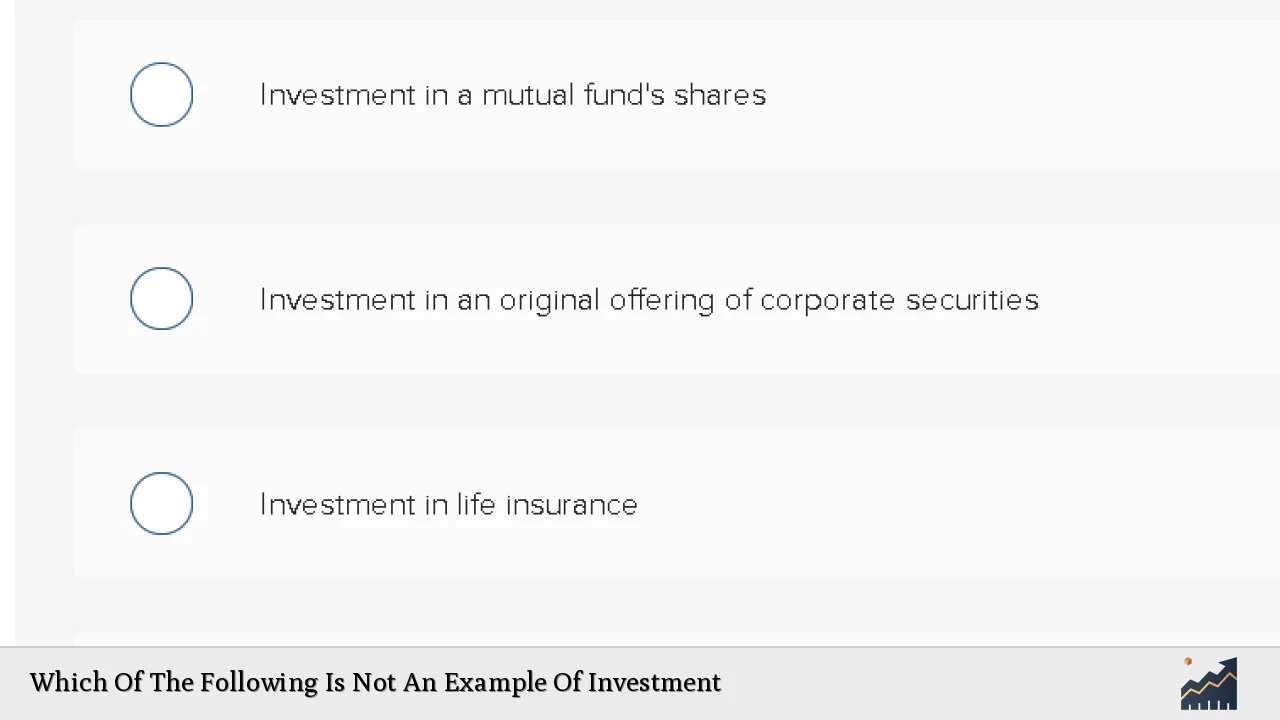

Investment is a fundamental concept in finance, encompassing a wide range of activities where capital is allocated with the expectation of generating returns. However, not all financial activities qualify as investments. Understanding the nuances between different types of financial transactions is crucial for both individual investors and finance professionals. This article explores the distinction between genuine investments and other financial actions that may be mistaken for investments.

| Key Concept | Description/Impact |

|---|---|

| Direct Investment | Involves purchasing assets directly, such as stocks or real estate, with the expectation of future returns. |

| Indirect Investment | Investing through financial intermediaries, such as mutual funds or insurance policies, where the investor does not directly hold the assets. |

| Savings Deposit | Depositing money in a bank account is considered saving rather than investing since it typically yields lower returns and does not involve risk-taking associated with investment. |

| Speculative Activities | Buying and selling assets with the hope of making quick profits, often associated with high risk and volatility. |

| Non-Financial Investments | Investments that do not yield monetary returns but instead provide benefits like cost savings or improved efficiency. |

Market Analysis and Trends

The investment landscape is continually evolving, influenced by economic conditions, technological advancements, and regulatory changes.

