Understanding the various types of investments is crucial for individual investors and finance professionals alike. This article delves into the different investment categories, their characteristics, and how they can complement one another in a diversified portfolio. The goal is to provide a comprehensive overview that not only explains each type but also highlights current market trends and strategic implementation.

| Key Concept | Description/Impact |

|---|---|

| Cash Equivalents | Low-risk investments such as money market funds and treasury bills that offer liquidity and stability. |

| Fixed Income | Investments like bonds that provide regular interest payments, suitable for income-focused investors. |

| Equities | Stocks that represent ownership in companies, offering potential for high returns but with higher risk. |

| Real Estate | Investments in property that can generate rental income and appreciate over time, diversifying risk. |

| Alternative Investments | Includes hedge funds and private equity, often used to enhance portfolio returns and reduce correlation with traditional assets. |

| Derivatives | Financial contracts whose value is derived from underlying assets, used for hedging or speculation. |

| Sustainable Investments | Focus on environmental, social, and governance (ESG) criteria, appealing to socially conscious investors. |

Market Analysis and Trends

The investment landscape is continuously evolving, influenced by economic conditions, technological advancements, and changing investor preferences. As of 2024, the global investment market is projected to grow from approximately $4 trillion in 2023 to over $4.25 trillion in 2024, with a compound annual growth rate (CAGR) of 7.5% expected through 2028. This growth is driven by several key trends:

- Rise of Sustainable Investing: There is an increasing demand for investments that adhere to ESG criteria. Investors are looking for opportunities that not only provide financial returns but also contribute positively to society.

- Technological Integration: The adoption of robo-advisors and AI-driven investment strategies is reshaping how individuals manage their portfolios. These technologies enhance accessibility and personalization in investment management.

- Market Volatility: Ongoing geopolitical tensions and economic fluctuations have led to increased volatility in equity markets. Investors are seeking safer assets like bonds and cash equivalents as a hedge against uncertainty.

- Emergence of Digital Assets: Cryptocurrencies and blockchain technology are gaining traction as alternative investments. These assets offer high-risk, high-reward opportunities but require careful consideration due to regulatory uncertainties.

Implementation Strategies

To effectively implement an investment strategy that aligns with individual financial goals, consider the following approaches:

- Diversification: Spread investments across various asset classes—such as equities, fixed income, real estate, and alternatives—to mitigate risk.

- Dollar-Cost Averaging: Regularly invest a fixed amount in a particular asset or portfolio over time, reducing the impact of market volatility.

- Value Investing: Focus on undervalued stocks with strong fundamentals. This strategy requires patience but can yield substantial long-term gains.

- Growth Investing: Invest in companies expected to grow at an above-average rate compared to their industry or the overall market. This strategy often involves higher risk but can lead to significant capital appreciation.

- Income Generation: For those seeking regular income, consider fixed-income securities like bonds or dividend-paying stocks.

Risk Considerations

Every investment carries inherent risks. Understanding these risks is essential for effective portfolio management:

- Market Risk: The possibility of losing money due to fluctuations in market prices. This risk affects all types of investments but is particularly pronounced in equities.

- Credit Risk: The risk that a bond issuer will default on its payments. Fixed-income investors should assess the creditworthiness of issuers before investing.

- Liquidity Risk: The risk of being unable to sell an investment quickly without incurring significant losses. Real estate and certain alternative investments may pose higher liquidity risks.

- Regulatory Risk: Changes in laws or regulations can impact investment performance. Staying informed about regulatory developments is crucial for compliance and strategic planning.

Regulatory Aspects

The regulatory environment for investments is increasingly complex. Key considerations include:

- SEC Regulations: The U.S. Securities and Exchange Commission (SEC) enforces rules that govern securities transactions. Investors should be aware of regulations affecting their investments, particularly regarding disclosures and compliance requirements.

- Global Regulations: Different countries have varying regulations affecting foreign investments. Understanding these regulations is essential for international investors.

- Consumer Protection Laws: New regulations aimed at protecting retail investors are being implemented globally. These laws are designed to enhance transparency and reduce fraud risks in investment products.

Future Outlook

The future of investing will likely be shaped by several factors:

- Technological Advancements: Continued innovation in fintech will drive changes in how investments are managed and accessed. Expect more personalized services powered by AI.

- Increased Focus on ESG: As awareness of climate change and social issues grows, sustainable investing will become more mainstream, influencing corporate behaviors and investment strategies.

- Market Adaptability: Investors must remain flexible and adaptable to navigate the changing economic landscape effectively. This includes being open to new asset classes like cryptocurrencies as they mature.

