Investment is a fundamental concept in economics, often misunderstood in its application and implications. Economists typically define investment as the allocation of resources towards the production of goods and services that will enhance future economic productivity. This definition contrasts with the more colloquial understanding of investment, which often includes financial investments such as stocks and bonds. In this article, we will explore what constitutes an investment from an economic perspective, analyze current market trends, and provide insights into implementation strategies, risk considerations, regulatory aspects, and future outlook.

| Key Concept | Description/Impact |

|---|---|

| Physical Capital Investment | Investment in tangible assets like machinery, buildings, and infrastructure that directly increase productive capacity. |

| Human Capital Investment | Investment in education and training that enhances the skills and productivity of the workforce. |

| Financial Investment | Purchase of financial assets (stocks, bonds) that do not directly contribute to productive capacity but provide capital for businesses. |

| Public Investment | Government spending on infrastructure projects that stimulate economic growth and job creation. |

| Foreign Direct Investment (FDI) | Investment made by a company or individual in one country in business interests in another country, contributing to global economic integration. |

Market Analysis and Trends

The landscape of investment is constantly evolving due to various economic factors. As of late 2024, several trends have emerged that shape investment strategies:

- Rising Interest Rates: Central banks worldwide have maintained higher interest rates to combat inflation. This environment has made borrowing more expensive, influencing both consumer spending and business investments.

- Shift Towards Sustainable Investments: There is a growing emphasis on environmental, social, and governance (ESG) criteria among investors. Companies that prioritize sustainability are increasingly attracting capital.

- Geopolitical Tensions: Ongoing geopolitical issues have led to volatility in markets and shifts in foreign direct investment patterns. Investors are becoming more cautious about where they allocate their resources.

- Digital Transformation: The rise of technology has created new avenues for investment, particularly in sectors like artificial intelligence, fintech, and renewable energy.

According to the UNCTAD World Investment Report 2024, global foreign direct investment fell by 2% to $1.3 trillion in 2023 due to economic slowdowns and rising geopolitical tensions. However, there are signs of recovery as easing financial conditions may support modest growth by year-end.

Implementation Strategies

To effectively navigate the investment landscape, individuals and institutions should consider the following strategies:

- Diversification: Spreading investments across various asset classes can mitigate risk. This includes a mix of equities, fixed income, real estate, and alternative investments.

- Focus on Fundamentals: Investors should analyze the underlying fundamentals of potential investments rather than relying solely on market trends or speculation. This includes assessing financial health, management quality, and market position.

- Long-Term Perspective: Maintaining a long-term view helps investors ride out market volatility. Short-term fluctuations can be misleading; focusing on long-term growth potential is crucial.

- Utilizing Technology: Leveraging technology for data analysis can enhance decision-making processes. Tools for tracking market trends and analyzing investment performance are essential for modern investors.

Risk Considerations

Investing inherently involves risks that must be carefully managed:

- Market Risk: The possibility of losing money due to market fluctuations can impact all types of investments. Understanding market dynamics is key to mitigating this risk.

- Credit Risk: For fixed income investments, the risk that a borrower may default on their obligations can affect returns. Investors should assess credit ratings and economic conditions before investing.

- Liquidity Risk: The risk associated with not being able to sell an asset quickly without incurring significant losses is crucial for investors to consider. Ensuring a balanced portfolio with liquid assets can help manage this risk.

- Regulatory Risk: Changes in laws or regulations can impact investment returns. Staying informed about regulatory environments is essential for compliance and strategic planning.

Regulatory Aspects

Understanding regulatory frameworks is vital for both individual investors and corporations:

- Securities Regulation: Regulatory bodies like the SEC enforce laws designed to protect investors from fraud while ensuring fair markets. Compliance with these regulations is crucial for maintaining investor confidence.

- Foreign Investment Regulations: Different countries have varying rules regarding foreign direct investments. Understanding these regulations can help businesses navigate international markets effectively.

- Tax Implications: Tax laws can significantly affect investment returns. Investors should be aware of capital gains taxes, dividend taxes, and other relevant tax considerations when making investment decisions.

Future Outlook

Looking ahead to 2025 and beyond, several factors will influence the investment landscape:

- Economic Recovery Post-Pandemic: As economies recover from pandemic-induced disruptions, sectors such as travel, hospitality, and retail are expected to rebound strongly.

- Technological Advancements: Innovations in technology will continue to create new opportunities for investment across various sectors including healthcare, renewable energy, and digital finance.

- Global Economic Integration: Despite geopolitical tensions, globalization will likely foster further integration of markets. This presents both challenges and opportunities for investors looking to diversify their portfolios internationally.

