Silicon Valley Bank (SVB), renowned for its deep ties to the technology and healthcare sectors, has made significant investments through its venture capital arm, SVB Capital. This entity manages a portfolio of approximately $9.5 billion, focusing on both direct investments in startups and commitments to other venture capital funds. SVB’s investment strategy primarily targets high-growth companies within the technology, life sciences, and healthcare sectors, reflecting its commitment to fostering innovation in these areas.

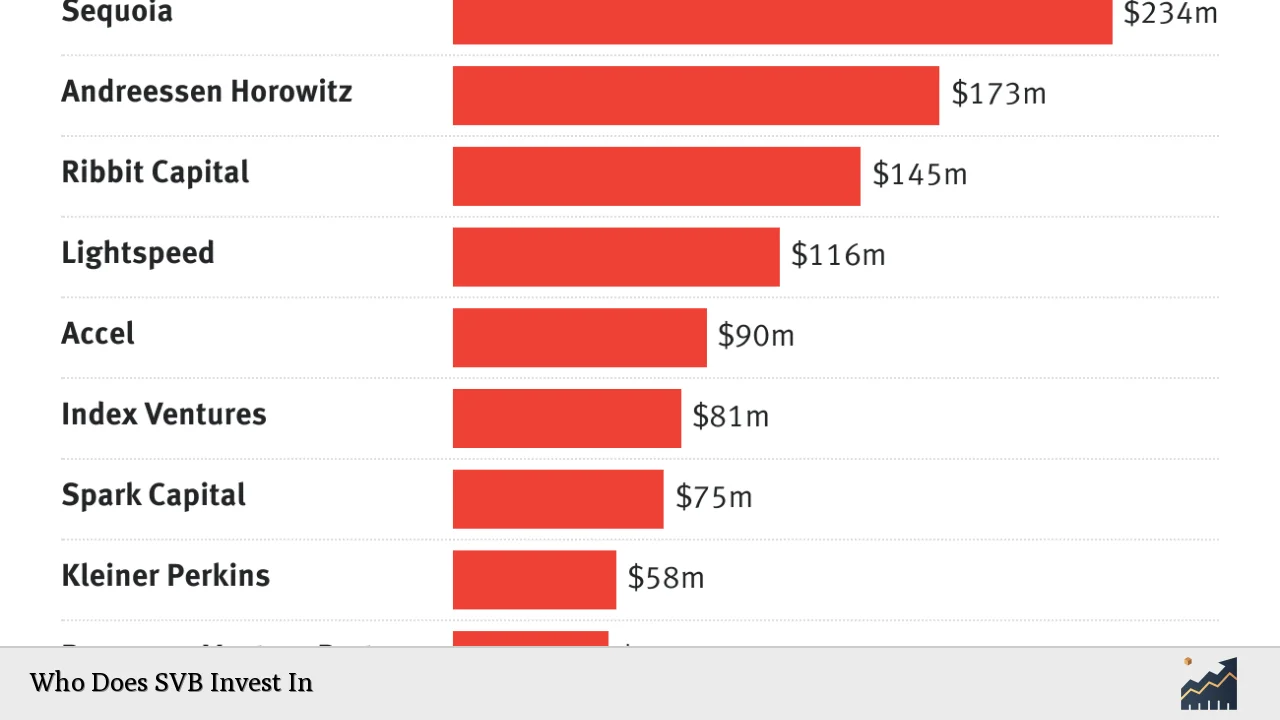

The bank’s investment approach is characterized by its partnerships with leading venture capital firms such as Sequoia Capital and Andreessen Horowitz. These relationships not only enhance SVB’s access to promising startups but also align its interests with some of the most successful investors in the industry. As of early 2022, SVB had invested significant sums into these firms, including $234 million in Sequoia and $173 million in Andreessen Horowitz funds. Additionally, SVB Capital has a notable focus on fintech through investments in firms like Ribbit Capital.

| Key Concept | Description/Impact |

|---|---|

| Investment Focus | SVB primarily invests in technology and healthcare sectors, targeting high-growth startups. |

| Partnerships | Collaborations with top VC firms like Sequoia Capital enhance access to lucrative investment opportunities. |

| Venture Capital Funds | SVB manages several funds that invest in other VC firms, diversifying its investment strategy. |

| Market Concentration | Heavy reliance on tech and healthcare sectors makes SVB vulnerable to market fluctuations. |

| Recent Trends | The healthcare sector has shown signs of recovery in VC fundraising, indicating potential growth opportunities. |