- Current Market Statistics: As of mid-2024, global equity markets reached an all-time high of approximately $78.4 trillion, reflecting a 10% increase from December 2023. This growth has been largely driven by technology sectors, particularly those related to artificial intelligence.

- Investment Trends: There is a noticeable shift towards sustainable and socially responsible investing (SRI), with many investors prioritizing environmental, social, and governance (ESG) factors in their decision-making processes.

- Market Volatility: Despite the overall growth, market volatility remains a concern due to geopolitical tensions and economic uncertainties. Investors are advised to adopt diversified strategies to mitigate risks associated with sudden market shifts.

Implementation Strategies

To effectively navigate the investment landscape, individuals and institutions can implement several strategies:

- Diversification: Spreading investments across various asset classes (stocks, bonds, real estate) can reduce risk.

- Long-Term Focus: Adopting a long-term investment horizon helps investors ride out market fluctuations and benefit from compounding returns.

- Regular Review: Periodically reviewing investment portfolios ensures alignment with financial goals and market conditions.

- Utilizing Technology: Leveraging fintech tools can enhance investment strategies through data analysis and automated trading.

Risk Considerations

Investing inherently involves risks that must be managed:

- Market Risk: The potential for losses due to market fluctuations can affect all asset classes.

- Credit Risk: This risk pertains to the possibility that a borrower may default on their obligations.

- Liquidity Risk: The risk that an asset cannot be quickly sold without incurring significant losses.

- Regulatory Risk: Changes in laws or regulations can impact investment strategies and returns.

Investors should conduct thorough due diligence and consider consulting financial advisors to navigate these risks effectively.

Regulatory Aspects

Understanding regulatory frameworks is essential for compliant investing:

- Securities Regulation: In many countries, securities are regulated by governmental bodies (e.g., SEC in the U.S.), ensuring transparency and protecting investors from fraud.

- Investment Advisers Act: This act mandates that investment advisers adhere to fiduciary standards, placing clients’ interests above their own.

- Global Compliance: Investors engaging in international markets must be aware of foreign regulations that may affect their investments.

Future Outlook

The future of investing appears dynamic:

- Technological Integration: The rise of AI and machine learning in finance will continue to transform how investments are analyzed and managed.

- Sustainable Investing Growth: The demand for ESG-compliant investments is expected to rise as more investors seek ethical options that align with their values.

- Market Adaptability: Investors will need to remain adaptable to changing economic conditions and emerging trends to capitalize on new opportunities while managing risks effectively.

Frequently Asked Questions About Which Of The Following Is Not An Example Of Investment

- What constitutes an investment?

An investment typically involves allocating capital to an asset with the expectation of generating income or capital appreciation over time. - Are savings deposits considered investments?

No, savings deposits are primarily considered savings rather than investments because they usually offer lower returns and do not involve risk-taking. - What is the difference between direct and indirect investment?

Direct investment involves purchasing assets directly (like stocks), while indirect investment involves using intermediaries (like mutual funds) to invest in assets. - Can non-financial investments yield returns?

Yes, non-financial investments can yield returns by avoiding future expenses or improving efficiency but do not typically provide monetary returns. - Why is diversification important in investing?

Diversification helps mitigate risks by spreading investments across various asset classes, reducing exposure to any single economic event. - What are some common risks associated with investing?

Common risks include market risk, credit risk, liquidity risk, and regulatory risk. - How can technology enhance investment strategies?

Technology can enhance investment strategies through data analysis tools, automated trading systems, and personalized financial advice based on algorithms. - What role do regulations play in investing?

Regulations ensure transparency in financial markets, protect investors from fraud, and establish standards for investment practices.

This comprehensive exploration clarifies what constitutes an investment while addressing common misconceptions about financial activities. Understanding these distinctions is vital for making informed decisions in today’s complex financial landscape.