Long-term investments are a critical component of financial strategy, providing individuals and institutions with opportunities to grow wealth over extended periods. However, misconceptions about what constitutes a long-term investment can lead to confusion among investors. This article aims to clarify these misconceptions, particularly focusing on which statements about long-term investments are inaccurate. By analyzing current market trends, investment strategies, and regulatory aspects, we will provide a comprehensive understanding of long-term investments and their implications.

| Key Concept | Description/Impact |

|---|---|

| Definition of Long-Term Investments | Long-term investments are assets held for more than one year, including stocks, bonds, real estate, and other securities intended to generate returns over time. |

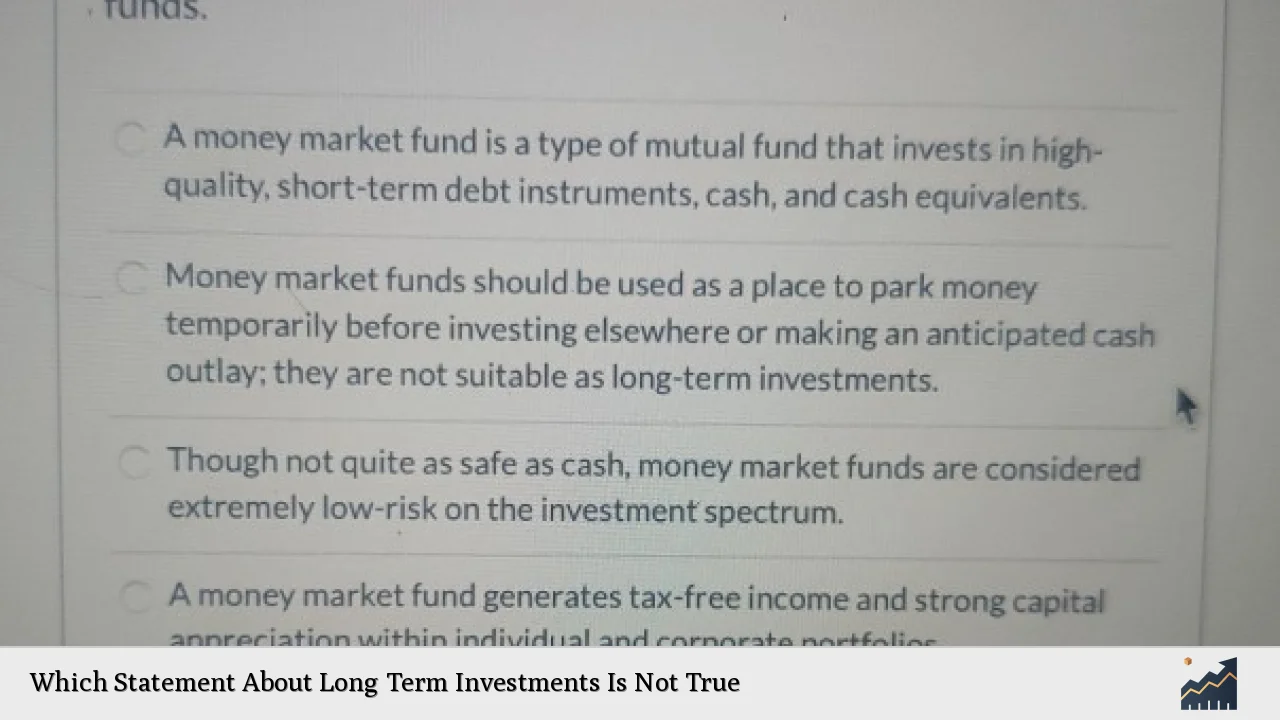

| Common Misconceptions | Many believe that long-term investments must be liquid or that they cannot include certain asset types like real estate or stocks held for speculation. |

| Market Trends | Current trends indicate a growing interest in sustainable and technology-driven investments as part of long-term strategies. |

| Investment Strategies | Strategies such as dollar-cost averaging and diversification are essential for mitigating risks associated with long-term investments. |

| Regulatory Considerations | Investors must be aware of regulations governing long-term investments, including tax implications and reporting requirements. |

| Risk Management | Understanding risk is crucial; long-term investments can be volatile but generally offer higher returns than short-term options. |

Market Analysis and Trends

The landscape of long-term investing is influenced by various factors including economic conditions, market volatility, and investor sentiment. Recent analysis indicates that:

- Economic Recovery: As economies recover post-pandemic, there is a renewed focus on sectors like technology and renewable energy. Investors are increasingly looking at companies that align with sustainable practices.

