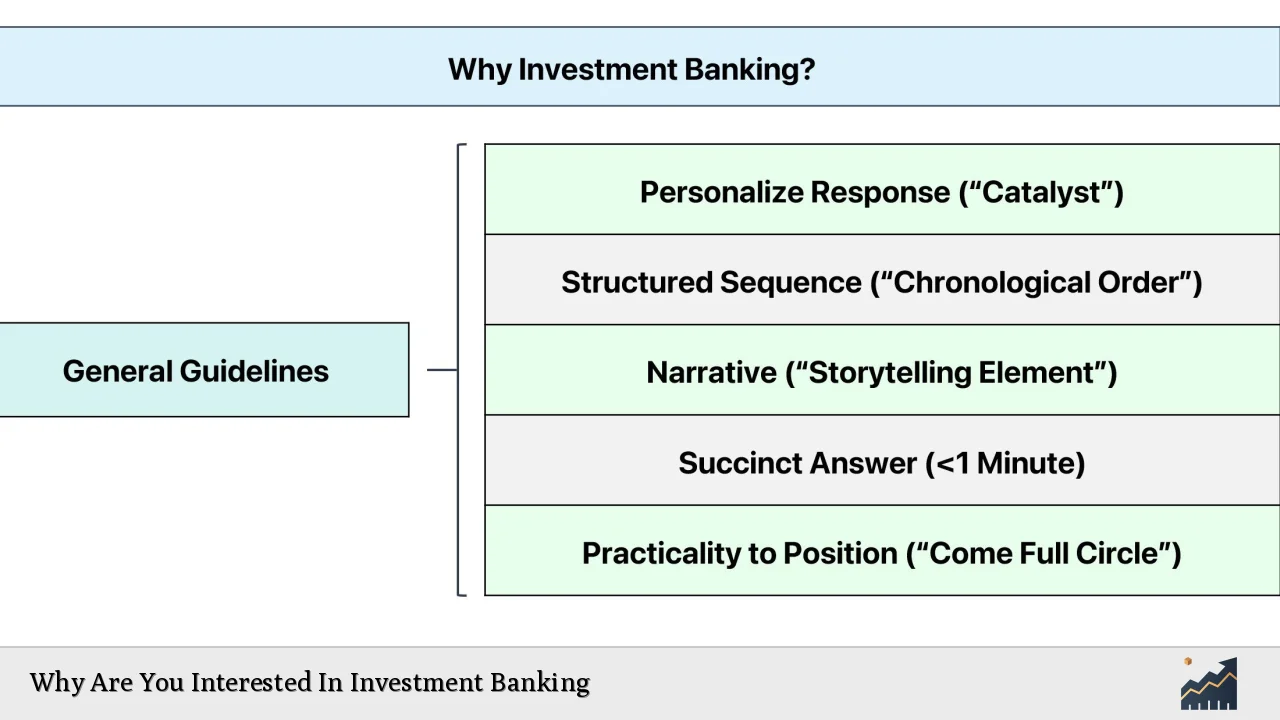

Key skills include analytical thinking, proficiency in financial modeling, strong communication abilities, attention to detail, and adaptability to fast-paced environments. - How do I prepare for an investment banking interview?

Preparation involves understanding technical concepts such as valuation methods, familiarizing yourself with current market trends, practicing behavioral questions, and being able to articulate your interest in the field. - What are typical career paths within investment banking?

Common career paths include Analyst → Associate → Vice President → Director → Managing Director. - What are the biggest challenges faced by investment bankers?

Challenges include managing high-stress environments, meeting tight deadlines on complex deals, navigating regulatory requirements, and maintaining work-life balance. - Is it necessary to have an MBA for a career in investment banking?

An MBA can enhance your prospects but is not strictly necessary; relevant experience and strong academic credentials can also lead to opportunities. - How does networking influence success in this field?

A strong professional network can open doors to job opportunities, mentorships, and insights about industry trends that are crucial for career advancement. - What role does technology play in modern investment banking?

Technology enhances efficiency through automation of processes like trading and compliance checks while also providing tools for data analysis that support decision-making. - What impact do economic conditions have on investment banking?

Evolving economic conditions directly affect deal flow; robust economies typically see increased M&A activity while downturns may lead to reduced transactions.

Investment banking remains an appealing career choice due to its potential for high earnings, intellectual challenges, opportunities for rapid advancement, and dynamic work environment. As the industry evolves with technological advancements and changing market demands, professionals must remain agile and informed to thrive in this competitive field.