Market Analysis and Trends

The landscape of venture capital investing has evolved significantly over the past few years, particularly within the sectors that SVB focuses on. In 2021, venture capital activity surged, driven by low interest rates and a booming tech sector. However, as interest rates began to rise in 2022, there was a marked slowdown in investment activity across the board. This shift has forced investors to reassess their strategies and focus on profitability rather than growth at all costs.

Current Market Statistics

- Venture Capital Fundraising: In the first half of 2024, the healthcare sector alone raised approximately $20 billion in venture capital, signaling a stabilization after previous downturns.

- Investment Focus: Approximately 50% of SVB Capital’s direct investments are concentrated in technology, media, and telecommunications sectors.

- Economic Indicators: The Federal Reserve’s recent rate cuts have created a more favorable environment for fixed-income investments, which may influence future funding strategies for banks like SVB.

Implementation Strategies

SVB employs several strategies to optimize its investment outcomes:

- Diversification: By investing across multiple funds and sectors, SVB mitigates risks associated with market volatility.

- Focus on Early-Stage Investments: SVB often targets early-stage companies that show potential for rapid growth, particularly in innovative fields such as biotech and fintech.

- Active Management: The bank maintains an active role in managing its investments through ongoing support for portfolio companies, including strategic guidance and access to networks.

Risk Considerations

Investing heavily in specific sectors like technology and healthcare presents unique risks:

- Market Volatility: The tech sector is known for rapid changes; downturns can significantly impact valuations.

- Liquidity Risks: A high percentage of SVB’s deposits are uninsured (approximately 94% as of late 2022), exposing it to liquidity challenges during economic downturns.

- Regulatory Changes: Shifts in regulatory frameworks can impact investment strategies and operational capabilities.

Regulatory Aspects

SVB operates under a unique regulatory environment due to its focus on venture capital:

- Capital Requirements: As a Tier IV bank, SVB is subject to different regulatory standards compared to larger institutions. This has implications for how it manages capital and liquidity.

- Supervisory Oversight: Recent failures highlighted weaknesses in oversight practices that could lead to stricter regulations for banks with similar business models.

Future Outlook

Looking ahead, several trends are likely to shape SVB’s investment strategy:

- Increased Focus on Profitability: As the market stabilizes post-pandemic, there will be a shift towards sustainable growth models rather than aggressive expansion.

- Emergence of New Technologies: Areas such as artificial intelligence and renewable energy are expected to attract significant investment as they become more mainstream.

- Global Market Dynamics: Economic conditions will continue to influence investor sentiment; thus, SVB may need to adapt its strategies to align with global trends.

Frequently Asked Questions About Who Does SVB Invest In

- What sectors does SVB primarily invest in?

SVB mainly focuses on technology and healthcare sectors, particularly startups that demonstrate high growth potential. - How does SVB manage risk?

SVB employs diversification strategies across different funds and sectors while actively managing its portfolio companies. - What is the significance of SVB’s partnerships with other VC firms?

These partnerships enhance access to promising startups and align interests with successful investors. - How has recent economic data affected SVB’s investment strategy?

The rise in interest rates has prompted a reevaluation of investment strategies towards profitability rather than just growth. - What role does regulatory compliance play in SVB’s operations?

Regulatory requirements impact how SVB manages capital and liquidity risks associated with its concentrated business model. - How does market volatility affect SVB’s investments?

Market fluctuations can significantly impact valuations within the tech sector where many of SVB’s investments are concentrated. - What is the future outlook for SVB’s investments?

The outlook suggests a focus on profitability and adaptation to emerging technologies as key drivers for future investments. - What challenges does SVB face moving forward?

The bank faces challenges related to market volatility, liquidity risks due to uninsured deposits, and potential regulatory changes.

This comprehensive analysis highlights the strategic positioning of Silicon Valley Bank within the venture capital landscape while addressing current market trends and future outlooks. Investors should remain vigilant about the evolving economic conditions that could impact their investment decisions related to SVB.