- Interest Rates: With central banks indicating potential rate cuts in 2024, the bond market is becoming more attractive for long-term investors seeking stable returns. Investment-grade bonds are particularly appealing due to their yield stability amidst economic uncertainty.

- Equity Markets: Equity markets are expected to see moderate growth in 2024, with analysts predicting high single-digit returns. This growth is driven by resilient corporate earnings despite looming economic challenges.

Implementation Strategies

To effectively engage in long-term investing, individuals should consider the following strategies:

- Diversification: Spreading investments across various asset classes (stocks, bonds, real estate) helps mitigate risk. A well-diversified portfolio can weather market fluctuations better than a concentrated one.

- Dollar-Cost Averaging: This strategy involves regularly investing a fixed amount regardless of market conditions. It reduces the impact of volatility by purchasing more shares when prices are low and fewer when prices are high.

- Research and Education: Continuous learning about market trends and investment vehicles is vital. Utilizing resources such as financial news platforms and investment courses can enhance decision-making.

Risk Considerations

Investing for the long term does not eliminate risk; rather, it requires a nuanced understanding of various risk factors:

- Market Risk: Long-term investors must be prepared for market fluctuations. Historical data shows that while markets can be volatile in the short term, they tend to recover over longer periods.

- Liquidity Risk: Some long-term investments may not be easily convertible to cash without significant loss in value. Investors should assess their liquidity needs before committing capital.

- Regulatory Risk: Changes in laws or regulations can impact the profitability of certain investments. Staying informed about regulatory changes is crucial for effective portfolio management.

Regulatory Aspects

Understanding the regulatory environment surrounding long-term investments is essential:

- Tax Implications: Long-term capital gains are typically taxed at lower rates than short-term gains. Investors should strategize their selling points to maximize tax efficiency.

- Reporting Requirements: Regulatory bodies require accurate reporting of investment holdings and transactions. Compliance with these regulations is critical to avoid penalties.

- Investment Products: Familiarity with different types of investment products (ETFs, mutual funds) helps investors choose options that align with their financial goals while adhering to regulatory standards.

Future Outlook

The outlook for long-term investing remains positive despite potential economic headwinds:

- Technological Advancements: Innovations in technology continue to create new investment opportunities. Sectors such as artificial intelligence and biotechnology are expected to drive growth in the coming years.

- Sustainable Investing: There is an increasing trend towards socially responsible investing (SRI) and environmental, social, and governance (ESG) criteria. Investors are more inclined to consider the ethical implications of their investment choices.

- Global Market Dynamics: As emerging markets grow, they present new opportunities for diversification. Investors should consider international exposure as part of their long-term strategy.

Frequently Asked Questions About Long Term Investments

- What qualifies as a long-term investment?

A long-term investment typically refers to assets held for more than one year, including stocks, bonds, real estate, and mutual funds. - Is it true that you must be wealthy to invest long term?

No, modern investment platforms allow individuals to start investing with small amounts through options like ETFs and micro-investing. - How do I manage risks associated with long-term investments?

Diversification across asset classes, regular portfolio reviews, and staying informed about market trends can help manage risks effectively. - What are the tax implications of selling long-term investments?

Long-term capital gains are usually taxed at a lower rate than short-term gains; therefore, timing your sales can optimize tax efficiency. - Can I lose money on long-term investments?

Yes, while long-term investing generally reduces risk over time, it does not eliminate it entirely; market fluctuations can impact asset values. - What role does diversification play in long-term investing?

Diversification helps mitigate risks by spreading investments across different asset classes, reducing the impact of poor performance from any single investment. - How often should I review my long-term investment portfolio?

A regular review (at least annually) allows you to adjust your strategy based on changing market conditions and personal financial goals. - Are there any specific regulations I need to be aware of when investing?

Yes, understanding tax regulations and compliance requirements related to your investments is crucial for effective management.

In conclusion, understanding what statements about long-term investments are not true can empower investors to make informed decisions. By addressing common misconceptions and focusing on strategic planning and risk management, individuals can better navigate the complexities of the investment landscape while positioning themselves for future financial success.