Investing in equity securities involves purchasing shares of companies, which can provide investors with ownership stakes and potential returns through capital appreciation and dividends. However, understanding the nuances of equity investments is crucial for making informed decisions. This article explores common misconceptions regarding equity securities, particularly focusing on identifying incorrect statements related to their classification, reporting, and influence.

| Key Concept | Description/Impact |

|---|---|

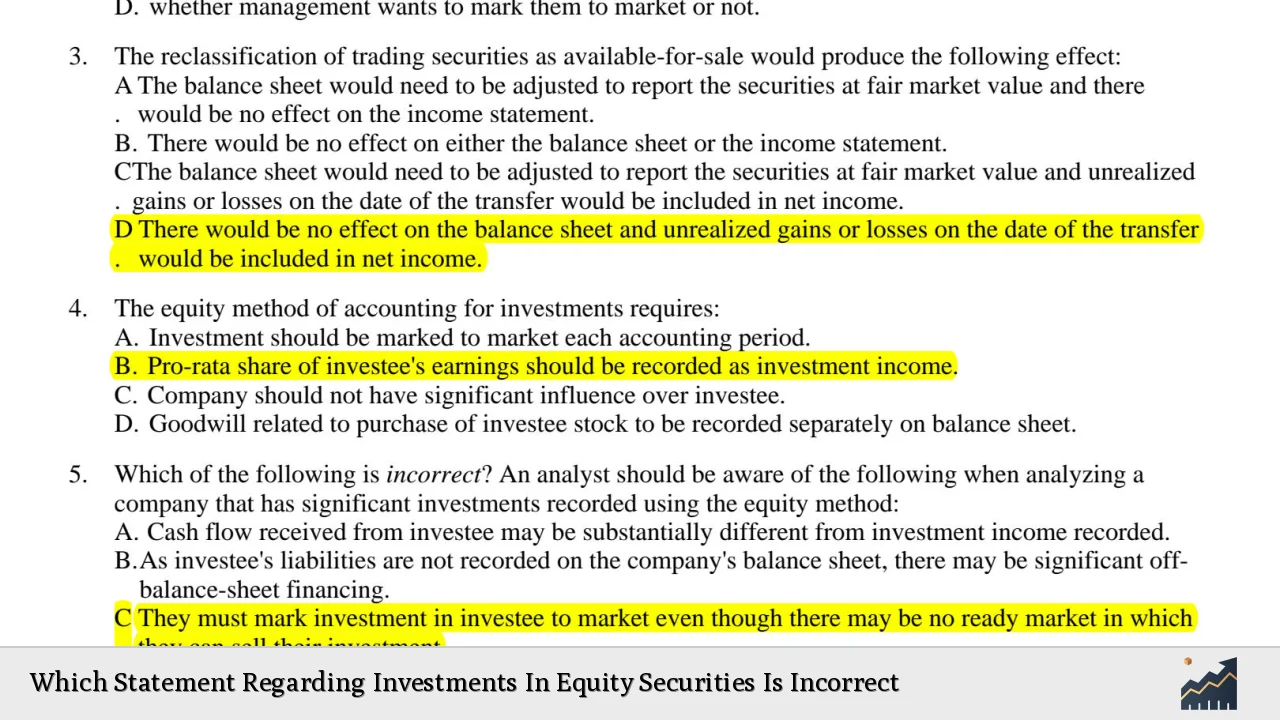

| Significant Influence | Investments in equity securities are classified based on the level of influence an investor holds over the investee company. Typically, ownership of 20% or more indicates significant influence. |

| Equity Method Accounting | The equity method is used for accounting investments where the investor has significant influence. This method requires adjustments based on the investee’s earnings and losses. |

| Long-term Asset Reporting | Equity investments are often reported as long-term assets unless they are intended for short-term trading, which can lead to confusion regarding their classification. |

| Consolidation Requirements | Investments that confer control (generally over 50% ownership) require consolidation into the investor’s financial statements, while significant influence does not necessitate this. |

Market Analysis and Trends

The equity markets have experienced notable fluctuations in recent years, influenced by various macroeconomic factors. As of late 2024, global equity markets have shown resilience, with many indices posting gains due to strong corporate earnings and a favorable economic environment.

