In the complex landscape of financial markets, regulatory bodies play a crucial role in ensuring the integrity, transparency, and efficiency of investment activities. Understanding who regulates these markets is essential for individual investors, finance professionals, and anyone interested in the investment landscape. This article delves into the various regulatory agencies involved in overseeing markets where investments are traded, their functions, and the implications for market participants.

| Key Concept | Description/Impact |

|---|---|

| Securities and Exchange Commission (SEC) | The SEC is the primary federal regulator overseeing securities markets in the U.S. It enforces laws against market manipulation and fraud, regulates securities exchanges, and requires public companies to disclose financial information. |

| Financial Industry Regulatory Authority (FINRA) | As a self-regulatory organization (SRO), FINRA oversees brokerage firms and exchange markets. It establishes rules for fair trading practices and protects investors by ensuring that brokers adhere to ethical standards. |

| Commodity Futures Trading Commission (CFTC) | The CFTC regulates the U.S. derivatives markets, including futures and options. It aims to protect market participants from fraud, manipulation, and abusive practices related to derivatives trading. |

| Federal Reserve System (Fed) | The Fed plays a critical role in regulating banks and maintaining monetary stability. Its policies indirectly influence investment markets through interest rate adjustments and monetary policy decisions. |

| Office of the Comptroller of the Currency (OCC) | The OCC charters, regulates, and supervises all national banks and federal savings associations. It ensures that these institutions operate safely and soundly while complying with applicable laws. |

| State Securities Regulators | Each state has its own securities regulator that enforces state securities laws, which may include registration requirements for securities offerings and oversight of local investment advisers. |

Market Analysis and Trends

The regulatory environment for investment markets is continuously evolving, influenced by economic conditions, technological advancements, and regulatory reforms. As of 2024, several key trends are shaping the landscape:

- Increased Regulatory Scrutiny: Following a series of high-profile market disruptions, regulatory bodies have ramped up enforcement actions against firms that fail to comply with existing laws. The SEC’s aggressive rulemaking agenda under Chair Gary Gensler has introduced significant changes affecting investment managers and financial institutions.

- Technological Integration: The rise of fintech has transformed how investments are traded. Regulatory frameworks are adapting to include guidelines for algorithmic trading and digital assets such as cryptocurrencies.

- Global Regulatory Coordination: With financial markets becoming increasingly interconnected, international cooperation among regulators is essential. Initiatives like the Financial Stability Oversight Council (FSOC) aim to address systemic risks that transcend national borders.

Current statistics highlight these trends:

- The global equity market reached an all-time high of approximately $78.4 trillion as of mid-2024, reflecting a nearly 10% increase from December 2023.

- Initial public offerings (IPOs) have seen a decline in activity due to market volatility; global IPO activity dropped by 19.4% in H1 2024 compared to H1 2023.

Implementation Strategies

To navigate the regulatory landscape effectively, investment firms should adopt comprehensive compliance strategies:

- Regular Compliance Audits: Firms must conduct periodic audits to ensure adherence to regulations set forth by agencies like the SEC and FINRA. This includes reviewing internal controls and risk management practices.

- Training Programs: Continuous education for employees on compliance requirements is vital. Training should cover topics such as anti-money laundering (AML) regulations, cybersecurity measures, and ethical trading practices.

- Technology Utilization: Leveraging technology can enhance compliance efforts. Automated systems can track regulatory changes and ensure timely reporting to relevant authorities.

Risk Considerations

Investors must be aware of various risks associated with regulatory compliance:

- Regulatory Risks: Non-compliance can lead to severe penalties, including fines or revocation of licenses. Firms must stay updated on evolving regulations to mitigate this risk.

- Market Risks: Changes in regulations can impact market dynamics. For instance, stricter trading rules may reduce liquidity or alter trading strategies.

- Operational Risks: Implementing new compliance measures may strain resources or disrupt existing processes. Firms should plan for potential operational challenges when adapting to new regulations.

Regulatory Aspects

Understanding the roles of key regulatory bodies is crucial for market participants:

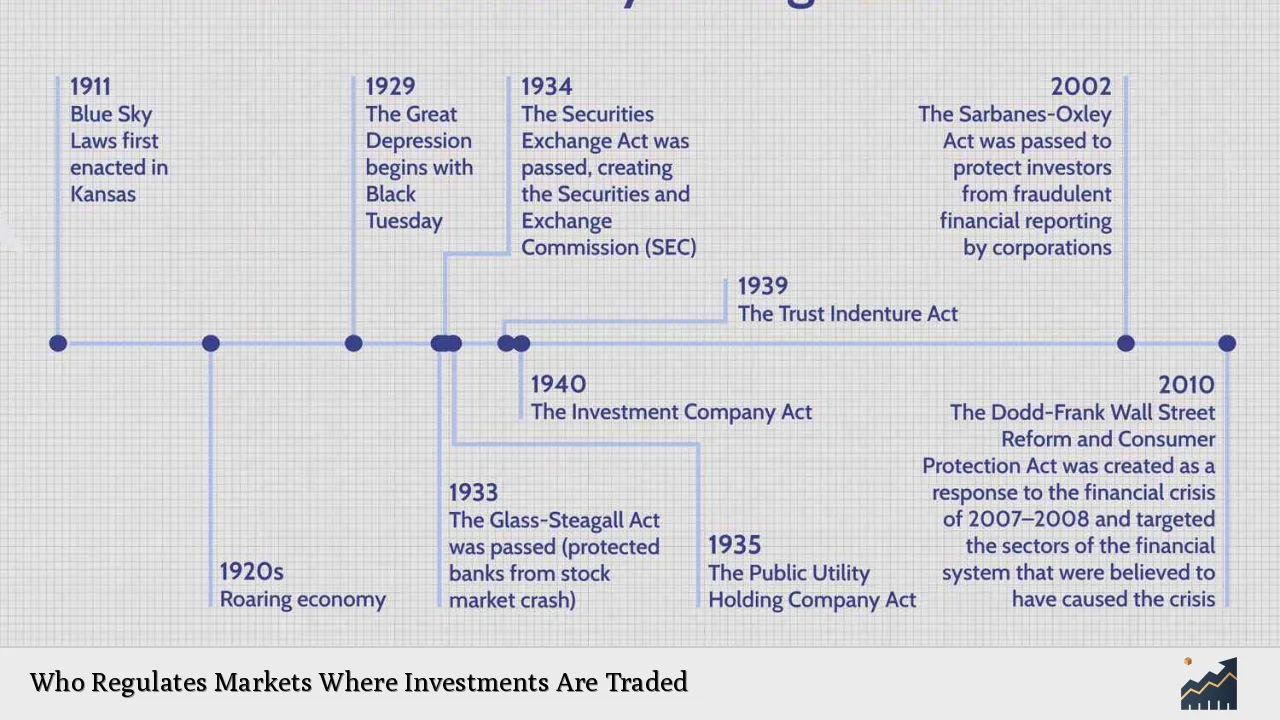

- Securities and Exchange Commission (SEC): Established in 1934, the SEC regulates securities transactions to protect investors from fraud. It oversees exchanges like the New York Stock Exchange (NYSE) and NASDAQ.

- Financial Industry Regulatory Authority (FINRA): As an SRO, FINRA ensures that brokerage firms operate fairly and transparently. It enforces rules governing broker-dealer conduct.

- Commodity Futures Trading Commission (CFTC): The CFTC oversees futures contracts and options markets. Its mission includes protecting market participants from fraud while promoting competitive trading practices.

Future Outlook

Looking ahead, several factors will shape the regulatory landscape:

- Continued Emphasis on Investor Protection: Expect regulators to prioritize investor protection measures amid rising concerns about market manipulation and fraud.

- Adaptation to Technological Changes: As technology continues to evolve rapidly, regulators will need to develop frameworks that address new financial products while fostering innovation.

- Global Collaboration: The interconnectedness of global markets will necessitate enhanced collaboration among international regulatory bodies to manage systemic risks effectively.

Frequently Asked Questions About Who Regulates Markets Where Investments Are Traded

- What is the role of the SEC?

The SEC regulates securities markets in the U.S., enforcing laws against fraud and requiring public companies to disclose financial information. - How does FINRA protect investors?

FINRA oversees brokerage firms’ conduct, ensuring fair trading practices and protecting investors through its rules. - What does the CFTC regulate?

The CFTC regulates futures contracts and options markets to prevent fraud and promote competitive trading practices. - Why is regulatory compliance important?

Compliance helps firms avoid penalties while ensuring fair treatment of investors and maintaining market integrity. - How do state regulators differ from federal regulators?

State regulators enforce state-specific securities laws while federal regulators oversee broader national standards. - What impact does technology have on regulation?

Technology introduces new challenges for regulators but also offers tools for better compliance monitoring. - What should firms do if they fail a compliance audit?

Firms should address identified issues promptly by implementing corrective actions and enhancing their compliance programs. - How can investors stay informed about regulatory changes?

Investors can follow updates from regulatory bodies like the SEC or subscribe to industry news sources for timely information.

This comprehensive overview highlights the critical role of various regulatory bodies in overseeing investment markets. Understanding these dynamics is essential for navigating today’s complex financial landscape effectively.