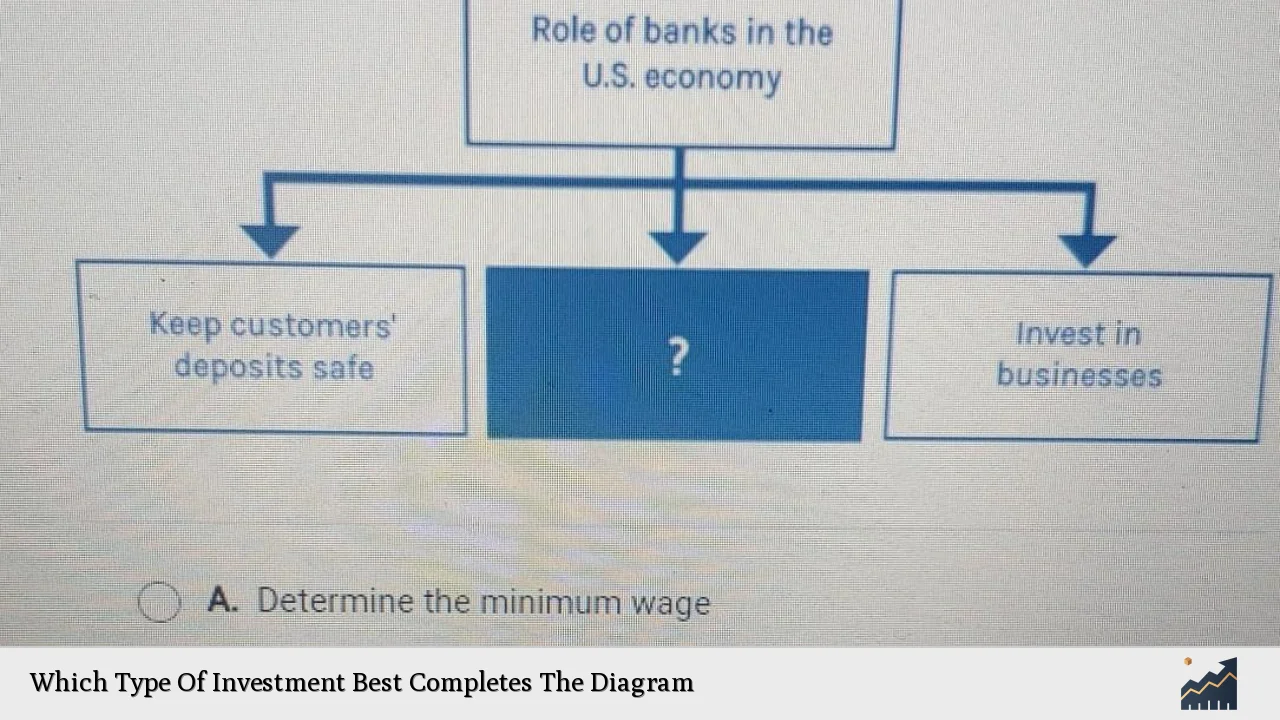

Frequently Asked Questions About Which Type Of Investment Best Completes The Diagram

- What are the main types of investments?

The main types include cash equivalents, fixed income (bonds), equities (stocks), real estate, alternatives (like hedge funds), derivatives, and sustainable investments. - How do I diversify my investment portfolio?

Diversification can be achieved by investing across different asset classes such as stocks, bonds, real estate, and alternatives to spread risk. - What is the significance of ESG investing?

ESG investing focuses on companies that meet environmental, social, and governance criteria, appealing to investors who prioritize ethical considerations alongside financial returns. - What risks should I consider when investing?

Main risks include market risk (price fluctuations), credit risk (default by issuers), liquidity risk (difficulty selling assets), and regulatory risk (changes in laws affecting investments). - How can technology improve my investment strategy?

Technological tools like robo-advisors offer personalized investment advice based on your financial goals while automating portfolio management processes. - What role do derivatives play in investing?

Derivatives can be used for hedging against risks or speculating on price movements of underlying assets but come with higher complexity and potential risks. - Why is it important to stay informed about regulations?

Staying informed helps ensure compliance with laws governing investments, protecting you from potential legal issues or financial penalties. - What does the future hold for alternative investments?

The future looks promising as more retail investors gain access to alternatives like private equity and cryptocurrencies through new fund structures.

This comprehensive analysis provides a detailed understanding of various investment types while addressing current trends and considerations necessary for informed decision-making in today’s dynamic financial landscape.