- Current Market Statistics: According to Lazard Asset Management, global equities rallied by over 3.8% in November 2024, marking a successful year for equity investors. The U.S. corporate sector reported an annual earnings growth of 11%, the highest since late 2021.

- Trends: The market has seen a shift towards value stocks as investors seek stability amid rising interest rates. This trend is expected to continue into 2025, with follow-on offerings dominating the capital markets as companies seek liquidity.

Implementation Strategies

Investors should adopt a strategic approach when investing in equity securities to maximize returns while managing risks effectively.

- Diversification: Spread investments across various sectors to mitigate risks associated with market volatility.

- Research and Analysis: Conduct thorough due diligence on potential investments by analyzing financial statements, market trends, and economic indicators.

- Utilizing the Equity Method: For those investing with significant influence (20% or more), applying the equity method of accounting can provide a clearer picture of investment performance and its impact on overall financial health.

Risk Considerations

Investing in equity securities carries inherent risks that investors must be aware of:

- Market Volatility: Equity markets can be highly volatile, influenced by economic events, interest rate changes, and geopolitical tensions.

- Company Performance: The success of individual investments is closely tied to the performance of the underlying companies. Factors such as management decisions, market competition, and consumer demand can significantly impact stock prices.

- Regulatory Changes: Changes in regulations affecting reporting standards or tax implications can alter investment landscapes unexpectedly.

Regulatory Aspects

Understanding regulatory requirements is crucial for compliance and informed decision-making in equity investments:

- GAAP Compliance: Under U.S. Generally Accepted Accounting Principles (GAAP), investments in equity securities must be reported at fair value unless they qualify for specific exceptions.

- Disclosure Requirements: Investors must adhere to strict disclosure requirements regarding unrealized gains or losses and any changes in investment value during reporting periods.

- Impact of SEC Regulations: The Securities and Exchange Commission (SEC) provides guidelines that affect how equity securities are reported and traded, influencing investor strategies.

Future Outlook

Looking ahead, several factors will shape the landscape for equity investments:

- Economic Growth Projections: The global economy is expected to grow at approximately 3.2% through 2025, providing a favorable backdrop for equities.

- Technological Advancements: Innovations such as artificial intelligence are anticipated to drive growth across various sectors, presenting new investment opportunities.

- Market Sentiment: Investor sentiment will likely remain cautious yet optimistic as they navigate potential volatility stemming from upcoming elections and macroeconomic uncertainties.

Frequently Asked Questions About Which Statement Regarding Investments In Equity Securities Is Incorrect

- What defines significant influence in equity investments?

Significant influence typically refers to owning 20% or more of a company’s voting stock, allowing the investor to participate in financial and operating policy decisions. - How are equity securities classified?

Equity securities are classified based on the level of ownership interest—either as trading securities (short-term), available-for-sale (long-term), or held-to-maturity (debt instruments). - What is the equity method of accounting?

The equity method is used when an investor has significant influence over an investee; it requires recognizing the investor’s share of the investee’s profits or losses on their income statement. - Are all equity investments reported as long-term assets?

Not necessarily; while many are classified as long-term assets, those intended for short-term trading may be reported as current assets. - What happens if an investor holds more than 50% of a company?

If an investor holds more than 50%, they typically consolidate the investee’s financial results into their own financial statements. - How do changes in fair value affect financial reporting?

Under GAAP, changes in fair value for most equity securities must be reflected in earnings unless specific exceptions apply. - What role do regulatory bodies play in equity investments?

Regulatory bodies like the SEC establish rules governing how equity investments are reported and traded to ensure transparency and protect investors. - What should investors consider when evaluating market trends?

Investors should analyze economic indicators, corporate earnings reports, geopolitical events, and sector performance to make informed decisions.

In conclusion, understanding the complexities surrounding investments in equity securities is essential for both novice and experienced investors. By recognizing common misconceptions and staying informed about market trends and regulatory requirements, investors can make more strategic decisions that align with their financial goals.