- Sustainable Development Goals (SDGs): Investments aligned with SDGs are expected to gain traction as governments and corporations focus on sustainable practices amid climate change concerns.

Frequently Asked Questions About Which Would Be Considered An Investment According To Economists

- What defines an economic investment?

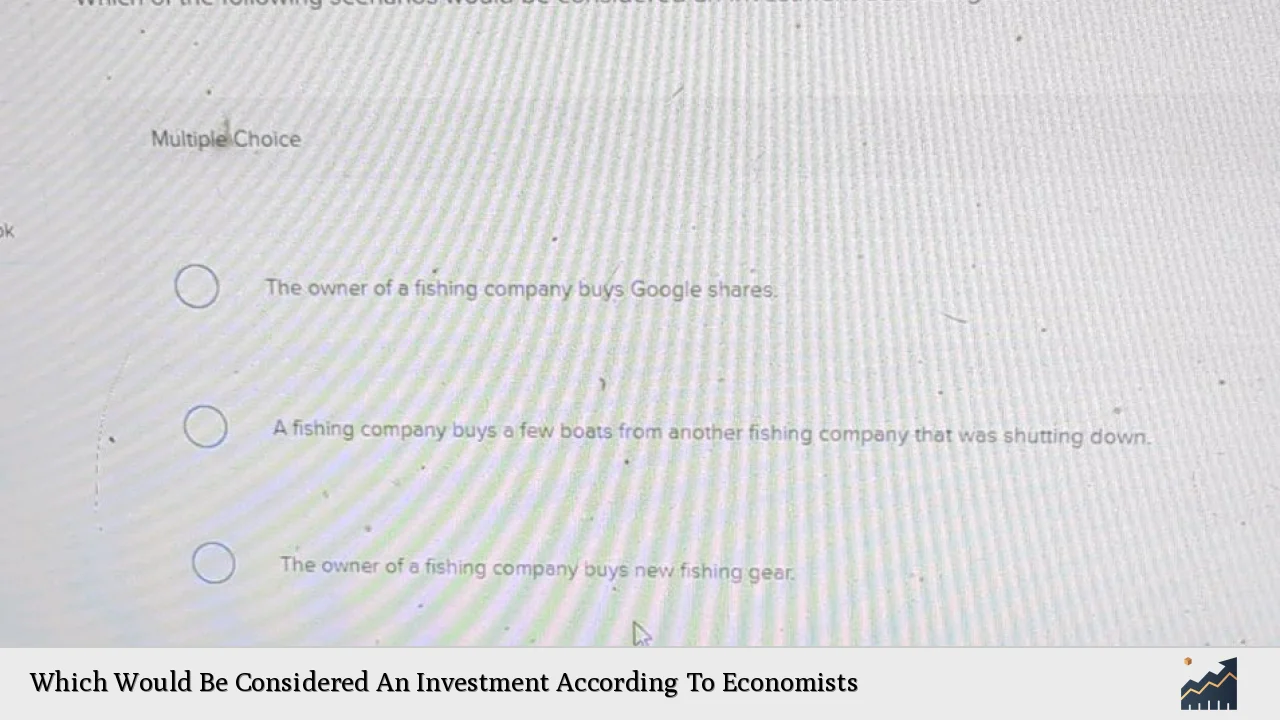

An economic investment is defined as the purchase or allocation of resources towards goods or services that enhance future productive capacity. - How do economists differentiate between financial investments and economic investments?

Economists view financial investments (like stocks) as transactions that do not directly increase productive capacity; whereas economic investments involve creating new capital goods or services. - What role does government play in investments?

Governments invest in infrastructure projects which stimulate economic growth by creating jobs and enhancing productivity. - Why is human capital considered an investment?

Investing in human capital through education increases the skills and productivity of workers, leading to higher future earnings. - What are some current trends affecting global investments?

Current trends include rising interest rates, a shift towards sustainable investing practices, digital transformation across industries, and geopolitical tensions influencing market dynamics. - What risks should investors be aware of?

Investors should consider market risk, credit risk, liquidity risk, regulatory risk, and geopolitical risks when making decisions. - How can diversification help mitigate risks?

Diversification spreads exposure across different asset classes or sectors which helps reduce the impact of poor performance in any single area. - What is the future outlook for global investments?

The future outlook includes recovery from pandemic impacts, technological advancements creating new opportunities, ongoing globalization trends despite challenges, and increased focus on sustainable development.

In conclusion, understanding what constitutes an investment according to economists requires recognizing the distinction between financial transactions and true productive investments. By focusing on tangible assets that enhance future productivity—alongside human capital development—investors can make informed decisions that align with both current market conditions and long-term economic goals.